Individual Insurance

In today's fast-paced and uncertain world, individual insurance has become an essential tool for safeguarding our health, wealth, and future. It provides a safety net, offering peace of mind and financial protection during unexpected life events. This comprehensive guide aims to demystify the complex world of individual insurance, empowering you to make informed decisions and take control of your personal financial security.

Individual insurance, often referred to as personal insurance, is a contractual agreement between an individual and an insurance company. It involves the policyholder paying regular premiums in exchange for financial protection against specific risks and uncertainties. These risks can range from health issues and accidents to loss of income and property damage.

The primary goal of individual insurance is to provide financial stability and security to individuals and their families, ensuring that they can weather the storms of life without suffering significant financial setbacks. It serves as a vital component of any comprehensive financial plan, offering a layer of protection that traditional savings and investments may not provide.

Understanding the Importance of Individual Insurance

The significance of individual insurance cannot be overstated. It is a crucial component of financial planning, providing a safety net during times of need. Whether it's a sudden illness, an unexpected accident, or a natural disaster, individual insurance policies offer financial support, covering a range of expenses and potential losses.

One of the key advantages of individual insurance is its customization. Unlike group insurance policies, which are often standardized, individual insurance allows for personalized coverage. Policyholders can tailor their insurance plans to suit their specific needs and circumstances, ensuring they receive the right level of protection for their unique situation.

Furthermore, individual insurance plays a critical role in risk management. By transferring the financial burden of potential risks to an insurance company, individuals can mitigate the impact of unforeseen events on their financial stability. This risk transfer mechanism is a fundamental principle of insurance, and it forms the backbone of individual insurance policies.

Key Benefits of Individual Insurance

- Financial Protection: Individual insurance policies provide a financial safety net, ensuring that policyholders can cover unexpected costs and maintain their standard of living during challenging times.

- Peace of Mind: Knowing that you have adequate insurance coverage can significantly reduce stress and anxiety, allowing you to focus on your well-being and recovery.

- Customizable Coverage: Individual insurance allows for personalized plans, ensuring that policyholders can choose the right level of coverage for their specific needs and circumstances.

- Risk Management: By transferring financial risks to insurance companies, individuals can effectively manage and mitigate potential losses, protecting their financial stability.

- Access to Specialized Services: Many individual insurance policies offer access to a network of medical providers, legal services, and other specialized resources, ensuring that policyholders receive the best possible care and support.

For example, let's consider a scenario where an individual suffers a severe injury in a car accident. Without adequate insurance, the financial burden of medical expenses, vehicle repairs, and potential loss of income could be devastating. However, with individual insurance coverage, the policyholder can receive financial support to cover these costs, allowing them to focus on their recovery without worrying about financial strain.

Similarly, individual health insurance plays a critical role in ensuring access to quality healthcare. With rising medical costs, having health insurance provides peace of mind, knowing that you can receive the necessary medical treatment without facing financial hardship.

Types of Individual Insurance Policies

Individual insurance policies come in various forms, each designed to address specific risks and needs. Understanding the different types of insurance available is crucial in making informed decisions about your coverage.

Health Insurance

Health insurance is perhaps one of the most crucial types of individual insurance. It provides coverage for medical expenses, including doctor visits, hospital stays, prescription medications, and other healthcare services. With rising healthcare costs, having health insurance is essential for maintaining access to quality medical care.

Health insurance policies can vary widely, offering different levels of coverage and benefits. Some policies focus on preventive care, covering regular check-ups and screenings, while others provide more comprehensive coverage for major medical expenses. Understanding your specific healthcare needs and choosing a policy that aligns with them is vital.

For instance, individuals with pre-existing medical conditions may require more specialized health insurance plans that offer broader coverage and access to specific treatments. On the other hand, younger, healthier individuals may opt for more basic plans with lower premiums to meet their essential healthcare needs.

| Health Insurance Type | Coverage Highlights |

|---|---|

| Comprehensive Health Insurance | Covers a wide range of medical services, including inpatient and outpatient care, prescription drugs, and preventive care. |

| Major Medical Insurance | Provides coverage for significant medical events, such as surgeries, accidents, and critical illnesses, with higher limits and comprehensive benefits. |

| Catastrophic Health Insurance | Designed for younger, healthier individuals, offering basic coverage with low premiums and high deductibles, suitable for emergency situations. |

Life Insurance

Life insurance is another critical type of individual insurance, providing financial protection to loved ones in the event of the policyholder's death. It ensures that beneficiaries receive a lump-sum payment, which can be used to cover funeral expenses, pay off debts, or provide ongoing financial support.

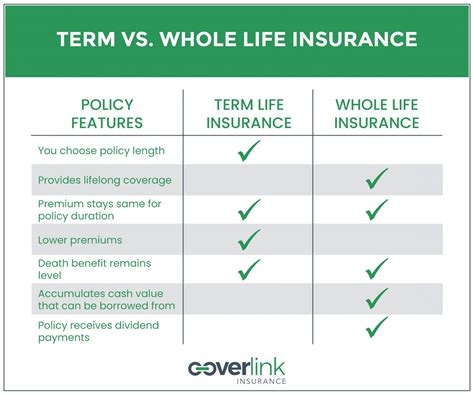

Life insurance policies come in various forms, including term life insurance and permanent life insurance. Term life insurance offers coverage for a specific period, typically 10 to 30 years, while permanent life insurance provides lifelong coverage, often with a cash value component that can be accessed during the policyholder's lifetime.

The decision between term and permanent life insurance depends on individual needs and financial goals. Term life insurance is generally more affordable and suitable for those seeking temporary coverage, such as during their working years when they have financial obligations. Permanent life insurance, on the other hand, offers lifelong protection and can be a valuable asset for estate planning and wealth accumulation.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Offers coverage for a specified term, typically renewable at higher rates as the policyholder ages. Provides financial protection during working years. |

| Whole Life Insurance | Provides lifelong coverage with a cash value component that grows over time. Offers guaranteed death benefits and the potential for tax-deferred savings. |

| Universal Life Insurance | A flexible permanent life insurance policy that allows policyholders to adjust coverage levels and premium payments. Offers cash value accumulation and death benefits. |

Property and Casualty Insurance

Property and casualty insurance, often referred to as homeowners or renters insurance, provides financial protection against damage or loss of personal property and liability claims. This type of insurance is crucial for individuals who own or rent a home, ensuring that they can recover from unexpected events such as fires, theft, or natural disasters.

Homeowners insurance typically covers the structure of the home, personal belongings, and additional living expenses if the home becomes uninhabitable due to a covered event. Renters insurance, on the other hand, covers personal belongings and provides liability protection for individuals living in rented properties.

When choosing property and casualty insurance, it's essential to consider the specific risks in your area, such as the likelihood of natural disasters or crime. Additionally, understanding the limits and deductibles of your policy is crucial to ensure you have adequate coverage for your needs.

| Property and Casualty Insurance Type | Coverage Highlights |

|---|---|

| Homeowners Insurance | Covers the structure of the home, personal belongings, and additional living expenses. Provides liability protection for the policyholder and their family. |

| Renters Insurance | Protects personal belongings and provides liability coverage for individuals living in rented properties. Offers affordable protection for renters. |

| Condo Insurance | Covers the interior of a condo unit, personal belongings, and provides liability protection. Condo associations typically have master policies that cover the building's structure. |

Other Types of Individual Insurance

In addition to health, life, and property insurance, there are numerous other types of individual insurance policies available to address specific needs and risks. These include:

- Auto Insurance: Provides financial protection in the event of an auto accident, covering vehicle repairs, medical expenses, and liability claims.

- Disability Insurance: Offers income protection in the event of a disability that prevents the policyholder from working, ensuring a steady income stream.

- Long-Term Care Insurance: Covers the cost of long-term care services, such as nursing home stays or in-home care, for individuals who require assistance with daily activities.

- Travel Insurance: Provides coverage for unexpected events while traveling, including trip cancellations, medical emergencies, and lost luggage.

- Pet Insurance: Offers financial protection for unexpected veterinary expenses, ensuring pet owners can provide the best possible care for their furry companions.

Key Considerations When Choosing Individual Insurance

When navigating the world of individual insurance, there are several key considerations to keep in mind. These factors will help you make informed decisions and select the right insurance policies to meet your specific needs.

Assessing Your Risks and Needs

The first step in choosing individual insurance is to assess your unique risks and needs. Consider your age, health status, financial obligations, and lifestyle. For example, if you have a family to support, life insurance becomes a critical component of your financial plan. Similarly, if you own a home, property insurance is essential to protect your investment.

Take the time to evaluate your current and future financial responsibilities. Consider factors such as your income, debts, and savings. Understanding your financial situation will help you determine the level of coverage you require and the types of insurance that are most relevant to your circumstances.

Understanding Policy Terms and Conditions

Before committing to an insurance policy, it's crucial to thoroughly understand the terms and conditions. Read the fine print and familiarize yourself with the coverage limits, deductibles, and exclusions. Pay close attention to the specific events or circumstances that are covered by the policy, ensuring that they align with your potential risks.

Understanding policy terms is especially important when it comes to health insurance. Be aware of any pre-existing condition exclusions, waiting periods, and limitations on coverage for specific treatments or medications. Ensure that the policy provides adequate coverage for your healthcare needs, including any ongoing or anticipated medical conditions.

Comparing Premiums and Coverage

When comparing individual insurance policies, it's essential to balance premiums and coverage. While lower premiums may be attractive, they often come with higher deductibles and limited coverage. On the other hand, policies with extensive coverage may have higher premiums.

Consider your budget and financial goals when evaluating premiums. Determine the maximum amount you can comfortably afford to pay for insurance premiums without straining your finances. Then, assess the coverage provided by different policies, ensuring that they offer adequate protection for your needs.

Remember, the cheapest policy may not always be the best value. It's crucial to find a balance between affordable premiums and comprehensive coverage that meets your specific requirements.

Choosing a Reputable Insurance Provider

Selecting a reputable insurance provider is vital to ensure that you receive the benefits and support you deserve. Research and compare different insurance companies, considering their financial stability, customer service reputation, and claims handling processes.

Look for insurance providers with a strong financial rating, indicating their ability to meet their financial obligations. Check online reviews and customer feedback to gauge the level of satisfaction and service provided by the company. Additionally, consider the company's claims process and track record, ensuring that they have a history of prompt and fair claim settlements.

Seeking Professional Advice

Navigating the complex world of individual insurance can be challenging, especially for those without a financial background. Seeking advice from a qualified insurance agent or financial advisor can be invaluable in making informed decisions.

An insurance professional can provide personalized guidance based on your specific needs and circumstances. They can help you understand the various insurance options available, explain policy terms and conditions, and assist in comparing different policies to find the best fit for your budget and coverage requirements.

Additionally, an insurance agent can guide you through the application process, ensuring that you provide accurate and complete information to secure the best possible rates and coverage. They can also help you review and update your insurance policies as your needs and circumstances change over time.

Maximizing the Benefits of Individual Insurance

Once you've chosen the right individual insurance policies, it's essential to maximize their benefits and ensure you're fully protected. Here are some key strategies to make the most of your insurance coverage.

Regularly Review and Update Your Policies

Life is constantly evolving, and so are your insurance needs. Regularly review your insurance policies to ensure they still align with your current circumstances and risks. Major life events, such as marriage, the birth of a child, or a career change, can significantly impact your insurance requirements.

For example, if you recently purchased a new home, you may need to update your homeowners insurance policy to reflect the increased value of your property. Similarly, if you've started a family, you may want to increase your life insurance coverage to provide adequate financial protection for your loved ones.

Understand Policy Exclusions and Limitations

While insurance policies provide valuable coverage, it's important to understand their limitations and exclusions. Familiarize yourself with the specific circumstances or events that are not covered by your policies. This knowledge will help you make informed decisions and consider additional coverage if necessary.

For instance, if you frequently travel abroad, standard health insurance policies may not cover medical emergencies outside your home country. In such cases, purchasing travel insurance with medical coverage can provide the necessary protection.

Keep Your Insurance Information Up-to-Date

To ensure seamless claim processes and timely support, it's crucial to keep your insurance information up-to-date. This includes providing accurate contact details, address information, and any changes in your personal circumstances that may impact your insurance coverage.

For example, if you've recently changed jobs or started a new business, notify your insurance provider to ensure that your coverage reflects your new professional status. Failure to provide accurate and timely updates may result in delayed claim settlements or even policy cancellations.

Utilize Additional Policy Benefits

Many individual insurance policies offer additional benefits and services beyond the basic coverage. Take the time to explore and utilize these benefits, as they can provide significant value and support during challenging times.

For instance, some health insurance policies provide access to wellness programs, offering discounts on gym memberships or providing resources for managing chronic conditions. Life insurance policies may offer access to financial planning services or estate planning support. Understanding and utilizing these additional benefits can enhance your overall insurance experience.

Educate Yourself and Stay Informed

The world of insurance is constantly evolving, with new policies, regulations, and trends emerging regularly. Stay informed about changes in the insurance industry, as they may impact your coverage and options.

Read insurance-related articles, blogs, and news to stay updated on the latest developments. Attend webinars or workshops to deepen your understanding of insurance concepts and best practices. By staying informed, you can make more strategic decisions and ensure that your insurance portfolio remains relevant and effective.

The Future of Individual Insurance

As technology advances and consumer needs evolve, the individual insurance industry is undergoing significant transformations. These changes are shaping the future of insurance, offering new opportunities and challenges for policyholders and providers alike.

Digitalization and Insurance Technology

The rise of digital technologies and the internet has revolutionized the insurance industry. Insurtech, a term used to describe the intersection of insurance and technology, is driving innovation and efficiency in the sector. Insurance companies are leveraging digital tools and platforms to enhance customer experiences, streamline processes, and offer more personalized coverage.

Digitalization has led to the development of online insurance marketplaces, where consumers can easily compare and purchase policies from multiple providers. Insurers are also utilizing data analytics and artificial intelligence to better understand customer needs and risks, enabling them to offer more tailored and efficient insurance solutions.

Personalized Insurance Products

With the advent of Insurtech, insurance companies are increasingly able to offer highly personalized insurance products. Using advanced data analytics and customer insights, insurers can design policies that cater to the unique needs and circumstances of individuals.

For example, usage-based auto insurance policies, often referred to as pay-as-you-drive insurance, offer premiums based on actual driving behavior rather than traditional factors like age and location. This allows drivers to pay premiums that more accurately reflect their risk profile, providing a fairer and more affordable insurance option.</