Car Insurance Premium Increase

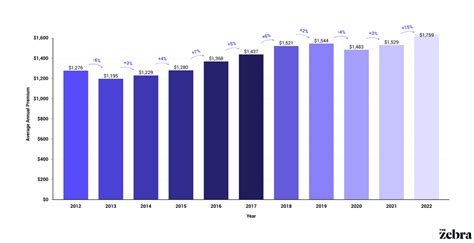

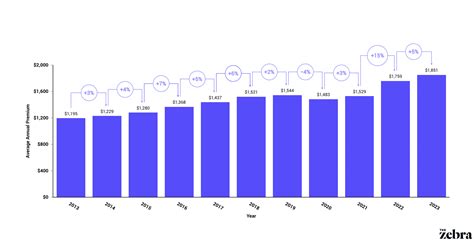

The cost of car insurance is a significant concern for many vehicle owners, and understanding the factors that influence premium increases is essential for managing expenses. In recent years, there has been a noticeable rise in insurance costs, prompting a closer examination of the contributing factors and potential strategies to mitigate these increases.

Understanding Car Insurance Premium Increases

Car insurance premiums are influenced by a multitude of factors, ranging from individual driving records to broader economic and societal trends. One of the primary drivers of premium increases is the rising cost of vehicle repairs and medical treatments. As technological advancements make vehicles more complex and expensive to repair, and as healthcare costs continue to soar, insurance providers must adjust their rates to maintain solvency.

Additionally, changes in traffic patterns and accident rates can significantly impact insurance premiums. Urban areas, for instance, often experience higher accident rates due to increased traffic congestion and the challenges of navigating busy city streets. This elevated risk typically translates to higher insurance premiums for city dwellers.

Demographic shifts also play a role in premium adjustments. Insurance companies carefully analyze data on age, gender, and geographic location to assess risk levels. For instance, younger drivers, particularly males, are statistically more likely to be involved in accidents, leading to higher premiums for this demographic.

Moreover, legislative changes and legal precedents can influence insurance rates. Increases in liability coverage requirements or changes in no-fault insurance laws can compel insurance providers to adjust their rates to comply with new regulations.

Factors Contributing to Premium Increases

Vehicle Repair Costs

The escalating cost of vehicle repairs is a significant factor in rising insurance premiums. As automotive technology advances, repair processes become more intricate and costly. Modern vehicles are equipped with advanced safety features, complex electronic systems, and high-tech engines, all of which contribute to higher repair bills.

| Repair Type | Average Cost Increase |

|---|---|

| Bodywork | 15-20% over the last 5 years |

| Mechanical Repairs | 10-15% over the last 5 years |

| Electronic System Diagnostics | 20-25% over the last 5 years |

Furthermore, the increasing prevalence of luxury and high-performance vehicles on the road adds to the complexity and expense of repairs. These vehicles often require specialized parts and skilled technicians, driving up repair costs and subsequently impacting insurance premiums.

Medical Treatment Costs

Rising medical costs are another critical factor in insurance premium increases. Healthcare expenses, including those related to accident-related injuries, have been steadily climbing. This trend is influenced by various factors, including the increasing cost of medical procedures, advanced diagnostic technologies, and the rising price of prescription medications.

In the context of car insurance, these escalating medical costs can significantly impact premium rates. When an insured individual is involved in an accident, the insurance provider is responsible for covering the cost of medical treatments. As these costs rise, insurance companies must adjust their premiums to maintain financial stability and meet their obligations.

Traffic Patterns and Accident Rates

Traffic congestion and accident rates are key factors that insurance providers consider when setting premiums. Urban areas, in particular, experience higher traffic volumes and, consequently, a greater number of accidents. This increased risk of accidents leads to higher insurance premiums for city residents.

| City | Accident Rate (per 100,000 vehicles) | Premium Increase |

|---|---|---|

| New York City | 350 | 12% over the last year |

| Los Angeles | 320 | 8% over the last year |

| Chicago | 280 | 6% over the last year |

Additionally, certain types of roads and intersections are known to have higher accident rates due to design flaws or poor visibility. Insurance companies closely monitor these locations and may adjust premiums for drivers who frequently travel through these high-risk areas.

Demographic and Legal Factors

Demographic Risk Assessment

Insurance companies utilize demographic data to assess risk levels and set premiums. Age, gender, and geographic location are key factors in this assessment. Younger drivers, especially males, are statistically more likely to be involved in accidents, leading to higher insurance premiums for this demographic.

Urban residents, as previously mentioned, often face higher premiums due to the increased risk of accidents in densely populated areas. Conversely, rural areas generally have lower accident rates, resulting in more affordable insurance premiums.

Legislative and Legal Changes

Changes in legislation and legal precedents can significantly impact insurance rates. Increases in liability coverage requirements, for instance, mandate that insurance providers offer higher coverage limits, which can lead to premium increases. Similarly, alterations to no-fault insurance laws can affect the way claims are processed and paid out, potentially influencing premium rates.

Moreover, legal judgments in high-profile accident cases can set precedents that impact insurance rates. If a court awards a significant settlement in a personal injury case, insurance providers may adjust their rates to account for the increased risk of similar outcomes in future cases.

Strategies to Mitigate Premium Increases

While some factors that influence insurance premium increases are beyond individual control, there are strategies that vehicle owners can employ to potentially mitigate these increases and manage their insurance costs.

Safe Driving Practices

Maintaining a clean driving record is one of the most effective ways to keep insurance premiums low. Insurance providers reward safe drivers with discounts and more favorable rates. By avoiding accidents and traffic violations, drivers can significantly reduce the likelihood of premium increases.

Choosing the Right Coverage

Understanding the different types of car insurance coverage and selecting the right level of coverage for your needs can help keep costs down. Comprehensive and collision coverage, while providing broad protection, can be costly. Consider your vehicle’s age, value, and your personal risk tolerance when deciding on the appropriate level of coverage.

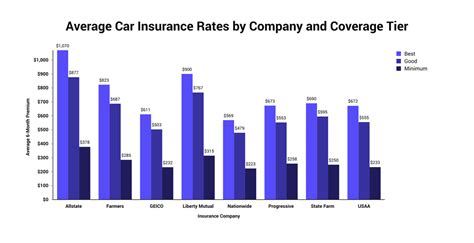

Comparing Insurance Providers

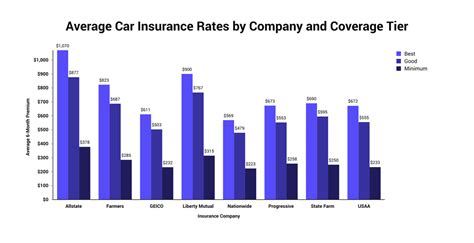

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Online comparison tools can be a convenient way to quickly assess rates from multiple insurers. Additionally, consulting with an insurance broker can provide valuable insights and personalized recommendations.

Utilizing Discounts and Incentives

Many insurance providers offer a range of discounts and incentives to attract and retain customers. Common discounts include those for safe driving, multi-policy bundles, and loyalty rewards. Additionally, some insurers provide incentives for vehicle safety features like anti-theft devices and advanced driver assistance systems.

Managing Credit Score

Insurance providers often consider credit scores when setting premiums. Maintaining a good credit score can lead to more favorable insurance rates. Conversely, a poor credit score may result in higher premiums, as insurance companies perceive individuals with lower credit scores as higher risk.

Future Implications and Potential Solutions

As car insurance premiums continue to rise, it’s essential to explore potential solutions and strategies to make insurance more accessible and affordable. One approach is to advocate for regulatory changes that address the root causes of premium increases, such as advocating for more affordable healthcare or exploring alternatives to traditional car ownership models.

Furthermore, the insurance industry can explore innovative solutions to manage costs. For instance, the increasing adoption of autonomous vehicles could lead to a significant reduction in accident rates, potentially lowering insurance premiums. Additionally, the development of advanced safety features and driver assistance systems can further reduce the risk of accidents, positively impacting insurance rates.

Lastly, the integration of telematics and usage-based insurance models can provide a more accurate assessment of individual risk levels. By monitoring driving behavior and offering discounts for safe driving habits, insurance providers can encourage safer driving practices and potentially reduce premiums for responsible drivers.

How do insurance companies determine premium increases?

+Insurance companies use a combination of factors to determine premium increases, including vehicle repair and medical treatment costs, traffic patterns and accident rates, demographic risk assessment, and legislative and legal changes. These factors are carefully analyzed to assess the level of risk associated with insuring a particular individual or group, which informs the premium rates.

Are there any ways to negotiate car insurance premiums?

+While insurance premiums are primarily determined by risk assessment, there are strategies to potentially negotiate more favorable rates. This includes maintaining a clean driving record, choosing the right coverage level, comparing quotes from multiple providers, and utilizing available discounts. Consulting with an insurance broker can also provide insights into negotiating more affordable rates.

How can I lower my car insurance costs without compromising coverage?

+To lower car insurance costs without compromising coverage, it’s important to understand your specific needs and risk tolerance. Evaluate the different types of coverage and choose the level that provides adequate protection without unnecessary expenses. Additionally, practicing safe driving habits, comparing quotes, and taking advantage of available discounts can help keep costs down while maintaining sufficient coverage.