Car Insurance Open Today

Are you in need of car insurance on a weekend or public holiday when most insurance agencies are closed? Finding car insurance that is open today, especially during non-business hours, can be a challenging task. However, with the rise of digital services and the increasing demand for convenient insurance options, several providers have adapted to offer flexible hours and online platforms to cater to customers' needs. In this comprehensive guide, we will explore the concept of car insurance that is open today, discussing its advantages, how to access it, and providing valuable insights to help you make informed decisions about your vehicle coverage.

Understanding Car Insurance That’s Open Today

Traditional car insurance agencies typically operate during standard business hours, Monday through Friday, which can be inconvenient for individuals with busy schedules or those who require immediate insurance coverage outside of these hours. However, the insurance industry has evolved to meet the changing demands of customers, and several innovative options have emerged to provide car insurance that is accessible even when physical offices are closed.

Digital Insurance Providers

One of the most significant developments in the insurance sector is the emergence of digital-first insurance companies. These providers have revolutionized the industry by offering online platforms that allow customers to obtain quotes, purchase policies, and manage their insurance needs entirely online. By leveraging technology, these digital insurers have eliminated the need for physical office visits, enabling them to offer extended hours of operation and even 24⁄7 accessibility.

Digital insurance providers often utilize intuitive websites and mobile applications, making it convenient for customers to obtain quotes, compare policies, and complete the purchase process from the comfort of their homes or on the go. This approach not only caters to the digital-native generation but also provides a level of convenience that traditional agencies may struggle to match.

Extended Hours of Operation

While some digital insurance companies offer round-the-clock services, others have extended their operating hours to accommodate customers who require assistance during non-standard business hours. These providers understand that emergencies and unexpected situations can arise at any time, and they aim to be there for their customers when they need them the most.

By extending their hours of operation, these insurance agencies ensure that customers can reach out for assistance, obtain quotes, or address urgent concerns outside of the typical 9-5 workday. This flexibility is particularly beneficial for individuals who work unconventional hours or those who prefer to handle their insurance matters after work or on weekends.

Self-Service Options

In addition to extended hours, many insurance providers now offer self-service options that empower customers to manage their policies and make certain changes without the need for direct assistance from agents. Self-service portals and mobile applications allow policyholders to view and update their coverage details, make payments, and even report minor claims without waiting for business hours to commence.

These self-service options not only provide convenience but also reduce response times and streamline the insurance process. Customers can quickly access their policy information, make necessary adjustments, and obtain the necessary documentation without the delay associated with traditional, manual processes.

Accessing Car Insurance Open Today

Now that we understand the various options available for car insurance that is open today, let’s explore how you can access these services and make the most of their flexibility.

Online Insurance Marketplaces

Online insurance marketplaces have become a popular platform for customers to compare policies and purchase car insurance from multiple providers in one place. These marketplaces aggregate information from various insurance companies, allowing you to input your details once and receive multiple quotes simultaneously. Many of these platforms operate 24⁄7, ensuring you can access them at any time, even on weekends or holidays.

When using an online insurance marketplace, it's essential to provide accurate and detailed information to obtain the most relevant quotes. Take the time to input your vehicle's make, model, and year, as well as your personal details and driving history. This ensures that the quotes you receive are tailored to your specific needs and circumstances.

Direct-to-Consumer Insurance Providers

Direct-to-consumer insurance providers are companies that sell their policies directly to customers, cutting out the middleman and offering a more streamlined and efficient process. These providers often have robust online platforms that allow you to obtain quotes, purchase policies, and manage your insurance coverage entirely online. By eliminating the need for physical interactions, they can provide extended hours of operation and a more personalized experience.

When considering direct-to-consumer insurance providers, it's crucial to research and compare multiple options. Look for companies that have a solid reputation, offer competitive rates, and provide excellent customer service. Reading reviews and seeking recommendations from trusted sources can help you make an informed decision.

Mobile Applications

In today’s digital age, mobile applications have become an integral part of our daily lives, and the insurance industry has embraced this trend. Many insurance providers now offer dedicated mobile apps that allow customers to manage their policies, obtain quotes, and access various services on the go. These apps often feature user-friendly interfaces and provide a seamless experience, ensuring that you can access your insurance information anytime, anywhere.

When selecting an insurance provider, consider whether they offer a mobile app and evaluate its features and user experience. A well-designed app can make it convenient for you to stay on top of your insurance needs, report claims, and access important documentation when needed.

Benefits of Car Insurance Open Today

The ability to access car insurance that is open today offers several advantages that can greatly benefit policyholders. Let’s explore some of the key benefits of choosing insurance providers with extended hours or digital platforms.

Convenience and Accessibility

One of the most significant advantages of car insurance that is open today is the convenience and accessibility it provides. With extended hours or 24⁄7 digital platforms, you can obtain quotes, purchase policies, and manage your insurance needs at your convenience. This flexibility is especially beneficial for individuals with busy schedules or those who prefer to handle their insurance matters outside of traditional business hours.

Whether you're a night owl, an early riser, or someone who works irregular shifts, having insurance that is open today ensures that you can access the services you need when it suits your schedule. This level of convenience can make the insurance process less stressful and more tailored to your lifestyle.

Quick Response Times

In emergency situations or when you need immediate assistance, having insurance that is open today can be a lifesaver. With digital platforms and extended hours, you can reach out to your insurance provider and receive a prompt response, even outside of regular business hours. This quick response time can be crucial when dealing with accidents, breakdowns, or other urgent matters.

Insurance providers that prioritize customer service and understand the importance of timely assistance often invest in robust digital systems and staff their call centers accordingly. As a result, you can expect faster claim processing, more efficient communication, and a higher level of support when you need it the most.

Competitive Pricing

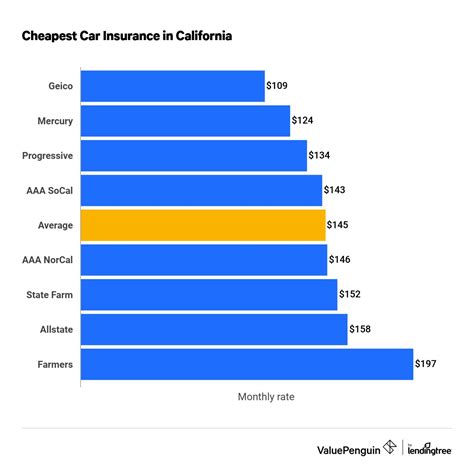

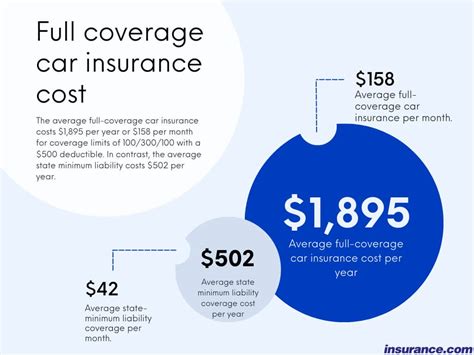

The competitive nature of the insurance industry, coupled with the rise of digital insurance providers, has driven down prices and made insurance more affordable for consumers. By cutting out intermediaries and leveraging technology, these providers can offer competitive rates that traditional agencies may struggle to match.

When shopping for car insurance, it's essential to compare quotes from multiple providers to find the best value for your money. Online insurance marketplaces and direct-to-consumer providers often provide an easy way to compare rates, ensuring you can make an informed decision and choose a policy that fits your budget without compromising on coverage.

Performance Analysis and Customer Satisfaction

When considering car insurance that is open today, it’s crucial to evaluate the performance and customer satisfaction of the providers you’re considering. Here’s a deeper look into what to consider when making your choice.

Claim Handling and Resolution

One of the most critical aspects of any insurance provider is their claim handling process. When you purchase car insurance, you want to ensure that the provider will be there for you when you need them the most - during a claim. Look for insurance companies that have a solid track record of prompt and fair claim resolution.

Consider researching customer reviews and feedback to gauge the satisfaction levels of policyholders who have filed claims. Online platforms and social media can be excellent resources for gathering insights into the claim handling process and the overall customer experience.

Customer Service and Support

Excellent customer service is a hallmark of reputable insurance providers. When assessing car insurance that is open today, evaluate the level of support and assistance you can expect from the provider. Look for companies that offer multiple channels of communication, including phone, email, and live chat, to ensure you can reach out for assistance whenever needed.

Read customer reviews and testimonials to understand the quality of customer service provided by the insurance company. Positive feedback regarding prompt responses, helpful agents, and efficient resolution of queries can indicate a high level of customer satisfaction.

Policy Customization and Flexibility

Every driver’s insurance needs are unique, and a one-size-fits-all approach may not suffice. Look for insurance providers that offer customizable policies, allowing you to tailor your coverage to your specific requirements. Whether you need comprehensive coverage, liability-only insurance, or additional add-ons, having the flexibility to choose the right coverage for your vehicle and driving habits is essential.

Evaluate the range of coverage options and additional features offered by the insurance provider. Some providers may specialize in certain types of coverage, such as classic car insurance or rideshare driver coverage, so choose a company that aligns with your specific needs.

Evidence-Based Future Implications

The insurance industry is continuously evolving, and the rise of digital insurance providers and extended-hours services is shaping the future of car insurance. Here’s a glimpse into some of the potential implications of these trends.

Increased Competition and Innovation

The emergence of digital insurance providers has introduced a new level of competition into the insurance market. With more players offering innovative services and extended hours of operation, traditional insurance agencies are forced to adapt and improve their offerings to stay competitive.

This increased competition is beneficial for consumers as it drives innovation and encourages providers to enhance their services, streamline processes, and offer more value-added features. As a result, policyholders can expect better rates, more comprehensive coverage options, and an overall improved insurance experience.

Enhanced Customer Experience

The focus on digital platforms and extended hours of operation is centered around enhancing the customer experience. Insurance providers are investing in technology and customer-centric approaches to make the insurance journey more convenient, efficient, and personalized.

With digital tools and self-service options, customers can take control of their insurance needs, manage their policies, and access important information at their fingertips. This shift towards a more customer-centric model ensures that policyholders have a positive and satisfying experience, from obtaining quotes to filing claims.

Data-Driven Personalization

The wealth of data collected by digital insurance providers offers an opportunity for personalized insurance experiences. By analyzing customer behavior, driving patterns, and risk factors, insurance companies can offer tailored coverage options and more accurate pricing. This data-driven approach allows providers to offer customized policies that meet the unique needs of individual drivers.

Personalization can lead to more satisfied customers, as they receive coverage that aligns with their specific circumstances and driving habits. Additionally, data-driven insights can help insurance companies identify areas for improvement and develop more effective risk management strategies.

Can I get car insurance instantly online?

+Yes, many digital insurance providers offer instant online quotes and even allow you to purchase policies immediately. This instant access ensures you can obtain coverage quickly and conveniently.

Are there any additional fees for purchasing car insurance online?

+Some insurance providers may charge a small fee for online transactions, but many offer competitive rates and waive these fees to encourage digital engagement. Always check the terms and conditions to understand any potential charges.

How can I be sure the online insurance provider is reputable?

+Research the insurance company thoroughly, check their licensing and accreditation, and read customer reviews. Look for companies with a solid reputation, positive feedback, and a history of fair and prompt claim resolution.