Health Insurance And Texas

Health insurance is a critical aspect of personal financial planning and overall well-being, and for residents of Texas, understanding the state's unique health insurance landscape is essential. With a diverse population and a rapidly evolving healthcare system, Texans face a range of options and considerations when it comes to securing adequate health coverage. This comprehensive guide aims to demystify the world of health insurance in Texas, offering an in-depth analysis of the key players, plans, and policies that shape this vital industry.

The Landscape of Health Insurance in Texas

Texas, with its vast size and diverse population, presents a complex environment for health insurance. The state’s healthcare system is influenced by a combination of federal regulations, state policies, and local initiatives, creating a unique and often challenging landscape for both providers and consumers.

One of the key characteristics of health insurance in Texas is the state's decision to not expand Medicaid under the Affordable Care Act (ACA). This means that many low-income Texans who don't qualify for traditional Medicaid fall into a "coverage gap," unable to afford private insurance plans and yet not eligible for federal subsidies. This gap has led to a significant number of uninsured individuals in the state, presenting a challenge for both policymakers and healthcare providers.

Key Players in the Texas Health Insurance Market

The health insurance market in Texas is dominated by a few major players, each offering a range of plans and services tailored to the diverse needs of Texans.

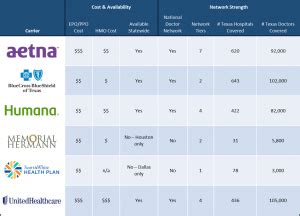

- Blue Cross Blue Shield of Texas (BCBSTX): As the state's largest health insurer, BCBSTX offers a comprehensive suite of health plans, including individual, family, and employer-sponsored options. They are known for their wide network of providers and their commitment to community health initiatives.

- UnitedHealthcare: UnitedHealthcare is a national provider with a strong presence in Texas. They offer a variety of health plans, including Medicare Advantage and Medicaid plans, and are known for their innovative approaches to healthcare delivery and cost management.

- Aetna: Aetna, now a subsidiary of CVS Health, provides a range of health insurance plans in Texas, including individual, family, and Medicare plans. They focus on delivering value-based care and have a strong network of providers across the state.

- Humana: Humana is a leading health and wellness company offering a range of health insurance plans, including Medicare Advantage, Medicare Supplement, and Medicaid plans in Texas. They emphasize personalized care and have a robust digital health platform.

Types of Health Insurance Plans in Texas

Texans have access to a variety of health insurance plans, each designed to meet different needs and budgets. Here’s an overview of the most common types of plans available:

| Plan Type | Description |

|---|---|

| Individual Plans | Designed for individuals and families, these plans offer coverage for essential health benefits, including doctor visits, hospital stays, and prescription drugs. Plans can be purchased directly from insurers or through the federal marketplace. |

| Employer-Sponsored Plans | Many employers in Texas offer health insurance as a benefit to their employees. These plans often provide comprehensive coverage and can be a cost-effective option for employees, as the premiums are typically shared between the employer and the employee. |

| Medicaid | Medicaid is a state-administered program that provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. In Texas, Medicaid is known as Texas Health Steps, and eligibility is based on income and certain other criteria. |

| Medicare | Medicare is a federal health insurance program primarily for people aged 65 or older, although people under 65 with certain disabilities or conditions may also qualify. In Texas, Medicare provides coverage for a range of healthcare services, including hospital stays, doctor visits, and prescription drugs. |

| Medicare Advantage | Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies and approved by Medicare. These plans provide an alternative to original Medicare and often include additional benefits, such as vision, dental, and hearing coverage. |

| Short-Term Health Plans | Short-term health plans offer temporary coverage for individuals who are between jobs, awaiting coverage from a new employer, or for other reasons are not eligible for a more comprehensive plan. These plans typically have lower premiums but also have limited coverage and are not required to cover pre-existing conditions. |

Understanding Health Insurance Costs in Texas

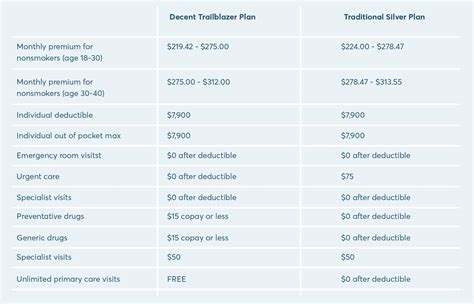

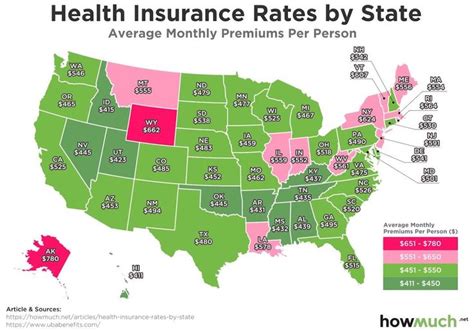

The cost of health insurance in Texas can vary significantly depending on several factors, including the type of plan, the level of coverage, the age and health status of the individual, and the location. Here’s a breakdown of some of the key cost considerations:

Premiums

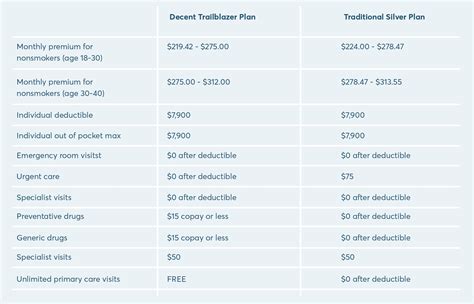

Premiums are the monthly payments made to an insurance company to maintain health coverage. In Texas, the average monthly premium for an individual health insurance plan ranges from approximately 200 to 500, depending on the level of coverage and the insurance provider. Employer-sponsored plans often have lower premiums, with the employer typically covering a portion of the cost.

Deductibles and Out-of-Pocket Costs

Deductibles and out-of-pocket costs are additional expenses that individuals may incur when accessing healthcare services. A deductible is the amount an individual must pay out of pocket before the insurance coverage begins. Out-of-pocket costs can include copayments (a fixed amount paid for a healthcare service), coinsurance (a percentage of the cost of a healthcare service), and any costs that exceed the plan’s coverage limits.

Subsidies and Tax Credits

For individuals purchasing health insurance through the federal marketplace, subsidies and tax credits may be available to help offset the cost of premiums. These subsidies are based on income and family size and can significantly reduce the cost of coverage. In Texas, approximately 70% of enrollees in the federal marketplace receive financial assistance, making health insurance more affordable for many residents.

The Impact of Texas’ Health Insurance Policies

The state of Texas has implemented several policies that have shaped the health insurance landscape and impacted the coverage and affordability of healthcare for its residents.

Limited Medicaid Expansion

Texas’ decision to not expand Medicaid under the ACA has resulted in a significant number of uninsured individuals. While the state has implemented some programs to bridge the coverage gap, such as the Healthy Texas Women program for reproductive healthcare and the Texas Uninsured Program for certain working adults, the overall lack of expanded Medicaid coverage has limited access to healthcare for many low-income Texans.

Mandated Benefits

Texas law requires health insurance plans to cover certain essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and pediatric services, including oral and vision care. These mandated benefits ensure that Texans have access to a comprehensive range of healthcare services.

Consumer Protection

Texas has implemented several consumer protection measures, such as prohibiting insurance companies from denying coverage based on pre-existing conditions and requiring them to offer a range of coverage options. Additionally, the state has established an Office of the Consumer Health Insurance Advocate to assist Texans with insurance-related issues and ensure fair practices in the insurance market.

Navigating Health Insurance in Texas: Tips and Resources

Understanding and choosing the right health insurance plan in Texas can be complex. Here are some tips and resources to help navigate the process:

- Research and Compare Plans: Utilize resources like the federal marketplace (HealthCare.gov) or the Texas Department of Insurance's website to research and compare different health insurance plans. Consider factors such as cost, coverage, and provider network when making your decision.

- Understand Your Needs: Assess your personal healthcare needs and budget to determine the type of plan that best suits you. Consider factors such as prescription drug usage, chronic conditions, and the likelihood of needing specialized care.

- Explore Subsidies and Tax Credits: If you're purchasing a plan through the federal marketplace, be sure to check if you're eligible for subsidies or tax credits. These financial assistance programs can significantly reduce your insurance costs.

- Understand Your Rights: Familiarize yourself with your rights as a health insurance consumer in Texas. This includes understanding the state's mandated benefits, your right to appeal insurance decisions, and your right to privacy and confidentiality.

- Utilize Community Resources: Many community organizations and healthcare providers offer resources and assistance to help Texans navigate the health insurance landscape. These resources can provide valuable information and support, especially for those who may be uninsured or underinsured.

Conclusion: Empowering Texans with Health Insurance Knowledge

Health insurance is a vital component of overall health and financial well-being, and for Texans, understanding the unique landscape of health insurance in their state is crucial. By demystifying the world of health insurance and providing a comprehensive guide to the key players, plans, and policies, we aim to empower Texans to make informed decisions about their health coverage. Remember, knowledge is power, and when it comes to health insurance, being informed can lead to better access to quality healthcare and financial stability.

What is the Affordable Care Act (ACA) and how does it impact health insurance in Texas?

+

The Affordable Care Act, commonly known as Obamacare, is a federal law that was enacted to make health insurance more affordable and accessible. It introduced several key provisions, including the expansion of Medicaid to cover more low-income individuals, the establishment of health insurance marketplaces where individuals can shop for and purchase insurance plans, and the requirement for most individuals to have health insurance or face a tax penalty (although this penalty was eliminated in 2019). In Texas, the decision to not expand Medicaid under the ACA has had a significant impact on the number of uninsured individuals in the state.

Are there any programs or initiatives in Texas to help low-income individuals access health insurance?

+

Yes, Texas has implemented several programs to help low-income individuals access health insurance. For example, the Healthy Texas Women program provides reproductive healthcare services to low-income women, and the Texas Uninsured Program offers limited healthcare coverage to certain working adults who don’t qualify for Medicaid or CHIP. Additionally, the state has a federally funded marketplace (HealthCare.gov) where individuals can shop for and purchase health insurance plans, and many of these plans are eligible for financial assistance based on income.

What are the penalties for not having health insurance in Texas?

+

As of 2019, there are no penalties for not having health insurance in Texas. Prior to this, individuals who did not have health insurance could face a tax penalty under the Affordable Care Act. However, with the elimination of the penalty, there are no longer any federal or state penalties for being uninsured in Texas.

How can I find a doctor or specialist who accepts my health insurance plan in Texas?

+

Most health insurance providers offer an online tool or directory to help you find doctors and specialists who are in-network and accept your insurance plan. You can also contact your insurance company’s customer service line or your doctor’s office to verify if they accept your insurance. It’s important to note that some doctors may be out-of-network for certain plans, so it’s always a good idea to check beforehand to avoid unexpected costs.