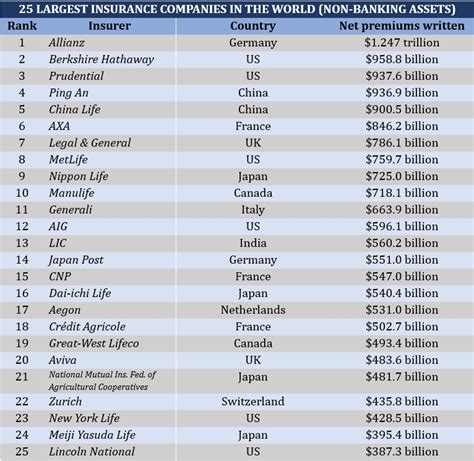

Largest Insurance Companies In Usa

The insurance industry is a cornerstone of the financial landscape in the United States, offering protection and financial security to millions of individuals, businesses, and organizations across the nation. With a vast array of services, from health and life insurance to property and casualty coverage, these companies play a pivotal role in managing risks and safeguarding people's assets and well-being. The largest insurance companies in the USA dominate this critical sector, wielding significant influence over industry trends and consumer choices.

Dominant Players in the US Insurance Sector

The US insurance market is characterized by a diverse mix of companies, ranging from longstanding industry giants to innovative startups. Among these, a handful of corporations stand out for their extensive reach, vast resources, and comprehensive range of services. These entities not only dominate the domestic market but also have a significant global presence.

MetLife: A Century-Old Leader

MetLife, short for Metropolitan Life Insurance Company, is an iconic name in the American insurance landscape. With roots stretching back to 1868, MetLife has been a trusted provider of life insurance and other financial services for over a century and a half. Headquartered in New York City, MetLife boasts an extensive network of branches and agents across the country, catering to a diverse range of customers.

The company's portfolio is diverse, encompassing not just life insurance but also various other forms of coverage, including disability, long-term care, and even pet insurance. MetLife's strength lies in its ability to offer personalized solutions to its customers, catering to their unique needs and financial situations. Through innovative products and a customer-centric approach, MetLife has solidified its position as one of the top insurance providers in the US.

| Category | MetLife's Performance |

|---|---|

| Total Assets | $566.8 billion (as of Q2 2023) |

| Net Income | $1.2 billion (2022) |

| Market Capitalization | $42.86 billion (as of September 2023) |

Berkshire Hathaway: The Warren Buffett Empire

Berkshire Hathaway, often referred to as the “Oracle of Omaha’s” empire, is a multinational conglomerate holding company with a substantial presence in the insurance sector. Led by the renowned investor Warren Buffett, Berkshire Hathaway has amassed an impressive portfolio of subsidiaries and holdings over the years, including some of the biggest names in insurance.

Within the insurance realm, Berkshire Hathaway owns GEICO, one of the largest auto insurers in the US, as well as other prominent insurance brands like National Indemnity and General Re. The company's insurance operations span various sectors, including property, casualty, liability, and even specialty insurance for unique risks. Berkshire Hathaway's strategic acquisitions and investment decisions have positioned it as a formidable force in the insurance industry.

| Key Metrics | Berkshire Hathaway's Insurance Operations |

|---|---|

| Total Assets | $338.9 billion (as of Q2 2023) |

| Net Income | $11.8 billion (2022) |

| Total Premiums Written | $83.9 billion (2022) |

State Farm: America’s Largest Property and Casualty Insurer

State Farm is a household name in the US insurance industry, particularly known for its dominance in the property and casualty insurance market. Founded in 1922, State Farm has grown to become one of the largest mutual insurance companies in the world, serving millions of policyholders across the United States. Headquartered in Bloomington, Illinois, State Farm maintains a strong regional presence, with agents and offices in almost every state.

The company's product portfolio is extensive, offering auto, home, life, health, and various other types of insurance. State Farm's success can be attributed to its focus on local agents who build personalized relationships with customers, providing tailored advice and solutions. This unique agent-based model has helped State Farm earn a reputation for exceptional customer service and loyalty.

| Performance Metrics | State Farm's Dominance |

|---|---|

| Total Assets | $303.4 billion (as of 2022) |

| Total Premiums Written | $82.5 billion (2022) |

| Market Share in Property and Casualty Insurance | 16.7% (2022) |

Prudential Financial: A Comprehensive Financial Services Provider

Prudential Financial, often simply referred to as Prudential, is a leading multinational financial services company headquartered in Newark, New Jersey. While Prudential is best known for its life insurance and annuity products, it also offers a wide range of financial services, including asset management, retirement services, and investment solutions.

Prudential's insurance operations are extensive, with a focus on life insurance, health insurance, and various specialty products. The company has a strong presence in the individual and group insurance markets, catering to a diverse range of customers. Prudential's success is attributed to its commitment to innovation and customer-centricity, ensuring it remains a trusted partner for individuals and businesses alike.

| Key Financials | Prudential Financial's Strength |

|---|---|

| Total Assets | $1.14 trillion (as of Q2 2023) |

| Net Income | $2.1 billion (2022) |

| Total Premiums Written | $44.8 billion (2022) |

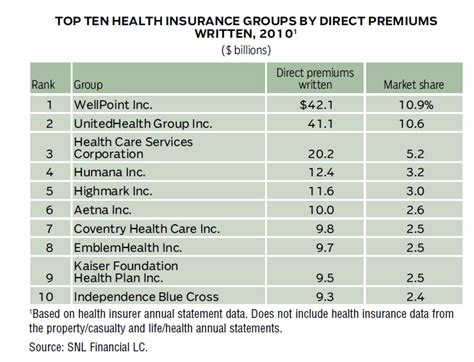

Progressive: Leading the Way in Auto Insurance

Progressive is a prominent player in the US insurance market, particularly renowned for its innovative approach to auto insurance. Headquartered in Mayfield Village, Ohio, Progressive has been a disruptor in the industry, leveraging technology to offer customers a more personalized and efficient insurance experience.

The company's focus on auto insurance is evident, with a wide range of products and services designed to meet the diverse needs of drivers. Progressive has been at the forefront of digital transformation, offering online quotes, mobile apps for policy management, and innovative tools like Snapshot, which rewards safe driving with discounts. This customer-centric approach has helped Progressive earn a reputation for convenience and value.

| Performance Highlights | Progressive's Success |

|---|---|

| Total Assets | $92.7 billion (as of Q2 2023) |

| Net Income | $3.2 billion (2022) |

| Total Premiums Written | $42.1 billion (2022) |

The Future of the Insurance Industry

The US insurance industry is in a state of continuous evolution, driven by technological advancements, changing consumer preferences, and emerging risks. As we look to the future, several key trends are shaping the landscape and influencing the strategies of these leading insurance companies.

Embracing Digital Transformation

The digital revolution has profoundly impacted the insurance industry, with companies leveraging technology to enhance customer experiences, streamline operations, and improve risk assessment. This shift towards digital has been accelerated by the COVID-19 pandemic, which forced many insurers to rapidly adapt to remote work and digital engagement.

Leading insurance companies are investing heavily in digital infrastructure, developing user-friendly platforms, and integrating AI and machine learning to improve efficiency and accuracy. This digital transformation is not only enhancing the customer experience but also enabling insurers to gather and analyze vast amounts of data, leading to more precise risk assessments and personalized products.

Focus on Customer-Centricity

In an increasingly competitive market, customer satisfaction and loyalty have become paramount. Leading insurance companies are recognizing the need to shift from a product-centric to a customer-centric approach, focusing on delivering personalized experiences that meet individual needs.

This shift is evident in the way companies are engaging with customers, offering customized products and services, and providing omnichannel support. Insurers are leveraging data analytics to understand customer behavior and preferences, enabling them to deliver targeted solutions. Additionally, many companies are investing in innovative technologies like chatbots and virtual assistants to provide instant support and enhance the overall customer experience.

Addressing Emerging Risks

The insurance industry must continuously adapt to new and evolving risks, from natural disasters exacerbated by climate change to emerging technologies like autonomous vehicles and artificial intelligence. These risks present both challenges and opportunities for insurers, requiring them to develop innovative solutions and adapt existing products.

For instance, as the frequency and intensity of natural disasters increase, insurers are developing new products and risk management strategies to protect customers. Similarly, with the rise of autonomous vehicles, insurers are exploring new coverage models and liability frameworks. This constant innovation ensures that insurance products remain relevant and effective in a rapidly changing world.

Regulatory and Compliance Challenges

The insurance industry is heavily regulated, and companies must navigate a complex web of rules and regulations at both the state and federal levels. While these regulations are essential for consumer protection and market stability, they can also present challenges, particularly in an era of rapid technological change.

Leading insurance companies are investing in robust compliance frameworks and legal teams to ensure they remain compliant with changing regulations. This includes staying abreast of evolving data privacy laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), as well as adapting to new insurance laws and guidelines. The ability to navigate this complex regulatory landscape is crucial for companies to maintain their competitive edge and avoid legal pitfalls.

Conclusion

The largest insurance companies in the USA are industry pioneers, constantly evolving to meet the changing needs of their customers and navigate the complex landscape of risks and regulations. Their dominance in the market is a testament to their ability to innovate, adapt, and deliver value to policyholders across the nation.

As we move forward, these companies will continue to shape the insurance industry, driving digital transformation, enhancing customer experiences, and developing solutions to address emerging risks. Their success and influence will be pivotal in ensuring the financial security and well-being of individuals, businesses, and communities across the United States.

How do these insurance companies maintain their market dominance?

+

These companies maintain their market dominance through a combination of factors, including their extensive financial resources, which allow them to invest in innovative products and technologies, as well as their established brand reputation and customer loyalty. Additionally, their wide range of services and comprehensive financial solutions cater to a diverse customer base.

What role do agents play in the success of these insurance companies?

+

Agents play a crucial role in the success of insurance companies, especially those with an agent-centric model like State Farm. Agents build personal relationships with customers, offering tailored advice and solutions. This local presence and personalized service contribute significantly to customer satisfaction and loyalty.

How are these companies adapting to the digital age?

+

These insurance companies are embracing digital transformation by investing in user-friendly platforms, leveraging AI and machine learning for improved risk assessment, and offering digital tools for policy management and quotes. This shift towards digital enhances customer experiences and enables more precise and personalized insurance solutions.