20 Year Term Life Insurance Rates

Life insurance is an essential financial tool that provides security and peace of mind for individuals and their loved ones. Among the various life insurance options available, term life insurance stands out for its affordability and flexibility, particularly for those seeking coverage over a specific period. In this comprehensive guide, we delve into the world of 20-year term life insurance rates, exploring the factors that influence premiums, the benefits it offers, and how it can be a strategic choice for your financial future.

Understanding Term Life Insurance

Term life insurance is a type of coverage that provides protection for a defined period, known as the “term.” Unlike permanent life insurance policies that offer lifelong coverage, term life insurance focuses on providing financial support during a specific stage of life, typically when financial obligations are at their peak. The term can vary, with common durations being 10, 15, 20, or even 30 years.

The premise of term life insurance is simple: you pay regular premiums for a set period, and in the event of your untimely demise during the term, your beneficiaries receive a tax-free death benefit. This benefit can help cover a range of expenses, including funeral costs, outstanding debts, daily living expenses, and even college tuition for your children.

Why Choose a 20-Year Term?

Selecting a 20-year term life insurance policy is a popular choice for several reasons:

- Cost-Effectiveness: Twenty-year terms often offer the best value in terms of premiums. They strike a balance between shorter-term policies that may be more affordable but require frequent renewals and longer-term policies that offer lifetime coverage but at a higher cost.

- Coverage Duration: This term aligns well with the stage of life when many individuals have significant financial responsibilities. It covers you during your prime earning years, ensuring your family is protected if the unexpected occurs.

- Flexibility: Unlike permanent life insurance, term life allows you to tailor your coverage to your specific needs. If your circumstances change, you can easily adjust or renew your policy.

- Renewal Options: Many 20-year term policies offer the flexibility to renew at the end of the term, often with the option to convert to a permanent policy if your needs evolve.

Factors Influencing 20-Year Term Life Insurance Rates

The cost of a 20-year term life insurance policy is influenced by several key factors:

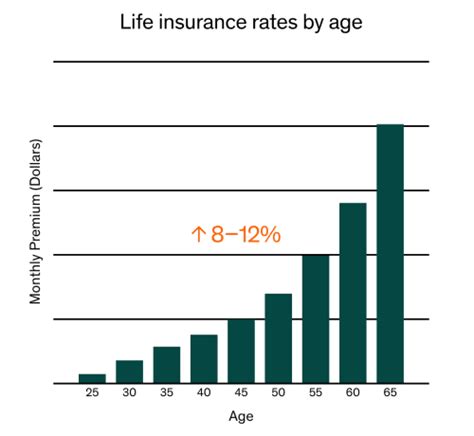

- Age: One of the most significant factors is your age when you purchase the policy. Generally, younger individuals enjoy lower premiums as they are considered less risky to insure.

- Health Status: Your current health plays a vital role. Those with excellent health may qualify for preferred rates, while pre-existing conditions or unhealthy lifestyles could lead to higher premiums or policy exclusions.

- Tobacco Use: Tobacco users often face higher premiums due to the increased health risks associated with smoking or chewing tobacco.

- Medical History: Your medical history, including any past or current illnesses, surgeries, or treatments, is carefully assessed. A clean bill of health can lead to more favorable rates.

- Occupation: High-risk occupations, such as those involving heavy machinery or extreme sports, may result in higher premiums.

- Family Health History: Insurers may consider your family’s health history to assess potential genetic risks.

- Lifestyle: Your lifestyle choices, including alcohol consumption, exercise habits, and overall fitness level, can impact your premium rates.

- Policy Amount: The higher the coverage amount you choose, the higher your premiums will be.

- Rider Options: Additional rider benefits, such as waiver of premium or accelerated death benefit, can increase the cost of your policy.

Real-World Examples of 20-Year Term Life Insurance Rates

To illustrate the range of rates, let’s examine some hypothetical scenarios:

Scenario 1: Healthy, Non-Smoking Individual (Age 30)

- Policy Details: 20-year term, $500,000 coverage

- Premium: Approximately $25 per month

- Comments: This individual enjoys a preferred rate due to their healthy lifestyle and non-smoking status.

Scenario 2: Smoker with Pre-Existing Condition (Age 40)

- Policy Details: 20-year term, $300,000 coverage

- Premium: Around $60 per month

- Comments: Smoking and a pre-existing condition lead to a higher premium, but coverage is still affordable.

Scenario 3: High-Risk Occupation (Age 35)

- Policy Details: 20-year term, $750,000 coverage

- Premium: Approximately $45 per month

- Comments: Despite a high-risk occupation, this individual qualifies for a standard rate due to their overall good health.

Performance Analysis: 20-Year Term Life Insurance

The performance of a 20-year term life insurance policy can be assessed through several key metrics:

- Cost-Effectiveness: As mentioned earlier, 20-year terms offer a balance between affordability and coverage duration, making them a cost-effective choice for many.

- Coverage Flexibility: The ability to adjust coverage amounts or add riders ensures that your policy can adapt to changing needs.

- Renewal Options: The flexibility to renew or convert to a permanent policy at the end of the term provides long-term peace of mind.

- Tax Benefits: The death benefit received by your beneficiaries is tax-free, ensuring maximum financial support.

Evidence-Based Future Implications

The future of term life insurance, particularly 20-year terms, looks promising:

- Increasing Awareness: As financial literacy grows, more individuals are recognizing the importance of life insurance, leading to a potential rise in policy purchases.

- Advancements in Underwriting: Technological advancements are improving the accuracy of underwriting, allowing for more precise risk assessments and potentially lower premiums.

- Customizable Policies: Insurers are introducing more customizable options, allowing policyholders to tailor their coverage to their specific needs and budgets.

- Renewal Trends: The ability to renew term policies is expected to become even more prevalent, offering long-term protection without the need for medical exams.

Frequently Asked Questions (FAQ)

Can I purchase a 20-year term life insurance policy at any age?

+Yes, you can typically purchase a 20-year term policy at various ages. However, premiums may vary based on your age and health status.

What happens if I outlive my 20-year term policy?

+If you outlive your term policy, the coverage expires, and you no longer have protection. However, you may have the option to renew or convert to a permanent policy.

Are there any restrictions on the death benefit I can receive?

+Generally, there are no restrictions on the death benefit, and it is paid tax-free to your beneficiaries. However, certain exclusions may apply, such as suicide or fraudulent statements.

Can I add rider benefits to my 20-year term policy?

+Yes, many insurers offer rider options to enhance your coverage. Common riders include waiver of premium, accelerated death benefit, and critical illness coverage.

Final Thoughts

Term life insurance, especially the 20-year term, offers a strategic and cost-effective solution for individuals seeking financial protection during their most crucial years. By understanding the factors that influence premiums and the benefits of this type of coverage, you can make an informed decision to secure your family’s future. Remember, life insurance is a long-term commitment, and selecting the right policy and insurer is crucial for your peace of mind.