Affordable Medical Insurance Quote

Finding affordable medical insurance is a crucial aspect of healthcare for many individuals and families. With the rising costs of healthcare, having access to quality and reasonably priced insurance coverage is essential. This comprehensive guide aims to delve into the world of medical insurance, exploring the factors that influence affordability, the various options available, and strategies to secure the best quotes. By understanding the market, consumers can make informed decisions to ensure their healthcare needs are met without breaking the bank.

Understanding Medical Insurance Affordability

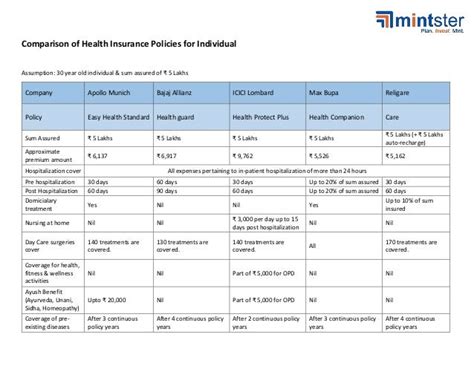

The concept of affordability in medical insurance is multifaceted, encompassing a range of factors. It’s not merely about the premium cost but also includes deductibles, copayments, and the overall coverage provided. Here’s a breakdown of the key elements that contribute to the affordability of a medical insurance plan.

Premium Costs

The premium is the amount an individual or family pays to the insurance company for coverage. It’s typically paid monthly or annually and varies based on factors such as age, location, and the chosen plan’s coverage level. Premium costs can be influenced by the insurer’s assessment of the risk associated with the individual’s health status and lifestyle.

| Plan Type | Premium Range (Monthly) |

|---|---|

| Catastrophic Coverage | $100 - $250 |

| Basic Coverage | $250 - $400 |

| Comprehensive Coverage | $400 - $800 |

Note: These premium ranges are indicative and can vary based on individual circumstances and the insurer.

Deductibles and Copayments

Deductibles and copayments are out-of-pocket expenses that individuals pay before the insurance coverage kicks in. A deductible is the amount paid for covered healthcare services before the insurance company starts to contribute. Copayments, on the other hand, are fixed amounts paid for a covered service, typically at the time of receiving the service.

| Plan Type | Deductible Range | Copayment Range |

|---|---|---|

| Catastrophic Coverage | $1,000 - $5,000 | $20 - $50 |

| Basic Coverage | $500 - $2,000 | $30 - $60 |

| Comprehensive Coverage | $0 - $1,500 | $10 - $30 |

Coverage Benefits

The breadth of coverage offered by a medical insurance plan is a critical factor in determining its affordability. Plans with comprehensive coverage typically include a wide range of services such as preventive care, hospital stays, specialist visits, and prescription medications. On the other hand, plans with limited coverage might exclude certain services, making them more affordable but potentially leaving the insured vulnerable to unexpected medical expenses.

Strategies for Securing Affordable Quotes

Securing an affordable medical insurance quote requires a strategic approach. Here are some tactics to consider when shopping for insurance:

Shop Around and Compare

Don’t settle for the first quote you receive. Compare prices and coverage across multiple insurance providers. Online marketplaces and insurance brokers can be valuable resources for comparing plans and prices. Additionally, check with your state’s insurance department for information on approved plans and rates.

Understand Your Health Needs

Assess your current and potential future health needs. If you’re generally healthy and don’t anticipate major medical expenses, a high-deductible plan with lower premiums might be a suitable option. However, if you have ongoing health issues or anticipate the need for regular medical care, a plan with a lower deductible and broader coverage might be more cost-effective in the long term.

Consider Government-Sponsored Programs

Explore government-sponsored health insurance programs such as Medicare, Medicaid, or the Children’s Health Insurance Program (CHIP). These programs provide coverage to eligible individuals, often at reduced costs or even no cost. Check your eligibility and understand the enrollment periods to take advantage of these programs.

Utilize Employer-Sponsored Plans

If you’re employed, investigate the medical insurance plans offered by your employer. Many employers offer a range of plan options with varying levels of coverage and cost-sharing. Take advantage of open enrollment periods to review and select the plan that best suits your needs and budget.

Negotiate and Bundle Services

If you’re self-employed or purchasing insurance directly, consider negotiating with insurance providers. You can also explore bundling services, such as dental and vision coverage, with your medical insurance to potentially reduce overall costs.

Future Implications and Industry Trends

The landscape of medical insurance is continually evolving, influenced by regulatory changes, technological advancements, and shifts in consumer preferences. Here are some key trends and their potential impact on the affordability of medical insurance.

Telehealth and Virtual Care

The rise of telehealth services has transformed the way healthcare is delivered. Virtual consultations and remote monitoring can reduce costs for both providers and patients, making healthcare more accessible and potentially more affordable. Insurance providers are increasingly incorporating telehealth benefits into their plans, expanding coverage options for consumers.

Value-Based Care Models

Value-based care models, which focus on the quality and outcomes of care rather than the quantity of services provided, are gaining traction. These models aim to improve patient health while controlling costs. As these models become more prevalent, they could lead to more affordable and efficient healthcare systems, benefiting patients and insurers alike.

Regulatory Changes and Market Competition

Regulatory changes, such as the Affordable Care Act (ACA) and subsequent amendments, have had a significant impact on the medical insurance market. The ACA, for instance, introduced mandates and subsidies to increase access to affordable insurance. Future regulatory shifts could further influence the market, impacting affordability and consumer choices.

Technology and Data-Driven Insights

Advancements in technology and data analytics are enabling insurance providers to better understand consumer needs and price plans accordingly. By leveraging data, insurers can offer more personalized and cost-effective coverage options. This data-driven approach has the potential to enhance the accuracy of premiums, making insurance more affordable for those who need it most.

Conclusion

Securing affordable medical insurance is a multifaceted process that requires a deep understanding of the market, one’s health needs, and available options. By comparing plans, negotiating costs, and staying abreast of industry trends, individuals can make informed decisions to ensure they have the coverage they need at a price they can afford. As the medical insurance landscape continues to evolve, staying proactive and engaged is key to accessing quality healthcare without financial strain.

How do I know if I’m eligible for government-sponsored health insurance programs like Medicare or Medicaid?

+Eligibility for government-sponsored health insurance programs varies based on factors such as age, income, and disability status. For Medicare, you generally become eligible at age 65, but younger individuals with certain disabilities or end-stage renal disease may also qualify. Medicaid eligibility is primarily based on income and varies by state. It’s advisable to check with your state’s insurance department or a licensed insurance agent to determine your eligibility and explore available options.

What are some common mistakes to avoid when shopping for medical insurance?

+When shopping for medical insurance, it’s crucial to avoid rushing into a decision without thoroughly understanding the plan’s coverage and costs. Failing to compare multiple plans and quotes can lead to overpaying for coverage. Additionally, neglecting to review the plan’s network of providers and hospitals can result in unexpected out-of-network expenses. Finally, not understanding the plan’s limitations and exclusions can leave you vulnerable to financial surprises. Take the time to research, compare, and understand the fine print to make an informed choice.

Are there any tax benefits associated with medical insurance?

+Yes, there are tax benefits associated with medical insurance. Under the Affordable Care Act (ACA), individuals who purchase their own health insurance and meet certain income requirements may be eligible for a premium tax credit to help offset the cost of their premiums. Additionally, if you itemize your deductions on your tax return, you may be able to deduct certain medical expenses that exceed a specified percentage of your adjusted gross income. It’s advisable to consult with a tax professional to understand the specific tax benefits available to you.