Erie Car Insurance

When it comes to choosing the right car insurance, drivers often find themselves faced with a multitude of options, each promising the best coverage and value. Among the many providers in the market, Erie Car Insurance has emerged as a prominent choice, offering a comprehensive range of policies tailored to meet the diverse needs of vehicle owners. This article delves into the world of Erie Car Insurance, exploring its unique features, coverage options, and the reasons why it has become a trusted name in the industry.

A Brief Overview of Erie Car Insurance

Erie Insurance Group, commonly known as Erie Car Insurance, is a property and casualty insurance company with a rich history spanning over a century. Founded in 1918, the company has grown from its humble beginnings in Erie, Pennsylvania, to become a leading provider of auto, home, business, and life insurance across multiple states in the United States. Erie’s commitment to its customers and its strong financial stability have made it a reliable choice for millions of policyholders.

Erie’s Unique Approach to Car Insurance

Erie Car Insurance takes a customer-centric approach, aiming to provide personalized coverage that fits each driver’s unique circumstances. They understand that every driver has different needs and risks, and their policies are designed to offer flexibility and customization. This focus on individual needs sets Erie apart from many other insurance providers, who often offer more standardized coverage options.

One of the key aspects of Erie's approach is its rate-locking feature. Erie allows customers to lock in their rates for the duration of their policy, providing stability and predictability in their insurance costs. This feature is particularly beneficial for budget-conscious drivers, as it helps them plan their expenses effectively.

Erie’s Coverage Options

Erie Car Insurance offers a comprehensive suite of coverage options to meet various driving needs and risks. These include:

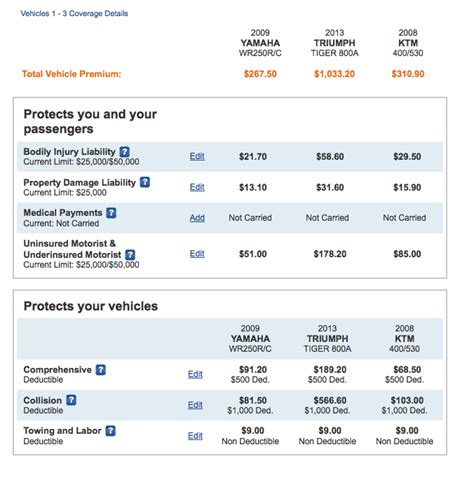

- Liability Coverage: This is the most basic form of car insurance, providing protection against claims for bodily injury or property damage caused by the policyholder. Erie offers flexible liability limits to suit different budgets and risk profiles.

- Collision Coverage: This coverage pays for the repair or replacement of the insured vehicle after an accident, regardless of fault. Erie’s collision coverage includes a range of deductibles to suit different preferences and financial situations.

- Comprehensive Coverage: Comprehensive coverage protects against damages caused by events other than collisions, such as theft, vandalism, weather-related incidents, or animal collisions. Erie’s comprehensive coverage includes options for coverage enhancements, providing additional protection for specific situations.

- Uninsured/Underinsured Motorist Coverage: This coverage protects policyholders when involved in an accident with a driver who either has no insurance or insufficient insurance to cover the damages. Erie offers this coverage to ensure its policyholders are adequately protected even when involved with uninsured or underinsured drivers.

- Medical Payments Coverage: Erie’s medical payments coverage helps cover the medical expenses of the policyholder and their passengers after an accident, regardless of fault. This coverage provides peace of mind and ensures that medical bills are taken care of promptly.

Additional Benefits and Services

Erie Car Insurance goes beyond traditional coverage options to provide a range of additional benefits and services that enhance the overall customer experience. These include:

- Roadside Assistance: Erie offers 24⁄7 roadside assistance, providing help with towing, flat tire changes, jump starts, and more. This service ensures that policyholders can get back on the road quickly and safely in the event of an emergency.

- Accident Forgiveness: Erie’s accident forgiveness program rewards safe drivers by not increasing their rates after their first at-fault accident. This benefit promotes safer driving habits and provides peace of mind for policyholders.

- Discounts: Erie offers a variety of discounts to make their policies more affordable. These include multi-policy discounts, good student discounts, and discounts for mature drivers, among others. These incentives encourage policyholders to maintain safe driving habits and reward them for their loyalty.

- Digital Tools and Resources: Erie provides its policyholders with access to a range of digital tools and resources to make managing their insurance policies easier. This includes online policy management, mobile apps for quick claims reporting, and educational resources to help drivers understand their coverage and make informed decisions.

Erie’s Financial Strength and Customer Satisfaction

Erie Car Insurance is renowned for its financial stability and customer satisfaction. The company consistently receives high ratings from independent financial rating agencies, such as A.M. Best and Standard & Poor’s, indicating its strong financial health and ability to meet its obligations to policyholders. This stability provides assurance to customers that their insurance coverage is secure and reliable.

Additionally, Erie has a strong track record of customer satisfaction. The company is known for its excellent customer service, with dedicated agents who are committed to providing personalized attention and support. Erie's claim process is efficient and straightforward, ensuring that policyholders receive the coverage they need when they need it most. This focus on customer satisfaction has led to high customer retention rates and positive reviews across various platforms.

Erie’s Community Involvement

Erie Car Insurance is not just about providing insurance coverage; it is also deeply committed to the communities it serves. The company actively engages in a range of community initiatives and philanthropic efforts, demonstrating its dedication to social responsibility. Erie’s community involvement includes supporting local education programs, sponsoring community events, and contributing to disaster relief efforts.

| Community Initiative | Description |

|---|---|

| Erie Insurance Giving Circle | This program allows Erie employees to donate to charities of their choice, with Erie matching their contributions. It has supported numerous causes, including education, healthcare, and disaster relief. |

| Erie Insurance All-Stars | A program that recognizes and rewards high school students for their academic achievements, community involvement, and leadership skills. It provides scholarships and mentorship opportunities to help students achieve their goals. |

| Erie Insurance Disaster Relief Fund | Erie established this fund to provide financial assistance to policyholders and communities affected by natural disasters. It has helped thousands of individuals and families rebuild their lives after devastating events. |

Erie’s Digital Innovation and Technology

In today’s digital age, Erie Car Insurance understands the importance of leveraging technology to enhance the customer experience. The company has invested significantly in digital innovation, developing a range of online and mobile tools to make insurance more accessible and convenient.

Erie's digital platform allows customers to manage their policies, view coverage details, make payments, and file claims online. The company's mobile app offers quick and easy access to policy information, allowing policyholders to stay informed and connected wherever they are. Additionally, Erie has implemented advanced data analytics and AI technologies to streamline its processes, improve customer service, and enhance risk assessment.

Erie’s Commitment to Environmental Sustainability

Erie Car Insurance is also dedicated to environmental sustainability and has taken steps to reduce its environmental impact. The company has implemented a range of green initiatives, such as paperless billing and document management, to minimize its carbon footprint. Erie’s offices and facilities are designed with energy efficiency in mind, utilizing sustainable materials and practices.

Furthermore, Erie encourages its policyholders to adopt eco-friendly practices by offering discounts for green vehicles and providing resources and incentives for sustainable driving habits. The company's commitment to environmental sustainability aligns with its values and demonstrates its responsibility as a corporate citizen.

Conclusion

Erie Car Insurance stands out in the competitive insurance market with its customer-centric approach, comprehensive coverage options, and strong financial stability. The company’s unique features, such as rate-locking and accident forgiveness, provide added value and peace of mind to policyholders. Erie’s commitment to customer satisfaction, community involvement, and digital innovation further enhances its reputation as a trusted insurance provider.

Whether you're a new driver or a seasoned motorist, Erie Car Insurance offers a range of policies and services tailored to meet your specific needs. With its rich history, strong financial foundation, and focus on customer experience, Erie continues to be a top choice for car insurance, providing reliable coverage and exceptional service to its policyholders.

How do I get a quote for Erie Car Insurance?

+To get a quote for Erie Car Insurance, you can visit their official website and use their online quoting tool. Alternatively, you can contact an Erie Insurance agent near you for a personalized quote. Providing accurate information about your vehicle, driving history, and desired coverage options will help ensure an accurate quote.

What makes Erie Car Insurance different from other providers?

+Erie Car Insurance differentiates itself through its customer-centric approach, offering personalized coverage and unique features like rate-locking and accident forgiveness. Erie’s strong financial stability, commitment to customer satisfaction, and community involvement also set it apart from many other insurance providers.

What discounts are available with Erie Car Insurance?

+Erie Car Insurance offers a range of discounts, including multi-policy discounts, good student discounts, and discounts for mature drivers. Additionally, Erie provides incentives for eco-friendly vehicles and sustainable driving habits. These discounts can help make car insurance more affordable for policyholders.

How does Erie Car Insurance handle claims?

+Erie Car Insurance has a dedicated claims team that works to ensure a smooth and efficient claims process. Policyholders can file claims online, over the phone, or through their mobile app. Erie’s claims adjusters are known for their professionalism and commitment to providing timely and fair settlements.