Bestcarinsurance

Welcome to a comprehensive guide on understanding and navigating the world of car insurance. In today's fast-paced and often unpredictable environment, having adequate car insurance is not just a legal requirement but a necessity to safeguard your financial well-being. This guide aims to provide an in-depth analysis of the car insurance landscape, offering valuable insights, expert advice, and practical tips to help you make informed decisions. We will explore the various aspects of car insurance, from understanding different policy types and coverage options to learning how to assess and compare providers effectively. Whether you're a first-time buyer or an experienced driver looking to switch policies, this guide will equip you with the knowledge and tools to secure the best car insurance deal for your unique needs.

The Fundamentals of Car Insurance

Car insurance is a contractual agreement between you, the policyholder, and an insurance company. It provides financial protection against potential losses and liabilities arising from operating a motor vehicle. These losses can range from vehicle damage in an accident to legal expenses and even the cost of replacing or repairing your vehicle. The purpose of car insurance is to mitigate the financial risks associated with driving, offering peace of mind and ensuring you’re not left with a significant financial burden in the event of an unfortunate incident.

There are several key components to understand when it comes to car insurance policies:

- Policy Types: The main types of car insurance policies include liability insurance, which covers bodily injury and property damage caused to others; collision insurance, which covers damage to your own vehicle in an accident; and comprehensive insurance, which provides coverage for non-collision events like theft, vandalism, and natural disasters. Many drivers opt for a combination of these policies to ensure comprehensive protection.

- Coverage Options: Each policy type offers a range of coverage options. For instance, liability insurance covers bodily injury and property damage, but you can choose different levels of coverage (e.g., $50,000, $100,000, or $300,000 per person for bodily injury) to tailor your policy to your needs and budget. Other coverage options include rental car reimbursement, roadside assistance, and gap insurance.

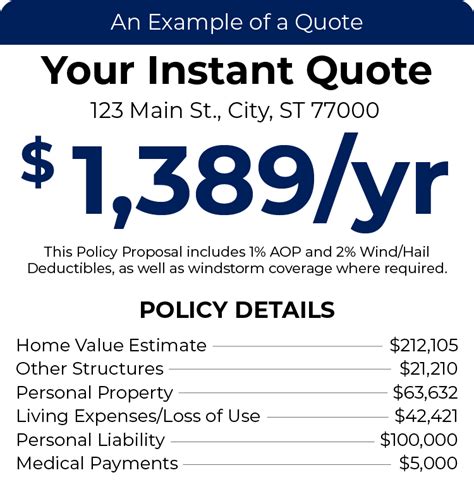

- Premiums and Deductibles: The premium is the amount you pay for your insurance policy, typically on a monthly or annual basis. It's determined by a variety of factors, including your driving record, the make and model of your car, your age, and your location. The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it means you'll pay more out of pocket if you need to make a claim.

Assessing Your Insurance Needs

Before diving into the world of car insurance, it’s crucial to assess your specific needs and circumstances. This step will help you identify the type of coverage that’s right for you and ensure you’re not paying for coverage you don’t need.

Evaluating Your Vehicle and Driving Habits

Consider the make, model, and age of your vehicle. Older vehicles might not require as much comprehensive coverage as newer, more expensive models. If you drive frequently for work or pleasure, you’ll want to ensure you have adequate coverage for your mileage. On the other hand, if you only drive occasionally or have a short commute, you may be able to opt for a lower level of coverage to save on premiums.

Understanding Your Financial Situation

Your financial situation plays a significant role in determining the type and level of car insurance coverage you choose. Assess your budget and determine how much you can comfortably afford to pay in premiums. Keep in mind that choosing a higher deductible can lower your premium, but it means you’ll have to pay more out of pocket if you need to make a claim.

Considering Your Risk Profile

Your driving history and risk profile are key factors in determining your car insurance rates. If you have a clean driving record with no accidents or traffic violations, you’re likely to qualify for lower rates. However, if you’ve had accidents or moving violations in the past, you may need to opt for higher levels of coverage to protect yourself financially. It’s also important to consider where you live and drive. Urban areas with high traffic and crime rates generally have higher insurance premiums than rural areas.

Comparing Car Insurance Providers

Once you have a clear understanding of your insurance needs, it’s time to start comparing car insurance providers. With numerous companies offering car insurance, it’s essential to shop around to find the best coverage at the most competitive price.

Researching Reputable Insurers

Start by researching reputable car insurance companies. Look for established providers with a solid financial rating and a good reputation for customer service and claim handling. Online reviews and ratings can be a useful starting point, but it’s important to take these with a grain of salt, as they may not always reflect the overall customer experience.

Understanding Provider Coverage Options

Each insurance provider offers a range of coverage options. Ensure that the providers you’re considering offer the specific types of coverage you need, such as liability, collision, comprehensive, and any additional coverages you deem necessary. Compare the coverage limits and deductibles to ensure you’re getting the level of protection you require.

Comparing Premiums and Discounts

Premiums can vary significantly between providers, even for similar coverage. Get quotes from multiple insurers to compare prices. Also, look for potential discounts. Many providers offer discounts for a variety of reasons, such as good driving records, safe vehicles, multi-policy bundles (e.g., bundling car insurance with home insurance), and loyalty discounts for long-term customers.

Assessing Customer Service and Claim Handling

The quality of customer service and claim handling can make a significant difference in your insurance experience. Research how responsive and helpful the provider’s customer service team is, and look into their claim handling process. You want an insurer that makes it easy to file a claim and provides efficient and fair claim settlements.

The Claims Process

Understanding the claims process is an essential part of your car insurance journey. Knowing what to expect and how to navigate the process can make a significant difference in how smoothly and successfully your claim is resolved.

Filing a Claim

When an accident or incident occurs, the first step is to contact your insurance provider to initiate a claim. Provide them with all the necessary details, including the date, time, and location of the incident, the other parties involved, and any relevant witnesses. Be as detailed as possible, as this information will help the insurer assess the claim accurately.

The Claims Investigation Process

Once you’ve filed a claim, the insurer will conduct an investigation. This process typically involves gathering information, assessing the damage, and determining liability. The insurer may request additional documentation, such as police reports, medical records, or repair estimates, to support your claim. It’s important to cooperate fully with the investigation process and provide any requested information promptly.

Settlement and Resolution

After the investigation is complete, the insurer will determine the value of your claim and offer a settlement. This settlement amount is based on the terms of your policy and the extent of the damage or loss. If you agree with the settlement, you’ll receive payment, typically by check or direct deposit. If you disagree with the settlement offer, you can negotiate with the insurer or, in some cases, seek the assistance of an insurance adjuster or attorney to help you get a fair settlement.

Tips for Choosing and Maintaining Car Insurance

Choosing the right car insurance and maintaining it effectively can be a complex process, but with the right approach and knowledge, it can be manageable. Here are some additional tips to help you make the most of your car insurance experience.

Regularly Review and Update Your Policy

Life changes, and so do your insurance needs. Review your policy annually or whenever significant changes occur in your life, such as buying a new car, getting married, or moving to a different state. These changes can affect your insurance needs and premiums, so it’s important to ensure your policy is up to date and provides the coverage you require.

Take Advantage of Discounts

Insurance providers offer a wide range of discounts to encourage safe driving and loyalty. Common discounts include multi-policy discounts (for bundling multiple insurance policies with the same provider), good student discounts (for students with good academic records), safe driver discounts (for drivers with clean records), and loyalty discounts (for long-term customers). Make sure you’re aware of all the potential discounts you qualify for and take advantage of them to lower your premiums.

Understand Your Policy’s Exclusions

While car insurance provides valuable protection, it’s important to understand what your policy doesn’t cover. Exclusions can vary depending on the type of policy and the insurer. Common exclusions include normal wear and tear, intentional damage, mechanical breakdowns, and certain types of natural disasters. By understanding your policy’s exclusions, you can better assess your risk and consider purchasing additional coverage if needed.

Develop Safe Driving Habits

One of the best ways to keep your car insurance premiums low is to maintain a clean driving record. Avoid traffic violations and accidents, as these can significantly increase your premiums. Additionally, consider taking a defensive driving course, which can not only improve your driving skills but may also qualify you for a safe driver discount.

Keep Comprehensive Records

Maintaining comprehensive records of your car insurance policy, including all correspondence with your insurer, is essential. This includes policy documents, quotes, coverage details, and any communications related to claims or changes to your policy. These records can be invaluable if you need to make a claim or dispute a decision made by your insurer.

The Future of Car Insurance

The car insurance industry is continuously evolving, with new technologies and innovations shaping the way insurance is offered and managed. Here’s a glimpse into the future of car insurance.

Telematics and Usage-Based Insurance

Telematics technology allows insurance companies to track and analyze a vehicle’s driving data, such as speed, braking, and mileage. This data is used to assess a driver’s risk and offer personalized insurance rates. Usage-based insurance, or pay-as-you-drive insurance, is becoming increasingly popular, as it allows drivers to pay premiums based on their actual driving behavior rather than general risk factors.

AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning are transforming the insurance industry. These technologies are being used to streamline the claims process, improve risk assessment, and enhance customer service. AI-powered chatbots, for example, can provide instant assistance to policyholders, while machine learning algorithms can analyze vast amounts of data to identify patterns and trends, helping insurers offer more accurate and personalized coverage.

Connected Car Technology

The integration of connected car technology is revolutionizing the way vehicles are insured. Connected cars can provide real-time data on driving behavior, vehicle health, and location, which can be used to offer more precise insurance rates. Additionally, this technology can enable insurers to offer new types of coverage, such as roadside assistance or usage-based insurance that adapts to the driver’s behavior in real time.

Blockchain and Smart Contracts

Blockchain technology has the potential to transform the insurance industry by enhancing security, transparency, and efficiency. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate various insurance processes, including claims handling and policy management. This technology can reduce the need for intermediaries, lower administrative costs, and speed up claim settlements.

Conclusion

Car insurance is a vital component of responsible driving and financial planning. By understanding the fundamentals of car insurance, assessing your specific needs, comparing providers, and staying informed about the latest industry trends, you can navigate the car insurance landscape with confidence. Remember, the right car insurance policy should provide the coverage you need at a price you can afford, offering you peace of mind on the road.

What is the difference between liability insurance and comprehensive insurance?

+Liability insurance covers bodily injury and property damage caused to others in an accident for which you are at fault. Comprehensive insurance, on the other hand, provides coverage for non-collision events, such as theft, vandalism, and natural disasters. It covers damage to your own vehicle, regardless of fault.

How can I lower my car insurance premiums?

+There are several ways to lower your car insurance premiums. You can opt for a higher deductible, maintain a clean driving record, take advantage of discounts (such as safe driver or multi-policy discounts), and consider usage-based insurance, which may offer lower rates based on your actual driving behavior.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Contact the police to file a report, and exchange information with the other parties, including their insurance details. Take photos of the accident scene and any damage to your vehicle. Then, contact your insurance provider to initiate a claim, providing them with all the necessary details.