Dental And Eye Insurance For Seniors

Dental and eye health are often overlooked aspects of overall well-being, especially among seniors. As we age, our oral and visual health needs become more complex and require specialized care. Understanding the options available for dental and eye insurance is crucial for maintaining a high quality of life during our golden years. In this comprehensive guide, we will delve into the world of dental and eye insurance for seniors, exploring the specific challenges they face and the solutions available to address them.

The Importance of Dental and Eye Health for Seniors

Seniors face unique challenges when it comes to dental and eye health. Age-related conditions, such as dry mouth, gum disease, and tooth loss, can significantly impact their overall health and quality of life. Similarly, age-related eye conditions, including cataracts, glaucoma, and age-related macular degeneration (AMD), can lead to vision loss and reduced independence.

Proper dental and eye care can help seniors maintain their oral and visual health, allowing them to enjoy a better quality of life, eat a varied diet, and engage in social activities. Regular check-ups and timely interventions can prevent or manage these conditions, ensuring seniors can continue to lead active and fulfilling lives.

Understanding Senior Dental Insurance Options

Senior dental insurance options vary, and it's essential to understand the different plans available to make an informed decision. Here's an overview of the primary types of dental insurance for seniors:

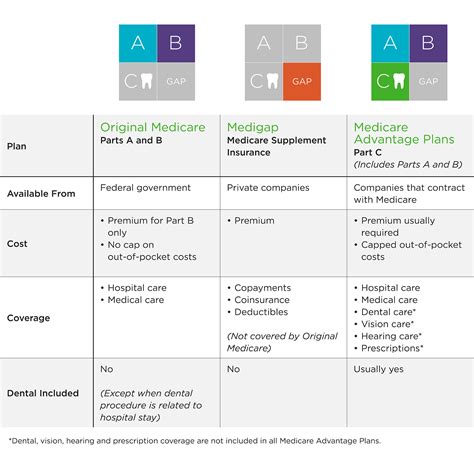

Medicare Advantage Dental Plans

Many Medicare Advantage plans offer dental coverage as an additional benefit. These plans are administered by private insurance companies and typically provide more comprehensive dental benefits than original Medicare. However, the specific coverage and out-of-pocket costs can vary depending on the plan.

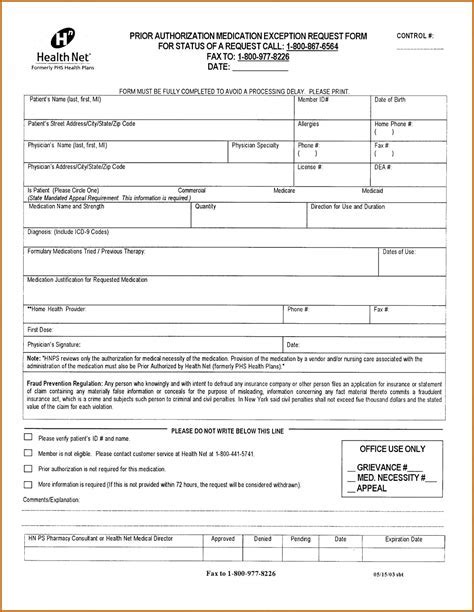

Medicare Advantage dental plans often include coverage for routine dental services, such as cleanings, fillings, and X-rays. Some plans may also cover more extensive procedures, like root canals or dental implants, but these benefits are usually subject to additional costs and may require prior authorization.

| Plan Type | Coverage |

|---|---|

| Medicare Advantage | Varies by plan; may include routine and major dental services. |

Supplemental Dental Insurance Plans

Supplemental dental insurance plans are designed to work alongside Medicare or other primary insurance coverage. These plans typically offer more flexibility in choosing dental providers and may provide coverage for a broader range of services.

Supplemental dental plans often have annual maximums and deductibles, and the specific benefits can vary depending on the plan chosen. Some plans may offer preventive care at 100% coverage, while others may have coinsurance or copayments for various procedures.

Discount Dental Plans

Discount dental plans are not traditional insurance but offer members access to a network of dental providers at discounted rates. These plans typically have low monthly fees and can be a cost-effective option for seniors who require occasional dental care.

Discount dental plans do not provide insurance coverage and do not typically cover pre-existing conditions. Members pay a discounted fee directly to the provider at the time of service. The savings can vary depending on the plan and the specific dental procedures required.

Choosing the Right Dental Insurance Plan for Seniors

Selecting the appropriate dental insurance plan depends on several factors, including individual needs, budget, and the availability of specific procedures. Here are some key considerations to keep in mind when choosing a dental insurance plan for seniors:

Assessing Dental Needs

Seniors should evaluate their current and future dental needs. Consider the frequency of dental visits, the types of procedures likely to be required, and any pre-existing dental conditions. This assessment will help determine the level of coverage needed.

Evaluating Out-of-Pocket Costs

Understand the out-of-pocket costs associated with each plan, including premiums, deductibles, coinsurance, and copayments. Consider the overall budget and whether the plan's costs align with the available financial resources.

Network of Dental Providers

Review the network of dental providers available under each plan. Ensure that the plan includes dentists who are conveniently located, accept the chosen plan, and are experienced in treating seniors.

Coverage for Specific Procedures

Review the plan's benefits to understand the coverage provided for specific dental procedures. Consider whether the plan covers the procedures most likely to be needed, such as root canals, dental implants, or specialized treatments for gum disease.

Navigating Eye Insurance for Seniors

Eye insurance for seniors is equally important, as age-related eye conditions can significantly impact their vision and overall health. Here's an overview of the options available for eye insurance coverage:

Medicare Part B Coverage

Original Medicare (Part A and Part B) covers certain eye exams and treatment for eye conditions under Medicare Part B. This includes annual dilated eye exams for individuals at high risk for glaucoma and diabetic retinopathy. Additionally, Medicare Part B covers medically necessary eye procedures, such as cataract surgery and treatment for age-related macular degeneration (AMD).

| Medicare Part | Coverage |

|---|---|

| Part B | Annual eye exams, cataract surgery, and treatment for specific eye conditions. |

Medicare Advantage Vision Plans

Many Medicare Advantage plans include vision benefits as an additional feature. These plans often provide coverage for routine eye exams, eyeglasses, and contact lenses. The specific benefits and out-of-pocket costs can vary depending on the chosen plan.

Supplemental Vision Insurance Plans

Supplemental vision insurance plans are designed to complement Medicare or other primary insurance coverage. These plans typically offer more extensive vision benefits, including coverage for annual eye exams, eyeglasses, contact lenses, and even laser eye surgery.

Supplemental vision plans often have annual maximums and deductibles, and the specific coverage can vary depending on the chosen plan. Some plans may also offer discounts on vision-related products, such as eyeglass frames or contact lens solutions.

Choosing the Right Eye Insurance Plan for Seniors

Selecting an eye insurance plan for seniors involves considering individual vision needs and the availability of specific procedures. Here are some key factors to consider:

Assessing Vision Needs

Seniors should evaluate their current and future vision needs. Consider the frequency of eye exams, the types of vision corrections required (such as glasses or contacts), and any pre-existing eye conditions.

Evaluating Out-of-Pocket Costs

Understand the out-of-pocket costs associated with each plan, including premiums, deductibles, coinsurance, and copayments. Consider the overall budget and whether the plan's costs align with the available financial resources.

Network of Eye Care Providers

Review the network of eye care providers available under each plan. Ensure that the plan includes ophthalmologists or optometrists who are conveniently located, accept the chosen plan, and have experience treating seniors.

Coverage for Specific Procedures

Review the plan's benefits to understand the coverage provided for specific eye procedures. Consider whether the plan covers the procedures most likely to be needed, such as cataract surgery, laser eye surgery, or specialized treatments for age-related macular degeneration.

Frequently Asked Questions

What are the key differences between Medicare Advantage and Medicare Part B when it comes to dental coverage for seniors?

+Medicare Advantage plans often offer more comprehensive dental coverage than original Medicare (Part A and Part B). While Medicare Part B covers certain dental procedures considered medically necessary, such as oral surgery or extractions, it does not typically cover routine dental care like cleanings, fillings, or X-rays. Medicare Advantage plans, on the other hand, may provide coverage for a wider range of dental services, including preventive care and even major procedures like dental implants.

Are there any government programs or subsidies available to help seniors with dental and eye insurance costs?

+Yes, there are government programs and subsidies available to assist seniors with dental and eye insurance costs. For example, some states offer Medicaid coverage for certain dental services for eligible seniors. Additionally, the Affordable Care Act (ACA) requires many insurance plans to offer vision coverage for children, which may extend to dependent children of seniors. However, the availability and extent of these programs can vary by state and individual circumstances.

Can seniors with pre-existing dental or eye conditions still obtain insurance coverage?

+Yes, seniors with pre-existing dental or eye conditions can still obtain insurance coverage. However, it's important to note that some insurance plans may have pre-existing condition exclusions or waiting periods for certain procedures. It's advisable to carefully review the plan's policy documents and discuss any specific concerns with the insurance provider to understand the coverage and any potential limitations.

Are there any discounts or special programs available for seniors to access affordable dental and eye care?

+Yes, there are various discounts and special programs available to help seniors access affordable dental and eye care. For instance, dental schools often offer discounted services provided by supervised dental students. Additionally, some non-profit organizations and charitable clinics provide free or low-cost dental care to eligible seniors. Similarly, some vision centers and optical stores offer senior discounts on eyeglasses or contact lenses.

How can seniors ensure they receive the best possible care from their dental and eye insurance plans?

+Seniors can ensure they receive the best possible care from their dental and eye insurance plans by actively managing their oral and visual health. This includes regular check-ups, timely preventive care, and open communication with their dental and eye care providers. By staying informed about their coverage, understanding their benefits, and advocating for their specific needs, seniors can optimize their dental and eye insurance plans.

Dental and eye insurance for seniors is a critical aspect of maintaining their overall health and well-being. By understanding the available options, assessing individual needs, and making informed decisions, seniors can access the necessary dental and eye care to lead fulfilling lives. Remember, proper oral and visual health can greatly enhance seniors’ quality of life, allowing them to enjoy their golden years to the fullest.