Cheap Nyc Car Insurance

Finding affordable car insurance in New York City (NYC) can be a challenging task due to the city's unique traffic conditions and high population density. However, it is not impossible to secure reasonably priced insurance coverage. Understanding the factors that influence car insurance rates and exploring various options can help NYC residents save money on their policies.

Understanding NYC Car Insurance Rates

Car insurance rates in NYC are influenced by a multitude of factors, including personal driving history, the type of vehicle insured, and the neighborhood where the vehicle is primarily parked. NYC's congested streets and high accident rates contribute to the city's reputation for expensive insurance premiums.

According to a recent report by the Insurance Information Institute (III), the average cost of car insurance in NYC is approximately $2,200 per year. This is significantly higher than the national average of $1,674 per year. The report also highlights that NYC residents with clean driving records can expect to pay an average of $1,600 per year, while those with violations or accidents may pay upwards of $3,000 annually.

Factors Affecting NYC Car Insurance Rates

- Driving Record: A clean driving record is essential for obtaining affordable insurance. Even a single traffic violation or accident can significantly increase insurance premiums. It is crucial to maintain a safe driving history to keep costs down.

- Vehicle Type: The make, model, and year of your vehicle play a role in determining insurance rates. Sports cars and luxury vehicles, for instance, often have higher insurance costs due to their higher repair and replacement expenses.

- Neighborhood: The location where you primarily park your vehicle can impact insurance rates. Areas with higher crime rates or a history of frequent accidents may result in increased premiums.

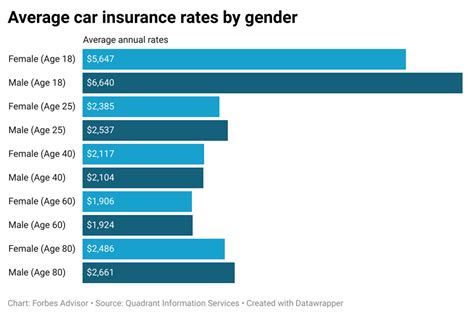

- Age and Gender: Younger drivers, particularly males under the age of 25, tend to pay higher insurance premiums due to their perceived higher risk on the roads. However, this factor becomes less significant as drivers gain more experience and age.

- Credit Score: Insurance companies often consider an individual's credit score when determining insurance rates. Maintaining a good credit score can lead to more favorable insurance premiums.

Tips for Finding Cheap NYC Car Insurance

While NYC car insurance rates may be higher than in other areas, there are strategies to mitigate these costs and find more affordable coverage. Here are some tips to consider:

Shop Around and Compare Quotes

The insurance market in NYC is highly competitive, with numerous providers offering a range of coverage options. Shopping around and comparing quotes from different insurers is crucial to finding the best deal. Online comparison tools and insurance brokers can be valuable resources for this process.

Consider Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as car insurance with homeowners or renters insurance. If you own a home or rent in NYC, explore the possibility of bundling your insurance policies to save money.

Increase Your Deductible

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you assume more financial responsibility in the event of an accident or claim, which can result in lower monthly premiums.

Take Advantage of Discounts

Insurance companies often provide various discounts to policyholders. These discounts can be based on factors such as safe driving records, vehicle safety features, good student status, and more. Ask your insurance provider about the discounts they offer and ensure you are taking advantage of all applicable discounts.

Maintain a Clean Driving Record

As mentioned earlier, a clean driving record is crucial for obtaining affordable car insurance. Avoid traffic violations and accidents by practicing defensive driving and adhering to traffic laws. Even a single speeding ticket or accident can lead to increased insurance premiums for several years.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that allows insurers to track your driving behavior and offer customized rates. This type of insurance uses a small device or smartphone app to monitor factors like miles driven, driving speed, and braking habits. If you have a safe and efficient driving style, you may qualify for lower insurance premiums with usage-based insurance.

Consider Public Transportation

NYC offers an extensive public transportation network, including subways, buses, and rideshare services. Consider reducing your reliance on personal vehicles and utilizing public transportation instead. The less you drive, the lower your insurance premiums may be. Additionally, public transportation can save you money on fuel and maintenance costs.

The Future of Affordable NYC Car Insurance

The insurance industry is constantly evolving, and new technologies and trends are shaping the future of car insurance in NYC. Here are some developments to keep an eye on:

Automated Claims Processing

Insurance companies are increasingly adopting automated claims processing systems, which can streamline the claims process and reduce administrative costs. This efficiency may translate into lower insurance premiums for policyholders.

Electric Vehicle (EV) Incentives

The growing popularity of electric vehicles is prompting insurance companies to offer incentives and discounts for EV owners. As more NYC residents adopt electric vehicles, insurance providers may introduce specialized policies and discounts to encourage this transition.

Advanced Driver Assistance Systems (ADAS)

Many modern vehicles are equipped with advanced driver assistance systems, such as lane departure warning, adaptive cruise control, and automatic emergency braking. These safety features can reduce the risk of accidents and lead to lower insurance premiums. As ADAS technology becomes more widespread, insurance providers may offer discounts for vehicles equipped with these systems.

Personalized Insurance Policies

Insurance companies are exploring ways to offer more personalized insurance policies that take into account an individual's unique driving behavior and circumstances. By leveraging data analytics and machine learning, insurers can provide customized coverage options and potentially lower premiums for low-risk drivers.

Insurance-Tech Startups

The insurance industry is witnessing the emergence of insurance-tech startups that are disrupting traditional insurance models. These startups often leverage technology to offer innovative insurance products and more affordable coverage. Keep an eye out for these startups and the unique insurance solutions they bring to the market.

💡 Pro Tip: Regularly review your insurance policy and shop around for new quotes every year. Insurance rates and policies can change, and you may find better deals or more suitable coverage options over time.

Frequently Asked Questions

What is the average cost of car insurance in NYC?

+The average cost of car insurance in NYC is approximately $2,200 per year, according to the Insurance Information Institute (III). However, this can vary based on individual factors such as driving record, vehicle type, and neighborhood.

How can I lower my car insurance premiums in NYC?

+To lower your car insurance premiums in NYC, consider shopping around for quotes from different insurers, bundling policies, increasing your deductible, taking advantage of available discounts, and maintaining a clean driving record. Additionally, exploring usage-based insurance and utilizing public transportation can also help reduce costs.

Are there any specific discounts available for NYC residents?

+Yes, NYC residents may qualify for various discounts, including safe driver discounts, good student discounts, loyalty discounts, and multi-policy discounts. It’s important to inquire with your insurance provider about the discounts they offer and ensure you meet the eligibility criteria.

How does my driving record impact my insurance rates in NYC?

+Your driving record plays a significant role in determining your insurance rates in NYC. A clean driving record with no violations or accidents can lead to lower premiums. On the other hand, even a single traffic violation or accident can result in increased insurance costs for several years.

Can I find affordable insurance if I own an expensive or high-performance vehicle in NYC?

+It can be more challenging to find affordable insurance for expensive or high-performance vehicles in NYC due to their higher repair and replacement costs. However, shopping around for quotes and exploring specialized insurance providers for luxury or sports cars may help you find more competitive rates.