Homeowners Insurance Usa

Homeownership is a significant milestone for many Americans, and protecting that investment is crucial. Homeowners insurance is a vital component of responsible homeownership, offering financial protection and peace of mind. In the United States, the homeowners insurance market is diverse and complex, catering to the varied needs and risks faced by homeowners across the nation. This article delves into the intricacies of homeowners insurance in the USA, exploring its importance, coverage options, and the factors influencing policy costs.

Understanding Homeowners Insurance

Homeowners insurance is a form of property insurance that provides financial protection against losses and damages to an individual’s home and its contents. It is designed to safeguard homeowners from the financial burden of unforeseen events, such as natural disasters, theft, or accidents. In the USA, where weather conditions can be extreme and varied, and the risk of property damage is relatively high, homeowners insurance is not just a wise choice but often a necessity.

Key Components of Homeowners Insurance

Homeowners insurance typically covers a range of perils, including fire, lightning, windstorm, hail, explosion, riot, civil commotion, vandalism, theft, and more. However, it’s important to note that standard policies often exclude certain natural disasters, such as earthquakes and floods, requiring separate coverage.

Additionally, homeowners insurance provides liability coverage, which protects the policyholder from lawsuits arising from injuries or property damage caused by the homeowner or their family members on the insured premises. This coverage is particularly crucial as it can provide financial security in situations where a visitor or passerby is injured on the insured property.

The Importance of Adequate Coverage

Choosing the right homeowners insurance policy is critical to ensure comprehensive protection. It’s not just about finding the cheapest option but rather selecting a policy that aligns with your specific needs and the unique characteristics of your home and its surroundings.

Consider the replacement cost of your home and its contents. A standard policy typically covers the cost to rebuild your home, but it’s important to ensure that the coverage amount is sufficient. In some cases, rebuilding costs can exceed the original construction cost due to increases in labor and material prices. An underinsured homeowner could face significant financial strain if they need to rebuild their home after a covered loss.

Personal Property Coverage

Homeowners insurance also covers personal property, such as furniture, appliances, electronics, and clothing. However, the coverage amount is often a percentage of the dwelling coverage, typically 50-70%. It’s essential to review your policy to understand the coverage limits and any specific exclusions for high-value items like jewelry or artwork.

If you have valuable possessions, you might consider scheduling them on your policy to ensure they are adequately insured. This means listing each item separately with its value and providing proof of ownership, such as receipts or appraisals. Scheduled personal property coverage can provide more comprehensive protection for high-value items, ensuring they are replaced at their full value in the event of a covered loss.

Factors Influencing Homeowners Insurance Costs

The cost of homeowners insurance can vary significantly based on several factors. Understanding these factors can help homeowners make informed decisions and potentially save money on their insurance premiums.

Location

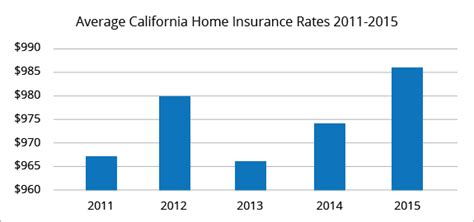

One of the most significant factors influencing homeowners insurance costs is the location of the property. Areas prone to natural disasters, such as hurricanes, tornadoes, or wildfires, generally have higher insurance rates. This is because insurance companies factor in the increased risk of claims in these areas when setting their premiums.

For example, states like Florida, Texas, and California, which are frequently affected by hurricanes and wildfires, tend to have higher homeowners insurance rates. Similarly, regions with a high crime rate or a history of severe weather events may also see increased insurance costs.

Home Construction and Age

The construction and age of your home can also impact your insurance rates. Homes built with modern, fire-resistant materials may be eligible for lower rates, as they are less susceptible to certain types of damage. Additionally, newer homes are often constructed to higher standards and may have more advanced safety features, such as sprinkler systems or fire alarms, which can also reduce insurance costs.

On the other hand, older homes may require more extensive coverage due to potential issues with outdated electrical or plumbing systems. These homes may also be more susceptible to certain types of damage, such as water leaks or roof damage, which can lead to higher insurance costs.

Coverage Limits and Deductibles

The coverage limits and deductibles you choose can significantly impact your insurance premium. Higher coverage limits typically result in higher premiums, as the insurance company is taking on more risk. Similarly, selecting a lower deductible can increase your premium, as you are shifting more of the financial responsibility to the insurance company in the event of a claim.

It’s important to find a balance between coverage and cost. Choosing too low of a coverage limit or too high of a deductible can leave you financially vulnerable in the event of a claim. On the other hand, selecting unnecessarily high coverage limits or a low deductible can result in unnecessary expense.

Tips for Lowering Homeowners Insurance Costs

While homeowners insurance is a necessary expense, there are strategies to potentially reduce your premiums without sacrificing coverage.

Bundle Policies

Many insurance companies offer discounts when you bundle multiple policies together. For example, if you have auto insurance with the same provider as your homeowners insurance, you may be eligible for a discount on both policies. This is known as a multi-policy discount and can save you a significant amount on your premiums.

Improve Home Security

Investing in home security features, such as deadbolt locks, security systems, or fire alarms, can make your home less susceptible to theft or damage. Insurance companies often offer discounts for homes with these features, as they reduce the risk of claims. Additionally, if you live in an area with a high crime rate, these security measures can be particularly beneficial in lowering your insurance costs.

Review and Update Your Policy Regularly

It’s important to review your homeowners insurance policy regularly, especially after significant life events or changes to your home. For example, if you’ve made improvements to your home, such as adding a new wing or upgrading your kitchen, you should update your policy to ensure these improvements are adequately insured.

Additionally, if your personal circumstances change, such as getting married, having children, or purchasing expensive items, your insurance needs may also change. Reviewing your policy annually can help ensure you have the right level of coverage and that you’re not paying for unnecessary coverage.

| Policy Type | Coverage Limits | Deductible Options |

|---|---|---|

| Standard Homeowners Policy (HO-3) | Covers dwelling and personal property up to policy limits | Typically $500 - $2,000 |

| High-Value Homeowners Policy | Covers high-value homes and their contents | Usually higher deductibles for reduced premiums |

| Condominium Owners Policy | Covers interior unit and personal property | Similar to standard policies |

Frequently Asked Questions

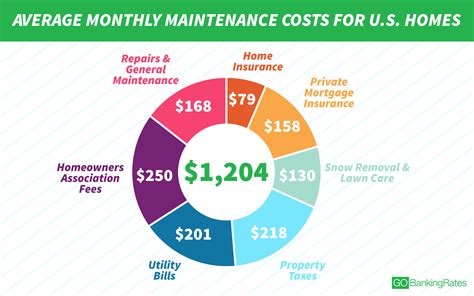

What is the average cost of homeowners insurance in the USA?

+

The average cost of homeowners insurance in the USA varies significantly based on location, the value of the home, and the coverage limits. According to industry data, the national average for annual homeowners insurance premiums is around 1,200. However, this can range from as low as 500 to over $3,000 depending on the factors mentioned.

How often should I review my homeowners insurance policy?

+

It is recommended to review your homeowners insurance policy annually or whenever there are significant changes to your home or personal circumstances. This ensures that your coverage remains adequate and that you are not overpaying for unnecessary coverage.

What is the difference between actual cash value and replacement cost coverage?

+

Actual cash value (ACV) coverage pays for the cost of replacing your property minus depreciation. In contrast, replacement cost coverage pays the full cost of replacing your property without deducting for depreciation. Replacement cost coverage is generally more expensive but provides more comprehensive protection.

Are there any discounts available for homeowners insurance?

+

Yes, many insurance companies offer discounts for homeowners insurance. These can include multi-policy discounts (when you bundle homeowners and auto insurance), loyalty discounts, security system discounts, and more. It’s worth shopping around and asking about available discounts to potentially save on your premiums.

What should I do if I need to file a claim with my homeowners insurance?

+

If you need to file a claim, it’s important to contact your insurance company as soon as possible. They will guide you through the claims process, which typically involves providing details about the incident, documenting the damages, and submitting an official claim form. It’s beneficial to have your policy details and any relevant documents readily available.