Whole Term Life Insurance Cost

When it comes to whole life insurance, also known as permanent life insurance, the cost can vary significantly based on several factors. Understanding these costs is crucial for individuals seeking lifelong financial protection and peace of mind for their loved ones. In this comprehensive guide, we will delve into the intricacies of whole term life insurance costs, exploring the key variables that influence premiums and providing an in-depth analysis of the financial implications.

Understanding Whole Term Life Insurance Costs

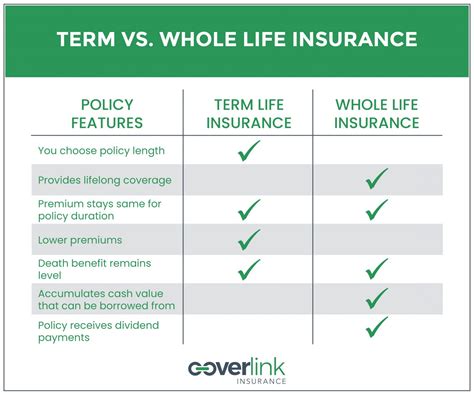

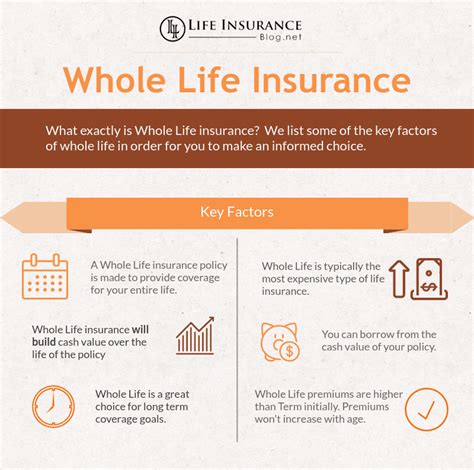

Whole term life insurance offers a lifetime guarantee, ensuring that the policy remains active as long as the premiums are paid. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers a more comprehensive and long-lasting solution. However, the cost of whole life insurance can be higher due to its permanent nature and the accumulation of cash value over time.

Factors Influencing Whole Term Life Insurance Costs

Several key factors come into play when determining the cost of whole term life insurance. These factors include the policyholder's age, health status, lifestyle, and the chosen coverage amount. Let's explore each of these factors in detail to gain a comprehensive understanding.

Age and Health Status

One of the primary determinants of whole term life insurance costs is the policyholder's age and health status. Insurance companies carefully assess an individual's health and medical history to determine their risk profile. Younger individuals generally enjoy lower premiums as they are considered to have a lower risk of developing serious health conditions. As we age, the risk of health issues increases, leading to higher premiums.

Additionally, pre-existing health conditions or medical history can significantly impact the cost of whole life insurance. Insurance companies may require medical examinations or review medical records to assess the applicant's health thoroughly. Individuals with a history of serious illnesses or medical conditions may face higher premiums or even be denied coverage altogether.

| Age Group | Average Premium (per $100,000 coverage) |

|---|---|

| 20-29 | $120 - $180 |

| 30-39 | $150 - $220 |

| 40-49 | $200 - $280 |

| 50-59 | $250 - $350 |

| 60-69 | $300 - $450 |

Lifestyle and Risk Factors

Insurance companies also consider an individual's lifestyle and potential risk factors when determining whole term life insurance costs. Engaging in high-risk activities such as extreme sports, hazardous occupations, or having a history of reckless behavior can lead to higher premiums. Insurance providers assess these factors to evaluate the likelihood of potential claims and adjust premiums accordingly.

For example, individuals who smoke or have a history of substance abuse may face higher premiums due to the increased health risks associated with these habits. Similarly, occupations involving manual labor or exposure to hazardous materials may also result in higher premiums, as they pose a higher risk of accidental injuries or health complications.

Coverage Amount and Duration

The amount of coverage chosen for a whole term life insurance policy directly impacts the cost. Higher coverage amounts typically result in higher premiums, as the insurer assumes a greater financial responsibility. Additionally, the duration of the policy plays a role in determining costs. Longer-term policies, such as those extending over several decades, may have higher premiums compared to shorter-term policies.

It's important to carefully consider the coverage amount and duration to ensure it aligns with your financial goals and the needs of your loved ones. Consulting with a financial advisor or insurance professional can help you determine the appropriate coverage amount and policy duration based on your specific circumstances.

Comparison of Whole Term Life Insurance Premiums

To provide a clearer picture of the cost variations, let's compare whole term life insurance premiums for individuals with different profiles. The following table illustrates the average annual premiums for a $500,000 whole term life insurance policy for individuals in various age groups and health categories.

| Age Group | Excellent Health | Average Health | Poor Health |

|---|---|---|---|

| 20-29 | $600 - $900 | $800 - $1,200 | $1,200 - $1,800 |

| 30-39 | $750 - $1,100 | $1,000 - $1,400 | $1,400 - $2,000 |

| 40-49 | $1,000 - $1,400 | $1,200 - $1,800 | $1,800 - $2,500 |

| 50-59 | $1,200 - $1,800 | $1,500 - $2,200 | $2,200 - $3,000 |

| 60-69 | $1,500 - $2,200 | $1,800 - $2,600 | $2,600 - $3,500 |

Financial Implications and Strategies

Understanding the financial implications of whole term life insurance costs is essential for making informed decisions. Here are some key considerations and strategies to navigate the financial aspects of whole term life insurance.

Budgeting and Affordability

When considering whole term life insurance, it's crucial to assess your financial situation and determine an affordable premium. Whole life insurance premiums are typically paid monthly, quarterly, or annually, depending on the policy and your preferences. Creating a budget and evaluating your financial commitments can help you determine the premium amount you can comfortably afford.

If the initial premiums seem high, it's worth exploring alternative payment options. Some insurers offer flexible payment plans, allowing you to pay premiums in installments or adjust the payment frequency to align with your financial capabilities. Additionally, considering the long-term benefits and peace of mind that whole life insurance provides can help justify the investment.

Cost-Saving Strategies

To minimize the cost of whole term life insurance, there are several strategies you can employ. Firstly, maintaining a healthy lifestyle and improving your overall health can lead to lower premiums. Regular exercise, a balanced diet, and avoiding high-risk activities can positively impact your health status and reduce the perceived risk by insurance providers.

Secondly, shopping around and comparing quotes from multiple insurers is essential. Insurance companies have different underwriting criteria and pricing structures, so obtaining quotes from at least three reputable insurers can help you find the most competitive rates. Online comparison tools and insurance brokers can streamline this process and provide valuable insights into the market.

Additionally, considering alternative life insurance options, such as term life insurance or universal life insurance, can be cost-effective solutions. Term life insurance provides coverage for a specified period, typically 10-30 years, and is generally more affordable than whole life insurance. Universal life insurance offers flexibility in premium payments and coverage amounts, allowing you to adjust your policy based on your changing needs.

Long-Term Benefits and Peace of Mind

While the cost of whole term life insurance may seem daunting initially, it's essential to consider the long-term benefits and the peace of mind it provides. Whole life insurance offers lifelong coverage, ensuring that your loved ones are financially protected even in the event of your untimely demise.

The cash value component of whole life insurance also adds to its appeal. Over time, a portion of your premiums accumulates as cash value, which can be accessed through policy loans or withdrawals. This cash value can be used for various financial needs, such as funding retirement, paying for your child's education, or covering unexpected expenses. The flexibility and potential for growth make whole life insurance an attractive long-term investment option.

Conclusion

Understanding the cost of whole term life insurance is crucial for individuals seeking comprehensive financial protection. The factors influencing these costs, such as age, health status, lifestyle, and coverage amount, play a significant role in determining the premiums. By assessing your individual circumstances, comparing quotes, and employing cost-saving strategies, you can find an affordable whole term life insurance policy that provides the financial security and peace of mind you desire.

Remember, whole term life insurance is a long-term commitment, and it's essential to carefully consider your needs and budget. With the right approach and guidance, you can secure a policy that aligns with your financial goals and ensures the well-being of your loved ones for years to come.

Frequently Asked Questions

How does whole term life insurance compare to term life insurance in terms of cost?

+Whole term life insurance typically has higher premiums compared to term life insurance. Term life insurance offers coverage for a specific period, usually 10-30 years, and is more affordable. However, whole term life insurance provides lifelong coverage and accumulates cash value over time, making it a more comprehensive and long-lasting solution.

Can I negotiate the premiums for whole term life insurance?

+Negotiating premiums for whole term life insurance is challenging due to the standardized pricing structures used by insurers. However, by comparing quotes from multiple insurers and demonstrating a healthy lifestyle and positive health status, you may be able to find more competitive rates. It’s important to shop around and seek guidance from insurance professionals.

Are there any tax benefits associated with whole term life insurance premiums?

+Whole term life insurance premiums are generally not tax-deductible. However, the death benefit received by your beneficiaries is typically tax-free. It’s essential to consult with a tax professional to understand the specific tax implications in your jurisdiction.

Can I increase my coverage amount for whole term life insurance later on?

+Some whole term life insurance policies allow you to increase your coverage amount at certain life events, such as marriage or the birth of a child. However, this option may be subject to additional underwriting and may result in higher premiums. It’s important to review your policy terms and consult with your insurer to understand your options.