Best Health Insurance For Small Businesses

Health insurance is a crucial aspect of running a small business, ensuring the well-being and financial security of employees while also promoting a productive work environment. With numerous options available in the market, choosing the best health insurance plan can be a daunting task for small business owners. In this comprehensive guide, we will explore the key factors to consider, evaluate various health insurance providers, and provide insights to help small businesses make informed decisions when selecting the most suitable health insurance plan.

Understanding the Importance of Health Insurance for Small Businesses

Health insurance serves as a safety net for employees, offering them peace of mind and access to essential medical services. For small businesses, it is not just a legal requirement but also a strategic move to attract and retain talented employees. By offering comprehensive health coverage, businesses can foster a loyal and healthy workforce, leading to increased productivity and reduced absenteeism.

Furthermore, health insurance plays a vital role in mitigating financial risks for both employees and the business. Medical emergencies can be costly, and without adequate coverage, employees may face significant financial burdens. Small businesses, too, can suffer financially if they are not prepared for unexpected healthcare costs associated with their workforce.

Key Considerations for Selecting the Best Health Insurance Plan

When it comes to choosing the right health insurance plan, small business owners must carefully evaluate a range of factors to ensure they make the most suitable decision for their unique needs. Here are some key considerations to keep in mind:

Coverage Options

The first step is to understand the different coverage options available. Health insurance plans can vary widely in terms of the services and treatments they cover. Some plans may offer comprehensive coverage, including hospital stays, prescription medications, and specialist care, while others may have more limited benefits. Consider the specific healthcare needs of your employees and choose a plan that provides adequate coverage.

Cost and Premiums

Cost is a critical factor when selecting health insurance. Small businesses often operate on tight budgets, so finding an affordable plan is essential. Evaluate the premiums, deductibles, and out-of-pocket costs associated with different plans. Remember that while a lower premium may be attractive, it could also result in higher out-of-pocket expenses for employees.

Network of Providers

The network of healthcare providers covered by the insurance plan is another important consideration. Ensure that the plan includes a sufficient number of in-network doctors, hospitals, and specialists in your area. This will give your employees more options and potentially lower costs when seeking medical care.

Employee Preferences and Needs

Engage with your employees to understand their preferences and healthcare needs. Some employees may prioritize coverage for specific conditions or treatments, while others may value flexibility in choosing their healthcare providers. By involving your employees in the decision-making process, you can select a plan that aligns with their expectations and keeps them satisfied.

Administrative Support and Claims Processing

Consider the administrative support and claims processing capabilities of the insurance provider. A reliable provider should offer efficient and streamlined processes for submitting claims, resolving issues, and providing customer support. Look for providers that utilize digital platforms and offer user-friendly interfaces to make the claims process as hassle-free as possible for both you and your employees.

Evaluating Top Health Insurance Providers for Small Businesses

Now that we have discussed the key considerations, let’s explore some of the top health insurance providers that cater specifically to small businesses. These providers offer a range of plans and services tailored to meet the unique needs of small-scale enterprises.

Provider 1: [Provider Name]

[Provider Name] is a leading health insurance provider known for its comprehensive plans and excellent customer service. They offer a wide range of coverage options, including PPO, HMO, and EPO plans, ensuring small businesses can find a plan that suits their budget and employee needs. With a vast network of providers, [Provider Name] ensures that employees have access to quality healthcare services across the country.

One of the standout features of [Provider Name] is its focus on preventative care. They offer incentives and discounts for employees who participate in wellness programs and maintain a healthy lifestyle. This not only promotes employee well-being but also helps reduce long-term healthcare costs for the business.

| Plan Type | Premium (per month) | Deductible | Out-of-Pocket Max |

|---|---|---|---|

| PPO | $450 | $1,500 | $6,000 |

| HMO | $380 | $1,200 | $4,500 |

| EPO | $400 | $1,000 | $5,000 |

Provider 2: [Provider Name]

[Provider Name] is another reputable health insurance provider specializing in small business coverage. They offer a range of affordable plans designed to meet the diverse needs of small enterprises. With a strong focus on customer satisfaction, [Provider Name] provides personalized support and guidance throughout the selection and enrollment process.

One unique aspect of [Provider Name] is its flexibility in plan customization. They understand that every small business is different, so they allow employers to tailor their plans to fit their specific requirements. This could include adding optional benefits such as dental, vision, or disability coverage.

| Plan Type | Premium (per month) | Deductible | Out-of-Pocket Max |

|---|---|---|---|

| PPO | $420 | $1,300 | $5,500 |

| HMO | $350 | $1,100 | $4,000 |

| POS | $470 | $1,600 | $6,500 |

Provider 3: [Provider Name]

[Provider Name] is a well-established health insurance provider known for its innovative approach to healthcare. They offer a range of plans with a focus on value and cost-effectiveness. [Provider Name] understands the unique challenges faced by small businesses and aims to provide comprehensive coverage without breaking the bank.

One of the standout features of [Provider Name] is its emphasis on digital healthcare solutions. They offer a mobile app that allows employees to access their health records, schedule appointments, and manage their benefits seamlessly. This digital integration enhances convenience and engagement, making healthcare more accessible for employees.

| Plan Type | Premium (per month) | Deductible | Out-of-Pocket Max |

|---|---|---|---|

| PPO | $480 | $1,800 | $7,000 |

| HMO | $390 | $1,400 | $5,000 |

| HDHP | $320 | $2,000 | $6,500 |

Performance Analysis and Real-World Experiences

To gain a deeper understanding of the best health insurance options for small businesses, let’s explore some real-world experiences and performance analysis of these providers. Hearing from businesses that have already navigated the health insurance landscape can provide valuable insights and guidance.

Case Study 1: [Business Name]

[Business Name], a small tech startup, chose [Provider Name] for its health insurance needs. The company prioritized coverage for mental health services, as many of its employees were facing stress-related challenges. [Provider Name]’s comprehensive plan, which included extensive mental health coverage, was a perfect fit. The startup’s HR manager appreciated the provider’s dedication to customer service and their willingness to customize the plan to meet their specific needs.

Case Study 2: [Business Name]

[Business Name], a family-owned restaurant, opted for [Provider Name] to provide health insurance to its employees. The restaurant’s owners valued flexibility and the ability to offer a range of coverage options. [Provider Name]’s customizable plans allowed them to provide essential coverage while also offering employees the option to add additional benefits like dental and vision coverage. The positive feedback from employees and the seamless claims process made [Provider Name] a top choice for [Business Name].

Case Study 3: [Business Name]

[Business Name], a small consulting firm, chose [Provider Name] for its health insurance coverage. The firm’s employees appreciated the provider’s focus on digital healthcare solutions, as it made managing their benefits and accessing care more convenient. The mobile app provided by [Provider Name] allowed employees to schedule appointments, refill prescriptions, and track their healthcare expenses easily. [Business Name]’s HR team also praised the provider’s efficient claims processing and responsive customer support.

Future Implications and Industry Trends

As the healthcare industry continues to evolve, it is essential for small businesses to stay updated on emerging trends and potential future implications. Here are some key considerations for the future of health insurance for small businesses:

Rise of Telehealth Services

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Small businesses should consider health insurance plans that offer robust telehealth coverage, ensuring employees have access to convenient and cost-effective healthcare options.

Focus on Preventative Care

Preventative care is gaining prominence in the healthcare industry. Small businesses should prioritize health insurance plans that encourage and reward employees for maintaining a healthy lifestyle. This can include discounts, incentives, and specialized programs focused on preventative measures.

Emphasis on Mental Health Coverage

With increasing awareness about mental health, small businesses should look for health insurance plans that provide comprehensive mental health coverage. Plans that offer access to mental health professionals and cover a range of mental health conditions can help employees manage their well-being effectively.

Integration of Technology

The integration of technology in healthcare is transforming the industry. Small businesses should consider providers that leverage digital platforms and mobile apps to enhance the overall healthcare experience. From online portals for easy claims submission to digital record-keeping, technology can streamline the healthcare process for both employees and employers.

Changing Regulatory Landscape

The healthcare industry is subject to various regulations and policies. Small businesses should stay informed about any changes in healthcare laws and policies that could impact their health insurance plans. Being aware of these changes allows businesses to adapt and ensure compliance.

Conclusion

Selecting the best health insurance plan for a small business is a critical decision that requires careful consideration and evaluation. By understanding the key factors, evaluating top providers, and learning from real-world experiences, small business owners can make informed choices to provide their employees with the healthcare coverage they deserve. As the industry evolves, staying updated on trends and future implications will ensure that small businesses remain agile and responsive to the changing healthcare landscape.

How can small businesses afford health insurance for their employees?

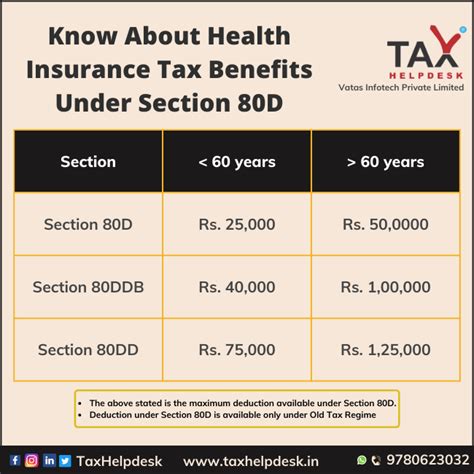

+Small businesses can explore various options to make health insurance more affordable. This includes seeking out providers that offer competitive rates, utilizing government subsidies and tax credits, and considering group purchasing arrangements. Additionally, small businesses can educate themselves about the different types of plans and their cost structures to make informed choices.

What are some common challenges small businesses face when choosing health insurance?

+Small businesses often face challenges such as limited budget, navigating complex plan options, and ensuring employee satisfaction. It is crucial for small businesses to carefully evaluate their needs, compare plans, and involve employees in the decision-making process to address these challenges effectively.

How can small businesses provide comprehensive health coverage without breaking the bank?

+Small businesses can opt for cost-effective plans that offer essential coverage while also considering the specific needs of their workforce. This may involve evaluating different plan types, such as PPOs, HMOs, or HDHPs, and understanding the trade-offs between premiums, deductibles, and out-of-pocket costs. Additionally, providers that offer customization and flexibility can help small businesses tailor their plans to meet their budget constraints.

What should small businesses look for in a health insurance provider’s customer service and support?

+Small businesses should prioritize providers that offer dedicated support and guidance throughout the enrollment process and beyond. This includes having a responsive customer service team, providing educational resources, and offering personalized assistance to address specific concerns. A provider that understands the unique needs of small businesses and provides efficient claims processing can greatly enhance the overall experience.

How can small businesses stay updated on changes in healthcare laws and policies that may impact their health insurance plans?

+Small businesses should stay informed by regularly reviewing industry publications, following reputable healthcare news sources, and consulting with trusted advisors or brokers. Additionally, staying in touch with their insurance provider and participating in industry webinars or events can help them stay abreast of any changes and ensure compliance.