Cheap Vehicle Insurance Quote

Finding a cheap vehicle insurance quote can be a challenging task, especially with the multitude of factors that influence insurance premiums. From your driving record to the make and model of your car, each detail plays a crucial role in determining the cost of your insurance policy. In this comprehensive guide, we will delve into the various aspects that impact insurance rates, offering valuable insights and strategies to help you secure the most affordable vehicle insurance quote tailored to your unique circumstances.

Understanding the Factors that Affect Insurance Rates

When it comes to vehicle insurance, several key factors are considered by insurance providers to assess the risk associated with insuring a driver. These factors, which can vary depending on the insurance company and your location, collectively determine the cost of your insurance premium.

Demographic Factors

Your demographic information, such as age, gender, and marital status, is one of the primary considerations in insurance rate calculations. Insurance companies often assign different risk levels to different demographic groups based on historical data and statistical analysis. For instance, younger drivers, especially those under the age of 25, are generally considered higher-risk due to their lack of driving experience and are charged higher premiums.

| Demographic Factor | Impact on Insurance Rates |

|---|---|

| Age | Younger drivers often pay more. |

| Gender | Insurance rates can vary based on gender. |

| Marital Status | Married individuals may enjoy lower rates. |

Additionally, your geographic location can significantly influence your insurance rates. Insurance companies analyze accident and claim statistics for specific areas to assess the level of risk associated with insuring drivers in those regions. Urban areas, for example, may have higher insurance rates due to the increased risk of accidents and car theft compared to rural areas.

Vehicle Characteristics

The make, model, and year of your vehicle are critical factors in determining insurance rates. Insurance companies consider various aspects of your vehicle, including its safety features, repair costs, and historical claims data.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems often qualify for discounts, as these features reduce the risk of accidents and injuries.

- Repair Costs: Cars that are expensive to repair or have a history of high insurance claims may be subject to higher insurance premiums.

- Vehicle Usage: How you use your vehicle also matters. If you primarily drive for pleasure or commute short distances, your insurance rates may be lower compared to someone who uses their vehicle for business or long-distance travel.

Driving Record

Your driving history is a significant factor in insurance rate calculations. Insurance companies carefully examine your record to assess your level of responsibility behind the wheel. A clean driving record, free from accidents, traffic violations, and claims, is highly favorable and can lead to reduced insurance premiums.

On the other hand, if you have a history of accidents, especially those deemed your fault, or if you have received multiple traffic citations, your insurance rates are likely to be higher. Insurance companies view such incidents as indicators of increased risk and adjust their premiums accordingly.

Credit Score

Believe it or not, your credit score can also impact your insurance rates. Many insurance companies use credit-based insurance scoring to assess the risk of insuring a driver. A higher credit score is often associated with lower insurance rates, as individuals with good credit are statistically less likely to file claims.

Coverage and Deductibles

The level of coverage you choose and the deductibles you select also play a role in determining your insurance premiums. Comprehensive and collision coverage, which protect against damage to your vehicle, typically cost more than liability-only coverage, which only covers damages to other parties in an accident.

Additionally, opting for higher deductibles can reduce your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a higher deductible, you essentially shoulder more of the financial burden in the event of a claim, which can result in lower insurance rates.

Strategies to Obtain a Cheap Vehicle Insurance Quote

Now that we have a clearer understanding of the factors that influence insurance rates, let’s explore some effective strategies to secure a cheap vehicle insurance quote tailored to your specific circumstances.

Shop Around and Compare Quotes

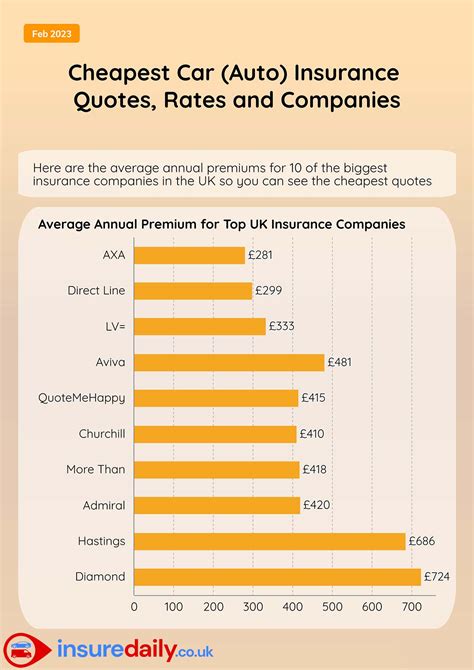

One of the most effective ways to find a cheap insurance quote is to shop around and compare rates from multiple insurance providers. Each insurance company uses its own formula to calculate premiums, and rates can vary significantly between providers. By obtaining quotes from several companies, you can identify the most affordable option for your needs.

Utilize online quote comparison tools to streamline the process. These tools allow you to enter your information once and receive multiple quotes from different insurers. Compare the coverage, deductibles, and overall cost to find the best deal that aligns with your budget and coverage requirements.

Improve Your Driving Record

As mentioned earlier, your driving record is a crucial factor in insurance rate calculations. By maintaining a clean driving record, you can significantly reduce your insurance premiums. Here are some tips to improve your driving record and lower your insurance costs:

- Avoid traffic violations: Obey traffic laws and practice defensive driving to reduce the risk of accidents and citations.

- Take a defensive driving course: Completing a certified defensive driving course can not only enhance your driving skills but also lead to insurance discounts.

- Review your driving habits: Analyze your driving behavior and make necessary improvements. Avoid aggressive driving, excessive speeding, and frequent hard braking, as these can increase your risk profile and insurance rates.

Choose the Right Vehicle

The make, model, and year of your vehicle significantly impact your insurance rates. When selecting a new car, consider vehicles with good safety ratings and low repair costs. Insurance companies often offer discounts for vehicles equipped with advanced safety features, as these reduce the risk of accidents and injuries.

Additionally, older vehicles with lower market values may be more affordable to insure, as the cost of repairs and potential claims is generally lower. However, it's important to strike a balance between cost-effectiveness and safety when choosing a vehicle.

Bundle Policies and Explore Discounts

Bundling your insurance policies, such as combining your auto insurance with home or renters insurance, can lead to significant savings. Many insurance companies offer multi-policy discounts to encourage customers to purchase multiple types of coverage from them.

Furthermore, explore other discounts that may be applicable to your situation. Common discounts include safe driver discounts, good student discounts (for young drivers with good academic records), and loyalty discounts for long-term customers. Ask your insurance provider about the discounts they offer and ensure you're taking advantage of all eligible opportunities.

Increase Your Deductible

As mentioned earlier, increasing your deductible can lower your insurance premiums. By agreeing to pay a higher deductible, you reduce the financial burden on your insurance company in the event of a claim. However, it’s essential to choose a deductible amount that you can comfortably afford in the event of an accident or incident.

Consider your financial situation and the potential costs associated with repairs or replacements. While a higher deductible may save you money on your monthly premiums, it's crucial to ensure that you have the necessary funds readily available should you need to make a claim.

Maintain a Good Credit Score

As credit-based insurance scoring is commonly used by insurance companies, maintaining a good credit score can positively impact your insurance rates. A strong credit score indicates financial responsibility and reduces the perceived risk of insuring you. Take steps to improve and maintain your credit score, such as paying your bills on time, reducing your debt, and regularly reviewing your credit report for errors.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that allows insurance companies to monitor your driving behavior and adjust your premiums accordingly. With this type of insurance, your driving habits, such as miles driven, time of day, and driving speed, are tracked using a small device installed in your vehicle or through an app on your smartphone.

By demonstrating safe and responsible driving habits, you can potentially qualify for significant discounts on your insurance premiums. Usage-based insurance is particularly beneficial for drivers who don't log many miles annually or those who primarily drive during low-risk hours.

Review and Adjust Your Coverage

Regularly review your insurance coverage to ensure it aligns with your current needs and circumstances. As your life circumstances change, such as getting married, buying a new home, or starting a family, your insurance requirements may also evolve. Evaluate your coverage limits, deductibles, and any additional endorsements to ensure you have adequate protection without paying for unnecessary coverage.

Consider dropping optional coverages, such as collision or comprehensive coverage, if you own an older vehicle with low market value. These coverages primarily protect the value of your vehicle, and if the cost of repairs exceeds the vehicle's value, it may not be cost-effective to maintain these coverages.

Conclusion: Finding the Right Balance

Securing a cheap vehicle insurance quote involves striking a balance between affordability and adequate coverage. While it’s tempting to opt for the lowest premium, it’s crucial to ensure that you have the necessary protection to cover potential losses and liabilities. By understanding the factors that influence insurance rates and implementing the strategies outlined in this guide, you can find the right balance between cost and coverage to suit your unique needs.

Remember, shopping around, comparing quotes, and taking proactive steps to improve your driving record and financial standing are key to securing a cheap insurance quote. Additionally, staying informed about your insurance options and regularly reviewing your coverage can help you make informed decisions and stay protected on the road.

How often should I compare insurance quotes to ensure I’m getting the best rate?

+It’s recommended to compare insurance quotes at least once a year, especially if your circumstances or vehicle have changed. Regularly reviewing your insurance options can help you identify opportunities for savings or better coverage.

Can I negotiate my insurance rates with my provider?

+While insurance rates are primarily based on objective factors, you can negotiate certain aspects of your policy. Discuss your specific circumstances, such as a clean driving record or loyalty to the provider, to see if they can offer any discounts or adjustments.

Are there any specific times of the year when insurance rates tend to be lower?

+Insurance rates can fluctuate throughout the year, but there isn’t a specific time when they are universally lower. However, some providers may offer seasonal promotions or discounts, so it’s worth checking during different times of the year.