Basic Auto Insurance

Understanding the fundamentals of auto insurance is crucial for any vehicle owner. This comprehensive guide aims to provide an in-depth analysis of Basic Auto Insurance, shedding light on its features, coverage, and implications for policyholders. By exploring real-world examples and industry data, we'll navigate the complexities of this essential financial protection.

The Essential Coverage: Basic Auto Insurance

Basic Auto Insurance serves as the foundational layer of protection for vehicle owners, offering a range of coverages to address various scenarios on the road. While the specific components may vary across jurisdictions and providers, this section delves into the core elements that define basic auto insurance policies.

Liability Coverage

At the heart of most basic auto insurance policies is liability coverage. This critical component safeguards policyholders against financial losses arising from accidents they cause. It covers expenses related to bodily injuries and property damage inflicted on others. For instance, if you’re at fault in an accident that injures a pedestrian or damages another vehicle, liability coverage steps in to provide financial support for the resulting claims.

The limits of liability coverage are typically defined by state laws or chosen by the policyholder during policy acquisition. These limits represent the maximum amount the insurance company will pay for covered damages. It's essential to choose limits that align with your financial capacity and potential risks. For instance, in states with higher minimum liability requirements, policyholders may opt for coverage exceeding the state-mandated minimum to ensure adequate protection.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured parties in an accident caused by the policyholder. |

| Property Damage Liability | Provides compensation for damage to others' property, such as vehicles, fences, or buildings, caused by the policyholder. |

Collision Coverage

Another cornerstone of basic auto insurance is collision coverage. This provision addresses damages to the policyholder’s vehicle in the event of a collision, regardless of fault. It covers repairs or replacements needed after an accident, providing financial relief during a stressful time. For instance, if you collide with a guardrail while driving, collision coverage can help cover the costs of repairing or replacing your vehicle.

Collision coverage typically comes with a deductible, which is the amount the policyholder must pay out of pocket before the insurance kicks in. Deductibles vary based on policy terms and individual preferences. Opting for a higher deductible can result in lower premiums, making it a strategic choice for some policyholders. However, it's essential to ensure the chosen deductible aligns with one's financial capacity and risk tolerance.

Comprehensive Coverage

Comprehensive coverage is an additional layer of protection offered in basic auto insurance policies. It provides coverage for damages caused by events other than collisions, such as theft, vandalism, natural disasters, or incidents like hitting an animal. This coverage ensures that policyholders have a safety net for a wide range of unexpected situations.

Like collision coverage, comprehensive coverage often comes with a deductible. The chosen deductible impacts the premium, with higher deductibles resulting in lower premiums. Policyholders must carefully consider their financial situation and potential risks when selecting a deductible for comprehensive coverage.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, is an optional coverage in basic auto insurance policies. It provides financial support for medical expenses incurred by the policyholder and their passengers in an accident, regardless of fault. This coverage can be a valuable addition, as it offers swift and straightforward access to funds for medical treatment.

MedPay coverage typically has a set limit, which represents the maximum amount the insurance company will pay for covered medical expenses. Policyholders can choose the coverage limit that aligns with their healthcare needs and financial capacity. It's essential to consider this coverage, especially for those who prioritize quick access to medical funds post-accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage is a critical component of basic auto insurance, designed to protect policyholders in situations where they’re involved in an accident with a driver who lacks adequate insurance coverage. This coverage steps in to provide financial support for bodily injuries and property damage, ensuring policyholders aren’t left bearing the entire burden.

The limits of uninsured/underinsured motorist coverage are often chosen by the policyholder and can be tailored to their specific needs and risk tolerance. It's crucial to understand that this coverage doesn't replace liability coverage; rather, it supplements it, providing an extra layer of protection in cases where the at-fault driver's insurance is insufficient.

The Cost and Considerations of Basic Auto Insurance

The cost of basic auto insurance is a critical factor for policyholders, and it’s influenced by a myriad of variables. This section explores the key determinants of insurance premiums and provides insights into strategies for managing these costs effectively.

Factors Influencing Premiums

Insurance premiums for basic auto insurance policies are calculated based on a combination of factors, each playing a role in assessing the level of risk associated with the policyholder. These factors include:

- Age and Driving Experience: Younger drivers, particularly those under 25, often face higher premiums due to their limited driving experience and higher risk profile. As drivers gain experience and reach their mid-20s, premiums tend to decrease.

- Vehicle Type and Usage: The type of vehicle and its primary purpose can impact premiums. High-performance vehicles or those used for business purposes may attract higher premiums due to their increased risk profile.

- Driving Record: A clean driving record is a significant factor in determining premiums. Drivers with a history of accidents or traffic violations may face higher costs, as they're seen as higher-risk policyholders.

- Location: The geographic area where the vehicle is primarily driven can influence premiums. Urban areas with higher traffic volumes and accident rates may result in higher costs compared to rural areas.

- Coverage Limits and Deductibles: The chosen coverage limits and deductibles play a crucial role in premium calculation. Higher limits and lower deductibles typically result in higher premiums, as they indicate a greater financial risk for the insurance company.

Strategies for Managing Costs

While basic auto insurance is essential, policyholders often seek ways to manage the associated costs effectively. Here are some strategies to consider:

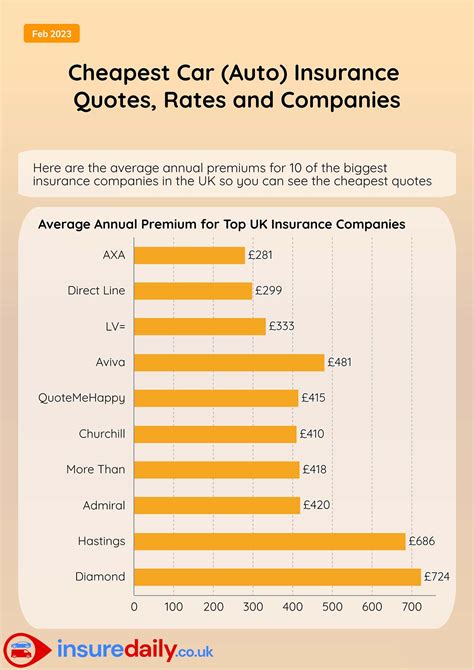

- Compare Quotes: Obtain quotes from multiple insurance providers to compare coverage and premiums. This step ensures you're getting the best value for your money and can help identify providers offering competitive rates.

- Review Coverage Regularly: Periodically assess your insurance needs and coverage. As your circumstances change, your insurance requirements may evolve. Regular reviews ensure your coverage remains adequate and cost-effective.

- Maintain a Clean Driving Record: A clean driving record is a significant factor in determining premiums. Avoid traffic violations and accidents to keep your record clean and potentially lower your premiums.

- Explore Discounts: Many insurance providers offer discounts for various reasons, such as good student discounts, safe driver discounts, or multi-policy discounts. Discuss these options with your insurer to determine if you're eligible for any savings.

- Consider Bundling: Bundling your auto insurance with other policies, such as home or renters' insurance, can often result in substantial discounts. Explore bundling options with your insurance provider to maximize your savings.

Real-World Examples and Case Studies

To illustrate the practical implications of basic auto insurance, let’s explore some real-world scenarios and case studies:

Scenario 1: Collision Coverage in Action

Imagine John, a 35-year-old driver with a clean driving record, purchases basic auto insurance with collision coverage. One day, while driving on a wet road, he loses control of his vehicle and collides with a guardrail. The damage to his car is significant, requiring extensive repairs. Fortunately, John’s collision coverage steps in, covering the costs of the repairs, providing him with the financial support he needs to get his vehicle back on the road.

Scenario 2: Uninsured Motorist Coverage

Sarah, a 28-year-old professional, opts for basic auto insurance with uninsured motorist coverage. One evening, while driving home from work, she’s involved in an accident with a driver who flees the scene. Sarah sustains minor injuries and her vehicle is damaged. Thanks to her uninsured motorist coverage, she’s able to receive compensation for her medical expenses and vehicle repairs, despite the at-fault driver’s absence.

Case Study: Comprehensive Coverage Pays Off

In a rural area prone to severe weather, Michael, a 42-year-old farmer, purchases basic auto insurance with comprehensive coverage. During a particularly strong storm, a large tree falls on his vehicle, causing significant damage. Michael’s comprehensive coverage comes to the rescue, covering the costs of repairing his vehicle, ensuring he’s not left with a substantial financial burden.

The Future of Basic Auto Insurance

The auto insurance landscape is evolving, and basic auto insurance is no exception. As technology advances and consumer preferences shift, the industry is adapting to meet new demands. This section explores some of the emerging trends and potential future developments in basic auto insurance.

Telematics and Usage-Based Insurance

Telematics, the technology that tracks driving behavior, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive insurance, leverages telematics data to offer customized premiums based on individual driving habits. This approach rewards safe drivers with lower premiums, encouraging safer driving practices and potentially revolutionizing the way basic auto insurance is priced.

Increased Focus on Preventative Measures

The insurance industry is increasingly recognizing the value of preventative measures in reducing accident risks. Basic auto insurance policies may evolve to include incentives for policyholders to adopt safer driving habits, such as defensive driving courses or the use of advanced safety features in their vehicles. By promoting proactive safety measures, insurers can help reduce accident rates and improve overall road safety.

Integration of Autonomous Vehicle Technology

The rise of autonomous vehicle technology is poised to revolutionize the auto industry. As self-driving cars become more prevalent, basic auto insurance policies will need to adapt to address the unique risks and benefits associated with this technology. Insurers will need to consider new coverage options, such as cyber insurance for autonomous systems, to ensure policyholders are adequately protected in this evolving landscape.

Expanding Coverage Options

As consumer needs and expectations evolve, basic auto insurance policies may expand to offer a wider range of coverage options. This could include enhanced roadside assistance packages, coverage for specific types of damage (e.g., flood or hail damage), or even coverage for personal belongings left in the vehicle. By offering more comprehensive coverage, insurers can provide greater peace of mind to policyholders.

What is the average cost of basic auto insurance?

+The average cost of basic auto insurance varies widely based on factors like location, driving record, and vehicle type. According to recent data, the national average for minimum liability coverage is approximately $500 per year. However, premiums can range from a few hundred dollars to several thousand, emphasizing the importance of shopping around and comparing quotes.

Can I customize my basic auto insurance policy?

+Yes, basic auto insurance policies often allow customization to suit individual needs. Policyholders can choose coverage limits, deductibles, and optional add-ons like rental car reimbursement or roadside assistance. Customization ensures policyholders get the coverage that aligns with their specific circumstances and preferences.

What happens if I’m involved in an accident with an uninsured driver?

+If you’re involved in an accident with an uninsured driver and have uninsured motorist coverage, your insurance provider will step in to cover your damages. This coverage ensures you’re not left bearing the financial burden when dealing with an uninsured driver. It’s a critical component of basic auto insurance, providing peace of mind in such situations.