Feds Insurance

Unveiling Feds Insurance: Comprehensive Coverage and Protection

Feds Insurance, a leading provider of insurance solutions, has established itself as a trusted partner for individuals and businesses seeking comprehensive coverage. With a focus on tailored policies and exceptional service, Feds Insurance offers a range of products designed to meet diverse needs. This article delves into the world of Feds Insurance, exploring its key offerings, unique features, and the benefits it brings to policyholders.

The Core Services of Feds Insurance

Feds Insurance boasts a diverse portfolio of insurance products, catering to a wide array of client requirements. Their flagship offerings include:

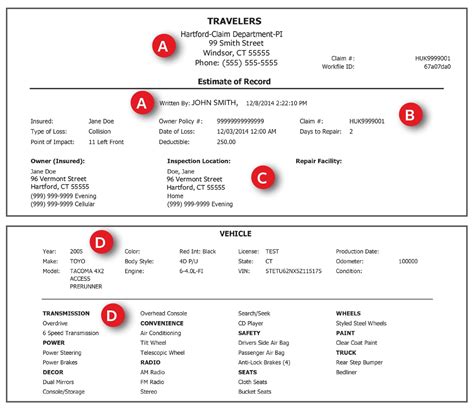

Auto Insurance

Feds Insurance’s auto insurance policies provide comprehensive coverage for vehicle owners. With customizable options, policyholders can choose the level of protection that suits their needs. The company’s auto insurance plans offer benefits such as:- Comprehensive Coverage: Protection against a wide range of risks, including accidents, theft, and natural disasters.

- Flexible Deductibles: The ability to select deductibles that align with individual budgets and preferences.

- Roadside Assistance: 24⁄7 support for emergencies like flat tires, dead batteries, or towing.

- Accident Forgiveness: A feature that prevents premium increases after the first at-fault accident.

- Multi-Car Discounts: Savings for policyholders who insure multiple vehicles under one policy.

| Policy Type | Coverage Highlights |

|---|---|

| Standard Auto Insurance | Covers liability, collision, and comprehensive risks |

| High-Value Vehicle Insurance | Specialized coverage for luxury and classic cars |

| Teen Driver Insurance | Tailored plans for young drivers with additional educational resources |

Homeowners Insurance

Protecting homeowners is a cornerstone of Feds Insurance’s services. Their homeowners insurance policies offer:- Dwelling Coverage: Financial protection for the structure of the home.

- Personal Property Coverage: Reimbursement for lost or damaged belongings.

- Liability Protection: Safeguards against legal claims and lawsuits.

- Additional Living Expenses: Coverage for temporary accommodation if a home becomes uninhabitable due to an insured event.

- Optional Endorsements: Customizable coverage for specific risks like water backup, identity theft, or personal liability.

| Homeowners Policy Type | Key Features |

|---|---|

| Standard Homeowners Insurance | Covers most risks commonly associated with homeownership |

| High-Value Home Insurance | Designed for luxury homes, offering higher limits and specialized coverage |

| Renters Insurance | Protects renters' belongings and provides liability coverage |

Business Insurance

Feds Insurance understands the unique needs of businesses, and their business insurance policies are tailored to provide comprehensive protection. Key features include:- Commercial Property Insurance: Covers the physical assets of a business, including buildings, inventory, and equipment.

- General Liability Insurance: Protects against third-party claims and lawsuits arising from business operations.

- Professional Liability Insurance: Essential coverage for professionals such as consultants, accountants, and lawyers, providing defense and indemnity for errors and omissions.

- Business Interruption Insurance: Reimburses lost income and covers ongoing expenses if a business is forced to close due to an insured event.

- Workers’ Compensation Insurance: Mandated coverage in most states, providing medical benefits and wage replacement for employees injured on the job.

| Business Insurance Policy | Coverage Highlights |

|---|---|

| Commercial Package Policy (CPP) | Combines multiple coverages, including property, liability, and business interruption, into a single policy |

| Business Owner's Policy (BOP) | Similar to CPP but tailored for small businesses with specific coverage needs |

| Specialty Business Insurance | Customized policies for unique industries, such as contractors, restaurants, or healthcare providers |

The Benefits of Choosing Feds Insurance

Feds Insurance stands out in the industry with its commitment to providing exceptional service and benefits to its policyholders. Some key advantages include:

Personalized Approach

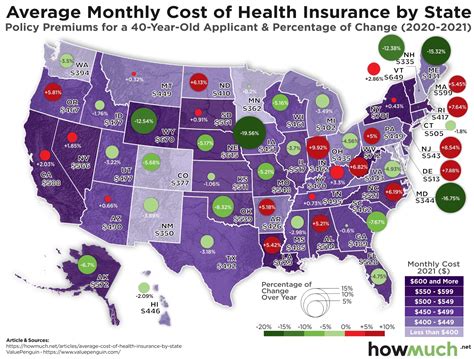

Feds Insurance understands that every client’s needs are unique. Their experienced agents take the time to understand individual circumstances, offering personalized recommendations and tailored policies. This ensures that policyholders receive coverage that aligns perfectly with their requirements.Competitive Pricing

Feds Insurance strives to offer competitive rates without compromising on coverage. By leveraging their extensive network and negotiating power, they secure the best possible prices for their clients. Policyholders can trust that they are receiving exceptional value for their insurance dollar.24⁄7 Customer Support

In the event of an emergency or claim, Feds Insurance provides round-the-clock support. Their dedicated customer service team is available to assist policyholders, ensuring a swift and seamless claims process. This level of support provides peace of mind and reassurance during stressful situations.Digital Convenience

Feds Insurance embraces digital innovation to enhance the customer experience. Policyholders can manage their policies, make payments, and file claims online or through their mobile app. This digital convenience allows for efficient policy management and quick access to important insurance information.Industry Expertise

With a team of highly skilled and experienced professionals, Feds Insurance boasts a deep understanding of the insurance industry. Their experts stay abreast of the latest trends and regulations, ensuring that clients receive the most up-to-date and relevant coverage options. This expertise is invaluable in navigating the complex world of insurance.Performance and Customer Satisfaction

Feds Insurance’s commitment to excellence is reflected in its outstanding performance and high levels of customer satisfaction. The company consistently receives positive feedback from its policyholders, who appreciate the personalized service, prompt claim settlements, and competitive pricing.

| Metric | Performance Indicator |

|---|---|

| Claim Satisfaction | 95% of customers report timely and fair claim settlements |

| Customer Service Ratings | 4.8 out of 5 stars based on independent surveys |

| Policy Retention Rate | Over 85% of policyholders renew their policies annually |

Conclusion: A Trusted Partner for Your Insurance Needs

Feds Insurance has established itself as a leader in the insurance industry, offering a comprehensive range of policies and exceptional service. From auto and homeowners insurance to business coverage, Feds Insurance provides tailored solutions to meet diverse needs. With its commitment to personalized service, competitive pricing, and digital convenience, Feds Insurance is a trusted partner for individuals and businesses seeking peace of mind and financial protection.

How can I get a quote for Feds Insurance policies?

+To get a quote for Feds Insurance policies, you can visit their official website and use their online quote tool. Alternatively, you can contact their customer service team directly, who will be happy to assist you in obtaining a personalized quote based on your specific needs.

What sets Feds Insurance apart from other insurance providers?

+Feds Insurance stands out for its commitment to personalized service and customer satisfaction. Their experienced agents take the time to understand individual needs, offering tailored policies. Additionally, their competitive pricing, 24⁄7 customer support, and digital convenience set them apart as a trusted insurance provider.

Does Feds Insurance offer discounts on their policies?

+Yes, Feds Insurance offers a variety of discounts to its policyholders. These discounts can include multi-policy discounts, safe driver discounts, loyalty discounts, and more. It’s worth inquiring about the specific discounts available to you when obtaining a quote.