Automotive Insurance Online

The world of automotive insurance is undergoing a digital transformation, with an increasing number of insurers offering online services and platforms. This shift towards online automotive insurance presents a myriad of opportunities and challenges for both consumers and insurance providers. In this comprehensive guide, we will delve into the intricacies of automotive insurance online, exploring its benefits, pitfalls, and the future it holds.

The Rise of Online Automotive Insurance

The traditional model of automotive insurance, characterized by physical interactions with agents and brokers, is being rapidly replaced by the convenience and efficiency of online platforms. This digital disruption has been driven by several key factors, including the increasing digital literacy of consumers, the demand for instant services, and the cost-effectiveness of online insurance models.

Online automotive insurance platforms allow customers to compare policies, obtain quotes, and purchase coverage all from the comfort of their homes. This convenience factor has been a major draw, particularly for younger generations who are accustomed to conducting their financial affairs online.

Key Benefits of Online Automotive Insurance

- Enhanced Convenience: Online insurance portals are accessible 24/7, allowing customers to manage their policies and make changes at their convenience.

- Real-Time Quotes: Customers can instantly receive multiple quotes, enabling them to make informed decisions quickly.

- Policy Customization: Online platforms often offer a wide range of coverage options, allowing users to tailor their policies to their specific needs.

- Cost Efficiency: By cutting out middlemen and streamlining processes, online insurance providers can often offer more competitive rates.

Case Study: A Consumer's Journey

Imagine Sarah, a young professional, who needs to insure her recently purchased car. Traditionally, she would have had to visit an insurance agent's office, provide extensive personal and vehicle details, and then wait for a quote. However, with online automotive insurance, Sarah's journey is vastly different.

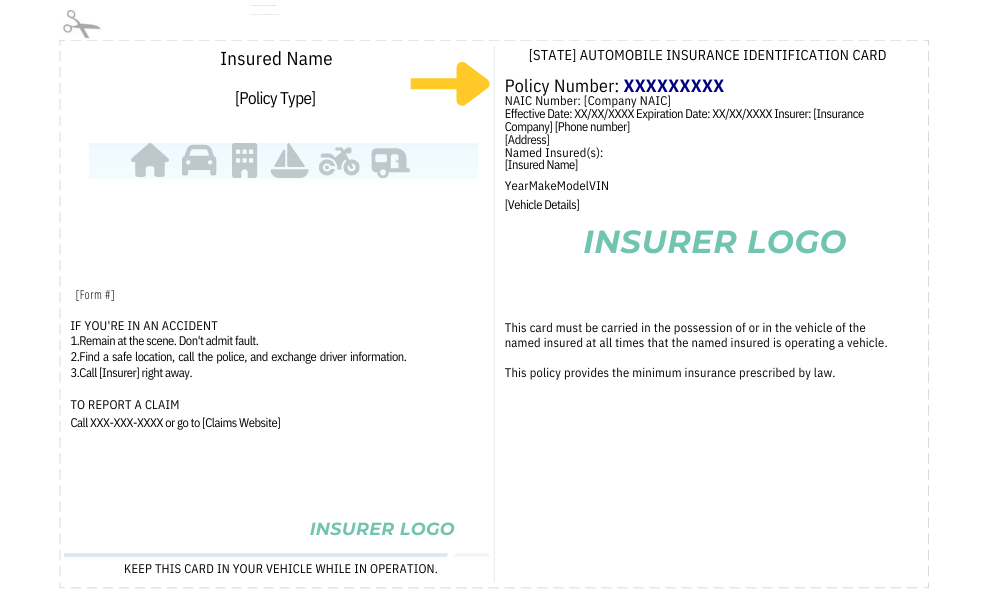

Sarah begins her search on a reputable online insurance platform. She inputs her vehicle's details, selects the coverage options she requires, and instantly receives a quote. The platform also offers her the flexibility to adjust her coverage and compare rates with other providers, all in a matter of minutes. Sarah can then proceed to purchase her policy, receiving an instant confirmation and all the necessary documents via email.

This seamless and efficient process not only saves Sarah time and effort but also empowers her to make informed decisions about her insurance coverage.

Navigating the Online Insurance Landscape

While the benefits of online automotive insurance are evident, consumers must also be aware of potential pitfalls and ensure they make informed choices.

Key Considerations for Consumers

- Reputation and Trustworthiness: Not all online insurance providers are created equal. Consumers should research and choose reputable platforms with a track record of fair practices and prompt claim settlements.

- Coverage and Exclusions: Online quotes may not always include all the coverage details. It's essential to thoroughly review the policy document to understand what is and isn't covered.

- Customer Service and Claims Process: While online insurance is convenient, issues may arise. Ensure the provider offers efficient customer support and has a streamlined claims process.

Expert Tips for Choosing an Online Provider

When selecting an online automotive insurance provider, consider the following:

- Look for providers with an established presence and a solid reputation in the market.

- Check for online reviews and ratings from independent sources to gauge customer satisfaction.

- Compare multiple providers to ensure you're getting the best value for your money.

- Ensure the provider offers a range of coverage options to suit your specific needs.

The Future of Automotive Insurance Online

The future of automotive insurance online is promising, with ongoing technological advancements set to further enhance the consumer experience.

Emerging Trends

- Artificial Intelligence (AI) Integration: AI-powered chatbots and virtual assistants are already being used to provide instant customer support and streamline policy management.

- Blockchain Technology: Blockchain's secure and transparent nature is being explored for insurance purposes, potentially revolutionizing the way policies are managed and claims are processed.

- Connected Car Data: As more vehicles become connected, insurers can leverage real-time driving data to offer personalized policies and dynamic pricing.

Impact on the Industry

The rise of online automotive insurance is expected to drive significant changes in the industry. Traditional insurance agents may need to adapt their business models to stay relevant, while new entrants with a digital-first approach may disrupt the market.

Additionally, the increased availability of data and analytics will allow insurers to offer more precise and personalized policies, further enhancing the consumer experience.

Regulatory Considerations

As the automotive insurance industry moves online, regulatory bodies will need to adapt to ensure consumer protection. This includes addressing issues such as data privacy, fair pricing, and the potential for fraud.

| Key Statistic | Data |

|---|---|

| Projected Growth of Online Insurance Market | Expected to reach $15 billion by 2025, growing at a CAGR of 18% |

| Average Savings with Online Insurance | Consumers can save up to 20% on their insurance premiums by switching to online providers |

Frequently Asked Questions

How do online insurance providers determine my premium?

+Online insurance providers use a variety of factors to determine your premium, including your driving history, the make and model of your vehicle, your age and gender, and your location. They also consider your coverage preferences and any discounts you may be eligible for.

<div class="faq-item">

<div class="faq-question">

<h3>Are online insurance policies as comprehensive as traditional ones?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, online insurance policies can be just as comprehensive as traditional ones. Online providers offer a wide range of coverage options, allowing you to customize your policy to your specific needs. It's important to carefully review the policy document to ensure you understand the coverage and exclusions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I need to make a claim with an online insurance provider?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you need to make a claim, you can typically do so online or over the phone. Most online insurance providers have dedicated claims teams who will guide you through the process. It's important to have all the necessary information and documentation ready to expedite the claims process.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I switch to an online insurance provider mid-policy term?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you can switch to an online insurance provider at any time. However, it's important to note that you may incur penalties or fees for canceling your existing policy early. It's advisable to review your current policy's terms and conditions before making the switch.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I ensure the security of my personal information when using online insurance platforms?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Online insurance platforms prioritize data security. Ensure the platform you're using has robust security measures in place, such as encryption and secure payment gateways. Additionally, be cautious of phishing attempts and only provide your personal information on trusted, secure websites.</p>

</div>

</div>