Home Insurance In Florida

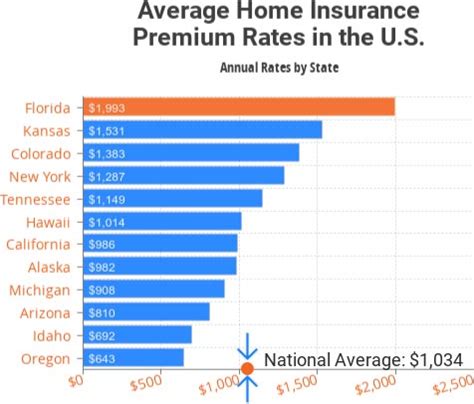

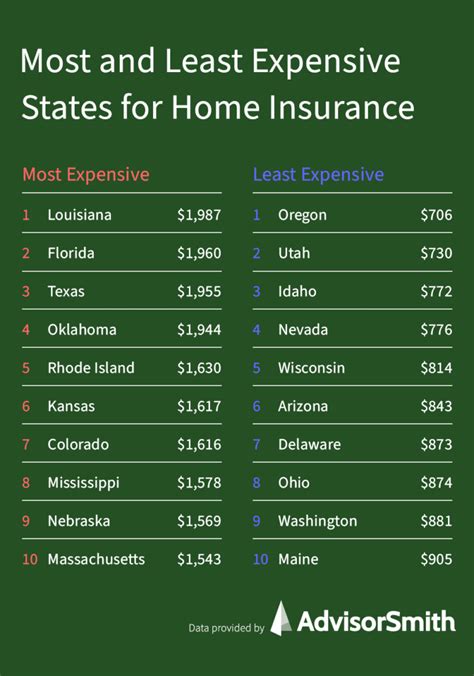

Florida, known for its vibrant culture, diverse ecosystems, and stunning beaches, also faces unique challenges when it comes to home insurance. With its tropical climate and susceptibility to natural disasters like hurricanes, floods, and storms, finding adequate and affordable home insurance coverage can be a complex task for residents.

In this comprehensive guide, we delve into the intricacies of home insurance in Florida, offering expert insights and practical advice to help Floridians navigate this essential aspect of homeownership. From understanding the specific risks in the Sunshine State to exploring coverage options and negotiating the best rates, we aim to provide a clear roadmap for securing peace of mind and financial protection.

Understanding the Risks: A Florida-Specific Perspective

Florida’s geography and climate present a distinct set of risks that significantly influence home insurance policies and rates. Let’s break down these factors and their implications.

Hurricane and Windstorm Coverage

Florida’s proximity to the Atlantic Ocean and the Gulf of Mexico makes it a prime target for hurricanes. These powerful storms can cause extensive damage to homes, from roof damage to flooding and complete destruction. As a result, hurricane coverage is a critical component of home insurance policies in Florida.

However, obtaining hurricane coverage can be challenging. Many standard home insurance policies in Florida exclude windstorm damage, requiring homeowners to purchase separate windstorm endorsements or windstorm policies. These policies typically have higher deductibles and may have limitations on coverage, especially in high-risk areas.

Additionally, the Florida market has seen significant changes in recent years. Some insurers have withdrawn from the state due to the high risk and cost of covering hurricanes, while others have implemented stricter underwriting guidelines and higher premiums. This has led to a more challenging environment for homeowners seeking comprehensive coverage.

Flood Insurance: A Necessary Addition

Flooding is another significant risk in Florida, with the state experiencing frequent and severe floods due to its low-lying areas and heavy rainfall. Standard home insurance policies typically do not cover flood damage, so it is essential to consider flood insurance as a separate policy.

The Federal Emergency Management Agency (FEMA) manages the National Flood Insurance Program (NFIP), which provides flood insurance to homeowners, renters, and business owners. However, it's important to note that NFIP policies have coverage limits and may not provide the level of protection needed for high-value homes. Private flood insurance policies may offer more comprehensive coverage, but they can be expensive.

Determining whether you need flood insurance depends on various factors, including your location, the value of your home, and your tolerance for risk. It's advisable to consult with an insurance professional to assess your specific needs and find the best flood insurance option.

Other Natural Hazards

Beyond hurricanes and floods, Florida residents must also consider other natural hazards that can impact their homes. These include:

- Tornadoes: Florida experiences a significant number of tornadoes each year, especially during the summer months. While tornadoes may not be as frequent or as powerful as in other parts of the country, they can still cause substantial damage to homes.

- Wildfires: While wildfires are more commonly associated with western states, Florida does have wildfire risks, particularly in areas with dense vegetation and during periods of drought.

- Sinkholes: Florida is known for its unique geological features, including sinkholes. These natural depressions in the earth's surface can cause significant damage to homes, especially if they occur under or near a property.

It's important to review your home insurance policy to ensure that it provides adequate coverage for these additional natural hazards. Some insurers may offer specific endorsements or policies to address these risks, while others may have limitations or exclusions.

Coverage Options: Navigating the Florida Market

Given the unique risks and challenges in Florida, understanding the coverage options available is crucial for homeowners. Let’s explore the different types of home insurance policies and the factors to consider when choosing the right coverage.

HO-3 Policy: The Standard Option

The HO-3 policy is the most common type of home insurance in Florida and across the United States. It provides comprehensive coverage for your home and personal belongings, including protection against:

- Fire

- Theft

- Vandalism

- Wind damage (excluding hurricanes)

- Liability for accidents on your property

The HO-3 policy typically covers the structure of your home and its contents, including furniture, appliances, and personal items. However, as mentioned earlier, it may exclude windstorm and hurricane damage, requiring a separate endorsement or policy.

The HO-3 policy is often a good starting point for homeowners, as it provides a broad range of coverage at a relatively affordable rate. However, it's important to review the policy's exclusions and limitations to ensure it meets your specific needs.

HO-5 Policy: Enhanced Coverage for High-Value Homes

For homeowners with high-value properties or those seeking more comprehensive coverage, the HO-5 policy is an excellent option. This policy, also known as a premium policy or comprehensive policy, provides broader coverage than the HO-3 policy and includes additional benefits.

The HO-5 policy typically covers:

- All risks not specifically excluded, providing more comprehensive protection.

- Personal belongings with a higher coverage limit, allowing for the replacement of more expensive items.

- Additional living expenses if your home becomes uninhabitable due to a covered loss.

- Increased liability coverage, providing greater financial protection in case of accidents on your property.

The HO-5 policy is ideal for homeowners who want peace of mind and enhanced protection for their valuable assets. However, it's important to note that this policy may have higher premiums due to the increased coverage.

Other Policy Options

In addition to the HO-3 and HO-5 policies, there are other types of home insurance policies available in Florida, each with its own set of advantages and limitations.

- HO-8 Policy: Designed for older homes or homes with unique architectural features, the HO-8 policy provides coverage based on the home's actual cash value rather than its replacement cost. This policy is often more affordable but may not provide sufficient coverage for high-value items.

- Dwelling Fire Policy: This policy primarily covers the structure of your home and is suitable for rental properties or homes that are unoccupied for extended periods. It typically excludes coverage for personal belongings and liability.

- Condo Insurance: If you own a condo, you'll need a condo insurance policy to cover your unit's interior and personal belongings. This policy complements the master policy provided by the condo association, which typically covers the building's exterior and common areas.

When choosing a home insurance policy, it's essential to consider your specific needs, the value of your home and belongings, and the risks you face. Consulting with an insurance professional can help you navigate these options and find the best coverage for your situation.

Assessing Your Needs: A Personalized Approach

Every homeowner in Florida has unique circumstances and requirements when it comes to home insurance. To ensure you have the right coverage, it’s crucial to assess your specific needs and tailor your policy accordingly.

The Value of Your Home and Belongings

The first step in determining your insurance needs is to assess the value of your home and its contents. This includes the cost to rebuild your home if it were completely destroyed, as well as the replacement cost of your personal belongings.

It's important to note that the market value of your home, which is what you could sell it for, is not the same as the replacement cost. The replacement cost considers the current cost of labor and materials to rebuild your home to its original condition. It's advisable to consult with a professional, such as a contractor or insurance adjuster, to accurately estimate the replacement cost.

Once you have a clear understanding of the replacement cost, you can ensure that your home insurance policy provides sufficient coverage. It's essential to review and update this estimate periodically, especially if you make significant improvements or upgrades to your home.

Personal Belongings and High-Value Items

In addition to the structure of your home, you’ll want to consider the value of your personal belongings. Standard home insurance policies provide coverage for personal property, but there may be limits on the amount and types of items covered.

For example, standard policies may have limits on the coverage for high-value items such as jewelry, art, collectibles, or electronics. If you have valuable possessions, it's crucial to review your policy's coverage limits and consider adding additional coverage through personal articles policies or endorsements to ensure these items are adequately protected.

It's also important to regularly review and update your inventory of personal belongings, especially after making significant purchases or acquiring new valuable items. This will help ensure that your insurance coverage remains up-to-date and provides adequate protection.

Liability and Additional Living Expenses

Home insurance policies typically include liability coverage, which provides protection if someone is injured on your property or if you are held legally responsible for causing damage or injury to others.

It's important to consider the limits of your liability coverage and whether they are sufficient for your needs. Higher liability limits can provide greater financial protection in case of a serious accident or lawsuit. Consulting with an insurance professional can help you assess your liability risks and determine the appropriate coverage limits.

Additionally, home insurance policies often include coverage for additional living expenses if your home becomes uninhabitable due to a covered loss. This coverage reimburses you for the cost of temporary housing, meals, and other necessary expenses while your home is being repaired or rebuilt. Reviewing the limits and duration of this coverage is essential to ensure it meets your needs in the event of a disaster.

Securing the Best Rates: Strategies for Florida Homeowners

Finding affordable home insurance in Florida can be a challenge, given the state’s unique risks and the dynamic insurance market. However, there are strategies you can employ to secure the best rates while still obtaining adequate coverage.

Shop Around and Compare Quotes

One of the most effective ways to find the best home insurance rates is to shop around and compare quotes from multiple insurers. The Florida insurance market is highly competitive, and rates can vary significantly between companies. By obtaining quotes from several providers, you can identify the most competitive options and negotiate better rates.

When comparing quotes, be sure to consider not only the price but also the coverage offered. Look for policies that provide the protection you need at a reasonable cost. It's also essential to review the policy's exclusions and limitations to ensure you understand what is and isn't covered.

Utilize Discounts and Savings

Many insurance companies offer discounts and savings opportunities that can help reduce your premiums. Here are some common discounts you may be eligible for:

- Multi-Policy Discount: Insuring your home and other assets, such as your car or boat, with the same insurer can often result in significant savings. This is known as a multi-policy discount or bundling discount.

- Loyalty Discount: Some insurers offer discounts to long-term customers as a reward for their loyalty. If you've been with the same insurer for several years, it's worth asking about loyalty discounts.

- Safety and Security Discounts: Installing security systems, smoke detectors, and fire extinguishers in your home can qualify you for discounts. These safety measures reduce the risk of accidents and losses, making you a more attractive customer to insurers.

- Claim-Free Discount: Insurers often reward homeowners who have a clean claims history with discounts. If you haven't filed any claims in a certain period, you may be eligible for this type of discount.

It's important to ask your insurance agent or broker about the discounts available and how you can qualify for them. By taking advantage of these savings opportunities, you can reduce your home insurance premiums significantly.

Consider Deductibles and Coverage Limits

The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can often lower your insurance premiums. However, it’s essential to choose a deductible that you can afford in the event of a claim.

Similarly, adjusting your coverage limits can impact your premiums. For example, if you have valuable possessions, increasing the coverage limits for personal property can provide more protection but may result in higher premiums. It's a delicate balance between adequate coverage and affordability.

When making these decisions, it's crucial to consult with an insurance professional who can guide you through the process and help you find the right balance between coverage and cost.

Maintain a Good Credit Score

Your credit score can play a significant role in determining your home insurance rates. Insurers often use credit-based insurance scores to assess the risk of insuring a homeowner. A higher credit score can indicate that you are more likely to manage your finances responsibly and may result in lower insurance premiums.

It's important to regularly review your credit report and take steps to improve your credit score if needed. This includes paying bills on time, reducing credit card debt, and correcting any errors on your credit report. By maintaining a good credit score, you can potentially save money on your home insurance premiums.

The Role of an Insurance Agent or Broker

Navigating the complexities of home insurance in Florida can be challenging, and that’s where an insurance agent or broker can provide valuable assistance.

Expertise and Guidance

Insurance agents and brokers are professionals who specialize in understanding the intricacies of insurance policies and the Florida market. They can provide expert guidance and advice tailored to your specific needs and circumstances.

An insurance professional can help you:

- Understand the coverage options available and recommend the best policies for your situation.

- Navigate the application process and ensure you provide accurate information to obtain the most favorable rates.

- Review your policy annually to ensure it remains up-to-date and provides adequate coverage.

- Advocate on your behalf in the event of a claim, helping you navigate the process and ensuring you receive the full benefits of your policy.

Shopping for the Best Rates

One of the key advantages of working with an insurance agent or broker is their ability to shop around for the best rates on your behalf. They have established relationships with multiple insurers and can quickly compare quotes to find the most competitive options.

Insurance professionals can also negotiate with insurers on your behalf, potentially securing better rates and coverage. They understand the market and can leverage their expertise to advocate for your interests.

Claims Assistance

In the event of a claim, an insurance agent or broker can be an invaluable resource. They can guide you through the claims process, helping you understand your policy’s coverage and ensuring you receive the benefits you’re entitled to.

Insurance professionals can assist with:

- Preparing and submitting your claim, including gathering the necessary documentation.

- Communicating with the insurance company on your behalf to expedite the claims process.

- Negotiating with the insurer to ensure you receive fair compensation for your losses.

- Providing support and guidance throughout the claims process, helping you navigate any challenges that may arise.

Having an insurance agent or broker on your side can provide peace of mind and ensure that you receive the full benefits of your home insurance policy.

Preparing for the Unexpected: Disaster Preparedness

Florida’s susceptibility to natural disasters underscores the importance of disaster preparedness. Being prepared can help mitigate the impact of a disaster and facilitate a smoother recovery process.

Create a Disaster Preparedness Plan

Developing a comprehensive disaster preparedness plan is crucial for homeowners in Florida. Here are some key steps to consider:

- Identify Potential Hazards: Assess the specific risks in your area, such as hurricanes, floods, tornadoes, or wildfires. Understand the warning signs and be aware of the potential impact on your home and belongings.

- Create an Emergency Kit: Assemble a kit with essential supplies, including non-perishable food, water, a first-aid kit, flashlights, batteries, and any necessary medications. Ensure your kit is easily accessible and regularly updated.

- Develop an Evacuation Plan: In the event of a severe storm or disaster, you may need to evacuate your home. Create a plan that includes multiple routes and destinations, and ensure all family members are aware of the plan.

- Secure Your Home: Take steps to reinforce your home against potential disasters. This may include installing hurricane shutters, reinforcing garage doors, and ensuring your roof is in good condition. Regular maintenance can help