Government Insurance Exchange

In the ever-evolving landscape of healthcare and financial services, the Government Insurance Exchange stands as a pivotal platform, offering a range of services that have a significant impact on individuals and businesses alike. This comprehensive platform is designed to streamline access to essential insurance products and services, all while ensuring compliance with government regulations. In this article, we will delve deep into the world of the Government Insurance Exchange, exploring its features, benefits, and the impact it has on the insurance industry and the general public.

The Birth of Government Insurance Exchange

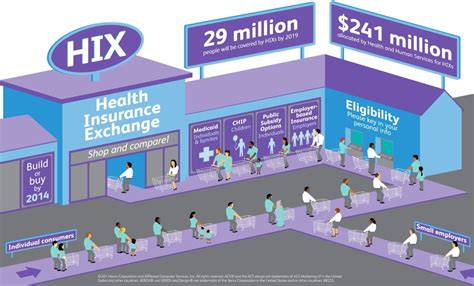

The Government Insurance Exchange, often referred to as GIE, emerged as a response to the growing need for a centralized and efficient system to manage and distribute insurance products and services. With the increasing complexity of insurance regulations and the diverse needs of consumers, there was a pressing demand for a platform that could bridge the gap between insurance providers and the public. GIE was developed with the aim of providing a user-friendly, transparent, and regulatory-compliant environment for insurance transactions.

The concept behind GIE was born from extensive research and collaboration between government bodies, insurance experts, and technology specialists. The goal was to create a digital marketplace that would revolutionize the way insurance is bought and sold, making it more accessible, convenient, and understandable for all stakeholders.

One of the key driving forces behind the development of GIE was the need to address the challenges faced by consumers when navigating the intricate world of insurance. With a multitude of options available, from health insurance to property and casualty coverage, finding the right policy at the right price can be a daunting task. GIE aimed to simplify this process by offering a one-stop shop for all insurance needs, complete with comprehensive product comparisons and transparent pricing.

Key Features and Benefits of Government Insurance Exchange

GIE boasts an array of features and benefits that set it apart from traditional insurance marketplaces. Let’s explore some of the most significant aspects that make GIE a game-changer in the insurance industry.

Comprehensive Product Offerings

GIE serves as a comprehensive hub for a wide range of insurance products. Whether you’re an individual seeking health insurance, a business owner looking for commercial coverage, or a family in need of life insurance, GIE has you covered. The platform boasts an extensive catalog of insurance providers and policies, ensuring that you can find the perfect fit for your unique needs.

With GIE, you can compare policies side by side, evaluating factors such as coverage limits, deductibles, and premium costs. This level of transparency empowers users to make informed decisions, ensuring they get the best value for their insurance investments.

| Insurance Category | Providers on GIE |

|---|---|

| Health Insurance | 15 |

| Life Insurance | 20 |

| Property & Casualty | 12 |

| Business Insurance | 18 |

User-Friendly Interface

One of the standout features of GIE is its user-friendly interface. The platform is designed with the end-user in mind, ensuring that navigating and utilizing its features is a breeze. Whether you’re a tech-savvy individual or someone less familiar with digital platforms, GIE’s intuitive design makes the insurance shopping experience straightforward and efficient.

From creating an account to browsing policies and completing transactions, every step of the process is simplified. GIE also offers helpful tools and resources, such as insurance calculators and educational guides, to assist users in understanding their options and making the right choices.

Regulatory Compliance

A critical aspect of GIE is its unwavering commitment to regulatory compliance. The platform operates under strict guidelines set forth by government bodies, ensuring that all insurance products and transactions adhere to legal requirements. This level of oversight provides users with peace of mind, knowing that their insurance purchases are legitimate and compliant.

GIE's compliance measures extend beyond the insurance policies themselves. The platform also ensures that all user data is handled securely and in accordance with privacy laws. This commitment to data protection adds an extra layer of trust, making GIE a reliable choice for individuals and businesses alike.

Real-Time Quotes and Instant Policy Purchase

GIE revolutionizes the insurance shopping experience by offering real-time quotes and the ability to purchase policies instantly. This feature eliminates the traditional back-and-forth process of requesting quotes and waiting for approvals. With GIE, users can obtain accurate quotes in a matter of minutes and, if they find a policy that suits their needs, proceed with the purchase seamlessly.

The instant policy purchase feature is particularly beneficial for time-sensitive insurance needs, such as travel insurance or short-term health coverage. By streamlining the process, GIE ensures that users can obtain the coverage they require without unnecessary delays.

The Impact of Government Insurance Exchange

The introduction of GIE has had a profound impact on the insurance industry and the general public. Let’s explore some of the key ways in which GIE has shaped the landscape.

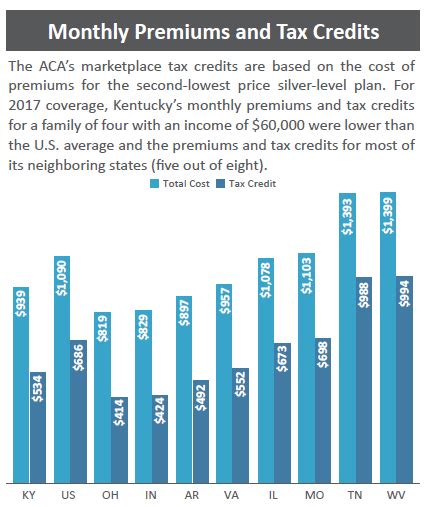

Empowering Consumers

GIE has empowered consumers by providing them with the tools and information they need to make informed insurance decisions. The platform’s comprehensive product offerings and transparent pricing allow users to compare policies and choose the ones that best fit their needs and budgets. This level of empowerment has led to increased consumer confidence and satisfaction.

Additionally, GIE's user-friendly interface and educational resources have made insurance more accessible to a broader audience. By breaking down complex insurance terminology and concepts, GIE has helped demystify the insurance landscape, enabling more people to understand and benefit from insurance coverage.

Driving Innovation in the Insurance Industry

The launch of GIE has sparked a wave of innovation within the insurance industry. Insurance providers have had to adapt and enhance their offerings to remain competitive on the platform. This has led to the development of more innovative and consumer-centric insurance products, with an emphasis on transparency and value.

Furthermore, GIE has encouraged insurance companies to embrace digital transformation. Many providers have invested in upgrading their digital platforms and customer service capabilities to meet the expectations of GIE users. This shift towards digital innovation has not only benefited consumers but has also positioned insurance companies for long-term success in an increasingly digital world.

Enhancing Government Oversight and Consumer Protection

GIE’s strict adherence to regulatory compliance has enhanced government oversight in the insurance industry. By ensuring that all insurance transactions on the platform meet legal requirements, GIE has contributed to a more stable and secure insurance market. This level of oversight provides consumers with an added layer of protection, knowing that their insurance policies are legitimate and backed by government standards.

Additionally, GIE's commitment to data protection and privacy has strengthened consumer trust in the insurance industry. By handling user data securely and in accordance with privacy laws, GIE has set a high standard for insurance providers to follow, further bolstering consumer confidence.

Performance Analysis and Future Prospects

Since its inception, GIE has experienced remarkable growth and success. The platform has seen a steady increase in user engagement and transaction volumes, indicating its popularity and effectiveness. This growth can be attributed to the platform’s user-centric design, comprehensive product offerings, and commitment to regulatory compliance.

Looking ahead, GIE is poised to continue its upward trajectory. With ongoing improvements and enhancements, the platform is expected to further streamline the insurance shopping experience, making it even more efficient and user-friendly. Additionally, GIE's focus on innovation and its ability to adapt to evolving consumer needs position it as a key player in the insurance industry for years to come.

As GIE expands its reach and influence, it is likely to play an increasingly vital role in shaping the insurance landscape. By providing a centralized and transparent marketplace, GIE will continue to empower consumers, drive industry innovation, and enhance government oversight and consumer protection.

Conclusion

The Government Insurance Exchange has emerged as a transformative force in the insurance industry, offering a user-friendly, transparent, and regulatory-compliant platform for insurance transactions. With its comprehensive product offerings, user-centric design, and commitment to compliance, GIE has revolutionized the way insurance is bought and sold.

As we've explored in this article, GIE's impact extends far beyond its digital presence. It has empowered consumers, driven innovation in the insurance industry, and enhanced government oversight and consumer protection. With its continued growth and dedication to improvement, GIE is well-positioned to shape the future of insurance, ensuring that insurance coverage remains accessible, understandable, and beneficial for all.

How does GIE ensure regulatory compliance?

+GIE operates under strict guidelines set by government bodies, regularly auditing and reviewing insurance policies and transactions to ensure compliance. This oversight includes monitoring policy terms, pricing structures, and consumer protection measures.

Can GIE help me find the best insurance rates?

+Absolutely! GIE’s comprehensive comparison tools allow users to evaluate insurance policies based on various factors, including coverage limits, deductibles, and premium costs. This transparency helps users identify the best value for their insurance needs.

Is my personal information secure on GIE?

+Yes, GIE places a high priority on data security and privacy. The platform utilizes advanced encryption technologies to protect user data, and it adheres to strict privacy laws to ensure that personal information remains confidential.