Best Company For Renters Insurance

Renters insurance is a crucial consideration for anyone living in a rented property, whether it's an apartment, a house, or a condominium. It provides protection for tenants against various risks and liabilities, offering peace of mind and financial security. In the United States, the market is flooded with insurance providers, making it challenging for renters to identify the best company that suits their needs. This article aims to guide renters in their search for the ideal insurance provider, offering an in-depth analysis of some of the top companies in the industry.

Understanding the Importance of Renters Insurance

Renters insurance is often an overlooked aspect of financial planning, yet it plays a vital role in safeguarding personal belongings and providing liability coverage. Unlike homeowners insurance, which is typically required by mortgage lenders, renters insurance is optional. However, it is an essential investment for renters to protect themselves from potential losses due to theft, fire, natural disasters, or accidental damage.

Apart from covering personal property, renters insurance also provides personal liability coverage. This means that if a guest is injured in your rented space and decides to sue you, renters insurance can help cover the legal fees and any damages you may be required to pay. It's a layer of protection that ensures your personal assets remain safe even in unforeseen circumstances.

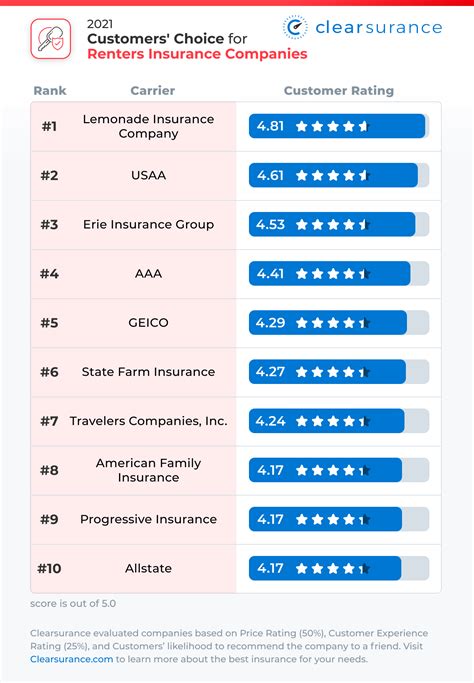

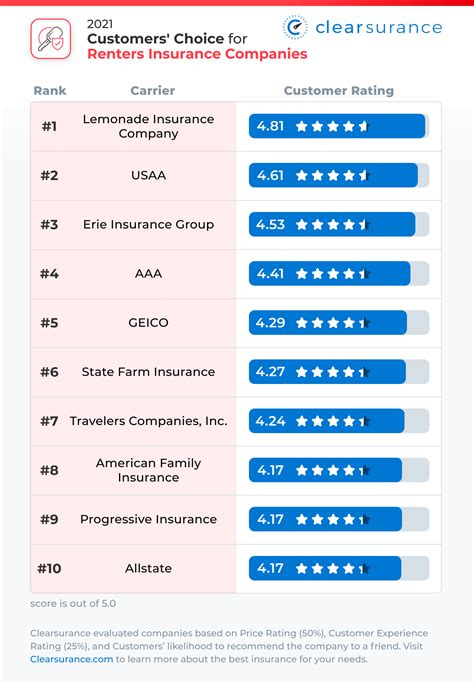

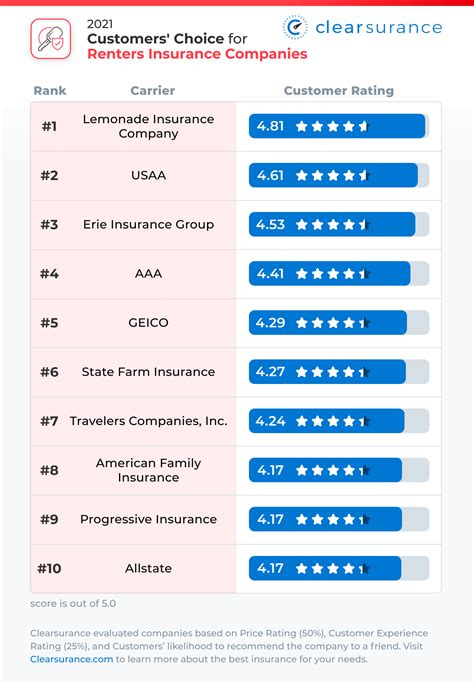

Top Companies for Renters Insurance

When it comes to choosing the best company for renters insurance, several factors come into play, including coverage options, pricing, customer service, and claims handling. Here’s an in-depth look at some of the top-rated insurance providers in the market.

State Farm

Overview: State Farm is one of the largest insurance companies in the United States, offering a wide range of insurance products, including renters insurance. They are known for their comprehensive coverage options and competitive pricing.

Coverage Options: State Farm provides customizable renters insurance policies that can be tailored to individual needs. Their standard coverage includes personal property protection, liability coverage, and additional living expenses in case of a covered loss. They also offer optional coverages like identity restoration and personal article floater policies for high-value items.

Pricing: State Farm is often considered affordable, with average monthly premiums ranging from $15 to $30, depending on the coverage limits and deductibles chosen. They offer discounts for bundling renters insurance with other policies, such as auto insurance.

Customer Service: State Farm is renowned for its exceptional customer service. They have a vast network of local agents who provide personalized assistance and guidance. Their customer support is easily accessible through various channels, including phone, email, and online chat.

Claims Handling: State Farm has a solid reputation for efficient and fair claims handling. They offer a dedicated claims team that works closely with policyholders to ensure a smooth and stress-free process. Their claims adjusters are known for their expertise and prompt response times.

Allstate

Overview: Allstate is another leading insurance provider in the United States, offering a comprehensive range of insurance products. They are known for their innovative approaches to insurance and their commitment to customer satisfaction.

Coverage Options: Allstate offers customizable renters insurance policies that cover personal property, liability, and additional living expenses. They also provide optional coverage enhancements, such as identity protection and personal injury protection.

Pricing: Allstate's renters insurance policies are generally affordable, with average monthly premiums ranging from $15 to $25. They offer discounts for bundling renters insurance with other policies, as well as for safety features like smoke detectors and security systems.

Customer Service: Allstate is dedicated to providing exceptional customer service. They have a team of knowledgeable agents who offer personalized guidance and support. Their customer service is accessible 24/7 through various channels, including phone, online chat, and mobile app.

Claims Handling: Allstate's claims process is designed to be efficient and hassle-free. They have a dedicated claims team that works diligently to process claims quickly and fairly. Policyholders can track their claims online and receive regular updates.

Progressive

Overview: Progressive is a well-known insurance company that offers a wide range of insurance products, including renters insurance. They are known for their innovative digital platform and competitive pricing.

Coverage Options: Progressive offers flexible renters insurance policies that cover personal property, liability, and additional living expenses. They also provide optional coverages, such as identity theft protection and valuable items coverage.

Pricing: Progressive is often considered one of the most affordable renters insurance providers. Their average monthly premiums start as low as $12, making it an attractive option for budget-conscious renters. They also offer discounts for bundling renters insurance with other policies.

Customer Service: Progressive prides itself on its excellent customer service. They have a team of dedicated agents who provide personalized assistance and guidance. Their customer support is easily accessible through various channels, including phone, online chat, and mobile app.

Claims Handling: Progressive has a streamlined claims process that aims to make the experience as stress-free as possible. They offer a dedicated claims team that works closely with policyholders to ensure a smooth and efficient claims journey. Policyholders can track their claims online and receive real-time updates.

LeaseLock

Overview: LeaseLock is a relatively new player in the insurance market, but they have quickly gained recognition for their innovative approach to renters insurance. They specialize in providing coverage specifically for renters and offer a unique digital experience.

Coverage Options: LeaseLock offers comprehensive renters insurance policies that cover personal property, liability, and additional living expenses. They also provide optional coverage for high-value items and identity theft protection.

Pricing: LeaseLock is known for its competitive pricing, with average monthly premiums starting at $10. They offer flexible payment options, including monthly, quarterly, or annual payments. LeaseLock also provides discounts for paying annually.

Customer Service: LeaseLock prioritizes excellent customer service and provides a seamless digital experience. Their website and mobile app offer easy-to-use interfaces for policy management and claims reporting. LeaseLock's customer support team is readily available through online chat and email.

Claims Handling: LeaseLock's claims process is designed to be simple and efficient. Policyholders can report claims online or through their mobile app, and the claims team works promptly to assess and process the claims. LeaseLock provides regular updates and ensures a transparent claims journey.

Comparative Analysis and Considerations

When choosing the best company for renters insurance, it’s essential to consider various factors that align with your specific needs and preferences. Here’s a comparative analysis to help you make an informed decision:

| Company | Coverage Options | Pricing | Customer Service | Claims Handling |

|---|---|---|---|---|

| State Farm | Customizable policies, including optional coverages | Affordable; discounts for bundling | Exceptional local agent support | Efficient and fair claims process |

| Allstate | Flexible policies with optional enhancements | Reasonable rates; discounts available | 24/7 accessible customer service | Streamlined and hassle-free claims process |

| Progressive | Flexible coverage options, including valuable items | Highly affordable; bundling discounts | Excellent digital and agent support | Stress-free claims journey with online tracking |

| LeaseLock | Comprehensive policies, including high-value items | Competitive pricing; flexible payment options | Seamless digital experience and online support | Simple and transparent claims process |

When evaluating these companies, it's important to consider your specific needs and budget. For instance, if you have high-value items or require specialized coverage, companies like State Farm or Allstate might be more suitable due to their customizable policies and optional coverages. On the other hand, if affordability is a top priority, Progressive or LeaseLock could be ideal choices with their competitive pricing and flexible payment options.

Additionally, consider the level of customer service and claims handling you prefer. Some renters may appreciate the personalized guidance offered by local agents, while others may find the convenience and accessibility of digital platforms more appealing. It's crucial to choose a company that aligns with your preferences and provides a seamless and stress-free experience throughout the insurance journey.

Frequently Asked Questions (FAQ)

What does renters insurance typically cover?

+

Renters insurance typically covers personal property, such as furniture, electronics, and clothing, against various risks like theft, fire, and natural disasters. It also provides liability coverage in case someone is injured in your rented space and decides to sue you. Additionally, renters insurance often covers additional living expenses if you need to relocate temporarily due to a covered loss.

Is renters insurance mandatory for tenants?

+

Renters insurance is not mandatory for tenants, but it is highly recommended. While it is an optional coverage, it provides valuable protection for your personal belongings and liability coverage. Many landlords may require tenants to have renters insurance as a condition of the lease agreement to protect their investment and minimize their own liability risks.

How much does renters insurance cost on average?

+

The cost of renters insurance can vary depending on several factors, including the coverage limits, deductibles, and the insurance company. On average, monthly premiums for renters insurance range from 12 to 30. However, it’s important to note that prices can differ significantly based on location, the value of personal belongings, and any additional coverages chosen.

Can I bundle my renters insurance with other policies to save money?

+

Yes, bundling your renters insurance with other policies, such as auto insurance, can often result in significant savings. Many insurance companies offer multi-policy discounts, which can lower your overall insurance costs. It’s worth exploring bundling options with the companies you’re considering to maximize your savings.

What should I consider when choosing a renters insurance company?

+

When choosing a renters insurance company, consider factors such as coverage options, pricing, customer service, and claims handling. Look for a company that offers customizable policies to fit your specific needs, provides competitive rates, and has a strong reputation for efficient and fair claims processing. Additionally, assess whether you prefer personalized agent support or the convenience of a digital platform.