Workers Compensation Insurance Quotes

Workers' compensation insurance is a crucial aspect of managing any business, as it provides protection for both employers and employees in the event of work-related injuries or illnesses. Obtaining accurate and competitive quotes for workers' compensation insurance is essential to ensure your business is adequately covered without incurring unnecessary expenses. In this comprehensive guide, we will delve into the world of workers' compensation insurance quotes, exploring the factors that influence rates, the quote process, and strategies to secure the best coverage for your business.

Understanding Workers’ Compensation Insurance

Workers’ compensation, often referred to as workman’s comp or simply comp, is a type of insurance that covers medical expenses, lost wages, and rehabilitation costs for employees who sustain injuries or become ill due to their work. It is a mandatory insurance policy for most employers, as it not only protects the business from potential lawsuits but also ensures employees receive the necessary care and support during their recovery.

The cost of workers' compensation insurance is determined by a variety of factors, including the nature of the business, the industry's risk profile, the location of the business, and the claims history of the employer. Understanding these factors is crucial when seeking quotes to ensure you receive an accurate and fair assessment of your business's insurance needs.

Factors Influencing Workers’ Compensation Rates

Several key factors play a role in determining the rates for workers’ compensation insurance. These include:

- Industry Classification: Different industries carry varying levels of risk. For instance, construction and manufacturing are generally considered high-risk industries due to the physical nature of the work, while office-based businesses are typically classified as lower risk.

- Business Size and Payroll: The size of your business and the total annual payroll are significant factors. Larger businesses with higher payrolls often face higher insurance premiums, as they may have a greater number of employees at risk of injury.

- Claims History: Insurance providers closely examine an employer’s claims history. A business with a history of frequent or severe claims may be considered a higher risk, resulting in increased premiums.

- Loss Prevention Measures: Implementing effective safety measures and training programs can positively impact your insurance rates. Demonstrating a commitment to workplace safety may lead to lower premiums.

- Location: The geographical location of your business can affect rates. Some areas may have higher rates of workplace injuries or specific industry risks, influencing the overall cost of insurance.

By understanding these factors, you can make informed decisions when seeking quotes and potentially negotiate better rates by addressing areas of concern.

The Process of Obtaining Workers’ Compensation Quotes

Obtaining quotes for workers’ compensation insurance involves a detailed process that helps insurance providers assess the specific risks associated with your business. Here’s an overview of the typical steps involved:

1. Initial Assessment

The first step is to provide basic information about your business, including the industry you operate in, the number of employees, and your annual payroll. This initial assessment helps insurance providers categorize your business and determine an initial premium estimate.

2. Risk Evaluation

Insurance providers will conduct a thorough evaluation of the risks associated with your business. They may request additional information, such as safety protocols, training programs, and historical data on workplace injuries or illnesses. This evaluation helps them understand the specific hazards your employees face and assess the likelihood of claims.

3. Quote Generation

Based on the information provided during the risk evaluation, insurance providers will generate a quote for workers’ compensation insurance. This quote will include the premium amount, coverage limits, and any additional services or benefits offered.

4. Comparison and Negotiation

It is essential to obtain quotes from multiple insurance providers to compare rates and coverage options. By comparing quotes, you can identify the best value for your business’s specific needs. Additionally, you may have the opportunity to negotiate with insurance providers, especially if you have implemented effective safety measures or have a strong claims history.

5. Policy Selection and Implementation

Once you have selected the insurance provider and policy that best suits your business, the next step is to finalize the agreement and implement the workers’ compensation insurance program. This involves signing the necessary paperwork and ensuring that all employees are aware of the coverage and their rights under the policy.

| Insurance Provider | Premium Rate | Coverage Limits |

|---|---|---|

| Provider A | $0.75 per $100 of payroll | $1 million per occurrence |

| Provider B | $0.80 per $100 of payroll | $2 million per occurrence |

| Provider C | $0.65 per $100 of payroll | $1.5 million per occurrence |

In the above example, we compare quotes from three different insurance providers. While Provider C offers the lowest premium rate, it's essential to consider the coverage limits and other benefits provided by each policy to make an informed decision.

Strategies for Securing the Best Workers’ Compensation Quotes

To ensure you receive the most competitive and accurate quotes for workers’ compensation insurance, consider implementing the following strategies:

1. Maintain a Safe Workplace

One of the most effective ways to lower insurance premiums is by creating a safe work environment. Invest in comprehensive safety training programs, ensure proper equipment and tools are provided, and regularly conduct safety audits to identify and address potential hazards. By reducing the risk of workplace injuries, you can significantly impact your insurance rates.

2. Develop a Strong Claims Management System

Implementing a robust claims management system can help minimize the impact of claims on your insurance rates. Promptly address and resolve claims, keep accurate records, and collaborate with insurance providers to mitigate potential long-term effects. A well-managed claims process demonstrates your commitment to workplace safety and can lead to more favorable quotes.

3. Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Take the time to shop around and compare quotes from multiple insurance providers. Consider factors such as premium rates, coverage limits, and additional services offered. By comparing quotes, you can identify the best value for your business and potentially negotiate better terms.

4. Bundle Policies for Discounts

If your business requires multiple insurance policies, such as general liability and workers’ compensation, consider bundling them with the same insurance provider. Many providers offer discounts when you purchase multiple policies, resulting in significant savings.

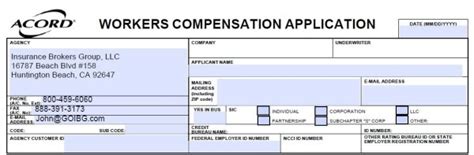

5. Work with Insurance Brokers

Insurance brokers can be valuable partners in obtaining the best workers’ compensation quotes. They have extensive knowledge of the insurance market and can negotiate on your behalf to secure competitive rates. Brokers can also provide guidance on risk management strategies and help you understand the fine print of insurance policies.

Future Implications and Industry Trends

The landscape of workers’ compensation insurance is constantly evolving, and staying informed about industry trends is crucial for businesses. Here are some key considerations for the future:

1. Technological Advancements

The use of technology in workers’ compensation insurance is on the rise. From digital claim management systems to wearable devices that monitor employee health and safety, technology is playing a significant role in reducing workplace risks and improving claim management. Staying updated with these technological advancements can help your business stay competitive and potentially lower insurance costs.

2. Focus on Prevention

Insurance providers are increasingly recognizing the importance of prevention in reducing workplace injuries and illnesses. By investing in preventive measures and implementing effective safety protocols, businesses can not only lower insurance premiums but also create a safer and more productive work environment. This shift towards prevention is expected to continue, making it a key focus for businesses seeking competitive quotes.

3. Data-Driven Decisions

The availability of data and analytics is transforming the insurance industry. Insurance providers are utilizing data to assess risks more accurately and tailor policies to individual businesses. As a result, businesses that can provide detailed and accurate data on workplace safety and claims history may benefit from more favorable quotes. Embracing data-driven decision-making can help your business stay ahead in the workers’ compensation insurance market.

Conclusion

Obtaining competitive and accurate workers’ compensation insurance quotes is a critical step in ensuring your business is adequately protected. By understanding the factors that influence rates, following a thorough quote process, and implementing effective strategies, you can secure the best coverage for your business while managing costs. Remember, a well-managed workers’ compensation program not only protects your employees but also contributes to the long-term success and sustainability of your business.

What is the average cost of workers’ compensation insurance per employee?

+The average cost of workers’ compensation insurance varies greatly depending on industry, location, and claims history. As a general guideline, the cost can range from 0.50 to 2.00 per $100 of payroll, but it’s essential to obtain specific quotes for your business to get an accurate estimate.

Can I negotiate workers’ compensation insurance rates?

+Yes, negotiation is a common practice when obtaining workers’ compensation insurance quotes. By demonstrating a strong commitment to workplace safety, providing detailed information on your business, and comparing quotes from multiple providers, you can often negotiate better rates and terms.

How often should I review and update my workers’ compensation insurance policy?

+It is recommended to review your workers’ compensation insurance policy annually or whenever significant changes occur in your business, such as an increase in payroll, expansion into new industries, or a change in location. Regular reviews ensure your coverage remains adequate and aligned with your business needs.

What are some common exclusions in workers’ compensation insurance policies?

+Common exclusions in workers’ compensation insurance policies may include intentional self-inflicted injuries, injuries resulting from drug or alcohol abuse, and certain pre-existing conditions. It’s important to carefully review the policy exclusions to understand what is and isn’t covered.

How can I reduce my workers’ compensation insurance premiums over time?

+To reduce workers’ compensation insurance premiums over time, focus on implementing robust safety measures, investing in employee training, and creating a culture of safety within your organization. Additionally, regularly reviewing and managing claims can help mitigate the impact of claims on your insurance rates.