Annual Car Rental Insurance

The world of car rentals can often be a confusing maze of options and add-ons, with insurance being a particularly crucial yet complex component. Understanding the nuances of car rental insurance is essential to ensure you're adequately covered without overspending. This comprehensive guide will delve into the world of annual car rental insurance, offering an in-depth analysis of its benefits, limitations, and how it can be a cost-effective solution for frequent travelers.

Unraveling the Benefits of Annual Car Rental Insurance

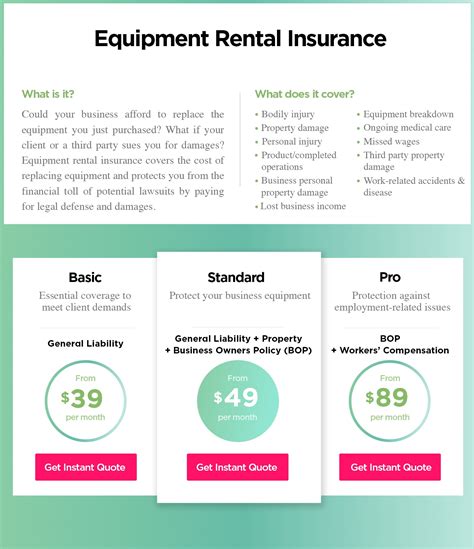

Annual car rental insurance, often offered by specialized insurance providers and some credit card companies, is a policy designed to cover rental vehicles for an entire year. This type of insurance provides an efficient and cost-effective solution for individuals who frequently rent cars, either for personal or business travel.

Coverage and Peace of Mind

The primary benefit of annual car rental insurance is the comprehensive coverage it offers. Unlike daily or weekly rental insurance policies, an annual plan provides consistent coverage for an entire year. This means that regardless of how many times you rent a car within that period, you’ll have the same level of protection each time.

Most annual policies include standard collision damage waiver (CDW) and loss damage waiver (LDW) coverage. CDW protects against damage to the rental vehicle, while LDW covers theft or vandalism. Some policies also offer liability coverage, which protects you against claims for bodily injury or property damage caused to others in an accident.

Additionally, many annual car rental insurance plans include personal accident coverage, which provides financial protection for you and your passengers in the event of an accident. This can include medical expenses, disability benefits, and even death benefits.

Convenience and Cost Savings

Annual car rental insurance is designed with convenience in mind. Instead of purchasing insurance each time you rent a car, you can simply activate your annual policy and rest assured that you’re covered. This not only saves time but also eliminates the stress of deciding on insurance options every time you rent.

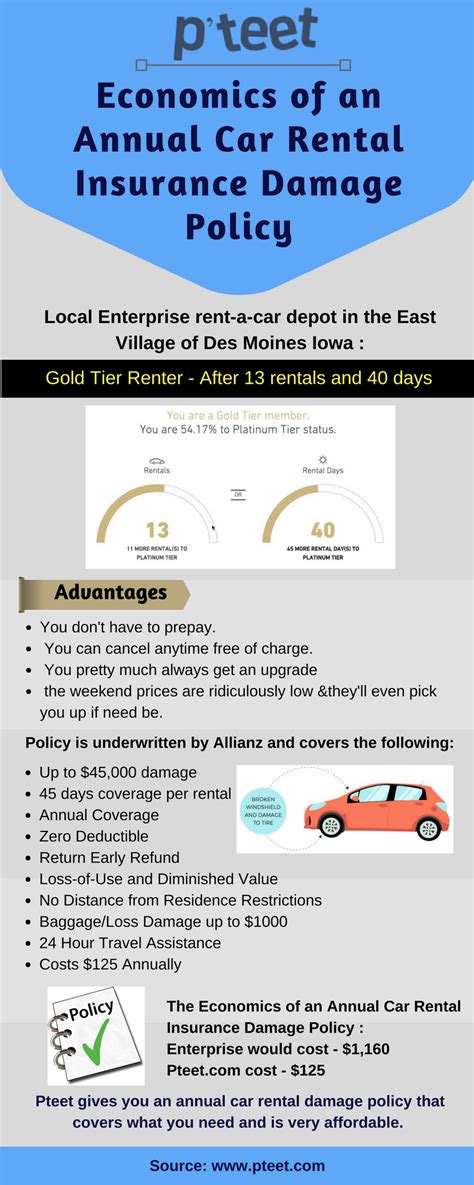

From a financial perspective, annual car rental insurance can be a significant cost-saver for frequent travelers. Daily rental insurance rates can quickly add up, especially when renting multiple times a year. With an annual policy, you pay a fixed premium for the entire year, often resulting in substantial savings.

Enhanced Rental Experience

With annual car rental insurance, you gain more flexibility and control over your rental experience. Many rental car companies offer various insurance options, some of which may be more comprehensive than others. However, with your own annual policy, you can decline their insurance and still enjoy the peace of mind of being fully insured.

Additionally, having your own insurance policy can streamline the rental process. You won’t need to spend time reviewing and comparing insurance options at the rental counter, and you’ll avoid the potential hassle of dealing with unfamiliar rental insurance providers.

Understanding the Limitations

While annual car rental insurance offers numerous advantages, it’s essential to understand its limitations to ensure you’re making an informed decision.

Coverage Restrictions

Annual car rental insurance policies typically have certain restrictions and exclusions. For instance, the coverage may be limited to a specific number of rental days per year or to a certain rental car company or class of vehicles. Some policies may also have geographical restrictions, only covering rentals within a certain country or region.

It’s crucial to review the policy’s terms and conditions to understand any restrictions on coverage. This ensures that your rental plans align with the policy’s parameters and that you’re aware of any potential gaps in coverage.

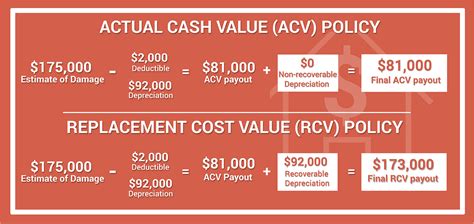

Excess and Deductibles

Like any insurance policy, annual car rental insurance often comes with an excess or deductible, which is the amount you’ll need to pay out of pocket in the event of a claim. The excess amount can vary depending on the policy and the rental company, so it’s important to factor this into your decision-making process.

Some policies may also have different excess amounts for different types of incidents. For instance, the excess for a collision may be higher than for theft or vandalism. Understanding these nuances can help you make more informed choices when selecting an annual car rental insurance policy.

Additional Coverage Options

While annual car rental insurance policies offer comprehensive coverage, there may be additional coverage options that you might want to consider. For example, personal effects coverage can protect your belongings if they’re stolen or damaged while in the rental car. Roadside assistance is another valuable add-on, providing help in case of a breakdown or other emergencies.

It’s worth exploring these additional coverage options to determine if they’re necessary for your specific needs. While they can enhance your protection, they may also increase the cost of your annual policy.

Performance Analysis: Annual Car Rental Insurance

To evaluate the effectiveness of annual car rental insurance, let’s examine a hypothetical scenario. Imagine a business traveler who rents a car 10 times a year for an average of 3 days each time. With daily rental insurance rates averaging 25 per day, the cost for this traveler would be 750 per year. However, with an annual car rental insurance policy costing $500, this traveler could save a significant amount while enjoying the same level of coverage.

Key Considerations for Choosing an Annual Policy

- Coverage Limits: Ensure the policy’s coverage limits align with your needs. For instance, check the maximum rental period, rental company or vehicle class restrictions, and geographical coverage.

- Excess and Deductibles: Understand the excess or deductible amounts and how they apply to different types of incidents.

- Additional Coverage: Evaluate if you require additional coverage options like personal effects coverage or roadside assistance.

- Reputation and Reliability: Research the insurance provider’s reputation and financial stability to ensure they’re a reliable option.

- Customer Service: Consider the provider’s customer service record and their claims process to ensure a smooth experience in the event of a claim.

Evidence-Based Future Implications

As the travel industry continues to evolve, the demand for efficient and cost-effective rental car insurance solutions is likely to increase. Annual car rental insurance policies offer a promising alternative to traditional daily or weekly insurance, providing a fixed-cost, comprehensive coverage option for frequent travelers.

With the ongoing development of technology and digital platforms, we can expect to see further innovations in the car rental insurance space. This includes more efficient and user-friendly methods of purchasing and managing insurance policies, potentially leveraging blockchain technology for secure and transparent transactions.

Conclusion

In conclusion, annual car rental insurance is a valuable option for individuals who frequently rent cars. It offers comprehensive coverage, convenience, and potential cost savings. However, it’s essential to carefully review the policy’s terms and conditions to ensure it meets your specific needs and to be aware of any limitations or exclusions.

As with any insurance decision, it’s crucial to weigh the benefits against the cost and to understand the implications of any policy choices. With the right annual car rental insurance policy, you can travel with confidence, knowing you’re protected without compromising on convenience or financial viability.

How much does annual car rental insurance typically cost?

+The cost of annual car rental insurance can vary widely depending on factors such as the level of coverage, the provider, and the policy’s terms. On average, you can expect to pay between 300 and 1,000 per year. However, it’s important to compare policies and consider your specific needs to find the best value.

Can I use my annual car rental insurance internationally?

+Many annual car rental insurance policies offer international coverage, but it’s essential to review the policy’s terms and conditions to understand any geographical restrictions. Some policies may only cover rentals within a specific country or region, while others may provide global coverage.

What happens if I exceed the rental period covered by my annual policy?

+If you exceed the rental period covered by your annual policy, you may be able to purchase additional coverage from the rental car company or extend your policy with your insurance provider. It’s important to review your policy’s terms and conditions to understand your options in this scenario.