Mo Insurance

In the vast landscape of insurance, Missouri, or MO, stands as a region with its own unique set of regulations, policies, and considerations. This guide aims to demystify the world of MO insurance, offering an in-depth analysis for those seeking comprehensive coverage and peace of mind.

Understanding MO Insurance: A Necessary Financial Tool

MO insurance is an essential financial tool for residents and businesses alike, providing a safety net against various risks and uncertainties. From natural disasters prevalent in the region to unexpected medical emergencies, having adequate insurance coverage is crucial for long-term financial stability.

The Scope of MO Insurance

MO insurance covers a broad spectrum of policies, each designed to address specific risks. Here’s a glimpse into the diverse world of MO insurance:

Auto Insurance: With its share of busy highways and rural roads, MO auto insurance is a necessity. This policy covers vehicles against accidents, theft, and damage, offering liability and comprehensive coverage.

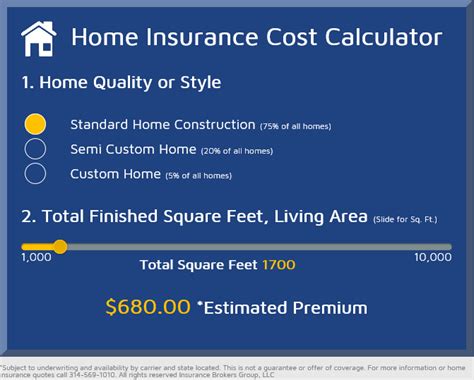

Home Insurance: MO’s diverse climate can pose challenges, from tornadoes to winter storms. Home insurance provides protection against these natural disasters, ensuring homeowners can rebuild and recover.

Health Insurance: With rising healthcare costs, MO health insurance is a vital investment. It covers a range of medical services, from routine check-ups to major surgeries, helping individuals manage their health without financial strain.

Life Insurance: Life insurance is a critical aspect of MO’s insurance landscape. It provides financial support to loved ones in the event of an unexpected demise, ensuring their future is secure.

Business Insurance: For entrepreneurs, MO business insurance is a must. It covers various risks, from property damage to liability claims, ensuring businesses can operate without constant worry.

MO Insurance Policies: A Deep Dive

Auto Insurance: Navigating the Roads with Confidence

MO auto insurance policies are tailored to meet the diverse needs of drivers. Here’s a breakdown of key components:

Liability Coverage: This covers damages and injuries caused to others in an accident for which the insured driver is at fault. It’s a legal requirement in MO.

Collision Coverage: In the event of an accident, collision coverage pays for repairs or replacements of the insured vehicle, regardless of fault.

Comprehensive Coverage: This policy protects against non-collision incidents like theft, vandalism, or natural disasters. It’s an essential addition to any MO auto insurance plan.

Uninsured/Underinsured Motorist Coverage: With a significant number of uninsured drivers on MO roads, this coverage is crucial. It protects insured drivers against accidents caused by uninsured or underinsured motorists.

Medical Payments Coverage: This policy covers medical expenses for the insured driver and passengers, regardless of fault. It’s an essential addition for comprehensive protection.

Home Insurance: Safeguarding Your Sanctuary

MO’s unique climate and geographical features make home insurance an indispensable tool. Here’s an in-depth look:

Dwelling Coverage: This policy covers the structure of the home against damages caused by various perils, including fire, windstorms, and vandalism.

Personal Property Coverage: It provides protection for the homeowner’s belongings, ensuring they’re covered in the event of theft or damage.

Liability Coverage: In case a guest is injured on the insured property, this coverage protects the homeowner against legal claims.

Additional Living Expenses: If a home is damaged and becomes uninhabitable, this coverage pays for temporary living expenses until the home is repaired or rebuilt.

Flood Insurance: MO’s susceptibility to flooding makes flood insurance a smart addition. It’s typically not included in standard home insurance policies but is a critical consideration for many residents.

Health Insurance: Prioritizing Well-Being

With healthcare costs on the rise, MO health insurance is a strategic investment. Here’s how it works:

Individual Plans: These policies are tailored to the needs of single individuals, offering coverage for medical expenses, prescription drugs, and preventive care.

Family Plans: Designed for families, these plans provide comprehensive coverage for all family members, ensuring everyone’s health needs are met.

Medicare Supplement Plans: For seniors, these plans supplement original Medicare coverage, filling in gaps and providing additional benefits.

Dental and Vision Plans: Often overlooked, these plans are essential for maintaining overall health. They cover a range of dental and vision services, ensuring optimal oral and eye health.

Short-Term Health Insurance: For those between jobs or in transition, short-term health insurance offers temporary coverage, bridging the gap until a more permanent plan is secured.

Life Insurance: Securing Your Legacy

Life insurance is a cornerstone of financial planning, and in MO, it’s a vital consideration. Here’s an overview:

Term Life Insurance: This policy provides coverage for a specified term, offering high coverage amounts at affordable rates. It’s ideal for those seeking protection for a defined period, such as while raising a family.

Whole Life Insurance: Offering permanent coverage, whole life insurance builds cash value over time. It’s a comprehensive solution for long-term financial security.

Universal Life Insurance: With flexible premiums and coverage amounts, universal life insurance provides customizable protection. It’s an ideal choice for those seeking flexibility in their life insurance policy.

Final Expense Insurance: This policy is designed to cover funeral and burial costs, ensuring loved ones aren’t burdened with these expenses. It’s a thoughtful addition to any life insurance portfolio.

Business Insurance: Protecting Your Enterprise

For entrepreneurs in MO, business insurance is a necessity. Here’s a detailed look:

General Liability Insurance: This policy covers a range of risks, including property damage, bodily injury, and advertising injuries. It’s a fundamental layer of protection for any business.

Commercial Property Insurance: It safeguards a business’s physical assets, including buildings, equipment, and inventory, against damage or loss.

Business Owner’s Policy (BOP): A BOP combines general liability and commercial property insurance, offering a comprehensive solution for small to medium-sized businesses.

Professional Liability Insurance: Also known as errors and omissions insurance, this policy protects businesses against claims of negligence or failure to perform. It’s a critical consideration for many professionals.

Workers’ Compensation Insurance: This policy provides coverage for employees who are injured on the job, ensuring they receive medical treatment and compensation. It’s a legal requirement in MO.

MO Insurance: A Strategic Investment

MO insurance is more than just a legal requirement; it’s a strategic investment in one’s financial future. By understanding the diverse range of policies and their specific benefits, individuals and businesses can make informed decisions, ensuring they’re adequately protected against life’s uncertainties.

FAQ

What are the MO insurance requirements for drivers?

+MO requires drivers to carry liability insurance, covering bodily injury and property damage. The minimum limits are 25,000 per person, 50,000 per accident for bodily injury, and $10,000 for property damage.

How does MO health insurance compare to other states?

+MO offers a range of health insurance plans, with a focus on individual and family coverage. The state’s insurance market is competitive, ensuring a variety of options and pricing. However, MO has seen higher-than-average premium increases in recent years.

Are there any discounts available for MO auto insurance policies?

+Yes, MO insurers often offer discounts for safe driving records, multiple vehicles insured, and policy bundling. Additionally, certain safety features in vehicles can qualify drivers for reduced premiums.

What is the process for filing an insurance claim in MO?

+Filing an insurance claim in MO typically involves notifying your insurer, providing detailed information about the incident, and submitting supporting documentation. The process can vary depending on the type of insurance and the specifics of the claim.

Are there any resources for low-income residents seeking affordable MO insurance options?

+Yes, MO has programs like the Missouri HealthNet, which provides health insurance coverage to eligible low-income residents. Additionally, there are resources available for affordable auto and home insurance, often through community organizations or state-sponsored initiatives.