Gap Auto Insurance

Welcome to a comprehensive guide on Gap Auto Insurance, a unique and often misunderstood aspect of vehicle protection. This article aims to demystify Gap Insurance, providing an in-depth analysis of its benefits, how it works, and its importance in the automotive insurance landscape. With an increasing number of vehicles on the road, understanding the intricacies of auto insurance is crucial for every vehicle owner.

Understanding Gap Insurance: A Necessary Protection

Gap Insurance, also known as Guaranteed Asset Protection, is a specialized form of coverage designed to bridge the financial gap that can occur when a vehicle is declared a total loss by an insurance company. This situation typically arises when the vehicle’s market value is less than the remaining balance on the financing or lease agreement. Gap Insurance steps in to cover this difference, ensuring policyholders are not left with a significant financial burden.

The Need for Gap Insurance

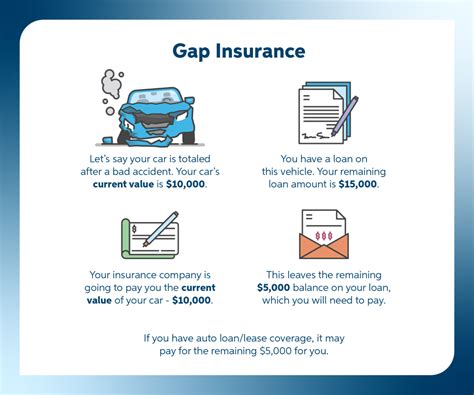

Vehicles, especially new ones, depreciate rapidly in value. This depreciation can outpace the repayment of a loan or lease, leaving a situation where the vehicle’s value is lower than the outstanding debt. In the event of a total loss, where the vehicle is damaged beyond repair or stolen, the insurance company typically pays out based on the vehicle’s current market value. Without Gap Insurance, policyholders could be responsible for paying off the remaining loan or lease balance, even though they no longer have the vehicle.

How Gap Insurance Works

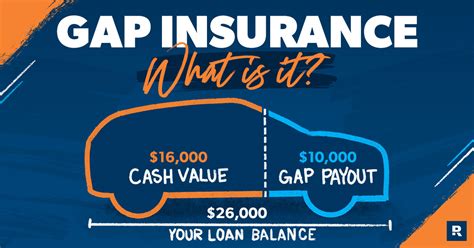

Gap Insurance is an additional policy that can be purchased alongside a standard auto insurance policy. It is designed to cover the difference between the vehicle’s actual cash value (ACV) and the amount owed on the financing or lease agreement. When a total loss is declared, the insurance company will pay out the ACV of the vehicle, and Gap Insurance will cover the remaining balance, up to the policy limit.

For example, if your vehicle is valued at $20,000 but you owe $25,000 on your loan, Gap Insurance would cover the additional $5,000, ensuring you are not left with a financial deficit.

| Scenario | Actual Cash Value | Loan Balance | Gap Insurance Payout |

|---|---|---|---|

| Total Loss | $20,000 | $25,000 | $5,000 |

Benefits of Gap Insurance

Gap Insurance provides several key benefits to vehicle owners:

- Financial Protection: The primary benefit is financial security. Gap Insurance ensures that policyholders are not responsible for paying off a vehicle they no longer own, protecting them from unexpected financial burdens.

- Peace of Mind: Knowing that you have Gap Insurance can provide significant peace of mind, especially for those who have recently purchased a new vehicle or have a high loan-to-value ratio.

- Safety Net for Rapid Depreciation: New vehicles often experience rapid depreciation in the first few years of ownership. Gap Insurance acts as a safety net during this period, covering the potential gap between the vehicle’s value and loan balance.

- Lease Protection: Gap Insurance is particularly beneficial for leaseholders, as it ensures they are not responsible for paying the full lease agreement amount if the vehicle is declared a total loss.

Real-World Applications of Gap Insurance

Let’s explore a couple of real-world scenarios where Gap Insurance can make a significant difference in protecting vehicle owners from financial hardship.

Scenario 1: New Car Financing

Imagine you’ve just purchased a new car, and due to a low down payment and a long loan term, your loan balance is higher than the vehicle’s current market value. In the unfortunate event of a total loss, your standard auto insurance would cover the ACV of the vehicle, but you would still be responsible for the remaining loan balance. This is where Gap Insurance steps in, covering the difference and ensuring you are not left with a large financial burden.

Scenario 2: Lease Agreements

Leaseholders often have high monthly payments and a significant amount of money tied up in the vehicle’s value. If the vehicle is declared a total loss, the leasing company may require the full payment of the remaining lease agreement. Gap Insurance can protect leaseholders from this financial obligation, ensuring they are not held responsible for the full cost of the lease.

Performance Analysis and Comparisons

When comparing Gap Insurance policies, it’s essential to consider the following factors:

- Coverage Limits: Different policies may have varying coverage limits. Ensure the policy you choose provides adequate coverage for your specific needs.

- Premium Costs: Gap Insurance premiums can vary. Compare quotes from multiple providers to find the most competitive rates.

- Policy Terms and Conditions: Read the fine print to understand the specific terms and conditions of the policy, including any exclusions or limitations.

- Provider Reputation: Choose a reputable insurance provider with a solid track record of paying out claims efficiently and fairly.

Gap Insurance vs. Other Coverages

While Gap Insurance is a specialized form of coverage, it is not a substitute for comprehensive or collision insurance. These policies are essential for covering damages to your vehicle, while Gap Insurance steps in to cover the financial gap in the event of a total loss.

Future Implications and Trends

The automotive insurance landscape is evolving, and with it, the role of Gap Insurance. As vehicle financing and leasing become more common, the demand for Gap Insurance is likely to increase. Additionally, as vehicles become more technologically advanced and potentially more expensive to repair, the need for comprehensive insurance coverage, including Gap Insurance, will become even more critical.

Moreover, with the rise of electric vehicles and their unique depreciation patterns, Gap Insurance may become an even more crucial consideration for those investing in this emerging technology.

Potential Developments

- Enhanced Coverage Options: Insurance providers may develop more comprehensive Gap Insurance policies that offer additional benefits, such as coverage for personal belongings in the vehicle or rental car reimbursement.

- Technological Integration: With the advancement of telematics and connected car technologies, Gap Insurance policies could integrate with these systems to provide more accurate and real-time assessments of vehicle values, enhancing the efficiency of claims processes.

- Consumer Education: As the understanding of Gap Insurance and its benefits grows, insurance providers may focus on educating consumers about this coverage, ensuring they are making informed decisions about their vehicle protection.

Is Gap Insurance necessary for all vehicle owners?

+

Gap Insurance is most beneficial for those who are financing or leasing their vehicles, especially if they have a high loan-to-value ratio. It is also recommended for those who drive vehicles that depreciate rapidly, such as new cars.

Can I get Gap Insurance after purchasing my vehicle?

+

In most cases, Gap Insurance must be purchased at the time of vehicle acquisition. However, some providers may offer it as an add-on to your existing policy. It’s best to check with your insurance provider for specific details.

What happens if I sell my vehicle before the Gap Insurance policy expires?

+

If you sell your vehicle and pay off the loan or lease, the Gap Insurance policy is no longer necessary. You can cancel the policy and receive a refund for the unused portion, if applicable.

Does Gap Insurance cover any type of vehicle loss or damage?

+

Gap Insurance is specifically designed to cover the financial gap in the event of a total loss. It does not cover other types of vehicle damage or loss, such as collisions or theft without a total loss declaration.

How much does Gap Insurance typically cost?

+

The cost of Gap Insurance can vary depending on several factors, including the value of your vehicle, the loan or lease balance, and the provider. It’s best to obtain quotes from multiple providers to understand the cost for your specific situation.