Business Insurance Quote Online

Securing a business insurance quote online is a crucial step for entrepreneurs and business owners, offering a convenient and efficient way to protect their ventures. In today's digital age, online platforms have revolutionized the insurance landscape, providing accessible tools for risk management and financial protection. This guide aims to provide an in-depth analysis of the process, highlighting the benefits, considerations, and best practices for obtaining a comprehensive business insurance quote online.

Understanding the Online Business Insurance Quoting Process

The digital revolution has transformed the way businesses acquire insurance coverage. Online quoting platforms offer a streamlined approach, allowing business owners to obtain quotes quickly and conveniently. This section will delve into the step-by-step process, highlighting the key elements and considerations for a successful online quote.

Step 1: Identifying Insurance Needs

The first step in the online quoting process is to identify the specific insurance needs of your business. This involves assessing various factors, including the nature of your business, the industry you operate in, and the unique risks associated with your operations. For instance, a construction company would require different coverage than an e-commerce business.

| Business Type | Common Insurance Needs |

|---|---|

| Construction | Liability, Worker's Compensation, Equipment Insurance |

| E-commerce | Product Liability, Cyber Insurance, Business Interruption |

| Healthcare | Professional Liability, Malpractice Insurance, Employee Health Benefits |

By understanding these specific needs, you can ensure that your online quote covers all the essential aspects of your business.

Step 2: Choosing a Reputable Online Platform

With numerous online platforms offering business insurance quotes, selecting a reliable and reputable one is crucial. Look for platforms that provide a comprehensive range of insurance options from multiple carriers, ensuring you have access to competitive rates and tailored coverage.

- Research online reviews and testimonials to gauge the platform's reputation.

- Check if the platform is affiliated with reputable insurance carriers.

- Consider platforms that offer additional resources and guides to assist in the quoting process.

Step 3: Providing Accurate Information

The accuracy of the information you provide during the online quoting process is critical. Misrepresentations or inaccuracies can lead to insufficient coverage or even policy cancellations. Here's a breakdown of the key information typically required:

- Business Details: Name, address, nature of business, number of employees, annual revenue, and any specific operations or services provided.

- Insurance History: Previous insurance claims, policy expirations, and any gaps in coverage.

- Risk Factors: Details about potential risks, including safety measures, incident reports, and any unique challenges your business faces.

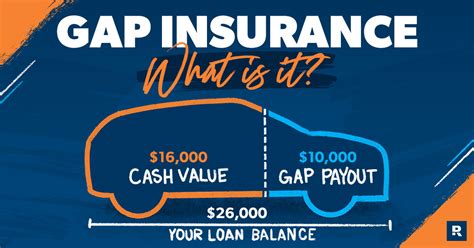

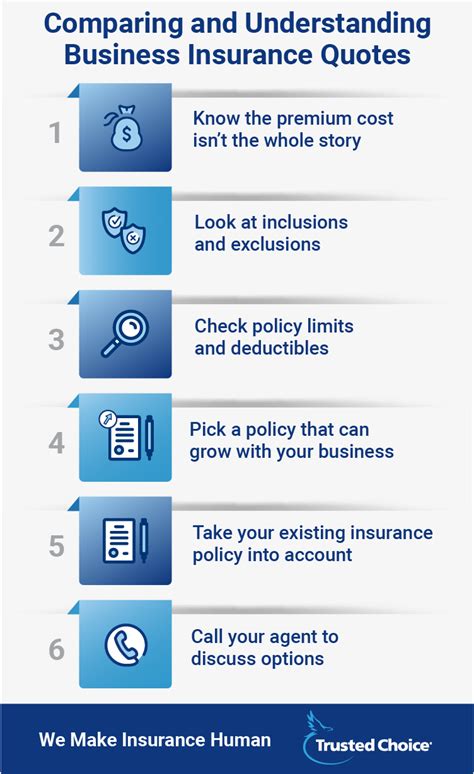

Step 4: Comparing Quotes and Coverage Options

Once you've received multiple quotes, it's essential to compare them thoroughly. Consider not only the price but also the coverage limits, deductibles, and any additional benefits or exclusions. Some policies may offer more comprehensive coverage at a slightly higher premium, making it a better value proposition.

Benefits of Online Business Insurance Quoting

The online quoting process for business insurance offers a range of advantages that make it an appealing choice for many entrepreneurs. Here's a closer look at some of the key benefits:

Convenience and Accessibility

One of the most significant advantages of online quoting is the convenience it offers. Business owners can access quotes anytime, from anywhere, without the need for face-to-face meetings or lengthy paperwork. This flexibility is especially beneficial for busy entrepreneurs who value their time.

Efficient and Streamlined Process

Online platforms are designed to streamline the quoting process, making it quicker and more efficient. Users can input their information once and receive multiple quotes from various carriers, saving time and effort compared to traditional methods.

Transparency and Comparison

Online quoting platforms provide a transparent view of the insurance market, allowing business owners to compare multiple options side by side. This transparency ensures that entrepreneurs can make informed decisions about their coverage, understanding the value and differences between policies.

Cost-Effectiveness

By leveraging the power of online platforms, business owners can often access more competitive rates. The online marketplace encourages carriers to offer attractive pricing to remain competitive, potentially resulting in significant savings for businesses.

Considerations for Effective Online Quoting

While the online quoting process offers numerous benefits, there are certain considerations to keep in mind to ensure a successful and satisfying experience.

Understanding Policy Exclusions

When comparing quotes, it's crucial to pay attention to policy exclusions. These are situations or events that are not covered by the insurance policy. Understanding exclusions can help you choose a policy that aligns with your specific business needs and minimizes potential gaps in coverage.

Customizing Coverage

Online quotes often provide a starting point for coverage. However, it's essential to recognize that your business may have unique needs that require customization. Discuss your specific requirements with an insurance professional to ensure your policy is tailored to your business.

The Role of an Insurance Professional

While online quoting is convenient, it's important to remember that insurance is a complex field. An experienced insurance professional can provide valuable guidance, helping you navigate the quoting process and ensuring you understand the nuances of your policy.

Best Practices for Online Business Insurance Quotes

To maximize the benefits of online quoting and ensure a positive experience, consider these best practices:

Research and Due Diligence

Before selecting an online quoting platform, conduct thorough research. Read reviews, compare features, and ensure the platform is reputable and secure. Due diligence can help you avoid potential pitfalls and ensure a smooth quoting process.

Provide Accurate and Detailed Information

Accuracy is critical when providing information for your online quote. Incomplete or inaccurate details can lead to incorrect quotes and potential issues with coverage. Take the time to gather all the necessary information and double-check for accuracy.

Shop Around and Compare

Don't settle for the first quote you receive. Take advantage of the online marketplace and compare multiple quotes. Shopping around can help you identify the best coverage at the most competitive price.

Read the Fine Print

When reviewing quotes, pay close attention to the policy details. Understand the coverage limits, deductibles, and any exclusions or limitations. Reading the fine print ensures you know exactly what you're getting and can make informed decisions.

The Future of Online Business Insurance Quoting

The online quoting landscape for business insurance is evolving rapidly, driven by advancements in technology and changing consumer preferences. Here's a glimpse into the future of this industry:

Artificial Intelligence and Automation

AI and automation are expected to play an increasingly significant role in online quoting. These technologies can streamline the quoting process further, providing personalized recommendations and enhancing the user experience.

Enhanced Data Security

With the rise of online quoting, data security becomes a critical concern. Future platforms will likely prioritize robust security measures to protect user information and maintain trust.

Integrating New Technologies

The integration of new technologies, such as blockchain and smart contracts, could revolutionize the insurance industry. These technologies could enhance transparency, automate certain processes, and even facilitate the creation of new insurance products.

Personalized Coverage Recommendations

Advanced algorithms and data analysis can lead to more personalized coverage recommendations. By analyzing a business's unique characteristics and risk profile, online platforms could offer tailored suggestions for optimal coverage.

Frequently Asked Questions

Can I get an accurate business insurance quote online without an agent’s help?

+

Yes, you can obtain an accurate quote online without an agent. However, it’s important to understand your business’s unique needs and provide detailed information to ensure the quote is tailored to your requirements. An agent can provide guidance and expertise to navigate complex insurance matters.

How do I know if an online business insurance quote is competitive?

+

To determine if an online quote is competitive, compare it with quotes from other reputable platforms or agents. Look for similar coverage limits, deductibles, and exclusions. Consider the reputation and financial stability of the insurance carrier. A competitive quote should offer comprehensive coverage at a reasonable price.

What happens if I provide inaccurate information during the online quoting process?

+

Providing inaccurate information can lead to issues with your insurance coverage. Misrepresentations may result in policy cancellations or denials of claims. It’s crucial to provide accurate and detailed information to ensure your policy reflects your business’s true needs and risks.

Are there any hidden fees or surprises with online business insurance quotes?

+

Reputable online platforms should provide transparent pricing, detailing all fees and charges associated with the policy. However, it’s essential to review the policy documents thoroughly to understand any potential additional fees or exclusions. Always ask questions if you have concerns about hidden costs.

How can I ensure I’m getting the best coverage for my business through online quotes?

+

To ensure the best coverage, thoroughly review each quote, comparing coverage limits, deductibles, and exclusions. Understand your business’s specific needs and risks, and discuss these with an insurance professional if needed. Customizing your coverage to your unique requirements is key to optimal protection.