Animal Insurance Price

Welcome to an in-depth exploration of the world of animal insurance, specifically focusing on the intriguing aspect of its pricing. The cost of pet insurance can vary significantly, influenced by a multitude of factors that often leave pet owners curious and eager to understand the intricacies. This article aims to demystify the pricing structure, shedding light on the unique variables that contribute to the final cost. By examining real-world examples and delving into the underlying economics, we aim to provide a comprehensive understanding of animal insurance pricing.

Understanding the Basics: Factors Affecting Animal Insurance Costs

The pricing of animal insurance policies is a complex interplay of various factors, each contributing uniquely to the overall cost. These factors can be broadly categorized into three main groups: the animal’s species and breed, the level of coverage offered, and the geographical location of the owner.

Species and Breed Considerations

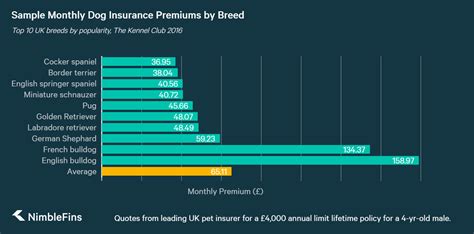

One of the primary determinants of animal insurance costs is the type of animal being insured. Different species have varying healthcare needs and susceptibility to certain ailments. For instance, horses often require more specialized care and are more prone to certain injuries or conditions compared to smaller pets like cats or dogs. Consequently, the insurance premiums for horses are typically higher.

Furthermore, within each species, breed variations can also impact insurance costs. Certain dog breeds, such as Bulldogs or German Shepherds, are known to have higher healthcare needs due to their genetic predispositions. This results in increased veterinary costs, which are reflected in the insurance premiums. Similarly, exotic pets like snakes or birds may require specialized veterinary care, leading to higher insurance costs.

| Animal Species | Average Insurance Premium |

|---|---|

| Dogs | $400 - $600 annually |

| Cats | $300 - $450 annually |

| Horses | $1,000 - $2,500 annually |

| Exotic Pets (e.g., snakes, birds) | $200 - $800 annually |

Coverage Options and Their Impact

The level of coverage chosen by the pet owner is another crucial factor influencing insurance costs. Similar to human health insurance, animal insurance policies offer a range of coverage options, each with its own premium. Basic plans typically cover essential care such as accidents, illnesses, and routine vaccinations. However, more comprehensive plans may include additional benefits like dental care, prescription medications, and alternative therapies.

The choice of deductible and reimbursement percentage also plays a role in determining the insurance premium. A higher deductible, where the owner pays more out-of-pocket before the insurance kicks in, usually results in a lower premium. Conversely, a lower deductible often comes with a higher premium.

| Coverage Type | Average Premium Increase |

|---|---|

| Comprehensive Coverage | +20% to +30% compared to basic plans |

| Lower Deductible | +10% to +15% for each $100 decrease in deductible |

| Reimbursement Percentage | Varies based on the percentage, but generally +5% to +10% for each 10% increase in reimbursement |

Geographical Location: A Key Pricing Factor

The geographical location of the pet owner is another significant determinant of animal insurance costs. Veterinary care costs can vary widely across different regions, influenced by factors such as the cost of living, local regulations, and the availability of specialized veterinary services.

For instance, urban areas often have higher veterinary care costs due to the higher cost of living and the concentration of specialized veterinary services. This translates to higher insurance premiums for pet owners in these areas. Similarly, regions with a higher prevalence of certain diseases or health conditions may also see increased insurance costs.

Additionally, the availability of emergency veterinary services can impact insurance costs. Areas with easy access to emergency veterinary care may see slightly lower premiums, as the risk of expensive emergency treatments is mitigated.

| Region | Average Insurance Premium |

|---|---|

| Urban Areas | $100 - $200 higher annually compared to rural areas |

| Regions with High Disease Prevalence | +5% to +15% annual premium increase |

| Areas with Easy Access to Emergency Care | Mild reduction in premiums |

Analyzing Real-World Examples: A Case Study Approach

To better understand the practical application of these factors, let’s delve into a few real-world examples. These case studies will provide a clearer picture of how different variables come together to influence animal insurance costs.

Case Study 1: Urban Dog Owner

Imagine a dog owner living in a bustling city like New York City. Given the urban location, veterinary care costs are generally higher. The owner has a young, healthy Labrador Retriever, a breed known for its robust health but with some genetic predispositions to certain conditions.

Let's assume the owner opts for a comprehensive insurance plan with a $200 deductible and an 80% reimbursement rate. Considering the urban location and the breed's health considerations, the annual premium for this plan could range from $550 to $700.

Case Study 2: Rural Cat Owner

Now, let’s consider a cat owner living in a rural area, away from the high costs of urban living. This owner has an older, mixed-breed cat with a history of minor health issues. Opting for a basic insurance plan with a 500 deductible and a 70% reimbursement rate, the annual premium might fall between 250 and $350.

Case Study 3: Exotic Pet Enthusiast

Finally, let’s explore the scenario of an owner with an exotic pet, such as a snake or a bird. These pets often require specialized care and have unique healthcare needs. Given the specialized nature of their veterinary care, insurance costs tend to be higher.

Assuming the owner chooses a comprehensive plan with a $300 deductible and a 75% reimbursement rate, the annual premium could range from $500 to $750, depending on the specific species and the owner's location.

The Economics Behind Animal Insurance Pricing

Understanding the economics behind animal insurance pricing is crucial to grasping the rationale behind the costs. Insurance companies, like any other business, aim to balance the risks and rewards of offering insurance. They carefully consider the potential costs of providing coverage against the premiums they collect.

Risk Assessment and Underwriting

Insurance companies employ a process known as underwriting to assess the risk associated with each animal and its owner. This involves evaluating various factors such as the animal’s age, breed, health history, and the owner’s location. Based on this assessment, the company determines the likelihood of claims and sets the premium accordingly.

Animals with higher risk profiles, such as those with pre-existing conditions or breeds prone to certain ailments, may face higher premiums. Conversely, younger, healthier animals with fewer risk factors are likely to have lower premiums.

Claims Experience and Actuarial Science

Insurance companies also rely on claims experience and actuarial science to set their premiums. Actuaries are professionals who use statistical methods to predict future events and assess financial risks. By analyzing historical data on claims, insurance companies can estimate the average cost of providing coverage for a given group of animals.

For instance, if a certain breed of dog is known to have a high incidence of hip dysplasia, an expensive condition to treat, insurance companies will factor this into their premiums for that breed. This ensures that the premiums collected are sufficient to cover the expected costs of providing coverage.

Future Implications and Industry Trends

As the animal insurance industry continues to evolve, several trends and future implications are worth noting. These developments can significantly impact the pricing and availability of animal insurance policies.

Advancements in Veterinary Medicine

Advancements in veterinary medicine are constantly improving the healthcare options available for animals. From cutting-edge surgeries to innovative therapies, these advancements can lead to better outcomes for pets but also increase the cost of veterinary care.

Insurance companies will need to adapt their pricing strategies to account for these changes. As the cost of veterinary care rises, premiums may also increase to ensure that insurance companies can continue to provide comprehensive coverage.

Increasing Awareness and Demand

With growing awareness about the benefits of animal insurance, more pet owners are opting for coverage. This increased demand can lead to more competitive pricing as insurance companies strive to attract customers. Additionally, as more pets are insured, insurance companies can gather more accurate data on claims, leading to more precise risk assessments and potentially lower premiums over time.

Technology’s Impact on Pricing

The integration of technology in the veterinary field, such as telemedicine and electronic health records, can also influence insurance pricing. These advancements can improve the efficiency of veterinary care, potentially reducing costs. Moreover, technology can enhance the data available to insurance companies, leading to more accurate risk assessments and pricing models.

Conclusion: Navigating the Complex World of Animal Insurance Pricing

In conclusion, the pricing of animal insurance policies is a nuanced and intricate process influenced by a multitude of factors. From the species and breed of the animal to the level of coverage chosen and the geographical location of the owner, each element plays a role in determining the final cost.

By understanding these factors and the underlying economics, pet owners can make more informed decisions when choosing animal insurance. It's essential to consider not only the immediate costs but also the potential long-term benefits of having insurance for one's beloved pets.

As the animal insurance industry continues to evolve, staying informed about the latest trends and developments will be key to navigating this complex world of pricing. With the right knowledge and a thoughtful approach, pet owners can find insurance policies that provide the necessary coverage at a reasonable cost.

How do insurance companies determine the cost of animal insurance policies?

+Insurance companies use a process called underwriting to assess the risk associated with each animal and its owner. They consider factors like the animal’s age, breed, health history, and the owner’s location. Based on this assessment, they set the premium to balance the potential costs of providing coverage against the premiums collected.

Can the price of animal insurance change over time for the same pet?

+Yes, the price of animal insurance can change over time. Premiums may increase annually to account for inflation and rising veterinary care costs. Additionally, changes in the animal’s health status or the owner’s location may also lead to adjustments in the premium.

Are there any discounts available for animal insurance policies?

+Yes, some insurance companies offer discounts for certain situations. For example, multi-pet discounts are common, where insuring multiple pets with the same company can lead to lower premiums. Additionally, some companies offer discounts for pets adopted from shelters or for certain breeds.