What's The Difference Between Whole Life Insurance And Term Life

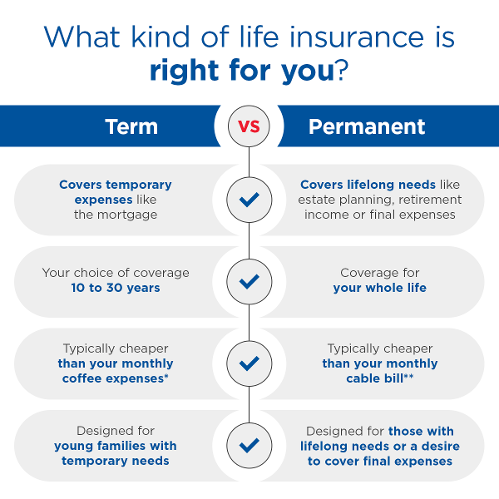

When it comes to safeguarding your financial future and ensuring peace of mind, life insurance is a crucial consideration. However, navigating the complex world of life insurance policies can be daunting, with various options available. Two of the most common types are whole life insurance and term life insurance, each with its unique characteristics and benefits.

Understanding the differences between these two policies is essential to making an informed decision that aligns with your specific needs and financial goals. Let's delve into the intricacies of whole life insurance and term life insurance to help you make a well-thought-out choice.

Whole Life Insurance: A Lifetime of Protection

Whole life insurance, also known as permanent life insurance, is a comprehensive policy designed to provide coverage for your entire life, offering a range of benefits that extend beyond the mere payment of death benefits.

Cash Value Accumulation

One of the key features of whole life insurance is its cash value accumulation. With this type of policy, a portion of your premium payments goes towards building a cash value within the policy. This cash value grows over time and can be accessed through loans or withdrawals, providing a financial safety net during times of need.

The cash value of a whole life insurance policy is tax-deferred, meaning it grows without immediate tax consequences. This makes it an attractive option for long-term financial planning and wealth accumulation.

Guaranteed Death Benefit

Whole life insurance policies offer a guaranteed death benefit, which means that regardless of when the insured passes away, their beneficiaries will receive the full amount specified in the policy. This provides a sense of security and ensures that your loved ones are financially protected throughout your life.

| Policy Feature | Whole Life Insurance |

|---|---|

| Duration | Lifetime coverage |

| Cash Value | Accumulates tax-deferred |

| Death Benefit | Guaranteed and fixed |

| Premium | Generally higher than term life |

The premiums for whole life insurance remain level throughout the policy's term, providing stability and predictability in your financial planning. However, it's important to note that whole life insurance policies typically have higher premiums compared to term life insurance due to the comprehensive nature of the coverage.

Term Life Insurance: Flexible and Affordable Coverage

Term life insurance, on the other hand, offers a more flexible and cost-effective option for those seeking temporary coverage. This type of policy provides protection for a specified period, known as the “term,” ranging from 10 to 30 years.

Affordable Protection

One of the primary advantages of term life insurance is its affordability. Premiums for term life policies are generally much lower compared to whole life insurance, making it an attractive choice for individuals and families on a budget. This affordability allows you to secure a substantial death benefit without straining your finances.

Renewable and Convertible

Term life insurance policies often come with the option to renew or convert them. You can renew your policy at the end of the term, typically at a higher premium to account for increased age and health risks. Alternatively, many term life policies allow you to convert them into a permanent life insurance policy, such as whole life or universal life, without undergoing a new medical exam.

Specific Financial Goals

Term life insurance is particularly well-suited for individuals with specific financial goals or obligations that have a defined timeline. For example, if you have young children and want to ensure their financial well-being until they reach adulthood, a term life policy can provide adequate coverage during this period.

| Policy Feature | Term Life Insurance |

|---|---|

| Duration | Specific term (e.g., 10, 20, or 30 years) |

| Premium | Generally lower than whole life |

| Death Benefit | Fixed for the term |

| Renewal/Conversion | Options available at the end of the term |

It's important to note that term life insurance does not build cash value like whole life insurance. The focus is solely on providing death benefit protection for a defined period. As a result, term life policies are often seen as a temporary solution to long-term financial needs.

Choosing the Right Policy: Factors to Consider

When deciding between whole life insurance and term life insurance, several factors come into play. Understanding your financial goals, budget, and specific needs is crucial to making an informed decision.

Financial Goals and Stability

If you’re looking for long-term financial stability and a comprehensive financial planning tool, whole life insurance may be the better option. Its cash value accumulation and guaranteed death benefit make it an attractive choice for those seeking a lifetime of protection and wealth accumulation.

Budgetary Constraints

On the other hand, if your budget is a primary consideration, term life insurance offers an affordable alternative. The lower premiums of term life policies make them accessible to a wider range of individuals, providing adequate coverage for specific periods without breaking the bank.

Specific Needs and Obligations

Assessing your specific needs and obligations is crucial. If you have young children or a mortgage that needs to be covered for a defined period, term life insurance can provide the necessary protection. However, if you require lifetime coverage and want to build a financial safety net, whole life insurance might be more suitable.

Flexibility and Longevity

Consider the flexibility and longevity of each policy. Term life insurance offers the option to renew or convert, providing some level of adaptability. Whole life insurance, on the other hand, provides lifelong coverage and stability, making it a reliable choice for those seeking permanent protection.

Health and Age Considerations

Your health and age can also influence your decision. Term life insurance premiums are typically based on your age and health at the time of purchase, so younger individuals in good health may find term life policies more affordable. Whole life insurance, with its level premiums, can provide stability regardless of future health changes.

Conclusion: Whole Life vs. Term Life

The choice between whole life insurance and term life insurance ultimately depends on your individual needs, financial goals, and budget. Whole life insurance offers a comprehensive, lifelong solution with cash value accumulation, making it ideal for those seeking long-term financial planning and stability.

On the other hand, term life insurance provides a cost-effective, flexible option for temporary coverage, making it accessible to a wider range of individuals. It's essential to carefully assess your financial situation and future needs to determine which type of policy best suits your requirements.

By understanding the differences between whole life insurance and term life insurance, you can make an informed decision and take control of your financial future. Remember, life insurance is an essential tool for protecting your loved ones and ensuring their financial well-being, so choosing the right policy is a critical step in your financial journey.

Can I switch from term life insurance to whole life insurance later in life?

+Yes, many term life insurance policies offer the option to convert to a permanent life insurance policy, such as whole life or universal life, without undergoing a new medical exam. This provides flexibility and the ability to transition to lifelong coverage if your financial needs change.

Are there any tax benefits associated with whole life insurance?

+Whole life insurance policies offer tax advantages. The cash value within the policy grows tax-deferred, and any loans or withdrawals from the cash value are generally tax-free as long as they do not exceed the policy’s basis. Additionally, the death benefit proceeds are typically received tax-free by beneficiaries.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage expires, and you no longer have protection. However, many term life policies offer the option to renew for an additional term or convert to a permanent life insurance policy, ensuring continued coverage if desired.