Car Insurance Agents Near Me

Are you searching for car insurance agents in your local area? Finding the right insurance coverage for your vehicle is crucial, and having a reliable insurance agent to guide you through the process can make all the difference. This comprehensive guide will walk you through the world of car insurance agents, providing you with valuable insights and information to help you make informed decisions.

Understanding the Role of Car Insurance Agents

Car insurance agents serve as intermediaries between insurance companies and policyholders. They are licensed professionals who are well-versed in the intricacies of insurance policies and can offer personalized advice based on your specific needs. Here’s a deeper look at their role and how they can assist you.

Assessing Your Insurance Needs

When you approach a car insurance agent, they will take the time to understand your unique circumstances. This includes factors such as the make and model of your vehicle, your driving history, and the level of coverage you desire. Based on this information, they can recommend suitable insurance options tailored to your requirements.

| Policy Type | Description |

|---|---|

| Liability Coverage | Covers damages caused to others in an accident. |

| Collision Coverage | Protects your vehicle in the event of a collision. |

| Comprehensive Coverage | Covers non-collision related incidents like theft or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you in case of an accident with a driver who has insufficient or no insurance. |

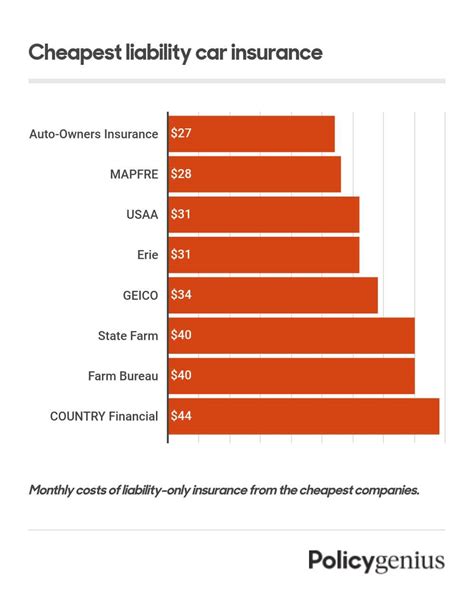

Comparing Insurance Options

Insurance agents have access to a wide range of insurance providers and can compare policies on your behalf. They can present you with multiple options, highlighting the key features, benefits, and costs of each. This allows you to make an informed choice and select the policy that best suits your budget and requirements.

Navigating the Insurance Process

The process of purchasing car insurance can be complex, especially if you’re new to it. Insurance agents can guide you through the entire process, from understanding the terms and conditions of a policy to completing the necessary paperwork. They can also assist with any claims you may need to make, ensuring you receive the coverage you’re entitled to.

Finding Reputable Car Insurance Agents Near You

Now that you understand the vital role insurance agents play, let’s explore how you can locate reputable agents in your vicinity.

Online Directories and Reviews

Start your search by utilizing online directories and review platforms. Websites like Google Maps, Yelp, or specialized insurance directories can provide you with a list of insurance agents in your area. Reading reviews from previous clients can offer valuable insights into the quality of service provided by these agents.

Local Insurance Agencies

Explore local insurance agencies in your community. These agencies often have a team of agents who are well-versed in the local insurance landscape. Visiting these agencies in person can give you a chance to meet the agents, ask questions, and assess their expertise and professionalism.

Referrals from Trusted Sources

Word-of-mouth referrals can be powerful tools in finding reliable insurance agents. Ask your friends, family, or colleagues if they have had positive experiences with any local insurance agents. Referrals from trusted sources can provide a level of confidence and peace of mind when choosing an agent.

Check Licensing and Credentials

It’s essential to verify the licensing and credentials of any insurance agent you’re considering. Most states have online databases where you can check an agent’s license status and any disciplinary actions taken against them. This step ensures you’re working with a legitimate and trustworthy professional.

Maximizing Your Interaction with Insurance Agents

When you’ve found a potential insurance agent, it’s important to make the most of your interaction with them. Here are some tips to ensure a productive and beneficial relationship.

Be Prepared with Your Information

Before meeting with an insurance agent, gather all the necessary information they’ll need to provide accurate quotes. This includes details about your vehicle, driving history, and any existing insurance policies you have. Being prepared demonstrates your seriousness and helps the agent offer more precise recommendations.

Ask Relevant Questions

Don’t be afraid to ask questions. Insurance policies can be complex, and it’s crucial to understand the fine print. Ask about coverage limits, deductibles, and any exclusions or limitations in the policy. Clear communication ensures you’re fully aware of what you’re signing up for.

Negotiate and Seek Discounts

Insurance agents often have some flexibility in negotiating rates and offering discounts. Discuss your budget and any specific concerns you have. They may be able to suggest ways to reduce your premium, such as bundling multiple policies or taking advantage of loyalty discounts.

Review and Compare Quotes

Obtain quotes from multiple insurance agents to compare prices and coverage options. This allows you to make an informed decision and choose the policy that provides the best value for your money. Don’t rush into a decision; take the time to carefully review each quote.

The Future of Car Insurance and Agent Services

The insurance industry is evolving, and technology is playing a significant role in shaping the future of car insurance and agent services. Here’s a glimpse into what we can expect.

Digitalization and Online Platforms

The rise of digital technology has led to the development of online insurance platforms. These platforms allow you to compare insurance quotes, purchase policies, and manage your coverage entirely online. While this doesn’t replace the role of insurance agents, it does provide an additional channel for convenient and efficient service.

Personalized Insurance Plans

Insurance providers are increasingly using data analytics to offer personalized insurance plans. By analyzing your driving behavior, vehicle usage, and other factors, they can provide tailored insurance options. This level of customization can lead to more affordable and comprehensive coverage for policyholders.

Telematics and Usage-Based Insurance

Telematics devices, which track driving behavior and vehicle usage, are gaining popularity. These devices can be used to offer usage-based insurance, where premiums are determined by how and when you drive. This incentivizes safe driving and can result in significant savings for policyholders.

Agent Specialization and Expertise

As the insurance landscape becomes more complex, insurance agents are specializing in specific areas. This allows them to provide expert advice and guidance in their respective fields. Whether it’s commercial vehicle insurance, classic car insurance, or specialized coverage for high-risk drivers, agents are becoming more specialized to meet diverse needs.

Conclusion

Finding the right car insurance agent is an important step in securing comprehensive and affordable insurance coverage for your vehicle. By understanding their role, utilizing online resources, and taking the time to interact with potential agents, you can make an informed decision. As the insurance industry continues to evolve, insurance agents will remain vital in guiding policyholders through the complex world of insurance, ensuring they receive the coverage they need and deserve.

How much does car insurance typically cost?

+The cost of car insurance can vary widely based on factors such as your location, driving history, and the type of vehicle you own. On average, you can expect to pay anywhere from 500 to 1,500 annually for a standard liability policy. However, the price can be significantly higher or lower depending on your specific circumstances.

What factors influence car insurance rates?

+Several factors can impact your car insurance rates. These include your age, gender, driving record, the make and model of your vehicle, and the coverage options you choose. Additionally, your location and the average cost of car repairs in your area can also affect your insurance rates.

Can I switch insurance agents if I’m not satisfied with my current one?

+Absolutely! Insurance is a highly competitive industry, and you have the freedom to choose the agent and insurance provider that best suits your needs. If you’re not satisfied with your current agent, you can easily switch to another by contacting them directly and requesting a quote from a new provider.