Disability Medical Insurance

When it comes to healthcare and insurance, individuals with disabilities often face unique challenges and require specialized coverage to meet their specific needs. Disability medical insurance plays a crucial role in ensuring that people with disabilities have access to essential healthcare services and can maintain their quality of life. In this comprehensive article, we will delve into the world of disability medical insurance, exploring its significance, coverage options, and the impact it has on the lives of those it serves.

Understanding Disability Medical Insurance

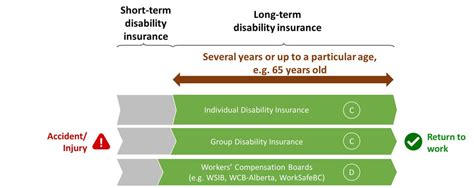

Disability medical insurance is a specialized form of health coverage designed to address the unique medical requirements of individuals living with disabilities. It goes beyond traditional health insurance by offering tailored benefits and support to accommodate the diverse needs of this community. The primary goal of disability medical insurance is to provide comprehensive and inclusive healthcare, ensuring that people with disabilities receive the necessary care, treatments, and services to manage their conditions effectively.

One of the key aspects of disability medical insurance is its focus on accessibility. Insurance providers offering this specialized coverage understand the importance of removing barriers to healthcare access. This includes ensuring that medical facilities, equipment, and services are accessible to individuals with a wide range of disabilities. From wheelchair-accessible examination rooms to sign language interpreters, disability medical insurance aims to create an inclusive healthcare environment.

Coverage Options and Benefits

Disability medical insurance offers a comprehensive array of coverage options and benefits tailored to the diverse needs of individuals with disabilities. Here are some key aspects of the coverage provided:

Specialized Medical Care

One of the primary advantages of disability medical insurance is access to specialized medical professionals and facilities. This coverage often includes a network of healthcare providers with expertise in treating specific disabilities or chronic conditions. Whether it’s neurologists for individuals with neurological disorders or physical therapists for those with mobility impairments, disability medical insurance ensures that policyholders have the necessary specialized care.

Assistive Devices and Technologies

Assistive devices and technologies play a vital role in enhancing the independence and quality of life for individuals with disabilities. Disability medical insurance typically covers a wide range of assistive devices, including wheelchairs, mobility aids, communication devices, and adaptive equipment. By providing coverage for these essential tools, insurance plans empower individuals to navigate their daily lives with greater ease and comfort.

Home Health Services

Many individuals with disabilities require ongoing support and care in the comfort of their own homes. Disability medical insurance often includes coverage for home health services, such as nursing care, personal care assistance, and therapeutic services. This allows individuals to receive the necessary medical attention while maintaining their independence and avoiding the need for long-term institutional care.

Rehabilitation and Therapy

Rehabilitation and therapy are crucial components of disability management and recovery. Disability medical insurance plans typically cover a range of rehabilitative services, including physical therapy, occupational therapy, speech therapy, and counseling. These services aim to improve functional abilities, manage pain, and promote overall well-being, enabling individuals to lead fulfilling lives despite their disabilities.

Prescription Medications

Prescription medications are often an integral part of managing chronic conditions and disabilities. Disability medical insurance provides coverage for a wide range of medications, ensuring that individuals have access to the necessary drugs to manage their health. This includes medications for pain management, muscle relaxants, anticonvulsants, and other specialized prescriptions tailored to specific disabilities.

Mental Health Support

Disabilities can have a significant impact on mental health, and disability medical insurance recognizes the importance of addressing this aspect. Many plans offer coverage for mental health services, including counseling, therapy, and psychiatric care. By providing access to mental health professionals, insurance providers aim to support the overall well-being and resilience of individuals living with disabilities.

Transportation Assistance

Transportation can be a significant barrier for individuals with disabilities, especially when accessing healthcare services. Disability medical insurance often includes coverage for transportation assistance, such as ambulatory services, wheelchair-accessible vehicles, or specialized transportation arrangements. This ensures that individuals can reach their medical appointments safely and reliably.

| Coverage Category | Benefits |

|---|---|

| Specialized Medical Care | Access to expert healthcare professionals |

| Assistive Devices | Coverage for wheelchairs, mobility aids, and communication devices |

| Home Health Services | Nursing care, personal assistance, and in-home therapeutic services |

| Rehabilitation | Physical, occupational, and speech therapy |

| Prescription Medications | Coverage for specialized medications |

| Mental Health Support | Counseling, therapy, and psychiatric care |

| Transportation Assistance | Ambulatory services and accessible transportation options |

The Impact of Disability Medical Insurance

The introduction and availability of disability medical insurance have had a profound impact on the lives of individuals with disabilities and their families. Here are some key ways in which this specialized coverage has made a difference:

Improved Access to Healthcare

Disability medical insurance has significantly improved access to healthcare services for individuals with disabilities. By providing comprehensive coverage, insurance plans remove financial barriers that often prevent people from seeking necessary medical attention. This ensures that individuals can receive timely diagnoses, treatments, and ongoing care without the worry of overwhelming medical expenses.

Enhanced Quality of Life

The specialized benefits offered by disability medical insurance directly contribute to an enhanced quality of life for individuals with disabilities. Access to assistive devices, home health services, and rehabilitative therapies empowers individuals to maintain their independence, mobility, and overall well-being. This, in turn, leads to increased participation in social and community activities, fostering a sense of belonging and purpose.

Reduced Financial Burden

The financial burden associated with managing disabilities can be substantial. Disability medical insurance plays a crucial role in alleviating this burden by covering a wide range of expenses. From medical treatments and assistive devices to home modifications and specialized therapies, insurance plans provide financial support, ensuring that individuals can focus on their health and well-being without the constant worry of mounting medical bills.

Employment and Economic Stability

Disability medical insurance also has a positive impact on employment and economic stability. By providing coverage for necessary medical services and equipment, individuals with disabilities can maintain their ability to work and contribute to the workforce. This not only enhances their financial independence but also contributes to a more inclusive and diverse workforce, benefiting both individuals and society as a whole.

Support for Caregivers

Disability medical insurance extends its benefits beyond the individuals themselves to include caregivers and family members. Many plans offer coverage for caregiver support services, such as respite care, counseling, and training. This support is crucial in helping caregivers manage the physical and emotional demands of caring for a loved one with disabilities, ensuring their own well-being and preventing caregiver burnout.

Advocacy and Awareness

The existence of disability medical insurance has played a significant role in raising awareness and advocating for the rights and needs of individuals with disabilities. By providing specialized coverage, insurance providers send a strong message about the importance of inclusivity and accessibility in healthcare. This, in turn, encourages further dialogue, policy changes, and advancements in disability rights and support systems.

Choosing the Right Disability Medical Insurance

When selecting a disability medical insurance plan, it’s essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

Evaluate Your Needs

Assess your unique medical requirements and the specific challenges you face due to your disability. Consider the types of medical services, assistive devices, and support you may need on a regular basis. By understanding your needs, you can choose a plan that provides adequate coverage and meets your specific requirements.

Research Insurance Providers

Take the time to research and compare different insurance providers offering disability medical insurance. Look for providers with a strong reputation for catering to the needs of individuals with disabilities. Check their network of healthcare providers, the range of benefits offered, and any additional support services they provide, such as case management or care coordination.

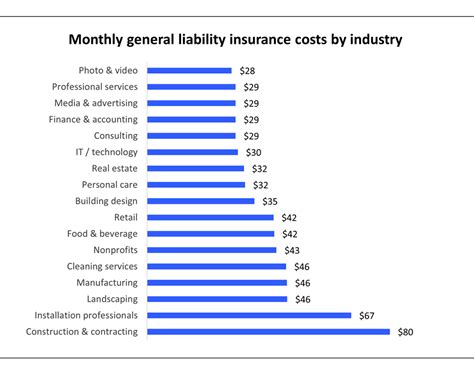

Consider Cost and Coverage

Evaluate the cost of the insurance plan, including premiums, deductibles, and out-of-pocket expenses. Strike a balance between affordability and the level of coverage you require. Remember that a more comprehensive plan may have higher costs, but it could provide greater peace of mind and access to a wider range of benefits.

Understand Policy Details

Carefully review the policy details and fine print to ensure you understand the coverage, exclusions, and limitations. Pay attention to the specific conditions and disabilities covered, as well as any waiting periods or pre-existing condition clauses. It’s essential to have a clear understanding of what is and isn’t covered to avoid any unexpected surprises.

Seek Professional Advice

If you’re unsure about which disability medical insurance plan to choose, consider seeking advice from healthcare professionals or disability advocacy organizations. They can provide valuable insights and guidance based on their experience working with individuals with similar disabilities. Their expertise can help you make an informed decision that aligns with your specific needs.

FAQs

How do I know if I qualify for disability medical insurance?

+To qualify for disability medical insurance, you typically need to have a qualifying disability as defined by the insurance provider. This often includes physical or mental impairments that significantly impact your ability to perform daily activities. It’s recommended to consult with your healthcare provider or an insurance professional to determine if your specific condition meets the eligibility criteria.

Can I customize my disability medical insurance plan?

+Yes, many disability medical insurance plans offer customization options to tailor the coverage to your specific needs. You can choose different levels of coverage, select specific benefits, and even add optional riders to enhance your plan. This flexibility allows you to create a plan that addresses your unique circumstances and provides the necessary support.

What happens if I need medical care while traveling?

+Most disability medical insurance plans include coverage for emergency medical care while traveling. However, the specific terms and conditions may vary. It’s important to review your policy details to understand the extent of coverage for travel-related medical expenses. Some plans may also offer additional travel assistance services, such as medical evacuation or assistance with finding accessible healthcare facilities.

Can I switch disability medical insurance providers if I’m not satisfied with my current plan?

+Yes, you have the option to switch disability medical insurance providers if you find that your current plan doesn’t meet your needs or expectations. However, it’s important to carefully evaluate the terms and conditions of your new plan, including any waiting periods or pre-existing condition clauses. Additionally, consider the process for transferring your coverage and any potential costs or penalties associated with switching providers.

Are there any government programs or subsidies available to assist with disability medical insurance costs?

+In many countries, there are government programs and subsidies available to assist individuals with disabilities in accessing affordable healthcare, including disability medical insurance. These programs vary by location and may include Medicaid, Medicare, or specific disability support programs. It’s recommended to research the options available in your region and consult with local disability advocacy organizations for guidance on accessing these benefits.

Disability medical insurance is a vital component of healthcare for individuals with disabilities, offering comprehensive coverage and support to manage their unique needs. By understanding the coverage options, evaluating your specific requirements, and choosing the right plan, you can ensure access to the necessary medical care and maintain a high quality of life. Remember, disability medical insurance is not just about financial protection; it’s about empowering individuals with disabilities to live their lives to the fullest, with dignity and independence.