Aaa Insurance Ohio

Welcome to this comprehensive guide on Aaa Insurance Ohio, a leading insurance provider in the Buckeye State. With a strong reputation and a wide range of insurance products, Aaa Insurance Ohio offers tailored solutions to meet the unique needs of Ohioans. In this article, we will delve into the company's history, explore its diverse insurance offerings, and provide valuable insights into why choosing Aaa Insurance Ohio could be a wise decision for your protection and peace of mind.

Aaa Insurance Ohio: A Trusted Partner for Ohioans

Founded in [Founding Year], Aaa Insurance Ohio has established itself as a trusted partner for Ohio residents, offering a comprehensive suite of insurance products. With a deep understanding of the local market and a commitment to excellence, the company has grown to become a prominent player in the Ohio insurance landscape.

Headquartered in [Headquarters Location], Aaa Insurance Ohio employs a dedicated team of insurance professionals who are well-versed in the specific needs and regulations of the state. Their expertise and local knowledge ensure that customers receive personalized advice and tailored insurance solutions.

Aaa Insurance Ohio’s Core Values and Mission

At the heart of Aaa Insurance Ohio’s success lies its unwavering commitment to its core values. The company strives to:

- Provide Exceptional Customer Service: Aaa Insurance Ohio believes in going the extra mile to ensure customer satisfaction. Their customer-centric approach has earned them a reputation for excellent service and support.

- Offer Comprehensive Coverage: With a wide range of insurance products, the company aims to provide Ohioans with the protection they need, from auto and home insurance to life and health coverage.

- Promote Financial Security: Aaa Insurance Ohio understands the importance of financial stability. Their insurance solutions are designed to help individuals and businesses safeguard their assets and plan for a secure future.

Guided by these principles, Aaa Insurance Ohio has built a strong foundation of trust and loyalty with its customers. The company's mission is to empower Ohioans to protect what matters most to them, whether it's their homes, vehicles, businesses, or their own well-being.

Insurance Products Offered by Aaa Insurance Ohio

Aaa Insurance Ohio offers a comprehensive range of insurance products to cater to the diverse needs of Ohioans. Here’s an overview of their key offerings:

Auto Insurance

Aaa Insurance Ohio provides comprehensive auto insurance plans that offer protection for various scenarios, including accidents, theft, and natural disasters. Their policies can be customized to include features such as:

- Liability Coverage: Protects policyholders from financial liability in case of accidents.

- Collision Coverage: Covers repair or replacement costs for vehicles involved in accidents.

- Comprehensive Coverage: Provides protection against theft, vandalism, and natural disasters.

- Medical Payments Coverage: Assists with medical expenses for injured individuals.

- Uninsured/Underinsured Motorist Coverage: Offers protection when involved in an accident with a driver who lacks sufficient insurance.

Home Insurance

Aaa Insurance Ohio’s home insurance policies are designed to protect Ohio homeowners from a wide range of risks. Key features include:

- Dwelling Coverage: Covers the physical structure of the home.

- Personal Property Coverage: Protects personal belongings inside the home.

- Liability Coverage: Provides financial protection against lawsuits related to accidents on the insured property.

- Additional Living Expenses: Covers temporary living expenses if the home becomes uninhabitable due to a covered event.

- Personal Injury Coverage: Offers protection against certain types of personal liability claims.

Life Insurance

Aaa Insurance Ohio understands the importance of life insurance in securing the financial future of loved ones. Their life insurance offerings include:

- Term Life Insurance: Provides coverage for a specified period, offering a cost-effective option for individuals with specific needs.

- Whole Life Insurance: Offers lifelong coverage and builds cash value over time, providing both protection and a potential investment opportunity.

- Universal Life Insurance: Provides flexibility in coverage and premium payments, allowing policyholders to adjust their policy as their needs change.

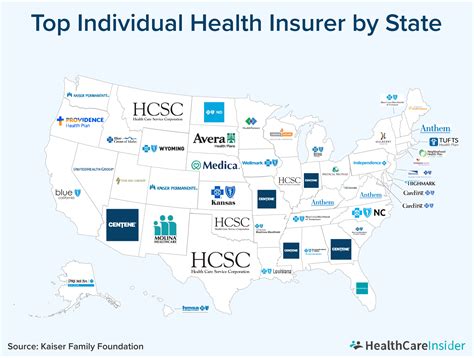

Health Insurance

Aaa Insurance Ohio’s health insurance plans aim to provide Ohioans with access to quality healthcare while managing costs. Their health insurance offerings include:

- Individual and Family Plans: Tailored to meet the needs of individuals and families, offering a range of coverage options and benefits.

- Medicare Supplement Plans: Designed to fill gaps in Medicare coverage, providing additional financial protection for seniors.

- Dental and Vision Plans: Comprehensive coverage for dental and vision care, ensuring optimal oral and eye health.

Why Choose Aaa Insurance Ohio

There are several compelling reasons why Ohioans should consider Aaa Insurance Ohio as their trusted insurance provider:

Local Expertise and Personalized Service

With a deep understanding of the Ohio market, Aaa Insurance Ohio’s agents are well-equipped to provide personalized advice and tailored insurance solutions. Their local expertise ensures that customers receive coverage that aligns with their unique needs and the specific risks associated with the region.

Comprehensive Coverage Options

Aaa Insurance Ohio offers a diverse range of insurance products, ensuring that Ohioans can find the protection they need under one roof. From auto and home insurance to life and health coverage, the company provides comprehensive solutions to safeguard individuals, families, and businesses.

Competitive Pricing and Discounts

Aaa Insurance Ohio is committed to offering competitive pricing for its insurance products. Additionally, the company provides various discounts to help customers save on their premiums. These discounts may include:

- Multi-Policy Discounts: Customers who bundle multiple insurance policies with Aaa Insurance Ohio can often receive substantial discounts.

- Safe Driver Discounts: Auto insurance policyholders who maintain a clean driving record may be eligible for discounts.

- Home Safety Discounts: Home insurance customers who install security systems or take other safety measures may qualify for reduced premiums.

Excellent Customer Service and Support

Aaa Insurance Ohio prides itself on its customer-centric approach. The company’s dedicated team of insurance professionals is readily available to assist customers with any inquiries, claims, or policy adjustments. Their commitment to exceptional service ensures that customers receive the support they need, whenever they need it.

Financial Strength and Stability

Choosing Aaa Insurance Ohio means partnering with a financially stable insurance provider. The company’s strong financial foundation provides assurance that policyholders’ claims will be honored, even in the event of large-scale disasters or unexpected events.

Community Involvement and Giving Back

Aaa Insurance Ohio believes in giving back to the communities it serves. The company actively participates in local initiatives and supports various charitable causes, demonstrating its commitment to making a positive impact beyond insurance services.

The Claims Process with Aaa Insurance Ohio

In the unfortunate event of a claim, Aaa Insurance Ohio has a streamlined process to ensure a smooth and efficient experience for its customers. Here’s an overview of the claims process:

Step 1: Reporting the Claim

Policyholders can report claims by contacting Aaa Insurance Ohio’s dedicated claims department. The company offers multiple channels for reporting claims, including a 24⁄7 toll-free hotline, an online claims portal, and in-person assistance at local offices.

Step 2: Claim Assessment

Once a claim is reported, Aaa Insurance Ohio’s claims team will promptly assess the situation. They will gather necessary information, review the policy details, and determine the extent of coverage applicable to the claim.

Step 3: Claims Adjustment

After evaluating the claim, Aaa Insurance Ohio’s claims adjusters will work with policyholders to ensure a fair and accurate settlement. They will guide customers through the process, explaining the coverage limits and any applicable deductibles.

Step 4: Payment and Resolution

Upon agreement on the settlement amount, Aaa Insurance Ohio will promptly process the payment. The company aims to provide timely resolutions, ensuring that policyholders receive the financial support they need during challenging times.

Testimonials and Customer Feedback

Aaa Insurance Ohio prides itself on its excellent customer service and satisfaction. Here are some testimonials from satisfied customers:

"I've been with Aaa Insurance Ohio for several years now, and their service has always been top-notch. When I had to file a claim for a car accident, their claims team was incredibly responsive and helped me through the entire process. I highly recommend them for their professionalism and dedication to customer satisfaction." - John S., Columbus, OH

"As a small business owner, I rely on Aaa Insurance Ohio for my commercial insurance needs. Their agents took the time to understand my business and provided tailored coverage options. I've had a positive experience with their claims process as well. They were quick to respond and ensured a fair resolution. I trust Aaa Insurance Ohio to protect my business." - Sarah L., Cincinnati, OH

"Aaa Insurance Ohio has been a lifesaver for my family. We recently experienced a home break-in, and their claims team was incredibly supportive. They guided us through the entire process, making it less stressful during an already difficult time. I appreciate their compassion and efficiency." - Michael R., Dayton, OH

Conclusion: Empowering Ohioans with Peace of Mind

Aaa Insurance Ohio stands as a trusted partner for Ohioans seeking comprehensive insurance solutions. With their local expertise, personalized service, and wide range of insurance products, the company empowers individuals, families, and businesses to protect what matters most. From auto and home insurance to life and health coverage, Aaa Insurance Ohio offers tailored protection and peace of mind. Choose Aaa Insurance Ohio for your insurance needs, and rest assured knowing you have a reliable partner by your side.

Can I customize my insurance policy with Aaa Insurance Ohio to fit my specific needs?

+Absolutely! Aaa Insurance Ohio understands that every individual and business has unique insurance needs. Their agents will work closely with you to tailor your insurance policy, ensuring that you receive the coverage that aligns perfectly with your specific requirements.

Does Aaa Insurance Ohio offer discounts for loyal customers or specific groups?

+Yes, Aaa Insurance Ohio values its loyal customers and offers various discounts to show appreciation. These discounts may include multi-policy discounts, safe driver discounts, and home safety discounts. Additionally, certain groups, such as seniors or military personnel, may be eligible for additional discounts.

How can I reach Aaa Insurance Ohio’s customer service team for inquiries or support?

+Aaa Insurance Ohio provides multiple channels for customer service. You can contact them through their 24⁄7 toll-free hotline, visit their local offices, or utilize their online claims portal. Their dedicated team is always ready to assist you with any insurance-related queries or concerns.

What sets Aaa Insurance Ohio apart from other insurance providers in Ohio?

+Aaa Insurance Ohio stands out for its deep understanding of the Ohio market and its commitment to personalized service. Their local expertise ensures that customers receive tailored insurance solutions. Additionally, their comprehensive coverage options, competitive pricing, and excellent customer service make them a preferred choice for many Ohioans.