Insurance Company Business

The insurance industry is a vital component of the global economy, providing financial protection and risk management solutions to individuals, businesses, and organizations. Insurance companies play a crucial role in mitigating the impact of unforeseen events and ensuring stability in various sectors. In this comprehensive guide, we will delve into the world of insurance companies, exploring their business models, key operations, and the strategies they employ to thrive in a dynamic and competitive market.

Understanding the Insurance Company Business

Insurance companies operate on the principle of risk pooling, where a large number of policyholders contribute premiums to a common fund. This fund is then utilized to pay out claims when policyholders experience covered losses. The fundamental goal of insurance companies is to balance the risks they assume with the premiums they collect, ensuring long-term sustainability and profitability.

Core Functions and Operations

The primary functions of insurance companies can be categorized into underwriting, claims management, and investment. Underwriting involves assessing the risks associated with each policy and determining the appropriate premiums. This process requires a deep understanding of the insured’s profile, historical data, and statistical models to accurately price the risk.

Claims management is a critical aspect of the insurance business. Insurance companies must efficiently handle and process claims, ensuring prompt and fair settlements. This involves thorough investigations, accurate assessments of damages, and effective communication with policyholders.

Investment plays a significant role in the financial health of insurance companies. Surplus funds generated from premiums are invested in various assets, such as stocks, bonds, and real estate, to generate returns. These investments provide a stable income stream and contribute to the overall profitability of the company.

Key Considerations for Insurance Companies

Insurance companies face numerous challenges and considerations in their day-to-day operations. One of the primary challenges is managing risk exposure. Underwriters must carefully assess and mitigate risks to avoid excessive losses. This involves staying updated on industry trends, analyzing historical data, and employing advanced risk modeling techniques.

Regulatory compliance is another critical aspect. Insurance companies operate within a highly regulated environment, with strict guidelines and oversight from government bodies. Compliance with these regulations is essential to maintain licensing and avoid legal repercussions.

Diversification and Product Offering

To remain competitive and resilient, insurance companies often diversify their product offerings. This approach allows them to cater to a broader range of clients and mitigate the impact of potential downturns in specific markets. For instance, a company may offer both personal and commercial lines of insurance, including auto, property, liability, and health insurance.

Furthermore, insurance companies continuously innovate and develop new products to meet evolving customer needs. This may involve introducing specialized coverage for emerging risks or offering tailored solutions for specific industries. By staying agile and responsive, insurance companies can maintain their relevance and market share.

The Digital Transformation of Insurance

The insurance industry has undergone a significant digital transformation in recent years. Technological advancements have revolutionized the way insurance companies operate, interact with customers, and manage their operations.

Digital Underwriting and Claims Processing

Digital underwriting has streamlined the policy application process, allowing customers to apply for insurance online and receive near-instant quotes. Advanced analytics and data-driven models have enhanced the accuracy and efficiency of risk assessment, reducing the need for manual interventions.

Similarly, digital claims processing has transformed the way insurance companies handle and settle claims. Policyholders can now submit claims electronically, often accompanied by digital evidence such as photos or videos. This digital approach accelerates the claims process, reduces administrative burdens, and enhances customer satisfaction.

| Digital Underwriting Benefits | Digital Claims Processing Benefits |

|---|---|

| Faster and more accurate risk assessment | Rapid claims settlement |

| Reduced paperwork and administrative costs | Enhanced customer experience |

| Improved data analysis and modeling | Streamlined claims handling process |

Data Analytics and AI Integration

Data analytics and artificial intelligence (AI) have become integral to the insurance industry. Insurance companies leverage advanced analytics to gain deeper insights into customer behavior, market trends, and risk patterns. This enables them to make more informed decisions, optimize pricing strategies, and enhance overall business performance.

AI-powered chatbots and virtual assistants have also transformed customer service. These technologies provide 24/7 support, answer common queries, and guide customers through the insurance process. By automating routine tasks, insurance companies can allocate resources more efficiently and focus on complex cases requiring human expertise.

Strategic Alliances and Partnerships

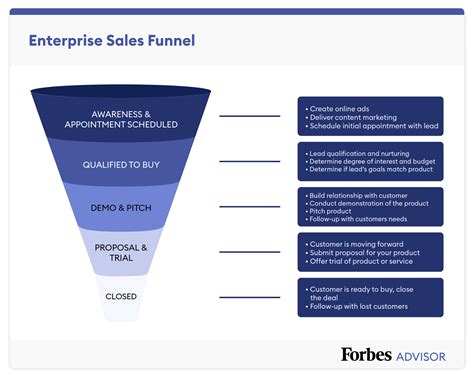

In a highly competitive market, insurance companies often form strategic alliances and partnerships to gain a competitive edge. These collaborations can take various forms, such as:

- Distribution Partnerships: Insurance companies may partner with banks, financial institutions, or other businesses to distribute their products through existing channels, expanding their reach and customer base.

- Reinsurance Agreements: Reinsurance involves transferring a portion of an insurance company's risk to another reinsurer. This helps spread the risk across multiple parties, providing financial protection and stability.

- Industry Consortia: Insurance companies may join forces with competitors to develop industry-wide standards, share best practices, and address common challenges. These consortia can drive innovation and enhance industry-wide efficiency.

Benefits of Strategic Alliances

Strategic alliances offer several advantages to insurance companies, including:

- Increased market share and customer reach

- Improved risk management and financial stability

- Enhanced operational efficiency through shared resources and expertise

- Access to new markets and customer segments

- Opportunities for collaborative innovation and product development

The Future of Insurance Companies

The insurance industry is poised for continued growth and evolution. As technology advances and customer expectations evolve, insurance companies must adapt to remain competitive. Here are some key trends and future implications:

Personalized Insurance

Insurance companies are increasingly focusing on personalized insurance solutions. By leveraging advanced analytics and customer data, they can offer tailored coverage options that meet individual needs. This shift towards personalization enhances customer satisfaction and loyalty.

Sustainable and Ethical Practices

With growing environmental and social consciousness, insurance companies are adopting sustainable and ethical practices. This includes offering eco-friendly insurance products, supporting renewable energy initiatives, and promoting social responsibility. By aligning with these values, insurance companies can attract environmentally conscious customers and build a positive brand image.

Expanded Digital Presence

The digital transformation of insurance is expected to accelerate further. Insurance companies will continue to enhance their online presence, offering seamless digital experiences for customers. This includes intuitive mobile apps, online policy management tools, and interactive digital platforms.

Enhanced Risk Management

As risks become more complex and unpredictable, insurance companies will invest in advanced risk management strategies. This may involve adopting cutting-edge technologies such as blockchain, AI, and the Internet of Things (IoT) to monitor and assess risks more accurately. By staying at the forefront of risk management, insurance companies can better protect their policyholders and maintain financial stability.

Collaborative Innovation

Insurance companies will increasingly collaborate with startups, tech companies, and research institutions to drive innovation. These partnerships will foster the development of innovative insurance products, improved customer experiences, and enhanced operational efficiency. By embracing a collaborative approach, insurance companies can stay ahead of the curve and adapt to changing market dynamics.

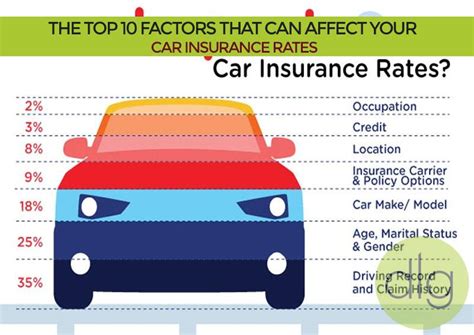

How do insurance companies determine premiums?

+

Insurance companies use a combination of factors to determine premiums, including the insured’s age, health status, occupation, location, and historical data. Underwriters analyze these factors to assess the level of risk associated with the policy and set premiums accordingly.

What are some common challenges faced by insurance companies?

+

Insurance companies often encounter challenges such as managing catastrophic events, dealing with fraud, adapting to regulatory changes, and staying competitive in a dynamic market. Effective risk management and a proactive approach to innovation are crucial to overcoming these challenges.

How do insurance companies invest their funds?

+

Insurance companies invest their surplus funds in a diversified portfolio of assets to generate returns. Common investment options include stocks, bonds, real estate, and alternative investments. The investment strategy aims to balance risk and return, ensuring financial stability and long-term growth.