Business Health Insurance Small

In today's dynamic business landscape, providing comprehensive health insurance options is not only a legal requirement for many businesses but also a strategic investment in the well-being and productivity of employees. This article delves into the intricacies of small business health insurance, exploring its significance, the challenges it presents, and the innovative solutions that can transform it into a powerful tool for both employers and employees.

Understanding the Small Business Health Insurance Landscape

For small businesses, offering health insurance is a complex decision that involves navigating a maze of regulations, cost considerations, and employee needs. The Affordable Care Act (ACA) has been a significant influencer in this domain, providing a framework for small businesses to offer compliant health coverage. However, the path to providing effective health insurance is riddled with challenges, from rising healthcare costs to the administrative burden of compliance.

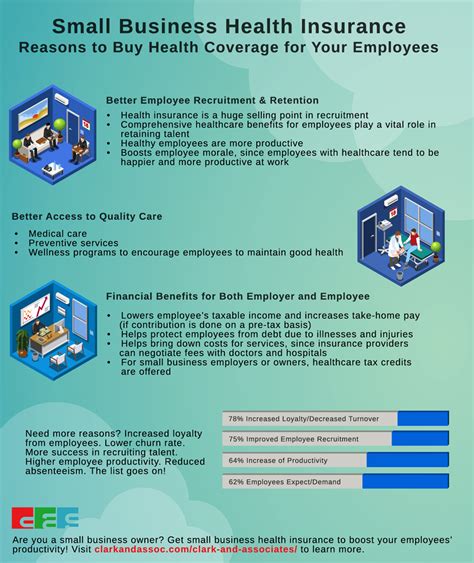

Despite these challenges, the benefits of offering health insurance are undeniable. It serves as a powerful recruitment and retention tool, helping businesses attract top talent and foster a loyal workforce. Moreover, it promotes a healthier, more productive workforce, reducing absenteeism and improving overall business performance. However, to truly harness these benefits, small businesses must navigate the intricacies of health insurance with strategic vision and a deep understanding of their specific needs.

Challenges and Solutions: A Strategic Approach

One of the primary challenges small businesses face is the escalating cost of health insurance. The rising healthcare costs, often beyond the control of small businesses, can significantly impact their financial health. To mitigate this, small businesses can explore innovative strategies such as:

- Health Savings Accounts (HSAs): These accounts offer tax advantages, allowing employees to save pre-tax dollars for medical expenses. They provide flexibility and control over healthcare spending, making healthcare more affordable.

- High-Deductible Health Plans (HDHPs): Coupled with HSAs, HDHPs can lower monthly premiums, providing cost savings for both businesses and employees. These plans encourage preventive care and responsible healthcare consumption.

- Telehealth Services: Integrating telehealth services into health insurance plans can improve access to healthcare, particularly for employees in remote locations. It also reduces the need for in-person visits, offering cost savings and convenience.

Another significant challenge is the administrative burden associated with health insurance. Small businesses often lack the resources and expertise to efficiently manage health insurance, from enrollment and plan selection to compliance with regulatory requirements. To address this, outsourcing health insurance administration to specialized brokers or HR consultants can be a viable solution. These experts can guide businesses through the complex process, ensuring compliance and optimal plan selection.

Furthermore, small businesses can leverage technology to streamline health insurance administration. Online enrollment platforms and HR software can simplify the process, making it more efficient and cost-effective. These tools also enhance employee engagement, providing easy access to plan details and allowing for seamless updates and changes.

The Role of Employee Engagement and Education

Effective health insurance is not just about the plan; it’s also about employee engagement and education. Small businesses can maximize the benefits of their health insurance offerings by ensuring employees understand their coverage and how to use it optimally.

Employee education programs can cover a range of topics, from explaining the basics of health insurance and the specific features of the business's plan to promoting preventive care and healthy lifestyles. These initiatives can be delivered through workshops, online resources, or one-on-one sessions with HR or benefits specialists. By empowering employees with knowledge, businesses can encourage better health outcomes and more responsible healthcare consumption.

Analyzing Plan Options and Performance

Choosing the right health insurance plan is critical to the success of a small business’s health insurance strategy. Factors such as the business’s industry, location, and employee demographics can significantly influence plan performance. For instance, businesses with a predominantly younger workforce may benefit from plans with lower premiums but higher deductibles, while those with an older workforce may require more comprehensive coverage.

To ensure the best fit, small businesses should analyze their options carefully. This involves evaluating a range of plans from different carriers, considering factors such as cost, coverage, and employee satisfaction. Carrier selection is a crucial step, as different carriers have different strengths and weaknesses, and some may be better suited to the specific needs of a small business and its employees.

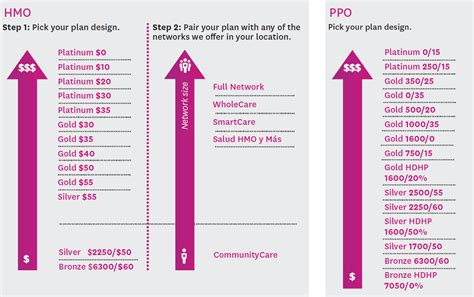

| Plan Type | Description | Pros | Cons |

|---|---|---|---|

| Preferred Provider Organization (PPO) | Offers flexibility with a network of preferred providers, allowing employees to choose their healthcare providers. | Flexibility, broader provider network, no referrals needed. | Higher premiums, potential for higher out-of-pocket costs. |

| Health Maintenance Organization (HMO) | Requires employees to choose a primary care physician and obtain referrals for specialist care. | Lower premiums, fixed copays, comprehensive preventive care. | Limited provider network, need for referrals. |

| Exclusive Provider Organization (EPO) | Similar to PPO but without out-of-network coverage. | Lower premiums than PPO, more comprehensive than HMO. | No out-of-network coverage, may require referrals. |

In addition to plan type, small businesses should consider the additional benefits and features offered by different carriers. These can include dental and vision coverage, prescription drug benefits, mental health services, and wellness programs. By analyzing these factors, small businesses can select a plan that best aligns with their employees' needs and their business's financial capabilities.

Future Trends and Innovations

The landscape of small business health insurance is continually evolving, driven by technological advancements, changing regulatory environments, and shifting employee expectations. Here are some trends and innovations that are shaping the future of small business health insurance:

- Telemedicine and Digital Health: The integration of telemedicine and digital health solutions is set to revolutionize healthcare access and delivery. Small businesses can leverage these technologies to offer more convenient and cost-effective healthcare services to their employees, particularly in remote or underserved areas.

- Value-Based Insurance Design (VBID): VBID is an innovative approach that adjusts cost-sharing based on the value of different services. It encourages the use of high-value, cost-effective services and discourages low-value services. This model has the potential to significantly improve health outcomes and reduce healthcare costs.

- Employee Well-being Programs: Beyond traditional health insurance, small businesses are increasingly focusing on holistic employee well-being. This includes offering wellness programs, mental health support, and financial wellness initiatives. These programs not only improve employee health but also enhance productivity and job satisfaction.

Looking ahead, small businesses will need to stay agile and responsive to these evolving trends. By staying informed and adaptable, they can ensure their health insurance offerings remain relevant, effective, and aligned with the needs of their workforce.

How can small businesses reduce the cost of health insurance without compromising coverage?

+Small businesses can explore cost-saving measures such as Health Savings Accounts (HSAs) and High-Deductible Health Plans (HDHPs). These strategies provide tax advantages and lower monthly premiums, respectively. Additionally, businesses can negotiate with carriers for better rates and consider offering a range of plan options to cater to different employee needs and preferences.

What role does employee engagement play in the success of a small business’s health insurance strategy?

+Employee engagement is crucial as it ensures employees understand and utilize their health insurance benefits effectively. By educating employees about their coverage and promoting preventive care, small businesses can encourage better health outcomes and responsible healthcare consumption, ultimately reducing healthcare costs and improving productivity.

How can small businesses select the right health insurance carrier and plan for their needs?

+Small businesses should carefully evaluate multiple carriers and plan options, considering factors such as cost, coverage, and employee satisfaction. It’s essential to assess the business’s unique needs and employee demographics to choose a plan that provides the best fit. Additionally, seeking guidance from insurance brokers or HR consultants can be beneficial in navigating the complex process of carrier and plan selection.