How To Shop For Auto Insurance

Finding the right auto insurance coverage can be a complex process, but it is an essential aspect of responsible vehicle ownership. The process of shopping for auto insurance involves a careful consideration of various factors, including your specific needs, budget, and the legal requirements in your region. This comprehensive guide will lead you through the key steps to ensure you make an informed decision when purchasing auto insurance.

Understanding Your Needs and Requirements

Before you begin shopping for auto insurance, it’s crucial to assess your unique circumstances and needs. Consider the following factors:

- Vehicle Type and Usage: Different vehicles have varying insurance needs. For instance, a luxury sports car will typically require more extensive coverage than a standard sedan. Additionally, the purpose of your vehicle’s use, whether for daily commuting, occasional leisure trips, or business purposes, can impact the type of insurance you need.

- Personal Circumstances: Your age, gender, marital status, and even your occupation can influence insurance rates. Young drivers, for example, are often considered higher risk and may face higher premiums. Understanding how these factors affect your insurance costs is essential.

- Legal Requirements: Every state or region has its own set of minimum legal requirements for auto insurance. These usually include liability coverage for bodily injury and property damage. Ensure you are aware of these minimums to avoid any legal issues.

- Budget and Coverage Preferences: Determine your budget for insurance and the level of coverage you desire. While it’s tempting to go for the cheapest option, it’s important to strike a balance between cost and the level of protection you need. Consider your ability to pay out-of-pocket for repairs or medical expenses in the event of an accident.

Researching Insurance Providers and Options

Once you have a clear understanding of your needs, it’s time to research the insurance market. There are numerous providers, each offering a range of coverage options and pricing structures. Here’s how to navigate this step effectively:

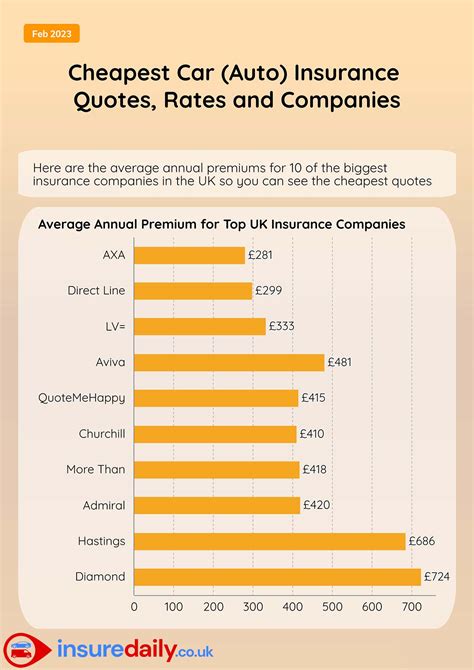

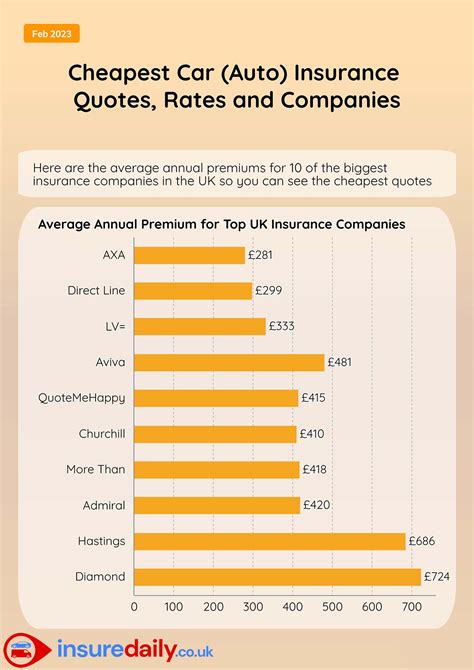

- Online Quotes: Start by obtaining quotes from various insurance providers online. Many websites offer comparison tools that allow you to input your details once and receive multiple quotes. This is a convenient way to get a sense of the market rates and the different coverage options available.

- Read Reviews and Ratings: Research the reputation and financial stability of the insurance companies you’re considering. Online reviews and ratings from independent sources can provide valuable insights into the quality of service and customer satisfaction. Be cautious of companies with consistently poor reviews.

- Understand Coverage Options: Familiarize yourself with the different types of coverage, such as liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each type offers specific protections, and it’s important to know what each covers and how it applies to your situation.

- Consider Bundling and Discounts: Many insurance providers offer discounts for bundling multiple policies (e.g., auto and home insurance) or for certain driver attributes, such as good driving records or safety features in your vehicle. Inquire about these discounts to potentially reduce your overall insurance costs.

Assessing and Comparing Quotes

With a list of quotes and coverage options from various providers, it’s time to analyze and compare them. This step is critical to ensuring you make an informed decision.

- Compare Coverage Limits: Ensure that the quotes you’re comparing offer similar coverage limits. For instance, if one quote has a liability limit of 100,000 while another offers 500,000, they are not directly comparable. Understand the implications of different coverage limits and choose the level that best suits your needs and budget.

- Evaluate Deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually means lower premiums, but it also means you’ll pay more if you need to make a claim. Assess your financial situation and comfort level with this trade-off.

- Review Additional Features: Some insurance providers offer additional benefits or perks, such as roadside assistance, rental car coverage, or accident forgiveness. While these features can be valuable, they may also increase your premium. Weigh the benefits against the cost to determine if they are worth including in your policy.

- Consider Long-Term Costs: Auto insurance is a long-term investment. While it’s tempting to choose the cheapest option in the short term, consider the potential for rate increases over time. Some providers may offer introductory discounts that expire after the first year, leading to higher premiums in subsequent years.

Choosing the Right Coverage and Provider

After thorough research and comparison, you should have a shortlist of insurance providers that meet your needs and budget. Now, it’s time to make a decision.

- Read the Fine Print: Before committing to a policy, carefully review the terms and conditions. Pay attention to exclusions, limitations, and any specific conditions that may apply to your coverage. Understanding these details can prevent surprises in the event of a claim.

- Consider Customer Service and Claims Handling: In the event of an accident, you’ll want to work with an insurance provider that offers prompt and efficient claims handling. Research the company’s reputation for customer service and claims processing. Look for providers with a history of fair and timely claim settlements.

- Seek Professional Advice: If you’re still unsure about which policy to choose, consider consulting an insurance broker or financial advisor. These professionals can provide personalized advice based on your specific circumstances and help you understand the nuances of different policies.

- Be Prepared for Changes: Remember that your insurance needs may change over time. Regularly review your policy to ensure it still aligns with your circumstances. Life events such as marriage, purchasing a new vehicle, or moving to a different state may require adjustments to your coverage.

Conclusion

Shopping for auto insurance is a critical task that requires careful consideration and research. By understanding your needs, researching the market, comparing quotes, and making an informed decision, you can find the right coverage at a competitive price. Remember, auto insurance is not just a legal requirement; it’s a protection for you, your vehicle, and others on the road. Take the time to get it right, and drive with confidence knowing you’re adequately insured.

FAQs

What is the average cost of auto insurance?

+The average cost of auto insurance can vary significantly based on several factors, including your location, the make and model of your vehicle, your driving history, and the coverage limits you choose. According to recent studies, the national average for auto insurance premiums is around $1,674 annually. However, it’s important to note that this is just an average, and your personal circumstances will likely result in a higher or lower premium.

Can I get auto insurance without a driver’s license?

+Obtaining auto insurance without a valid driver’s license can be challenging but not impossible. Some insurance providers may offer non-owner policies, which cover you when driving someone else’s vehicle. However, these policies often come with restrictions and may not provide the same level of coverage as a standard auto insurance policy. It’s advisable to consult with an insurance broker to explore your options.

What factors determine my insurance rates?

+Several factors influence your insurance rates, including your age, gender, marital status, driving history, the type of vehicle you drive, and your location. Insurance providers also consider your credit score, as it is seen as an indicator of financial responsibility. Additionally, the coverage limits and deductibles you choose can impact your premium. It’s important to shop around and compare quotes to find the best rates for your specific circumstances.