Cheap Car Insure

Finding affordable car insurance can be a challenging task, especially with the numerous factors influencing rates and the vast array of options available in the market. However, with the right knowledge and strategies, it is possible to secure quality coverage at a price that fits your budget. This comprehensive guide aims to shed light on the key aspects of cheap car insurance, providing you with the tools and insights to make informed decisions and potentially save a significant amount on your auto insurance costs.

Understanding Cheap Car Insurance

Cheap car insurance, or low-cost auto insurance, refers to coverage options that offer adequate protection for your vehicle and personal liability at an affordable price. While the definition of "cheap" can vary based on individual circumstances and budget constraints, it generally involves identifying the best value for your money. This often means finding a balance between coverage limits, deductibles, and the insurance company's reputation and financial stability.

It's crucial to remember that opting for the cheapest policy may not always be the wisest decision. Insufficient coverage can leave you vulnerable to financial risks in the event of an accident or other mishaps. Therefore, the goal should be to find a policy that provides adequate protection at a price that suits your financial situation.

Factors Affecting Car Insurance Rates

Numerous factors influence the cost of car insurance, and understanding these can help you make more informed choices when shopping for coverage. Here are some key considerations:

- Vehicle Type and Age: The make, model, and age of your car play a significant role in determining insurance rates. Generally, newer and more expensive vehicles tend to be costlier to insure due to higher repair costs and theft risks.

- Driving History: Your driving record is a critical factor in insurance pricing. A clean driving history with no accidents or traffic violations often leads to lower rates. Conversely, a history of accidents or citations can significantly increase your premiums.

- Coverage Limits and Deductibles: The level of coverage you choose directly impacts your premium. Higher coverage limits usually result in higher costs, while opting for higher deductibles can reduce your premium but increase your out-of-pocket expenses in the event of a claim.

- Location: The area where you live and drive has a substantial influence on insurance rates. Urban areas often have higher rates due to increased traffic congestion, theft risks, and accident rates.

- Age and Gender: Insurance companies consider age and gender when calculating rates. Young drivers, especially males under 25, often face higher premiums due to their higher risk profile. Similarly, older drivers may also face increased rates as their reaction times and vision may decline with age.

- Credit History: Surprisingly, your credit score can also impact your insurance rates. Many insurers believe that individuals with better credit scores are more responsible and therefore pose a lower risk. As a result, they may offer lower premiums to those with good credit.

Strategies for Securing Cheap Car Insurance

Now that we've covered the factors influencing insurance rates, let's explore some effective strategies to obtain cheap car insurance:

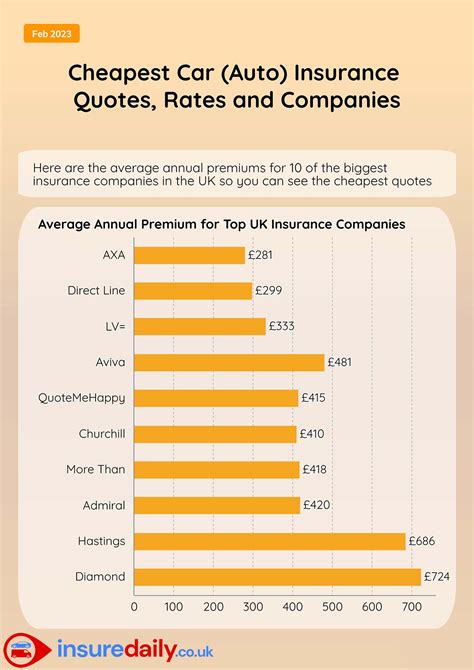

Shop Around and Compare Quotes

One of the most effective ways to find cheap car insurance is to shop around and compare quotes from multiple insurers. Each insurance company has its own rating system and pricing structure, so quotes can vary significantly. By comparing at least three to five quotes, you can identify the best value for your specific circumstances.

Utilize online quote comparison tools or contact insurance brokers who can provide quotes from various companies. Ensure you're comparing apples to apples by requesting quotes with similar coverage limits and deductibles.

Raise Your Deductibles

Opting for higher deductibles can significantly reduce your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you're essentially agreeing to bear more of the financial responsibility in the event of a claim. This shift in risk lowers your premium, as the insurer's potential liability decreases.

However, it's essential to choose a deductible amount that you can afford to pay in the event of an accident. If you select a deductible that's too high, you may struggle to cover the costs if you ever need to file a claim.

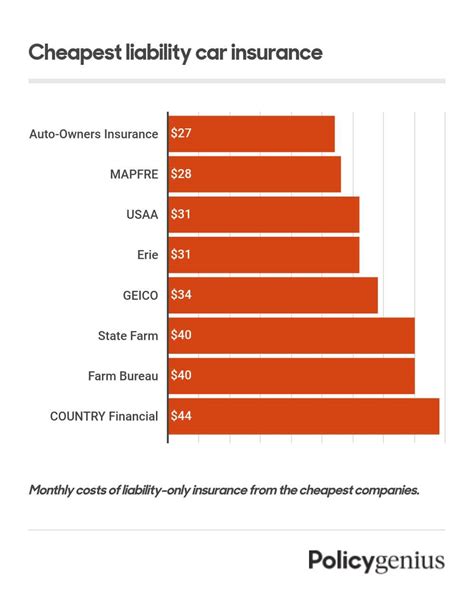

Review Your Coverage Limits

Another way to potentially lower your insurance costs is by reviewing your coverage limits. Assess your current coverage levels and consider whether they align with your needs and financial situation. If you have comprehensive and collision coverage, evaluate whether the limits are appropriate for your vehicle's age and value.

For instance, if you own an older vehicle that's paid off, you may consider dropping collision and comprehensive coverage and opting for liability-only coverage. This can result in substantial savings, especially if your vehicle isn't worth much.

Explore Discounts and Bundling Options

Insurance companies often offer various discounts that can significantly reduce your premium. Some common discounts include:

- Safe Driver Discount: This discount is offered to drivers with a clean driving record, free of accidents or traffic violations for a certain period.

- Good Student Discount: Many insurers provide discounts to students who maintain a certain GPA or honor roll status.

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can result in substantial savings.

- Anti-Theft Devices: If your vehicle is equipped with anti-theft devices or safety features, you may be eligible for a discount.

- Payment Method Discount: Some insurers offer discounts for paying your premium in full or using automatic payment methods.

Additionally, consider the following strategies to potentially lower your insurance costs:

- Maintain a Good Credit Score: As mentioned earlier, your credit history can impact your insurance rates. Work on improving your credit score to potentially secure lower premiums.

- Limit Mileage: If you drive less frequently, you may be eligible for a low-mileage discount. Some insurers offer pay-as-you-drive policies that track your mileage and adjust your premium accordingly.

- Choose a Safer Vehicle: Opting for a vehicle with a higher safety rating and fewer theft risks can result in lower insurance costs.

Analyzing Insurance Company Reputation and Financial Stability

When shopping for cheap car insurance, it's essential to consider not only the price but also the insurer's reputation and financial stability. Here's why these factors matter:

Reputation

An insurance company's reputation is a reflection of its overall performance and customer satisfaction. A reputable insurer is likely to offer better customer service, prompt claim handling, and fair practices. Look for companies with a solid track record of satisfied customers and positive reviews.

Consider checking online reviews and ratings from independent sources like the Better Business Bureau (BBB) or J.D. Power. These platforms provide valuable insights into customers' experiences with the insurer, including their claim processes, customer service, and overall satisfaction.

Financial Stability

Financial stability is crucial when choosing an insurance provider. A financially stable insurer is more likely to have the resources to pay out claims promptly and honor their obligations. On the other hand, a financially unstable insurer may struggle to meet its commitments, potentially leaving you in a bind if you need to file a claim.

Research the insurer's financial ratings from reputable agencies like A.M. Best, Moody's, or Standard & Poor's. These ratings provide an assessment of the insurer's financial strength and ability to meet its financial obligations.

Claims Handling and Customer Service

The insurer's claims handling process and customer service are critical aspects to consider. Efficient and prompt claims handling can make a significant difference in your experience as a policyholder. Look for insurers with a proven track record of handling claims fairly and quickly.

Consider reaching out to the insurer's customer service department before purchasing a policy. Assess their responsiveness, professionalism, and willingness to answer your questions. A good customer service experience can provide peace of mind and make it easier to manage any future claims.

Common Misconceptions About Cheap Car Insurance

There are several misconceptions surrounding cheap car insurance that can lead to poor decisions. Let's debunk some of these myths:

Myth: The Cheapest Policy is Always the Best Deal

While it's tempting to go for the lowest-priced policy, it's essential to consider the coverage limits and deductibles. A policy with extremely low premiums may have insufficient coverage, leaving you vulnerable to financial risks. Always assess the value of the policy based on your specific needs and budget.

Myth: All Insurance Companies are the Same

Insurance companies differ significantly in their pricing structures, coverage options, and customer service. Each insurer has its own unique approach, and what works for one person may not be the best fit for another. Take the time to research and compare multiple insurers to find the one that best aligns with your needs and budget.

Myth: You Can't Save Money on Car Insurance

Some people believe that car insurance rates are set in stone and there's no way to save money. However, this couldn't be further from the truth. By implementing the strategies outlined in this guide, you can significantly reduce your insurance costs without compromising on coverage.

Frequently Asked Questions

How can I find the cheapest car insurance in my area?

+To find the cheapest car insurance in your area, start by comparing quotes from multiple insurers. Utilize online comparison tools or consult insurance brokers who can provide quotes tailored to your specific needs. Additionally, consider adjusting your coverage limits and deductibles to find the best balance between cost and protection.

What factors determine my car insurance rates?

+Several factors influence your car insurance rates, including your driving history, the type and age of your vehicle, your location, age and gender, and your credit history. Each insurer weighs these factors differently, so it's essential to compare quotes from multiple providers to find the best rate.

Can I get car insurance with no down payment?

+Some insurance companies offer policies with no down payment required. However, keep in mind that paying a down payment can often result in lower monthly premiums. It's worth exploring your options and considering whether you can afford a higher down payment to potentially save money in the long run.

How can I improve my chances of getting cheap car insurance?

+To improve your chances of securing cheap car insurance, maintain a clean driving record, review and adjust your coverage limits and deductibles, explore discounts and bundling options, and shop around for the best rates. Additionally, consider factors like your vehicle's safety rating and credit score, as these can impact your premiums.

What should I do if I'm unhappy with my current car insurance provider?

+If you're unhappy with your current car insurance provider, it's a good idea to shop around for alternative options. Compare quotes from other insurers and consider switching to a provider that offers better rates, coverage, or customer service. Ensure you understand the terms of your current policy and any potential penalties for canceling early.

By following the strategies outlined in this guide, you can take control of your car insurance costs and potentially save a significant amount. Remember to prioritize adequate coverage while finding the best value for your money. With careful research and comparison, you can secure cheap car insurance that meets your needs and budget.