Auto Insurance State Farm Quote

Welcome to an in-depth exploration of Auto Insurance, specifically focusing on State Farm's Quote process. In this comprehensive guide, we will delve into the intricacies of automobile insurance, shedding light on the factors that influence your premium and the steps involved in obtaining a quote from State Farm. With a deep understanding of the industry and a wealth of expertise, we aim to provide you with valuable insights to navigate the world of auto insurance confidently.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind in the event of accidents, theft, or other mishaps. It serves as a safety net, ensuring that you and your vehicle are covered when the unexpected occurs. State Farm, a leading provider in the industry, offers a range of coverage options tailored to meet the diverse needs of drivers across the nation.

When it comes to auto insurance, the process of obtaining a quote is a critical step. It involves evaluating various factors to determine the level of coverage and the associated costs. State Farm's quote process is designed to be comprehensive, taking into account the unique circumstances of each driver to provide accurate and personalized insurance solutions.

Key Factors Influencing Auto Insurance Premiums

The cost of auto insurance, often referred to as the premium, is influenced by a multitude of factors. These factors can vary from one individual to another and play a significant role in determining the final quote. Here’s a breakdown of some key considerations:

- Driving Record: Your driving history is a major determinant. A clean record with no accidents or violations can lead to lower premiums, whereas a history of accidents or traffic violations may result in higher costs.

- Vehicle Type: The make, model, and year of your vehicle matter. Certain vehicles are more expensive to insure due to factors like repair costs, theft rates, or safety features.

- Coverage Options: The level of coverage you choose impacts your premium. Comprehensive and collision coverage, for instance, provide broader protection but come at a higher cost.

- Location: Where you live and drive your vehicle can affect your insurance rates. Areas with higher rates of accidents or theft may result in increased premiums.

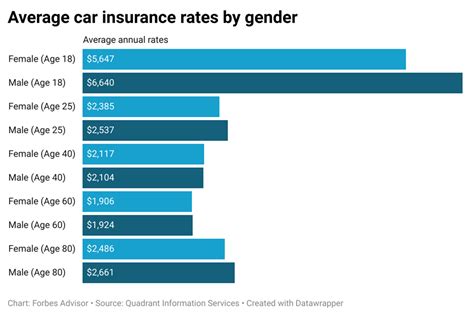

- Age and Gender: Age and gender can be considered in some cases, with younger drivers and certain gender groups often facing higher premiums due to statistical risk factors.

- Credit Score: In many states, insurance providers use credit-based insurance scores to assess risk. A higher credit score can lead to lower premiums, while a lower score may result in higher costs.

- Discounts and Bundles: State Farm, like many insurers, offers discounts for various reasons. These could include safe driving, multiple policies with the same provider, or even specific vehicle safety features. Bundling your auto insurance with other policies, such as home or life insurance, can also lead to significant savings.

Understanding these factors is crucial as they directly impact the cost of your auto insurance. By being aware of these considerations, you can make informed decisions when selecting coverage and potentially lower your premiums.

The State Farm Quote Process: Step-by-Step

State Farm offers a seamless and efficient quote process, ensuring that you receive accurate and personalized insurance options. Here’s a detailed breakdown of the steps involved:

Step 1: Gather Relevant Information

Before initiating the quote process, it’s essential to have certain information at hand. This includes details about your vehicle, such as make, model, year, and VIN (Vehicle Identification Number). Additionally, you’ll need personal information like your name, date of birth, driver’s license number, and social security number.

Other pertinent details include your current insurance coverage (if any), your driving record, and any recent accidents or violations. Having this information readily available will streamline the quote process and ensure accuracy.

Step 2: Choose Your Coverage

State Farm provides a range of coverage options to meet your specific needs. These include liability coverage, which is mandatory in most states and protects you against claims for bodily injury or property damage caused by you in an accident. Other optional coverages include collision, comprehensive, medical payments, uninsured/underinsured motorist coverage, and personal injury protection (PIP) - all of which offer varying levels of protection.

During this step, you'll select the coverage that aligns with your requirements and budget. It's essential to carefully consider each option to ensure you have the right amount of protection without overspending.

Step 3: Provide Vehicle and Driver Details

State Farm will request detailed information about your vehicle and your driving history. This includes the primary driver’s details, as well as any additional drivers who may operate the vehicle. Providing accurate and honest information is crucial, as any discrepancies could lead to issues with your coverage later on.

State Farm uses this information to assess the risk associated with insuring your vehicle and to determine the appropriate premium.

Step 4: Review and Customize Your Quote

Once State Farm has processed your information, you’ll receive a personalized quote. This quote will outline the coverage options you’ve selected, the associated costs, and any applicable discounts. It’s important to carefully review this quote to ensure it aligns with your expectations and budget.

During this step, you can also customize your coverage further. State Farm offers flexibility, allowing you to adjust deductibles, coverage limits, and other aspects to find the perfect balance between cost and protection.

Step 5: Purchase Your Policy

If you’re satisfied with your quote and the coverage it provides, the next step is to purchase your auto insurance policy. State Farm offers various payment options, including monthly, quarterly, or annual payments, to suit your financial preferences.

Once your policy is in place, you'll receive your insurance card and other necessary documents. It's essential to keep these documents readily accessible and to familiarize yourself with the terms and conditions of your policy.

Maximizing Your State Farm Auto Insurance Experience

Now that you understand the quote process, here are some additional tips to enhance your State Farm auto insurance experience:

- Explore Discounts: State Farm offers a variety of discounts to help lower your premiums. These include discounts for safe driving, bundling multiple policies, good student status, and more. Be sure to ask your agent about all the potential discounts you may qualify for.

- Review Your Policy Annually: Insurance needs can change over time. It's important to review your policy annually to ensure it still meets your requirements. This includes assessing your coverage limits, deductibles, and any additional drivers or vehicles.

- Utilize Digital Tools: State Farm provides a range of digital tools to manage your policy, file claims, and more. Their mobile app, for instance, allows you to access your policy information, pay bills, and even file claims quickly and conveniently.

- Understand Your Deductibles: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it's important to select a deductible you're comfortable paying in the event of a claim.

- Stay Safe on the Road: Maintaining a clean driving record is essential for keeping your premiums low. Avoid accidents and violations, and consider taking defensive driving courses, which can often lead to insurance discounts.

By following these tips and staying informed, you can make the most of your State Farm auto insurance experience, ensuring you have the right coverage at a competitive price.

Conclusion: Empowering Your Auto Insurance Journey

Navigating the world of auto insurance can be complex, but with the right knowledge and guidance, you can make informed decisions that protect your vehicle and your finances. State Farm’s comprehensive quote process, combined with their range of coverage options and personalized service, ensures you receive the protection you need at a price you can afford.

Remember, auto insurance is an essential aspect of responsible vehicle ownership. By understanding the factors that influence your premium and following the step-by-step quote process, you can secure the coverage that best suits your needs. With State Farm by your side, you can drive with confidence, knowing you're protected.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually or whenever your circumstances change. This includes changes in your vehicle, driving habits, or personal life. Regular reviews ensure your coverage remains up-to-date and aligns with your current needs.

Can I bundle my auto insurance with other policies to save money?

+Yes, bundling your auto insurance with other policies, such as home or renters insurance, can lead to significant savings. State Farm offers multi-policy discounts, making it a great option to consider if you’re looking to lower your overall insurance costs.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, it’s important to remain calm and prioritize safety. Exchange information with the other driver(s) involved, including names, contact details, and insurance information. Take photos of the scene and any damage to your vehicle. Report the accident to the police and contact your State Farm agent as soon as possible to initiate the claims process.