Al Insurance

In the world of insurance, it is crucial to understand the various aspects that make up the industry and how they impact individuals and businesses. Al Insurance is a term that encompasses a range of insurance products and services, offering protection and financial security to those who seek it. This article aims to delve into the specifics of Al Insurance, exploring its features, benefits, and the impact it has on the lives of policyholders.

The Evolution of Al Insurance: A Comprehensive Overview

Al Insurance has come a long way since its inception, evolving to meet the diverse needs of a modern society. From its humble beginnings as a means to protect against financial losses, it has grown into a complex industry, offering a myriad of products and services tailored to individual requirements.

At its core, Al Insurance is a form of risk management primarily used to hedge against the potential financial risks associated with various uncertainties in life, such as accidents, illnesses, natural disasters, and even death. By offering insurance policies, Al Insurance provides a safety net, ensuring individuals and businesses can recover financially and maintain stability during challenging times.

The Scope of Al Insurance Products

Al Insurance offers an extensive range of insurance products, each designed to address specific needs. These products can be broadly categorized into the following:

- Life Insurance: Life insurance policies provide financial protection to the policyholder's beneficiaries in the event of their untimely demise. These policies can offer a lump-sum payment, regular income, or a combination of both, ensuring the insured's loved ones are taken care of.

- Health Insurance: Health insurance plans cover the cost of medical treatments, hospitalization, and medications, providing individuals and families with peace of mind when it comes to their healthcare needs. With rising healthcare costs, health insurance has become an essential aspect of financial planning.

- Auto Insurance: Auto insurance policies protect policyholders against financial losses resulting from accidents, theft, or damage to their vehicles. This type of insurance is mandatory in many countries and offers liability coverage, comprehensive protection, and collision coverage.

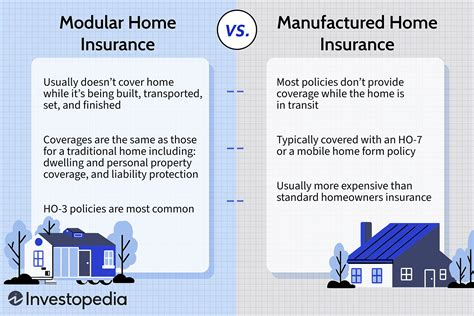

- Home Insurance: Home insurance policies safeguard homeowners and renters against potential risks such as fire, theft, natural disasters, and liability claims. It provides financial assistance to repair or replace damaged property, offering security and peace of mind.

- Business Insurance: Business insurance is crucial for companies of all sizes, offering protection against a range of risks, including property damage, liability claims, and business interruption. It ensures that businesses can continue operating and recover from unforeseen events.

| Insurance Type | Key Features |

|---|---|

| Life Insurance | Provides financial protection for beneficiaries in case of the insured's death. Offers a range of policies, including term life, whole life, and universal life insurance. |

| Health Insurance | Covers medical expenses, including hospitalization, surgeries, and medications. May include dental, vision, and mental health coverage. |

| Auto Insurance | Protects against financial losses from accidents, theft, and damage. Includes liability coverage, collision coverage, and comprehensive protection. |

| Home Insurance | Covers property damage, theft, and liability claims. Provides financial assistance for repairs or replacement of damaged items. |

| Business Insurance | Offers protection for businesses against various risks, including property damage, liability, and business interruption. Includes policies like general liability, professional liability, and commercial property insurance. |

The Benefits of Al Insurance: More Than Just Financial Protection

While the primary purpose of Al Insurance is to provide financial protection, its benefits extend far beyond that. Here are some key advantages that Al Insurance offers:

- Peace of Mind: Knowing that you and your loved ones are financially protected in the event of an unexpected tragedy or accident provides immense peace of mind. Al Insurance allows individuals to focus on their lives and careers without constantly worrying about potential financial burdens.

- Financial Security: Al Insurance ensures that policyholders have the necessary funds to cover unexpected expenses, whether it's a medical emergency, a natural disaster, or a business interruption. This financial security provides stability and helps individuals and businesses plan for the future with confidence.

- Asset Protection: By insuring valuable assets such as homes, vehicles, and businesses, Al Insurance safeguards against total loss. In the event of damage or theft, insurance policies provide the means to repair or replace these assets, maintaining the insured's standard of living.

- Risk Mitigation: Al Insurance policies encourage individuals and businesses to take proactive measures to mitigate risks. For example, many insurance companies offer discounts for safety features in homes and vehicles, promoting safer practices and potentially reducing the likelihood of accidents or losses.

- Estate Planning: Life insurance policies play a crucial role in estate planning, ensuring that the insured's beneficiaries receive a financial legacy. This can help cover funeral expenses, pay off debts, and provide a source of income for dependents, especially in the absence of the policyholder.

Al Insurance: A Global Perspective

The insurance industry, including Al Insurance, operates on a global scale, with each country having its own unique regulations and market dynamics. While the core principles of insurance remain consistent, the products and services offered may vary based on cultural, economic, and regulatory factors.

For instance, in countries with advanced healthcare systems, health insurance may focus more on providing additional benefits and covering out-of-pocket expenses, whereas in developing nations, health insurance might primarily aim to cover basic medical needs and reduce financial strain on individuals.

Similarly, the demand for auto insurance varies based on the level of vehicle ownership and road safety regulations in different regions. In countries with high vehicle ownership rates, auto insurance is often a legal requirement and a necessity for financial protection.

The need for home insurance also differs based on geographical factors, with regions prone to natural disasters having a higher demand for comprehensive coverage. Additionally, cultural factors may influence the types of insurance products preferred, such as personal liability insurance, which may be more prevalent in certain societies.

The Future of Al Insurance: Innovations and Trends

The insurance industry, including Al Insurance, is evolving rapidly, driven by technological advancements and changing consumer preferences. Here are some key trends shaping the future of Al Insurance:

- Digital Transformation: The insurance industry is embracing digital technologies to enhance customer experience and streamline operations. From online policy purchases to digital claim processing, the industry is becoming increasingly digitized, offering convenience and efficiency to policyholders.

- Telematics and Usage-Based Insurance: Telematics technology, which uses data from vehicles to assess driving behavior, is transforming auto insurance. Usage-based insurance policies reward safe driving with lower premiums, encouraging safer practices on the road.

- AI and Machine Learning: Artificial intelligence and machine learning are being utilized to improve risk assessment and fraud detection. These technologies enable insurance companies to make more accurate predictions and offer personalized insurance products tailored to individual needs.

- Parametric Insurance: Parametric insurance policies pay out based on predefined parameters, such as weather events or natural disasters, rather than actual losses. This innovative approach provides faster claim settlements and reduces the administrative burden on insurance companies.

- Blockchain Technology: Blockchain is revolutionizing the insurance industry by enhancing security, transparency, and efficiency. It enables secure peer-to-peer transactions, smart contracts, and improved data management, potentially reducing costs and improving customer trust.

Conclusion: Navigating the World of Al Insurance

Al Insurance plays a vital role in our lives, offering a safety net against financial risks and providing peace of mind. With a wide range of insurance products available, individuals and businesses can tailor their coverage to meet their specific needs. By understanding the benefits and features of Al Insurance, policyholders can make informed decisions and secure their financial future.

As the insurance industry continues to evolve, staying informed about the latest trends and innovations is essential. From digital transformation to parametric insurance, the future of Al Insurance looks promising, ensuring that individuals and businesses can access the protection they need in an ever-changing world.

FAQ

How does Al Insurance differ from traditional insurance companies?

+Al Insurance stands out by offering a comprehensive range of insurance products tailored to individual needs. It focuses on providing financial protection and peace of mind, ensuring policyholders can recover from unexpected events. Al Insurance leverages technology and innovative practices to enhance customer experience and offer personalized coverage.

What are the key benefits of Al Insurance’s life insurance policies?

+Al Insurance’s life insurance policies offer financial protection to beneficiaries in the event of the insured’s death. They provide a range of options, including term life, whole life, and universal life insurance, ensuring individuals can choose a policy that aligns with their needs and budget. Life insurance policies from Al Insurance can help secure the financial future of loved ones and provide a sense of security.

How does Al Insurance’s health insurance plan differ from other providers?

+Al Insurance’s health insurance plan focuses on providing comprehensive coverage for medical expenses. It includes a wide range of benefits, such as hospitalization, surgeries, medications, and even dental and vision care. Al Insurance aims to offer affordable and accessible healthcare solutions, ensuring policyholders can receive the medical treatment they need without financial strain.

What makes Al Insurance’s auto insurance policies unique?

+Al Insurance’s auto insurance policies offer comprehensive protection for policyholders. They include liability coverage, collision coverage, and comprehensive protection to safeguard against a range of risks. Al Insurance’s policies also encourage safe driving practices through telematics and usage-based insurance, rewarding policyholders with lower premiums for responsible driving.

How does Al Insurance ensure the security of its policyholders’ data?

+Al Insurance prioritizes the security of its policyholders’ data by implementing robust cybersecurity measures. They utilize encryption technologies, secure servers, and access controls to protect sensitive information. Additionally, Al Insurance stays updated with the latest security practices and regularly audits its systems to prevent data breaches and ensure the privacy of its customers.