Hsa Eligible Health Insurance

When it comes to managing your health and financial well-being, understanding Health Savings Accounts (HSAs) and their eligibility requirements is crucial. HSAs are powerful tools that can help you save for medical expenses and offer tax advantages, but navigating the eligibility criteria for HSA-compatible health insurance plans can be complex. In this comprehensive guide, we will delve into the world of HSA-eligible health insurance, exploring the key aspects, benefits, and considerations to help you make informed decisions about your healthcare coverage and financial planning.

Understanding Health Savings Accounts (HSAs)

Health Savings Accounts are tax-advantaged savings accounts specifically designed to be used in conjunction with certain high-deductible health insurance plans. HSAs allow individuals to set aside pre-tax funds to cover eligible medical expenses, offering a unique way to save for healthcare costs while also reducing the overall tax burden. These accounts provide a flexible and efficient approach to managing healthcare expenses, especially for those who anticipate needing medical care in the future.

HSA Eligibility Criteria

To be eligible for an HSA, you must meet specific criteria related to your health insurance coverage. Here are the key requirements:

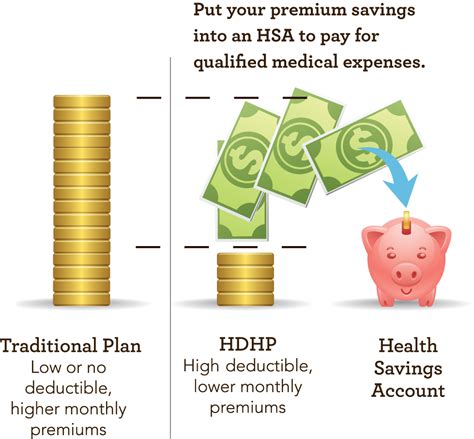

- High-Deductible Health Plan (HDHP): You must be enrolled in a qualifying HDHP. HDHPs are insurance plans with higher deductibles than traditional plans, typically ranging from 1,400 to 7,000 for individual coverage and 2,800 to 14,000 for family coverage. These plans generally have lower monthly premiums, making them an attractive option for those who prioritize cost savings.

- No Other Health Coverage: To qualify for an HSA, you cannot have other health coverage that provides significant benefits. This includes most types of health insurance, such as employer-sponsored plans or government-provided coverage like Medicare or Medicaid. However, certain limited coverage, such as dental, vision, or accident insurance, may be allowed.

- Not Enrolled in Medicare: HSA eligibility is generally limited to individuals under the age of 65 who are not eligible for Medicare. Once you enroll in Medicare, you are no longer eligible to contribute to an HSA.

- U.S. Residency: HSAs are typically only available to U.S. residents. Non-residents may have different eligibility requirements and should consult with a tax professional for guidance.

Benefits of HSA-Eligible Health Insurance

Opting for HSA-eligible health insurance offers a range of advantages that can significantly impact your financial and healthcare planning. Here are some key benefits to consider:

- Tax Savings: One of the primary advantages of HSAs is the tax benefits they provide. Contributions to your HSA are made with pre-tax dollars, reducing your taxable income. Additionally, any interest or investment earnings within the account grow tax-free, and qualified medical expenses can be paid for with tax-free withdrawals. This triple tax advantage makes HSAs a powerful tool for saving and managing healthcare costs.

- Flexible Spending: HSAs give you the flexibility to decide how and when to use your funds. You can save money in the account and let it grow over time, or you can use it to pay for eligible medical expenses as they arise. This flexibility allows you to tailor your healthcare spending to your specific needs and preferences.

- Long-Term Savings: HSAs offer a unique opportunity for long-term healthcare savings. Unlike flexible spending accounts (FSAs), which have use-it-or-lose-it provisions, HSAs allow you to carry over balances from year to year. This means you can accumulate funds over time, creating a substantial savings account for future medical expenses.

- Investment Potential: Many HSA providers offer investment options, allowing you to grow your savings beyond the basic interest-bearing accounts. By investing a portion of your HSA funds, you can potentially earn higher returns, further boosting your healthcare savings over time.

- Portability: HSAs are portable, meaning you maintain ownership of the account even if you change jobs or insurance providers. This portability ensures that your healthcare savings remain with you, providing stability and continuity in your financial planning.

Comparing HSA-Eligible Health Insurance Plans

When considering HSA-eligible health insurance, it’s essential to evaluate different plans and providers to find the best fit for your needs. Here are some key factors to consider during your comparison process:

- Premium Costs: Compare the monthly premiums for different HSA-eligible plans. While HDHPs generally have lower premiums than traditional plans, the cost can still vary significantly. Assess your budget and choose a plan that offers a balance between affordability and coverage.

- Deductible and Out-of-Pocket Limits: Review the deductible amounts and out-of-pocket maximums for each plan. Consider how these limits align with your anticipated medical expenses. A lower deductible may provide more immediate coverage, while a higher deductible can result in greater long-term savings if you contribute to your HSA.

- Provider Networks: Check the provider networks offered by each plan. Ensure that your preferred doctors, hospitals, and specialists are included in the network to avoid potential out-of-network charges.

- HSA Features and Fees: Evaluate the HSA options provided by each insurance carrier. Consider factors such as account fees, minimum balance requirements, and investment options. Some carriers may offer additional benefits or incentives to encourage HSA usage.

- Additional Coverage Options: Assess whether the plan offers additional coverage options that may be beneficial to you. For example, some plans include dental, vision, or prescription drug coverage as add-ons.

Maximizing Your HSA Benefits

To fully leverage the advantages of an HSA, it’s essential to understand how to maximize your contributions and make the most of your healthcare savings. Here are some strategies to consider:

- Maximize Annual Contributions: HSA contribution limits are set annually and adjusted for inflation. Aim to contribute the maximum amount allowed each year to take full advantage of the tax benefits. Remember, unused funds roll over year after year, so there’s no rush to spend them immediately.

- Strategic Spending: When using your HSA funds, consider your long-term financial goals. It may be beneficial to prioritize saving for more significant medical expenses, such as elective procedures or major illnesses, while using other forms of insurance or out-of-pocket payments for routine care.

- Investment Strategies: If your HSA provider offers investment options, explore the potential for growth. Consider your risk tolerance and investment horizons when selecting investment vehicles. While past performance does not guarantee future results, investing a portion of your HSA funds can provide the potential for higher returns over time.

- Keep Records: Maintain detailed records of all HSA contributions, investments, and distributions. This documentation is essential for tax purposes and can help you track your financial progress.

FAQs

Can I use my HSA for non-medical expenses?

+

No, HSAs are intended solely for eligible medical expenses. Withdrawing funds for non-medical purposes may result in penalties and taxes. It’s important to understand the qualified medical expenses covered by your HSA to ensure compliance.

What happens to my HSA if I switch insurance providers or change jobs?

+

Your HSA remains yours, even if you change insurance providers or leave your current job. You can continue to contribute to and use the funds in your HSA, providing long-term financial flexibility and stability.

Are there any age restrictions for HSAs?

+

Yes, HSAs are generally limited to individuals under the age of 65 who are not eligible for Medicare. Once you enroll in Medicare, you are no longer eligible to contribute to an HSA. However, you can continue to use the funds in your HSA for eligible medical expenses.

Can I have an HSA and a Flexible Spending Account (FSA) at the same time?

+

Generally, you cannot have both an HSA and an FSA simultaneously. HSAs and FSAs are designed for different purposes, and having both may lead to compliance issues. It’s best to choose the account that aligns with your healthcare and financial needs.

Conclusion

Health Savings Accounts offer a powerful way to save for healthcare expenses while enjoying significant tax advantages. By understanding the eligibility criteria for HSA-eligible health insurance and exploring the benefits and features of different plans, you can make informed decisions about your healthcare coverage and financial planning. Remember to consult with financial and tax professionals to ensure you maximize the advantages of your HSA and stay compliant with the latest regulations.

Stay tuned for more insights and updates on HSA-eligible health insurance and healthcare savings strategies.