How Much Is Car Insurance Per Month

Car insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind for drivers. The cost of car insurance can vary significantly based on numerous factors, making it essential for car owners to understand the components that influence their insurance premiums. In this comprehensive guide, we will delve into the world of car insurance, exploring the average costs, the factors that impact premiums, and strategies to find the best coverage at the most affordable rates.

Understanding Car Insurance Premiums

Car insurance premiums, or the monthly or annual cost of insurance coverage, are determined by a complex interplay of various factors. These factors can differ from one insurance provider to another, but some common elements include the driver’s age, gender, and driving history. Additionally, the type of vehicle, its age, and the level of coverage desired all play a role in determining the cost of insurance.

Average Monthly Premiums

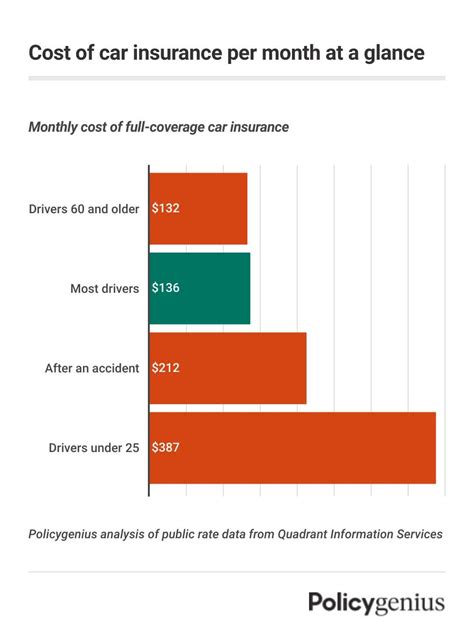

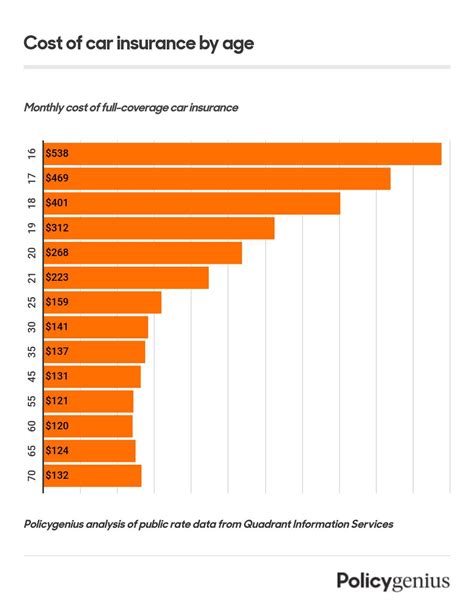

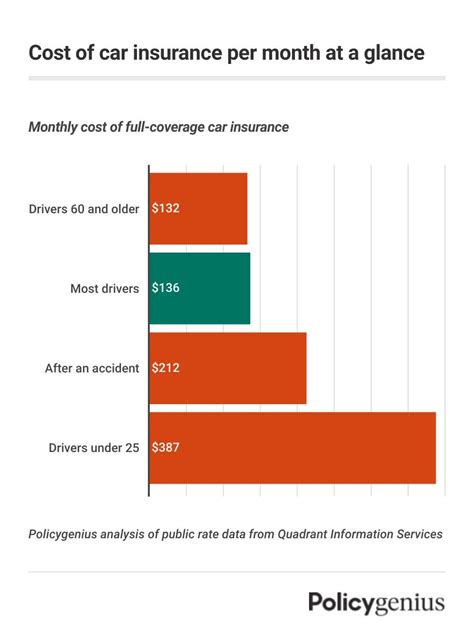

The average monthly car insurance premium in the United States is approximately $150, but this figure can vary significantly based on individual circumstances. For instance, younger drivers often face higher premiums due to their lack of driving experience, while older, more experienced drivers may enjoy lower rates. Gender can also impact premiums, with some insurance companies charging slightly different rates for male and female drivers.

| Age Group | Average Monthly Premium |

|---|---|

| 18-24 years | $200-$250 |

| 25-34 years | $175-$225 |

| 35-54 years | $150-$175 |

| 55+ years | $125-$150 |

Factors Influencing Car Insurance Costs

Several key factors contribute to the cost of car insurance. Understanding these factors can help drivers make informed decisions when choosing an insurance policy and potentially lower their premiums.

1. Driver’s Profile

The personal characteristics of the driver are a significant influence on insurance premiums. Age is a critical factor, with younger drivers often facing higher premiums due to their increased risk of accidents. Gender can also play a role, with some insurance companies charging different rates based on statistical differences in driving behavior and accident rates between males and females.

2. Driving History

Your driving record is a major determinant of your insurance premium. A clean driving history with no accidents or traffic violations can lead to lower premiums, as it indicates a lower risk for the insurance company. Conversely, a history of accidents or moving violations can result in higher premiums or even non-renewal of your policy.

3. Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance costs. Vehicle make and model are important factors, as some vehicles are statistically more prone to accidents or theft, leading to higher insurance rates. Vehicle usage, such as whether it’s used for commuting, pleasure, or business, can also affect premiums. Additionally, the vehicle’s age and value influence the cost of comprehensive and collision coverage, which pay for repairs or replacements in case of accidents or other incidents.

4. Coverage and Deductibles

The level of coverage you choose will directly affect your insurance premiums. Comprehensive coverage, which covers damages caused by events other than collisions (such as theft, fire, or natural disasters), and collision coverage, which covers damages to your vehicle in an accident, generally cost more than liability-only coverage. Higher deductibles (the amount you pay out-of-pocket before your insurance kicks in) can lower your monthly premiums, but they also mean you’ll have to pay more if you file a claim.

5. Location and Driving Environment

Where you live and drive can impact your insurance premiums. Urban areas often have higher premiums due to increased traffic congestion and a higher likelihood of accidents. Weather conditions and the risk of natural disasters in your area can also influence rates. Additionally, theft rates and the density of insurance claims in your region can affect your premiums.

6. Insurance Company and Policy Options

Different insurance companies offer varying rates and policy options. It’s essential to shop around and compare quotes from multiple providers to find the best deal. Additionally, bundling multiple policies, such as car and home insurance, can often result in significant savings.

Tips for Reducing Car Insurance Costs

While car insurance is a necessary expense, there are several strategies you can employ to potentially reduce your premiums and find the best coverage at the most affordable rate.

1. Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Compare rates from multiple providers to find the best deal. Online comparison tools can be a great starting point, but don’t forget to also get quotes directly from insurance companies to ensure you’re getting the most accurate and up-to-date information.

2. Maintain a Good Driving Record

A clean driving record is one of the best ways to keep your insurance premiums low. Avoid traffic violations and prevent accidents as much as possible. If you have a history of accidents or violations, consider taking a defensive driving course to improve your driving skills and potentially reduce your premiums.

3. Choose the Right Coverage and Deductibles

Select the coverage that suits your needs and budget. If you have an older vehicle with low value, you might consider dropping collision and comprehensive coverage to save on premiums. Remember, higher deductibles can lower your monthly payments, but be sure you can afford the deductible in case of a claim.

4. Take Advantage of Discounts

Insurance companies often offer various discounts that can lower your premiums. Common discounts include safe driver discounts, good student discounts, bundling discounts (for having multiple policies with the same insurer), and loyalty discounts for long-term customers. Ask your insurance provider about available discounts and see if you qualify for any.

5. Consider Telematics or Usage-Based Insurance

Some insurance companies offer telematics or usage-based insurance programs that track your driving behavior and offer discounts based on safe driving practices. These programs can be a great option for good drivers who want to further demonstrate their low-risk profile and potentially save on insurance costs.

Conclusion: Finding Affordable Car Insurance

Understanding the factors that influence car insurance premiums and employing strategies to reduce costs can help drivers find affordable coverage. By comparing quotes, maintaining a good driving record, choosing the right coverage, and taking advantage of discounts, car owners can navigate the world of car insurance with confidence and ensure they’re getting the best value for their insurance dollar.

How do I choose the right car insurance coverage for my needs?

+Choosing the right car insurance coverage involves considering your specific needs and budget. Start by understanding the different types of coverage available, such as liability, collision, comprehensive, and additional options like rental car reimbursement or roadside assistance. Assess your financial situation and determine how much risk you’re comfortable with. For example, if you have an older vehicle, you might consider dropping collision and comprehensive coverage to save on premiums. Additionally, research and compare quotes from multiple insurance providers to find the best coverage at the most affordable rate.

What factors can lead to an increase in my car insurance premiums?

+Several factors can lead to an increase in car insurance premiums. These include getting into an accident, receiving traffic violations, or having a poor credit score. Additionally, certain personal characteristics such as age, gender, and driving history can impact premiums. The type of vehicle you drive, its age, and its usage can also influence rates. Lastly, the insurance company and the policy options you choose can affect your premiums, so it’s important to shop around and compare quotes to find the best deal.

Are there any government programs or initiatives that can help lower car insurance costs for specific groups of people?

+Yes, there are government programs and initiatives that can help lower car insurance costs for certain groups of people. For example, some states offer low-cost auto insurance programs for low-income individuals or those who meet specific eligibility criteria. Additionally, some states have assigned-risk plans or insurance pools that provide coverage for high-risk drivers who may otherwise have difficulty obtaining insurance. It’s worth researching and exploring these options if you fall into one of these categories.