Good Insurance Plans

In today's world, having a comprehensive insurance plan is essential to protect ourselves and our loved ones from unexpected financial burdens. With a wide array of insurance options available, finding the right plan can be a daunting task. This article aims to guide you through the process, providing valuable insights and expert advice to help you secure the best insurance coverage tailored to your needs.

Understanding Your Insurance Needs

Before diving into the world of insurance plans, it’s crucial to assess your specific requirements. Insurance serves as a safety net, providing financial protection against various life events and risks. By identifying your unique needs, you can make informed decisions and select policies that offer the right coverage.

Consider the following factors when evaluating your insurance needs:

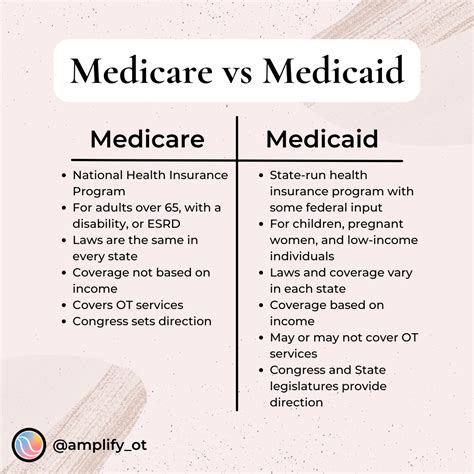

- Health Insurance: Medical expenses can be costly, and health insurance is vital to cover unexpected illnesses or injuries. Assess your family's health history and any pre-existing conditions to determine the level of coverage required.

- Life Insurance: Life insurance provides financial security for your loved ones in the event of your untimely demise. Evaluate your family's financial needs, such as mortgage payments, education expenses, and daily living costs, to determine the appropriate coverage amount.

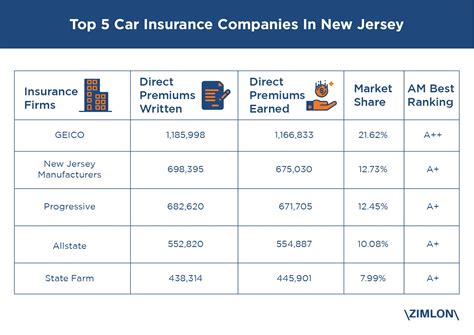

- Auto Insurance: Vehicle ownership comes with its own set of risks. Auto insurance protects you against accidents, theft, and liability claims. Research local laws and regulations to understand the minimum coverage requirements, and consider adding additional coverage for enhanced protection.

- Home Insurance: Whether you own a house or rent an apartment, home insurance is crucial to safeguard your assets and belongings. Assess the replacement value of your home and its contents, and choose a policy that provides adequate coverage for both structural damage and personal property losses.

- Travel Insurance: If you frequently travel, travel insurance can provide peace of mind. It covers a range of travel-related incidents, including trip cancellations, medical emergencies, and lost luggage. Evaluate the destinations you visit and the duration of your trips to select a suitable travel insurance plan.

Comparing Insurance Providers and Plans

Once you have a clear understanding of your insurance needs, it's time to explore the market and compare different providers and plans. Researching and evaluating options is essential to find the best fit for your circumstances.

Here are some key considerations when comparing insurance providers and plans:

- Reputation and Financial Stability: Choose reputable insurance companies with a solid financial standing. Research their history, customer reviews, and financial ratings to ensure they are reliable and capable of honoring claims.

- Coverage Options: Compare the coverage limits, deductibles, and exclusions offered by different plans. Look for policies that provide comprehensive coverage tailored to your specific needs, ensuring you are adequately protected.

- Premium Costs: While cost is an important factor, it should not be the sole determinant. Evaluate the value of the coverage provided in relation to the premium. Remember, the cheapest option may not always offer the best protection.

- Customer Service and Claims Process: Consider the insurance provider's customer service reputation and the ease of their claims process. Efficient and responsive customer service can make a significant difference when you need to file a claim.

- Additional Benefits and Discounts: Explore the extra perks and discounts offered by insurance providers. Some plans may include wellness programs, roadside assistance, or loyalty rewards, which can enhance the overall value of the policy.

Key Features of Good Insurance Plans

When evaluating insurance plans, certain features and characteristics should be considered to ensure you're making an informed decision.

Look for these key features in good insurance plans:

- Comprehensive Coverage: Choose plans that offer a wide range of coverage options, ensuring protection against various risks and scenarios. From medical emergencies to property damage, comprehensive coverage provides peace of mind.

- Customizable Policies: Good insurance plans allow you to tailor the coverage to your specific needs. Whether you require higher limits for certain risks or additional riders for unique circumstances, customizable policies provide flexibility.

- Competitive Pricing: While cost is important, it's essential to balance it with the level of coverage provided. Compare premiums and assess the value of the coverage offered to find a plan that fits your budget without compromising on protection.

- Clear and Transparent Terms: Avoid policies with vague or confusing terms and conditions. Look for insurance providers that offer straightforward and easy-to-understand policies, ensuring you know exactly what you're signing up for.

- Excellent Customer Service: A responsive and supportive customer service team is invaluable when dealing with insurance matters. Choose providers known for their excellent customer service, making it easier to navigate the policy and file claims when needed.

Tips for Choosing the Right Insurance Plan

To make the process of selecting an insurance plan smoother, consider these expert tips:

- Seek Professional Advice: Consult with insurance brokers or financial advisors who can provide personalized recommendations based on your unique circumstances. Their expertise can help you navigate the complex world of insurance and find the best fit.

- Read Reviews and Ratings: Research customer reviews and ratings to gain insights into the experiences of others with the insurance provider. Real-life experiences can offer valuable perspectives on the company's claims process and customer service.

- Compare Multiple Quotes: Obtain quotes from various insurance providers to compare coverage and pricing. This allows you to make an informed decision and find the most competitive rates.

- Understand Exclusions: Carefully review the policy's exclusions to ensure you're aware of any limitations or restrictions. Understanding what is not covered can help you make informed choices and consider additional coverage if needed.

- Consider Long-Term Needs: Insurance is a long-term investment, so consider your future needs and how they may change over time. Select a plan that can adapt to your evolving circumstances, ensuring continuous protection.

The Future of Insurance

The insurance industry is constantly evolving, driven by technological advancements and changing consumer preferences. Here's a glimpse into the future of insurance and how it may impact your coverage options:

Digital Transformation

The digital revolution has transformed the way insurance is purchased and managed. With the rise of online platforms and mobile apps, insurance providers are offering more convenient and accessible services. From online policy applications to digital claims processing, the future of insurance is increasingly digital.

Personalized Insurance

Insurance companies are leveraging data analytics and machine learning to offer personalized insurance plans. By analyzing individual risk factors and behavior patterns, insurers can tailor policies to specific needs, providing more accurate coverage and competitive pricing. This trend is set to continue, with insurance becoming increasingly personalized.

Telematics and Usage-Based Insurance

Telematics technology is transforming the auto insurance industry. Usage-based insurance plans use telematics devices to track driving behavior, rewarding safe drivers with lower premiums. This data-driven approach is expected to gain traction, encouraging safer driving practices and providing more accurate risk assessments.

Insurtech Innovations

Insurtech startups are disrupting the traditional insurance landscape with innovative solutions. From AI-powered claim processing to blockchain-based insurance contracts, these startups are challenging the status quo and offering more efficient and transparent insurance services. The collaboration between established insurers and Insurtech companies is shaping the future of the industry.

Environmental and Social Impact

The insurance industry is increasingly recognizing its role in addressing environmental and social challenges. Insurers are developing sustainable practices, investing in green initiatives, and offering coverage for environmental risks. Additionally, the rise of social impact insurance aims to address societal issues, such as access to healthcare and financial inclusion.

Regulatory Changes and Industry Standards

Regulatory bodies are introducing new standards and guidelines to enhance consumer protection and ensure fair practices. These changes may impact insurance policies, claims processes, and consumer rights. Staying informed about regulatory updates is essential to understand the evolving landscape and your rights as a policyholder.

Conclusion

Finding the right insurance plan is a critical decision that requires careful consideration and research. By understanding your insurance needs, comparing providers and plans, and considering key features, you can secure comprehensive coverage tailored to your unique circumstances. As the insurance industry continues to evolve, embracing digital transformation, personalized insurance, and sustainable practices, you can stay ahead of the curve and ensure your protection for the future.

How much does insurance typically cost?

+The cost of insurance varies widely depending on the type of coverage, the provider, and your specific circumstances. Factors such as age, location, health status, and driving record can impact premiums. It’s best to obtain quotes from multiple providers to compare costs and find the most competitive rates.

Can I bundle my insurance policies to save money?

+Bundling your insurance policies, such as combining auto and home insurance, can often result in significant savings. Many insurance providers offer multi-policy discounts, so it’s worth exploring this option to reduce your overall insurance costs.

What should I do if I need to file an insurance claim?

+If you need to file an insurance claim, contact your insurance provider promptly. They will guide you through the claims process, which typically involves providing documentation and evidence of the incident. It’s essential to follow their instructions and cooperate fully to ensure a smooth claims experience.

Are there any discounts available for insurance policies?

+Yes, insurance providers often offer various discounts to policyholders. Common discounts include multi-policy discounts (bundling multiple policies), safe driver discounts (for auto insurance), loyalty discounts (for long-term customers), and even discounts for certain occupations or affiliations. It’s worth inquiring about available discounts when shopping for insurance.

How can I ensure I have adequate insurance coverage for my business?

+For business owners, it’s crucial to assess the specific risks and liabilities associated with your industry and operations. Consult with insurance professionals who specialize in commercial insurance to tailor a comprehensive coverage plan that protects your business assets, employees, and customers. Regularly review and update your insurance policies to align with any changes in your business.