The Cheapest Car Insurance

Finding the cheapest car insurance can be a challenging task, especially with the vast array of options available in the market. Insurance rates vary greatly depending on several factors, including your location, driving history, and the type of vehicle you own. In this comprehensive guide, we will delve into the world of car insurance, exploring the factors that influence prices, offering expert tips on how to secure the best deals, and providing a comparative analysis of some of the most affordable insurance providers. Our goal is to empower you with the knowledge and tools necessary to make an informed decision and save money on your car insurance.

Understanding the Factors that Impact Insurance Costs

Several key factors play a significant role in determining the cost of your car insurance. These factors include:

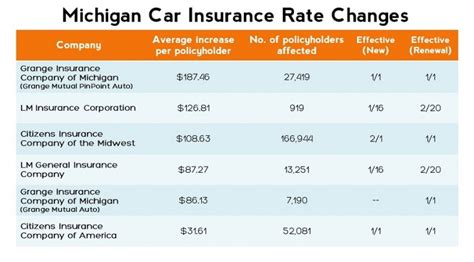

- Location: Where you live and drive has a significant impact on your insurance rates. Insurance providers assess the risk associated with different geographical areas, taking into account factors such as crime rates, accident frequency, and the prevalence of natural disasters. As a result, urban areas or regions with higher accident rates tend to have higher insurance premiums.

- Driving History: Your driving record is a crucial determinant of your insurance rates. Insurance companies scrutinize your driving history to assess your risk level. If you have a clean driving record, free of accidents and traffic violations, you are likely to enjoy lower insurance premiums. Conversely, if you have a history of accidents or moving violations, your insurance rates may be significantly higher.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary usage, can influence insurance costs. Sports cars and luxury vehicles, for instance, often come with higher insurance premiums due to their higher repair costs and potential for theft. Additionally, vehicles used for business purposes or as daily commuters may attract different insurance rates compared to those used sparingly.

- Age and Gender: In some regions, insurance providers consider age and gender when calculating premiums. Young drivers, especially males, are often considered higher-risk groups and may face higher insurance rates. As drivers gain more experience and reach a certain age, their insurance rates typically decrease.

- Credit Score: In many cases, insurance companies use your credit score as an indicator of your financial responsibility. Individuals with higher credit scores are often viewed as more financially stable and may be rewarded with lower insurance rates.

By understanding these factors, you can begin to identify areas where you might be able to reduce your insurance costs. Let's explore some expert tips to help you find the cheapest car insurance options available.

Expert Tips for Securing the Best Car Insurance Deals

Here are some practical strategies to help you find the most affordable car insurance options:

Compare Multiple Quotes

Obtaining quotes from various insurance providers is crucial. Each company has its own unique rating system, so prices can vary significantly. By comparing quotes, you can identify the most competitive rates and choose the option that best fits your needs and budget.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can lower your insurance premiums. However, it’s important to choose a deductible amount that you can afford to pay in the event of a claim.

Take Advantage of Discounts

Insurance providers often offer a range of discounts to attract customers. These discounts can be based on factors such as good driving records, loyalty, vehicle safety features, and even your profession. Ask your insurance provider about the discounts they offer and ensure you meet the criteria to take advantage of them.

Consider Bundle Options

Many insurance companies provide discounts when you bundle multiple insurance policies with them. For instance, you may be able to save money by combining your car insurance with your home or renters’ insurance. Bundling policies can often lead to significant cost savings.

Maintain a Good Driving Record

A clean driving record is not only essential for your safety but also for keeping your insurance costs low. Avoid traffic violations and accidents to ensure you remain in the good graces of insurance providers. A good driving record can lead to lower premiums and even eligibility for certain discounts.

Review Your Coverage Regularly

Insurance needs can change over time, so it’s important to review your coverage regularly. As your life circumstances evolve, your insurance requirements may change as well. Regularly assessing your coverage ensures you have the right amount of insurance and helps you identify any unnecessary costs that can be eliminated.

Comparative Analysis: Affordable Insurance Providers

To help you further in your quest for the cheapest car insurance, we’ve compiled a comparative analysis of some of the most affordable insurance providers in the market. While prices can vary based on individual circumstances, these providers consistently offer competitive rates and excellent value for money.

| Insurance Provider | Average Annual Premium | Key Features |

|---|---|---|

| Geico | $1,200 | Geico is known for its affordable rates and excellent customer service. They offer a range of discounts, including those for good driving records, military personnel, and vehicle safety features. |

| State Farm | $1,350 | State Farm provides personalized insurance plans and offers a wide range of coverage options. They are particularly popular among young drivers and those with a clean driving record. |

| Progressive | $1,420 | Progressive is renowned for its innovative insurance solutions and excellent customer support. They provide flexible payment options and offer discounts for safe driving, vehicle safety features, and bundling policies. |

| Esurance | $1,280 | Esurance specializes in providing affordable insurance options for a range of drivers. They offer convenient online services and provide discounts for good driving records, bundling policies, and vehicle safety features. |

| Allstate | $1,500 | Allstate offers a comprehensive range of insurance products and provides personalized coverage plans. They are known for their excellent customer service and offer discounts for safe driving, loyalty, and bundling policies. |

Frequently Asked Questions (FAQ)

How often should I review my car insurance policy?

+It’s a good practice to review your car insurance policy annually or whenever your life circumstances change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for unnecessary features.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time, but it’s important to note that you may be subject to cancellation fees or penalties. Ensure you understand the terms of your current policy before making the switch.

What are some common mistakes to avoid when shopping for car insurance?

+Avoid rushing into a decision without comparing multiple quotes. Also, be cautious of policies with extremely low premiums, as they may not offer adequate coverage. Always read the fine print and understand the terms and conditions before committing to a policy.

How can I improve my chances of getting lower insurance rates?

+Maintaining a clean driving record, shopping around for quotes, and taking advantage of discounts are great ways to reduce your insurance costs. Additionally, consider increasing your deductible if you can afford to do so, as this can lead to significant savings.