Health Insurance New Jersey

Health insurance is a crucial aspect of healthcare coverage, providing individuals and families with access to essential medical services and financial protection. In the state of New Jersey, understanding the health insurance landscape is vital for residents to make informed decisions about their coverage. This comprehensive guide aims to explore the world of health insurance in New Jersey, offering an in-depth analysis of options, benefits, and considerations for residents.

Understanding Health Insurance in New Jersey

New Jersey boasts a robust healthcare system, with a diverse range of insurance providers offering comprehensive plans to meet the needs of its residents. The state’s commitment to healthcare accessibility is evident in its efforts to expand coverage options and ensure compliance with federal healthcare regulations.

One key aspect of health insurance in New Jersey is the Affordable Care Act (ACA), which has significantly impacted the availability and affordability of healthcare plans. The ACA mandates that all residents have access to essential health benefits, including preventive care, hospitalization, and prescription medication coverage. As a result, New Jersey residents can choose from a variety of ACA-compliant plans that provide comprehensive coverage.

Marketplace vs. Private Insurance

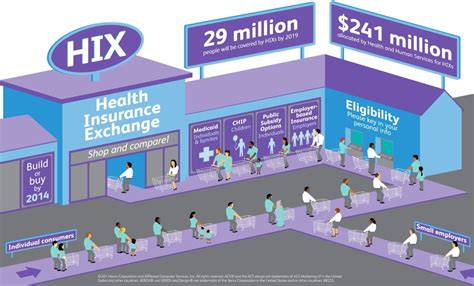

New Jersey residents have the option to obtain health insurance through the state’s Health Insurance Marketplace or through private insurance providers. The Marketplace, also known as the New Jersey Health Benefits Marketplace, offers a range of plans from various insurers, providing a centralized platform for residents to compare and enroll in coverage.

The Marketplace is particularly beneficial for individuals and families seeking financial assistance, as it offers income-based subsidies and tax credits to make insurance more affordable. Additionally, the Marketplace ensures that all plans meet the ACA's minimum standards, providing a level of assurance for consumers.

On the other hand, private insurance providers in New Jersey offer a wide array of plans tailored to specific needs. These plans may include additional benefits or coverages not available through the Marketplace, such as dental, vision, or specialized care. Private insurance can be a viable option for those with specific healthcare requirements or for employers seeking group health plans.

Key Considerations for Choosing Health Insurance

When selecting a health insurance plan in New Jersey, there are several crucial factors to consider:

- Coverage Options: Assess your healthcare needs and prioritize the essential benefits you require. Consider factors such as prescription drug coverage, mental health services, and specialist care.

- Network Providers: Review the list of in-network healthcare providers to ensure access to your preferred doctors and hospitals. Out-of-network care can result in higher costs, so verifying network coverage is essential.

- Cost and Financial Assistance: Evaluate the plan's premium, deductible, and copayment amounts. Consider your budget and any available financial assistance through the Marketplace or employer-sponsored plans.

- Plan Types: New Jersey offers various plan types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Research the differences and choose the plan type that aligns with your healthcare preferences.

- Prescription Drug Coverage: If you require prescription medications, ensure that your plan includes a comprehensive drug formulary and covers the specific medications you need.

Analyzing Health Insurance Plans in New Jersey

New Jersey’s health insurance landscape offers a diverse range of plans, catering to different demographics and healthcare needs. Here, we delve into the key features and considerations of some popular plan types.

Health Maintenance Organizations (HMOs)

HMOs are a popular choice for New Jersey residents seeking cost-effective and comprehensive coverage. These plans typically have lower premiums and out-of-pocket costs but require members to select a primary care physician (PCP) and obtain referrals for specialist care.

Key features of HMOs in New Jersey include:

- Fixed Copayments: HMOs often have fixed copayment amounts for office visits, laboratory tests, and other services, providing budget predictability.

- Limited Out-of-Pocket Costs: Members enjoy lower out-of-pocket expenses compared to other plan types, making HMOs an affordable option.

- Wide Network of Providers: HMOs in New Jersey typically have extensive networks, ensuring access to a broad range of healthcare professionals and facilities.

- Wellness Programs: Many HMO plans offer wellness incentives and programs to encourage preventive care and healthy lifestyles.

However, it's important to note that HMOs may have more restricted provider choices and require prior authorization for certain services. Residents should carefully review the HMO's network and coverage details to ensure they meet their specific healthcare needs.

Preferred Provider Organizations (PPOs)

PPOs provide New Jersey residents with greater flexibility in choosing healthcare providers. These plans allow members to visit any in-network doctor or hospital without a referral, offering more control over their healthcare decisions.

Key features of PPOs in New Jersey include:

- Freedom of Choice: PPO members can choose from a broad network of providers, including specialists, without needing prior authorization.

- Out-of-Network Coverage: While out-of-network care may incur higher costs, PPOs still provide some coverage, giving members more options.

- Comprehensive Benefits: PPO plans often include a wide range of benefits, such as prescription drug coverage, mental health services, and wellness programs.

- Flexible Copayments: PPOs may offer flexible copayment structures, allowing members to choose their preferred level of coverage and out-of-pocket costs.

PPOs are a popular choice for individuals and families seeking more freedom in their healthcare decisions. However, the flexibility comes at a cost, with generally higher premiums and out-of-pocket expenses compared to HMOs.

Exclusive Provider Organizations (EPOs)

EPOs represent a middle ground between HMOs and PPOs, offering a blend of features from both plan types. Like HMOs, EPOs have a restricted network of providers, but unlike HMOs, members can access specialists without a referral.

Key features of EPOs in New Jersey include:

- Network Coverage: EPOs have a defined network of providers, ensuring access to quality healthcare services within the network.

- No Referrals Needed: Members can visit specialists directly, providing more freedom compared to HMOs.

- Lower Costs: EPOs generally have lower premiums and out-of-pocket costs compared to PPOs, making them an affordable option.

- Limited Out-of-Network Coverage: While EPOs provide some out-of-network coverage, it is typically limited, encouraging members to stay within the network for cost-effectiveness.

EPOs strike a balance between cost and flexibility, making them a suitable choice for those seeking a compromise between HMO and PPO plans.

Health Insurance Enrollment and Resources in New Jersey

Understanding the enrollment process and available resources is crucial for New Jersey residents seeking health insurance coverage.

Enrollment Periods

New Jersey follows the federal guidelines for health insurance enrollment, with an annual Open Enrollment Period and opportunities for Special Enrollment Periods under certain circumstances.

- Open Enrollment Period: Typically occurring in the fall, this period allows residents to enroll in or switch health insurance plans. It's essential to mark your calendar and plan your coverage for the upcoming year during this time.

- Special Enrollment Periods: If you experience a qualifying life event, such as marriage, birth of a child, or loss of other coverage, you may be eligible for a Special Enrollment Period. These events provide a window to enroll outside of the Open Enrollment Period.

Resources and Assistance

New Jersey provides several resources to assist residents in navigating the health insurance landscape and making informed decisions.

- New Jersey Health Benefits Marketplace: The official website offers a wealth of information, including plan comparisons, coverage details, and enrollment assistance. Residents can create an account and receive personalized recommendations based on their needs.

- Consumer Assistance Programs: The state's consumer assistance programs provide guidance and support to residents navigating the healthcare system. These programs offer help with enrollment, appeals, and understanding coverage options.

- Community Health Centers: New Jersey has a network of community health centers that provide affordable healthcare services to residents, regardless of their insurance status. These centers can offer valuable resources and support for those seeking healthcare coverage.

Future Outlook and Trends in Health Insurance

The landscape of health insurance in New Jersey is constantly evolving, influenced by technological advancements, healthcare reforms, and changing consumer needs. Here, we explore some key trends and considerations for the future.

Digital Health and Telemedicine

The rise of digital health technologies and telemedicine has transformed the way healthcare is delivered and accessed. New Jersey, like many other states, is witnessing a growing trend towards virtual healthcare services.

Key considerations for the future include:

- Telemedicine Integration: Health insurance plans in New Jersey are increasingly incorporating telemedicine services, allowing members to access healthcare remotely. This trend is expected to continue, offering convenience and accessibility to members.

- Digital Health Tools: Insurers are developing digital health platforms and apps to enhance member engagement and provide personalized health recommendations. These tools can improve overall health outcomes and member satisfaction.

Value-Based Care and Population Health

The focus on value-based care and population health management is gaining momentum in New Jersey’s healthcare system. This approach aims to improve overall population health by delivering high-quality, cost-effective care.

Key trends to watch include:

- Accountable Care Organizations (ACOs): ACOs are groups of healthcare providers working together to coordinate care and improve health outcomes. New Jersey is seeing the growth of ACOs, which aim to reduce costs and enhance patient experiences.

- Population Health Initiatives: Insurers and healthcare providers are increasingly focusing on population health management, aiming to prevent diseases and improve overall well-being. This shift is expected to drive innovation and collaboration within the healthcare industry.

Healthcare Reform and Policy Changes

Healthcare reform and policy changes can significantly impact the health insurance landscape in New Jersey. While the future is uncertain, several key trends and considerations are worth monitoring.

- Affordable Care Act (ACA) Amendments: As the ACA continues to evolve, New Jersey residents should stay informed about potential amendments and their impact on coverage options and affordability.

- State-Level Reforms: New Jersey's state government may propose and implement healthcare reforms to address specific challenges and improve access to care. Residents should stay engaged with local healthcare initiatives and advocacy efforts.

Conclusion

Health insurance in New Jersey offers a diverse range of plans and coverage options to meet the unique needs of its residents. From understanding the Marketplace and private insurance options to analyzing plan types and future trends, this comprehensive guide provides a solid foundation for making informed healthcare decisions.

As the healthcare landscape continues to evolve, staying informed and engaged is crucial. By leveraging the resources and assistance available in New Jersey, residents can navigate the complex world of health insurance with confidence and ensure access to quality healthcare.

What is the cost of health insurance in New Jersey?

+The cost of health insurance in New Jersey can vary based on factors such as plan type, coverage options, and individual or family enrollment. Premiums can range from a few hundred dollars to over a thousand dollars per month. It’s essential to compare plans and consider any available financial assistance to find the most affordable option.

Can I enroll in health insurance outside of the Open Enrollment Period in New Jersey?

+Yes, New Jersey residents may be eligible for a Special Enrollment Period if they experience a qualifying life event. These events, such as marriage, birth of a child, or loss of other coverage, provide an opportunity to enroll outside of the standard Open Enrollment Period. It’s important to understand the qualifying events and act promptly to ensure coverage.

How do I choose the right health insurance plan for my family in New Jersey?

+Choosing the right health insurance plan for your family involves assessing your specific healthcare needs and budget. Consider factors such as coverage options, network providers, cost, and any available financial assistance. It’s beneficial to compare plans and seek guidance from consumer assistance programs or insurance brokers to make an informed decision.