Ccw Insurance

Welcome to an in-depth exploration of the world of CCW (Carrying a Concealed Weapon) Insurance. In today's society, where gun ownership and self-defense are prominent topics, understanding the intricacies of CCW Insurance is more important than ever. This comprehensive guide will delve into the various aspects of CCW Insurance, providing valuable insights for individuals who wish to stay informed and protected.

Unveiling CCW Insurance: A Comprehensive Overview

CCW Insurance, often referred to as Self-Defense Insurance or Concealed Carry Insurance, is a specialized type of coverage designed to protect individuals who legally carry concealed firearms for self-defense purposes. This unique form of insurance provides a safety net for those who wish to exercise their right to bear arms responsibly, ensuring they are financially protected in the event of legal or medical complications arising from the use of their firearm.

The concept of CCW Insurance has gained significant traction in recent years as gun ownership and concealed carry laws have become more prevalent. With an increasing number of states adopting shall-issue or constitutional carry policies, the need for comprehensive coverage has become imperative. CCW Insurance offers a range of benefits, from legal defense to medical reimbursement, ensuring that gun owners can exercise their rights with confidence and peace of mind.

The Rise of CCW Insurance: A Necessary Evolution

The history of CCW Insurance is relatively young, but its development has been rapid and essential. As gun rights and self-defense laws evolved, so too did the need for specialized insurance to address the unique risks associated with concealed carry. The first CCW Insurance policies emerged in the early 2000s, primarily in response to the growing demand for coverage among gun owners who wanted to protect themselves from potential legal and financial repercussions.

One of the key driving forces behind the development of CCW Insurance was the recognition that standard homeowners or liability insurance policies often excluded coverage for incidents involving firearms. This exclusion left gun owners vulnerable to significant financial burdens if they were ever involved in a self-defense situation. CCW Insurance stepped in to fill this gap, offering tailored coverage to address the specific needs of concealed carriers.

Over the years, CCW Insurance has evolved to become a comprehensive solution, providing not only legal defense and liability coverage but also offering benefits such as medical expense reimbursement, identity theft protection, and even firearm replacement or repair. These additional features make CCW Insurance an attractive option for gun owners who seek a holistic approach to their protection and peace of mind.

Understanding the Benefits of CCW Insurance

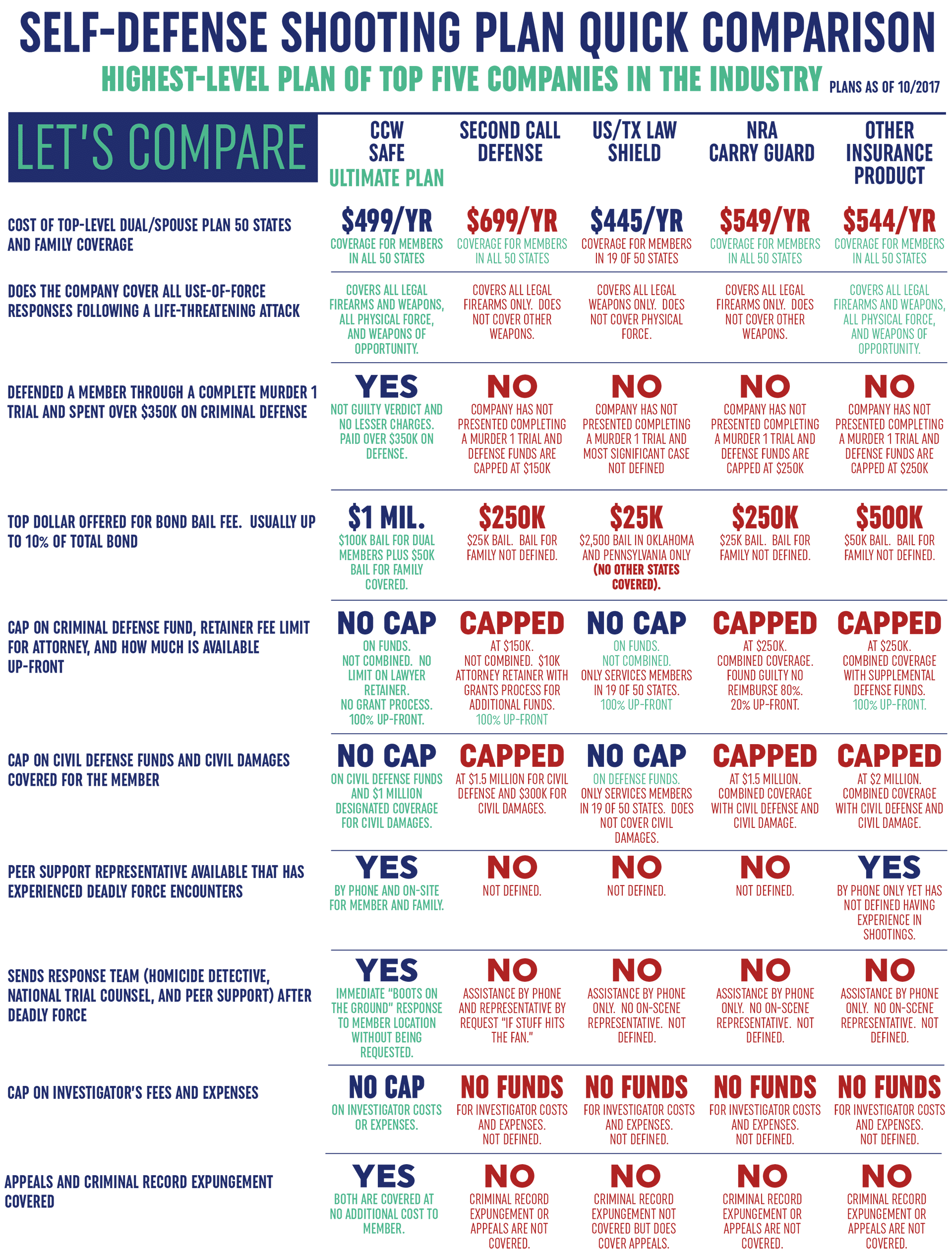

CCW Insurance offers a multitude of benefits that cater to the specific needs of concealed carry permit holders. One of the primary advantages is the comprehensive legal defense coverage it provides. In the event of a self-defense situation, CCW Insurance policies typically cover the cost of legal representation, including attorneys’ fees, court costs, and other related expenses. This ensures that individuals can access the legal support they need without incurring overwhelming financial burdens.

Another critical benefit of CCW Insurance is liability coverage. This aspect of the policy protects the insured against claims or lawsuits arising from the use of their firearm in a self-defense scenario. Liability coverage provides a financial safety net, ensuring that the insured is protected from potential damages or settlements that could arise from such incidents. This coverage is particularly crucial, as legal battles can be lengthy and costly, even if the insured is ultimately found to have acted within their rights.

Additionally, CCW Insurance policies often include medical expense reimbursement. This benefit covers the cost of medical treatment for the insured or their family members if they are injured in a self-defense incident. This aspect of CCW Insurance not only provides financial relief but also ensures that individuals have access to the medical care they need without delay.

Furthermore, many CCW Insurance policies offer identity theft protection, recognizing that the use of firearms can sometimes lead to personal information being exposed or compromised. This additional coverage provides peace of mind, ensuring that individuals are protected against the potential financial and personal consequences of identity theft.

| Benefit | Description |

|---|---|

| Legal Defense | Covers the cost of legal representation in self-defense cases. |

| Liability Coverage | Protects against claims and lawsuits arising from firearm use. |

| Medical Expense Reimbursement | Reimburses medical costs for the insured and their family. |

| Identity Theft Protection | Provides coverage for identity theft incidents. |

The Cost and Availability of CCW Insurance

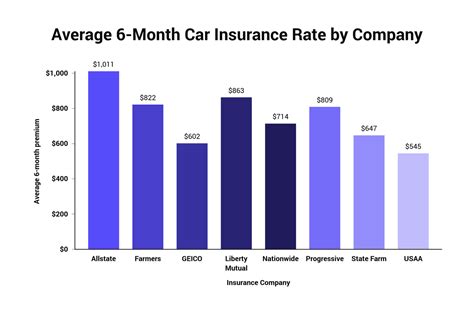

The cost of CCW Insurance varies depending on several factors, including the level of coverage desired, the insured’s location, and their individual circumstances. On average, CCW Insurance policies range from a few hundred to a few thousand dollars annually. The cost can be influenced by factors such as the insured’s age, criminal history, and the specific benefits and limits of the policy.

Despite the relatively high cost, CCW Insurance is becoming increasingly accessible. Many insurance providers now offer specialized CCW Insurance policies, recognizing the growing demand for such coverage. These providers understand the unique needs of concealed carry permit holders and tailor their policies to provide the necessary protection. Additionally, some organizations and associations dedicated to gun rights and self-defense often offer group rates or discounts on CCW Insurance, making it more affordable for their members.

Comparative Analysis: CCW Insurance vs. Standard Insurance

When considering CCW Insurance, it is essential to understand how it differs from standard homeowners or liability insurance policies. Standard insurance policies often exclude coverage for incidents involving firearms, leaving gun owners vulnerable in self-defense situations. In contrast, CCW Insurance is specifically designed to address these gaps, providing tailored coverage for the unique risks associated with concealed carry.

One of the key differences between CCW Insurance and standard insurance is the scope of coverage. CCW Insurance policies typically offer more comprehensive legal defense and liability coverage, recognizing the specific challenges and potential consequences of self-defense situations. Standard insurance policies, on the other hand, may have limited or no coverage for such incidents, leaving individuals exposed to significant financial risks.

Another distinction lies in the additional benefits provided by CCW Insurance. As mentioned earlier, CCW Insurance policies often include medical expense reimbursement, identity theft protection, and even firearm replacement or repair. These added benefits are not typically found in standard insurance policies, making CCW Insurance a more attractive option for individuals who wish to be fully protected in all aspects of their concealed carry lifestyle.

The Future of CCW Insurance: Expanding Horizons

As the demand for CCW Insurance continues to grow, the future of this specialized coverage looks promising. Insurance providers are recognizing the importance of catering to the needs of concealed carry permit holders, leading to the development of more innovative and comprehensive policies. The expansion of CCW Insurance is not only limited to coverage benefits but also extends to educational resources and support for gun owners.

One emerging trend in the CCW Insurance landscape is the integration of educational resources and training opportunities. Some insurance providers are partnering with firearms training organizations to offer discounts or incentives for policyholders who complete certified training courses. This not only enhances the safety and proficiency of concealed carry permit holders but also demonstrates a commitment to promoting responsible gun ownership.

Furthermore, the future of CCW Insurance may involve the exploration of new coverage options. As the legal landscape surrounding gun rights and self-defense continues to evolve, insurance providers may introduce innovative policies that address emerging needs. This could include coverage for specific scenarios, such as home defense or travel with firearms, ensuring that policyholders have the protection they need for a variety of situations.

Conclusion: Navigating the World of CCW Insurance

CCW Insurance represents a critical evolution in the world of insurance, offering specialized protection for individuals who choose to exercise their right to bear arms responsibly. With its comprehensive coverage, CCW Insurance provides peace of mind, ensuring that concealed carry permit holders can focus on their self-defense training and responsibilities without the added worry of financial or legal repercussions.

As the demand for CCW Insurance continues to grow, insurance providers are rising to the challenge, developing innovative policies and resources to meet the needs of this unique market. The future of CCW Insurance looks bright, with a focus on expanding coverage options, enhancing educational initiatives, and promoting responsible gun ownership. By staying informed and taking advantage of the protections offered by CCW Insurance, concealed carry permit holders can confidently exercise their rights and contribute to a safer society.

What is CCW Insurance, and why is it important for gun owners?

+CCW Insurance, also known as Self-Defense Insurance or Concealed Carry Insurance, is a specialized type of coverage designed to protect individuals who legally carry concealed firearms for self-defense purposes. It provides financial protection in the event of legal or medical complications arising from the use of their firearm. CCW Insurance is important for gun owners as it offers a safety net, ensuring they can exercise their rights responsibly without worrying about overwhelming financial burdens.

How does CCW Insurance differ from standard homeowners or liability insurance?

+CCW Insurance differs from standard insurance policies in that it specifically addresses the unique risks associated with concealed carry. Standard insurance policies often exclude coverage for incidents involving firearms, leaving gun owners vulnerable. CCW Insurance, on the other hand, provides comprehensive legal defense, liability coverage, and additional benefits such as medical expense reimbursement and identity theft protection, ensuring a holistic approach to protection.

What are the key benefits of CCW Insurance?

+The key benefits of CCW Insurance include comprehensive legal defense coverage, liability protection against claims and lawsuits, medical expense reimbursement for the insured and their family, and identity theft protection. These benefits ensure that individuals have the financial support and resources they need in the event of a self-defense situation, providing peace of mind and comprehensive protection.