Aarp Life Insurance Quotes

AARP Life Insurance Quotes: Unlocking the Key to Affordable Coverage and Peace of Mind

Introduction: Understanding the Value of AARP Life Insurance

In the vast landscape of insurance options, AARP life insurance stands out as a beacon of reliability and affordability. This comprehensive guide will delve into the intricacies of AARP life insurance quotes, shedding light on how this service can be a game-changer for individuals seeking peace of mind and financial security.

The American Association of Retired Persons (AARP) has long been a trusted name in the retirement and insurance space. Their life insurance offerings are tailored to meet the unique needs of seniors, providing a safety net for their loved ones while ensuring a stress-free retirement journey. By understanding the nuances of AARP life insurance quotes, individuals can make informed decisions, secure their future, and navigate the complexities of insurance with confidence.

The Benefits of AARP Life Insurance: A Comprehensive Overview

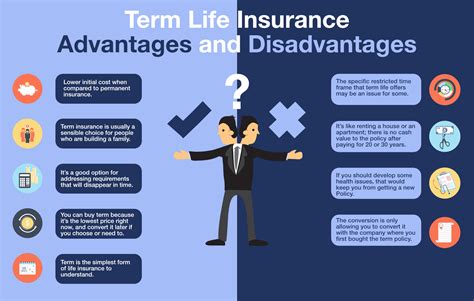

AARP life insurance is designed with the specific needs of older adults in mind. Here’s a glimpse into the key advantages that make this insurance option a top choice:

Affordable Premiums

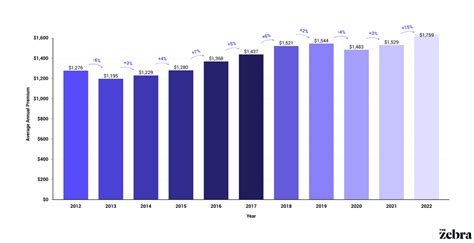

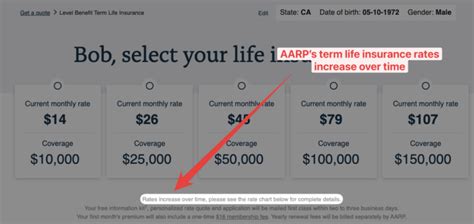

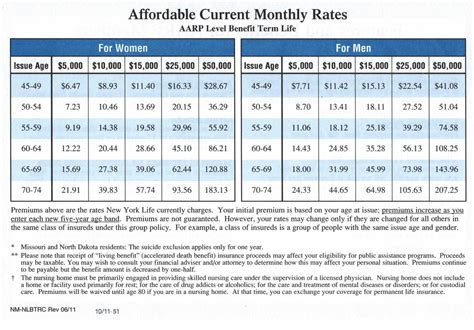

One of the standout features of AARP life insurance is its competitive pricing. AARP works closely with reputable insurance providers to offer policies that are tailored to be affordable for seniors. This means that individuals can secure substantial coverage without breaking the bank.

Customizable Plans

AARP understands that everyone’s needs are unique, especially when it comes to life insurance. Their policies offer a range of customization options, allowing individuals to choose the coverage amount, term length, and additional benefits that align perfectly with their circumstances and goals.

Simplified Application Process

Applying for life insurance can often be a daunting task, especially for those who are not familiar with the process. AARP has streamlined the application journey, making it straightforward and stress-free. The online application platform is user-friendly, and for those who prefer personal assistance, AARP’s dedicated customer support team is always ready to guide applicants through the process.

Reliable Claims Process

In the unfortunate event of a claim, AARP’s efficient and compassionate claims process ensures a smooth and respectful experience. Their team of experts works diligently to process claims promptly, providing beneficiaries with the financial support they need during a challenging time.

Exploring AARP Life Insurance Quotes: A Step-by-Step Guide

Obtaining an AARP life insurance quote is a straightforward process. Here’s a detailed breakdown to help you navigate each step confidently:

Step 1: Visit the AARP Website

Begin your journey by visiting the official AARP website. This is the gateway to a wealth of information and resources related to life insurance and other AARP services.

Step 2: Navigate to the Life Insurance Section

Once on the AARP website, locate the dedicated section for life insurance. Here, you’ll find detailed explanations of the various policies, their benefits, and how they can cater to your specific needs.

Step 3: Explore Policy Options

Take the time to explore the different life insurance policies offered by AARP. Each policy has its unique features and benefits, so understanding these nuances is crucial for making an informed decision.

Step 4: Request a Quote

When you’ve identified the policy that best aligns with your needs, it’s time to request a quote. AARP provides a user-friendly quote request form, where you can input your personal details and receive an instant estimate of your premium.

Step 5: Review and Compare

After receiving your quote, take the time to review the policy details and compare them with other options in the market. AARP’s quotes are transparent and easy to understand, making it a breeze to evaluate the value and affordability of their policies.

Step 6: Seek Expert Advice (if needed)

If you have any questions or need further clarification, AARP’s team of insurance experts is just a call or email away. They are dedicated to providing personalized guidance to help you make the right choice.

Real-Life Success Stories: AARP Life Insurance in Action

AARP life insurance has impacted countless lives, providing financial security and peace of mind to seniors and their families. Here are a few real-life success stories that showcase the power of AARP life insurance:

Story 1: Mr. Johnson’s Legacy

“I’ve been an AARP member for many years, and when it came time to secure life insurance, I knew AARP would be my go-to. The process was seamless, and the premium was incredibly affordable. I’m confident that my family will be taken care of thanks to the coverage I’ve secured.”

Story 2: Ms. Garcia’s Peace of Mind

“As a retiree, I wanted to ensure that my grandchildren’s future was secure. AARP life insurance offered me the perfect solution. The customizable plans allowed me to choose a coverage amount that fit my budget, and the application process was a breeze. I can now enjoy my retirement with peace of mind.”

Story 3: The Smith Family’s Unexpected Blessing

“When we lost our beloved grandfather, we were grateful for the life insurance policy he had through AARP. The claims process was efficient and compassionate, providing us with the financial support we needed during a difficult time. AARP’s life insurance truly made a difference in our lives.”

The Future of AARP Life Insurance: Innovations and Trends

AARP is committed to staying ahead of the curve, continuously innovating to meet the evolving needs of its members. Here’s a glimpse into the future of AARP life insurance:

Digital Transformation

AARP recognizes the importance of a seamless digital experience. They are investing in enhancing their online platforms, ensuring that members can access quotes, manage policies, and receive support with just a few clicks.

Expanded Coverage Options

To cater to a diverse range of needs, AARP is exploring new coverage options. This includes potential additions such as critical illness coverage, long-term care insurance, and more, ensuring that members have a comprehensive suite of options to choose from.

Member Engagement and Education

AARP understands the value of empowering its members with knowledge. They are dedicated to providing educational resources and workshops to help individuals make informed decisions about their financial future and insurance needs.

| Key Takeaway | Value |

|---|---|

| Affordable Premiums | AARP offers competitive rates, ensuring seniors can secure substantial coverage without financial strain. |

| Customizable Plans | Policies are tailored to individual needs, allowing for flexibility in coverage amounts and term lengths. |

| Simplified Application | AARP has streamlined the application process, making it accessible and stress-free for all applicants. |

| Reliable Claims | Efficient and compassionate claims process ensures beneficiaries receive support during challenging times. |

What are the eligibility requirements for AARP life insurance?

+

To be eligible for AARP life insurance, individuals must be aged 50 or older and be a member of AARP. Membership is open to anyone aged 50 or above, so becoming a member is the first step towards securing AARP life insurance.

Can I customize my AARP life insurance policy further?

+

Absolutely! AARP offers a range of add-on benefits and riders that allow you to tailor your policy to your specific needs. These may include accelerated death benefits, waiver of premium options, and more.

How long does it take to receive an AARP life insurance quote?

+

You can receive an instant quote by providing your basic information on the AARP website. The quote will give you an estimate of your premium based on your age, health status, and coverage amount.

Are there any medical exams required for AARP life insurance?

+

AARP life insurance policies typically do not require medical exams for individuals aged 50-80. However, for those aged 81 and above, a simplified medical questionnaire may be required.

Can I switch my AARP life insurance policy if my needs change?

+

Yes, AARP understands that life circumstances can change. You can review and adjust your policy at any time to ensure it continues to meet your needs. Their customer support team is always ready to assist with any policy changes.