Home Insurance Tampa Fl

Home insurance is an essential aspect of protecting your investment and ensuring peace of mind for homeowners in Tampa, Florida. The unique weather patterns and environmental factors in this vibrant city necessitate a comprehensive understanding of home insurance coverage. This article delves into the intricacies of home insurance in Tampa, offering expert insights and practical advice to guide homeowners in making informed decisions.

Understanding the Tampa Home Insurance Landscape

The Tampa Bay area, with its beautiful beaches and thriving metropolis, presents a unique set of risks that influence the home insurance market. From the frequent tropical storms and hurricanes to the occasional wildland fires, Tampa homeowners face a range of challenges that require tailored insurance solutions.

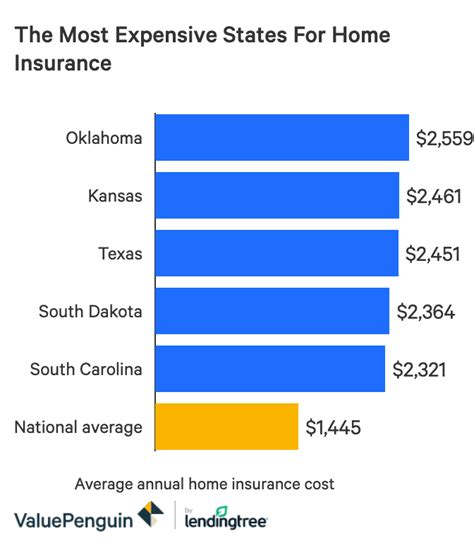

The average cost of home insurance in Tampa, Florida, can vary significantly depending on several factors. These include the location and size of the home, the coverage limits chosen, and the deductible amount. According to recent data, the average premium for a standard home insurance policy in Tampa is approximately $2,500 per year. However, this figure can range from as low as $1,500 to over $4,000, depending on the specific circumstances.

It's important to note that Tampa is located in a high-risk hurricane zone, which significantly impacts insurance rates. Properties in coastal areas or flood-prone zones may incur higher premiums due to the increased likelihood of storm damage. Additionally, the age and construction type of the home, as well as any recent claims history, can influence the cost of insurance.

Coverage Options for Tampa Homes

When selecting home insurance in Tampa, it’s crucial to understand the various coverage options available. These include:

- Dwelling Coverage: Protects the physical structure of your home against damage or destruction caused by perils such as fire, windstorms, and theft.

- Personal Property Coverage: Covers the contents of your home, including furniture, appliances, and personal belongings, against similar perils.

- Liability Coverage: Provides protection if someone is injured on your property or if you are held responsible for causing property damage to others.

- Additional Living Expenses: Covers temporary living expenses if your home becomes uninhabitable due to an insured event.

- Flood Insurance: A separate policy is often necessary to cover flood damage, as standard home insurance policies typically exclude this peril.

Each of these coverage options can be tailored to meet the specific needs of Tampa homeowners, taking into account the unique risks and challenges faced in the region.

Customizing Your Home Insurance Policy

To ensure your home insurance policy adequately protects your investment, it’s essential to customize it to your specific needs. Here are some factors to consider:

- Replacement Cost vs. Actual Cash Value: Choose replacement cost coverage to ensure you receive the full amount needed to rebuild your home, even if it exceeds your policy limits. Actual cash value coverage, on the other hand, pays out the cost of replacing your home minus depreciation.

- Deductibles: Opting for a higher deductible can lower your premium, but it's important to ensure you can afford the out-of-pocket expense should a claim arise.

- Additional Coverage Endorsements: Consider adding endorsements to your policy to cover specific risks, such as water backup, sinkhole damage, or identity theft.

- Bundle and Save: Many insurance companies offer discounts when you bundle your home and auto insurance policies together.

Working closely with a reputable insurance agent who understands the Tampa market can help you navigate these customization options and ensure you have the right coverage at a competitive price.

Choosing the Right Home Insurance Provider

With numerous insurance companies operating in the Tampa area, selecting the right provider can be a daunting task. Here are some key considerations to help you make an informed decision:

Financial Stability and Reputation

Look for insurance companies with a strong financial rating, indicating their ability to pay claims even in the face of large-scale disasters. Reputable companies will have a track record of prompt and fair claim settlements.

Coverage Options and Customization

Ensure the provider offers a comprehensive range of coverage options tailored to the specific risks in Tampa. They should also provide flexibility in customizing your policy to meet your unique needs.

Claim Handling Process

Research the provider’s claim handling process, including their response time, customer service reputation, and the ease of filing and managing claims. Online reviews and testimonials can provide valuable insights into the customer experience.

Discounts and Bundling Options

Explore the discounts and bundling options available to reduce your premium. Many providers offer discounts for factors such as home security systems, multiple policies, or loyalty.

Local Presence and Expertise

Consider working with an insurance agency that has a local presence in Tampa. Local agents often have a deeper understanding of the unique risks and can provide more personalized service.

Filing a Home Insurance Claim in Tampa

In the event of a covered loss, knowing how to file a home insurance claim efficiently is crucial. Here’s a step-by-step guide:

- Contact Your Insurance Company: Report the claim as soon as possible, providing details of the damage and any immediate steps taken to prevent further loss.

- Document the Damage: Take photos and videos of the damage, both inside and outside your home. These will be valuable when assessing the extent of the loss.

- Prepare an Inventory: Make a list of damaged or destroyed personal belongings, including their estimated value. Receipts or appraisals can help support your claim.

- Cooperate with the Claims Adjuster: Work closely with the assigned claims adjuster, providing any requested information or documentation in a timely manner.

- Review the Estimate: Once the adjuster has assessed the damage, review the repair or replacement estimate carefully. If you disagree with any aspect, discuss it with your adjuster.

- Choose Your Repair Contractors: You have the right to choose your own contractors for repairs. Ensure they are licensed and reputable, and obtain multiple estimates to compare prices.

- Stay in Communication: Keep in regular contact with your insurance company throughout the claims process. Promptly respond to any requests for additional information or documentation.

Remember, while the claims process can be complex, a well-prepared and cooperative approach can help ensure a smoother and more satisfactory outcome.

Tips for Lowering Your Tampa Home Insurance Costs

While home insurance is a necessary expense, there are strategies you can employ to reduce your premiums. Here are some tips to consider:

- Increase Your Deductible: Opting for a higher deductible can lower your premium, but ensure you can afford the out-of-pocket expense in the event of a claim.

- Bundle Policies: Many insurance companies offer discounts when you bundle your home and auto insurance policies together.

- Enhance Home Security: Installing a monitored security system, smoke detectors, and fire extinguishers can lead to insurance discounts.

- Maintain Your Home: Regularly maintaining your home, such as keeping the roof in good condition and addressing any potential water damage issues promptly, can help prevent costly repairs and reduce insurance costs.

- Shop Around: Compare quotes from multiple insurance companies to ensure you're getting the best rate for your specific circumstances.

By implementing these strategies and working with a reputable insurance agent, you can find the right balance between comprehensive coverage and affordable premiums for your Tampa home.

The Impact of Climate Change on Tampa Home Insurance

Climate change is an increasingly significant factor influencing home insurance rates in Tampa. With rising sea levels and more frequent and intense storms, the risk of flood and wind damage has escalated. Insurance companies are adjusting their rates and coverage options to account for these changing risks.

Homeowners in Tampa should be aware of these shifts and ensure their policies adequately cover the new realities of climate change. This may involve adding flood insurance or increasing coverage limits for wind damage. Staying informed about local climate change impacts and their insurance implications is crucial for Tampa residents.

Conclusion: Navigating Tampa’s Home Insurance Landscape

Home insurance in Tampa, Florida, is a complex but vital aspect of homeownership. By understanding the unique risks and challenges faced in this region, customizing your policy to meet your specific needs, and choosing a reputable insurance provider, you can ensure your home is adequately protected. With the right coverage and a proactive approach to risk management, Tampa homeowners can enjoy peace of mind knowing they are prepared for whatever the future holds.

What are the common causes of home insurance claims in Tampa?

+In Tampa, the most common causes of home insurance claims include wind and storm damage, water damage from plumbing issues or roof leaks, and theft or vandalism. The region’s frequent tropical storms and hurricanes also contribute to a higher incidence of wind-related claims.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually or anytime your circumstances change, such as after a major renovation, adding a family member, or acquiring valuable possessions. Regular reviews ensure your coverage remains up-to-date and adequate for your needs.

Can I negotiate my home insurance rates?

+While insurance rates are largely based on standardized formulas, you can negotiate with your insurance provider by discussing your specific circumstances and risk factors. Providing evidence of risk mitigation measures, such as security systems or storm-proof improvements, can sometimes lead to lower premiums.