General Liability Insurance Costs

General liability insurance is an essential aspect of risk management for businesses, offering financial protection against various claims and lawsuits that could arise during the course of operations. The cost of this insurance is a critical factor for businesses, influencing their overall financial strategy and ability to manage risks effectively. This article aims to delve into the intricacies of general liability insurance costs, exploring the key factors that influence them, the variations across industries, and strategies for optimizing coverage and premiums.

Understanding General Liability Insurance Costs

General liability insurance costs, often referred estrechamente related to the level of risk associated with a business’s operations. The insurance provider assesses the potential risks the business faces and sets the premium accordingly. This assessment considers a range of factors, including the industry the business operates in, its size, the nature of its activities, and its historical claims experience.

For instance, a construction company inherently faces more physical risks compared to a software development firm. Consequently, the insurance premiums for the construction company would likely be higher due to the increased potential for accidents, injuries, or property damage.

Additionally, the size of the business plays a role. Larger businesses with a broader scope of operations and more employees typically face higher insurance costs. This is because they have a greater exposure to potential risks and, consequently, a higher likelihood of claims.

Key Factors Influencing Insurance Costs

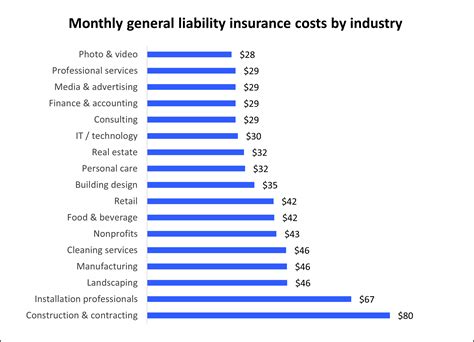

- Industry and Business Type: Different industries have different risk profiles. High-risk industries like construction, manufacturing, or hospitality often face higher insurance costs due to the nature of their operations. On the other hand, low-risk industries like consulting or software development might enjoy lower premiums.

- Claims History: Insurance providers carefully review a business’s claims history. A company with a history of frequent or large claims is likely to be charged higher premiums, as it represents a higher risk to the insurer.

- Policy Coverage and Limits: The level of coverage and the limits chosen by the business significantly impact insurance costs. Higher coverage limits and more comprehensive policies naturally lead to higher premiums.

- Location: The geographic location of a business can influence insurance costs. Certain areas may have higher rates of claims due to factors like crime rates, weather conditions, or local regulations.

- Loss Control Measures: Businesses that implement effective loss control measures and safety protocols may be rewarded with lower insurance costs. These measures demonstrate a commitment to risk management and can lower the likelihood of claims.

Industry-Specific Variations in Insurance Costs

The cost of general liability insurance varies significantly across industries. This variation is primarily driven by the unique risks and challenges associated with each sector.

| Industry | Average Annual Premium | Risk Factors |

|---|---|---|

| Construction | $10,000 - $20,000 | Physical risks, accidents, worker injuries |

| Retail | $5,000 - $15,000 | Customer injuries, product liability |

| Manufacturing | $8,000 - $18,000 | Equipment failure, product defects, worker safety |

| Professional Services | $3,000 - $10,000 | Professional liability, client claims |

| Healthcare | $15,000 - $30,000 | Medical malpractice, patient injuries |

These figures provide a general overview, but actual premiums can vary significantly based on the specific circumstances of each business.

Optimizing Coverage and Managing Costs

Businesses have several strategies at their disposal to optimize their general liability insurance coverage and manage costs effectively.

Risk Assessment and Mitigation

Conducting a thorough risk assessment is the first step. Identify potential hazards and risks specific to your business operations. Once identified, implement measures to mitigate these risks. This could include enhancing safety protocols, improving employee training, or investing in better equipment.

Reviewing and Negotiating Policies

Regularly review your insurance policies to ensure they align with your business’s current needs and risk profile. Discuss with your insurance provider to negotiate better rates, especially if your business has demonstrated a strong track record of safety and low claims.

Bundling Insurance Policies

Consider bundling multiple insurance policies with the same provider. This can often lead to discounts and more favorable rates. Common combinations include general liability insurance with commercial property insurance or business owner’s policies (BOPs), which combine general liability and property insurance.

Loss Control and Safety Programs

Implementing loss control and safety programs can not only reduce the likelihood of claims but also demonstrate to insurers that your business is proactive in managing risks. This can lead to more favorable insurance rates over time.

Comparing Quotes from Multiple Providers

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from multiple providers. Each insurer has its own risk assessment methodologies and pricing structures, so you might find significant variations in premiums for similar coverage.

Future Trends and Implications

The landscape of general liability insurance is evolving, influenced by various factors such as technological advancements, changing regulatory environments, and shifts in consumer behavior. Here’s a glimpse into some of the potential future trends and their implications for insurance costs.

Impact of Technology

Advancements in technology, such as the Internet of Things (IoT) and artificial intelligence (AI), are expected to transform the insurance industry. These technologies can enable more precise risk assessment and real-time monitoring of risks. For businesses, this could mean more accurate insurance premiums based on real-time data, potentially leading to more efficient pricing structures.

Regulatory Changes

Changes in regulations, especially those related to health and safety standards, can significantly impact insurance costs. Stricter regulations may lead to increased compliance costs for businesses, which could be reflected in higher insurance premiums. Conversely, if regulations become more lenient, insurance costs might decrease as the risk profile of certain industries changes.

Shifting Consumer Behavior

Consumer behavior, particularly in terms of their expectations for safety and accountability, can influence insurance costs. For instance, increased awareness about product safety and a higher expectation for transparency may lead to more frequent claims, thereby impacting insurance premiums. Businesses that anticipate and adapt to these shifts in consumer behavior may be better positioned to manage their insurance costs effectively.

Conclusion

General liability insurance costs are a complex interplay of various factors, including industry, business size, claims history, and risk management strategies. By understanding these factors and implementing effective risk management practices, businesses can optimize their insurance coverage and manage costs effectively. As the insurance landscape continues to evolve, staying informed about emerging trends and their potential implications is crucial for businesses to maintain a competitive edge and ensure financial resilience.

How often should I review my general liability insurance policy?

+It is recommended to review your policy annually or whenever there are significant changes in your business operations or structure. Regular reviews ensure your coverage remains adequate and aligned with your current needs.

Can I reduce my insurance costs by increasing my deductible?

+Yes, increasing your deductible (the amount you pay out-of-pocket before the insurance coverage kicks in) can lead to lower premiums. However, this strategy requires careful consideration, as it means you’ll be responsible for a larger portion of any claims.

What are some common exclusions in general liability insurance policies?

+Common exclusions may include professional services, pollution or environmental damage, contractual liabilities, and certain types of personal injury or property damage. It’s important to carefully review your policy’s exclusions to understand what is and isn’t covered.