Assurance Home Owner Insurance

Welcome to a comprehensive guide on Assurance Home Owner Insurance, a topic that is of utmost importance to homeowners across the nation. This article aims to provide an in-depth analysis of the coverage, benefits, and unique features offered by Assurance, helping you make an informed decision about your home insurance needs.

Understanding Assurance Home Owner Insurance

Assurance Home Owner Insurance is a leading provider of comprehensive coverage options tailored to meet the diverse needs of homeowners. With a strong focus on customer satisfaction and a range of customizable policies, Assurance has established itself as a trusted partner in the home insurance industry.

One of the key strengths of Assurance lies in its ability to offer personalized insurance solutions. Whether you own a condominium, a mobile home, or a traditional family residence, Assurance can craft a policy that aligns perfectly with your specific requirements. This level of customization ensures that homeowners receive the coverage they need without paying for unnecessary add-ons.

Coverage Options and Benefits

Assurance’s home insurance policies encompass a wide range of coverage options, providing peace of mind and financial protection to homeowners in various scenarios. Here’s an overview of the key benefits and features:

- Dwelling Coverage: Assurance offers robust protection for the structure of your home, covering damages caused by perils such as fire, lightning, windstorms, and hail. This coverage ensures that your home's physical structure is adequately insured, providing the necessary funds for repairs or rebuilding in the event of a covered loss.

- Personal Property Coverage: Your belongings are valuable, and Assurance understands the importance of protecting them. This coverage extends to your personal property, including furniture, electronics, and clothing. In the event of a covered loss, Assurance will reimburse you for the cost of replacing or repairing your damaged possessions.

- Liability Protection: Homeownership comes with certain legal responsibilities, and Assurance provides comprehensive liability coverage. This coverage safeguards you against lawsuits and legal expenses arising from accidents or injuries that occur on your property. With Assurance, you can rest easy knowing you're protected from potential financial burdens.

- Additional Living Expenses: In the unfortunate event that your home becomes uninhabitable due to a covered loss, Assurance's additional living expenses coverage steps in. This coverage reimburses you for temporary living expenses, such as hotel stays or rental costs, until your home is repaired or rebuilt.

- Personal Injury Coverage: Assurance goes beyond traditional home insurance by offering personal injury coverage. This coverage protects you against claims arising from slander, libel, or invasion of privacy, providing an extra layer of financial protection for your personal reputation and well-being.

Customizable Options and Endorsements

Understanding that every homeowner has unique needs, Assurance offers a variety of customizable options and endorsements to enhance your coverage. These additions allow you to tailor your policy to your specific circumstances and provide added protection for valuable items or specific situations.

For instance, if you own valuable jewelry, artwork, or collectibles, Assurance's Personal Article Policy endorsement can provide additional coverage for these items, ensuring they are adequately insured. Similarly, if you have a home-based business, Assurance offers endorsements to extend your liability coverage to include business-related risks.

| Endorsement | Description |

|---|---|

| Personal Article Policy | Provides additional coverage for valuable items like jewelry, artwork, and collectibles. |

| Business Pursuits Endorsement | Extends liability coverage for home-based businesses, protecting against business-related risks. |

| Water Backup Coverage | Covers damage caused by water backup from sewers or drains, a common exclusion in standard policies. |

| Identity Theft Coverage | Offers protection against the financial and emotional costs of identity theft, including reimbursement for expenses and legal fees. |

Claims Process and Customer Service

Assurance prides itself on its efficient and customer-centric claims process. When a covered loss occurs, Assurance aims to make the claims process as smooth and stress-free as possible. Policyholders can expect prompt response times, dedicated claims adjusters, and fair and transparent settlement processes.

The company's customer service team is readily available to assist with any inquiries or concerns. Assurance understands that home insurance is not a one-size-fits-all solution, and its representatives are trained to provide personalized guidance and support to help homeowners make informed decisions about their coverage.

Why Choose Assurance Home Owner Insurance

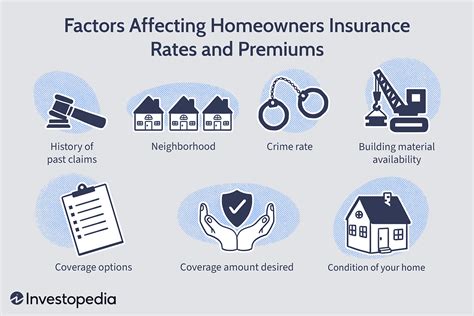

When it comes to choosing a home insurance provider, there are several factors to consider. Assurance stands out from the competition for several key reasons:

Competitive Pricing and Discounts

Assurance offers competitive pricing for its comprehensive home insurance policies. The company understands that homeowners value affordability without compromising on coverage. By offering competitive rates and various discounts, Assurance makes it possible for homeowners to protect their assets without breaking the bank.

Policyholders can take advantage of multiple discounts, including:

- Multi-Policy Discount: Save by bundling your home and auto insurance policies with Assurance.

- Loyalty Discount: Receive a discount for each consecutive year you maintain your policy with Assurance.

- Safety Features Discount: Get a discount for installing certain safety features in your home, such as smoke detectors, fire sprinklers, or security systems.

- New Home Discount: Enjoy a discount if you've recently purchased a new home.

Strong Financial Stability

Financial stability is a critical factor when choosing an insurance provider. Assurance boasts a strong financial foundation, backed by reputable insurance groups. This stability ensures that policyholders can rely on Assurance to fulfill its financial obligations, providing long-term peace of mind.

Digital Convenience and Innovation

In today’s digital age, Assurance recognizes the importance of offering convenient and accessible services. The company’s online platform and mobile app provide policyholders with easy access to their policy information, billing details, and claims status. Policyholders can manage their policies, make payments, and even file claims directly from their smartphones or computers.

Assurance's commitment to innovation extends beyond its digital offerings. The company continuously invests in research and development to stay at the forefront of the industry, introducing new coverage options and enhancements to meet evolving homeowner needs.

Real-World Success Stories

Assurance’s commitment to customer satisfaction and comprehensive coverage has resulted in numerous success stories. Here are a couple of real-life examples showcasing how Assurance has made a difference in the lives of its policyholders:

Hurricane Damage Recovery

When Hurricane Emma struck the Florida coast, it left behind a trail of destruction, including severe damage to Mr. Johnson’s home. As an Assurance policyholder, Mr. Johnson was relieved to have the comprehensive coverage he needed. Assurance’s claims adjusters promptly responded to his claim, providing him with the necessary funds to repair his home and get his life back on track.

Burglary Incident and Personal Belongings Coverage

Ms. Smith, a resident of Chicago, experienced a traumatic burglary incident. Fortunately, she had taken the precaution of insuring her valuable possessions with Assurance’s Personal Article Policy endorsement. This additional coverage ensured that Ms. Smith received the full replacement cost for her stolen jewelry and artwork, providing her with financial relief during a difficult time.

Future of Home Insurance with Assurance

As the home insurance landscape continues to evolve, Assurance remains dedicated to staying ahead of the curve. The company is committed to innovation, utilizing advanced technologies and data analytics to enhance its services and better serve its policyholders.

With a focus on customer-centricity, Assurance is exploring new ways to personalize the insurance experience. This includes leveraging artificial intelligence and machine learning to offer tailored coverage recommendations and streamline the claims process further. By staying at the forefront of industry advancements, Assurance aims to provide homeowners with the best possible protection and peace of mind.

How can I get a quote for Assurance Home Owner Insurance?

+Obtaining a quote for Assurance Home Owner Insurance is straightforward. You can start by visiting their official website and using their online quote tool. Alternatively, you can reach out to their customer service team, who will be happy to assist you in getting a personalized quote based on your specific needs and circumstances.

What are the typical coverage limits for Assurance’s home insurance policies?

+Assurance offers flexible coverage limits to cater to a wide range of homeowner needs. The typical coverage limits vary depending on the type of policy and the specific endorsements chosen. It’s recommended to discuss your coverage requirements with an Assurance representative to ensure you have adequate protection for your home and belongings.

Does Assurance offer coverage for natural disasters like earthquakes or floods?

+Yes, Assurance understands the importance of protecting homeowners from natural disasters. They offer optional coverage endorsements for both earthquakes and floods, allowing policyholders to enhance their protection against these specific perils. It’s crucial to discuss these endorsements with an Assurance representative to understand the coverage options and any potential limitations.