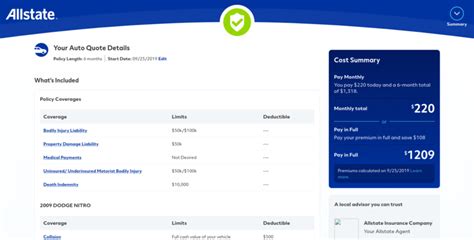

Insurance Quote Allstate

Unveiling the Allstate Insurance Quote Process: A Comprehensive Guide

Navigating the world of insurance can be a daunting task, but with Allstate, you're in capable hands. Their commitment to providing comprehensive coverage and transparent pricing makes them a trusted choice for many. In this in-depth article, we'll guide you through the Allstate insurance quote process, shedding light on the factors that influence your quote and offering valuable insights to ensure you get the best possible coverage for your needs.

Understanding the Allstate Insurance Quote Journey

The journey to securing an Allstate insurance quote is a simple and straightforward process. Here's a step-by-step breakdown to help you understand what to expect:

Step 1: Gather Essential Information

Before initiating the quote process, it's essential to have certain details at hand. These include personal information such as your name, date of birth, and contact details. Additionally, you'll need to provide information about the vehicle(s) you wish to insure, including make, model, year, and VIN number. If you're an existing customer, having your policy number ready can streamline the process.

Step 2: Select Your Coverage Options

Allstate offers a range of coverage options to tailor your policy to your specific needs. These include liability coverage, collision coverage, comprehensive coverage, personal injury protection, and more. Understanding your options and selecting the right coverage is crucial to ensure you're adequately protected. Allstate's website provides detailed explanations of each coverage type to help you make an informed decision.

Step 3: Provide Driving History and Vehicle Usage Details

Your driving history plays a significant role in determining your insurance quote. Allstate will ask for details such as any previous accidents or traffic violations you've been involved in. Additionally, they'll inquire about your annual mileage and primary use of the vehicle, whether it's for commuting, business, or pleasure. Providing accurate information is essential to ensure an accurate quote.

Step 4: Explore Discounts and Savings

Allstate is known for offering a variety of discounts to help customers save on their insurance premiums. These discounts can be based on factors such as safe driving records, multiple-policy bundling, and vehicle safety features. Exploring these discounts and understanding your eligibility can significantly impact your overall quote. Allstate's website provides a comprehensive list of available discounts, along with the criteria for qualification.

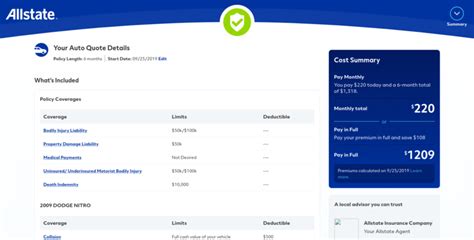

Step 5: Review and Customize Your Quote

Once you've provided all the necessary information, Allstate's quote tool will generate a personalized quote based on your unique circumstances. Review the quote carefully, ensuring that the coverage limits, deductibles, and additional options align with your expectations. If needed, you can adjust these parameters to customize your policy and get a quote that suits your budget and coverage preferences.

Factors Influencing Your Allstate Insurance Quote

Several factors come into play when determining your Allstate insurance quote. Understanding these factors can help you anticipate and potentially influence the cost of your insurance.

Your Driving Record

Your driving history is a significant determinant of your insurance quote. Allstate, like most insurers, takes into account factors such as accidents, traffic violations, and claims made against your policy. A clean driving record can lead to more favorable rates, while a history of accidents or violations may result in higher premiums.

| Driving Record Factor | Impact on Quote |

|---|---|

| Accident-free history | Lower premiums |

| Minor traffic violations | Moderate impact on rates |

| Multiple accidents or serious violations | Significant increase in premiums |

Vehicle Details and Usage

The type of vehicle you drive and how you use it also influence your insurance quote. Allstate considers factors such as the make, model, and age of your vehicle, as well as its safety features and accident history. Additionally, your annual mileage and primary use (commuting, business, or pleasure) can impact your rates. Vehicles with higher safety ratings and those used primarily for pleasure may result in more affordable insurance.

Coverage Selection and Limits

The coverage options and limits you choose play a crucial role in determining your insurance quote. Opting for higher coverage limits or adding additional coverage options, such as rental car reimbursement or roadside assistance, can increase your premium. On the other hand, selecting lower coverage limits or choosing basic coverage options can help reduce your insurance costs.

Discounts and Bundling

Allstate offers a range of discounts to help customers save on their insurance premiums. These discounts can be based on factors such as safe driving, multiple-policy bundling, vehicle safety features, and more. Exploring these discounts and taking advantage of eligible options can significantly reduce your overall insurance costs. Bundling multiple policies, such as auto and home insurance, is a common strategy to secure substantial savings.

Allstate's Commitment to Transparency and Customer Service

Allstate understands that choosing the right insurance coverage can be a complex decision. That's why they prioritize transparency and customer service throughout the quote process and beyond.

Transparent Pricing and Policy Details

Allstate believes in providing clear and transparent pricing to their customers. Their quote tool provides a detailed breakdown of your premium, highlighting the factors that influence your rate. This transparency ensures that you understand exactly what you're paying for and why. Additionally, Allstate's website offers comprehensive resources to help you understand your coverage options and make informed decisions.

Exceptional Customer Service and Support

Allstate is renowned for its exceptional customer service. Their dedicated team of agents is always ready to assist you with any questions or concerns you may have throughout the quote process and during your policy tenure. Whether you need help understanding your quote, have questions about coverage options, or require assistance with claims, Allstate's customer service representatives are known for their expertise and friendly approach.

Making an Informed Decision: Tips for Choosing the Right Coverage

With so many coverage options and factors to consider, choosing the right insurance policy can be a challenging task. Here are some tips to help you make an informed decision:

Assess Your Needs and Budget

Start by evaluating your specific insurance needs. Consider factors such as the value of your vehicle, your driving habits, and any unique circumstances that may impact your coverage requirements. Additionally, set a realistic budget for your insurance premiums. Balancing the coverage you need with your financial capabilities is essential to ensure you're adequately protected without straining your finances.

Understand Your Coverage Options

Take the time to thoroughly understand the different coverage options available to you. Allstate's website provides detailed explanations of each coverage type, helping you make an informed decision. Consider the potential risks and costs associated with your driving habits and choose coverage limits that provide adequate protection. Remember, choosing the right coverage is about finding the right balance between cost and protection.

Compare Quotes and Explore Discounts

Don't settle for the first quote you receive. Take the time to compare quotes from multiple insurers to ensure you're getting the best value for your money. Allstate's quote tool makes it easy to get a personalized quote, and you can always reach out to their customer service team for assistance. Additionally, explore the discounts you may be eligible for. Bundling your policies or taking advantage of safe driving discounts can significantly reduce your insurance costs.

Read the Fine Print

Before finalizing your insurance policy, carefully review the terms and conditions outlined in your policy documents. Pay close attention to coverage limits, deductibles, and any exclusions or limitations that may apply. Understanding these details ensures that you're fully aware of your coverage and any potential gaps. If you have any questions or concerns, don't hesitate to reach out to Allstate's customer service team for clarification.

Conclusion: Taking Control of Your Insurance Journey

Securing an insurance quote with Allstate is a straightforward process, but it's important to approach it with a clear understanding of your needs and budget. By gathering the necessary information, exploring coverage options, and leveraging available discounts, you can take control of your insurance journey and find a policy that provides the right balance of coverage and cost. With Allstate's commitment to transparency and exceptional customer service, you can feel confident in your decision and enjoy peace of mind knowing you're adequately protected.

Can I get an Allstate insurance quote online without providing personal information?

+

No, Allstate requires certain personal and vehicle information to generate an accurate quote. This information helps tailor the quote to your specific needs and circumstances.

How long does it take to get an Allstate insurance quote?

+

The time it takes to receive an Allstate insurance quote varies depending on the complexity of your circumstances and the coverage options you select. On average, it takes around 15-20 minutes to complete the online quote process.

Can I adjust my Allstate insurance quote after receiving it?

+

Absolutely! Allstate’s quote tool allows you to customize your coverage and explore different options. You can adjust your coverage limits, deductibles, and additional features to find the right balance of protection and cost.

What happens if I have multiple vehicles to insure with Allstate?

+

Allstate offers multi-vehicle discounts for customers who insure more than one vehicle with them. By bundling your policies, you can save money on your insurance premiums and enjoy the convenience of having all your vehicles covered under one insurer.

How can I reach Allstate’s customer service team for assistance with my insurance quote?

+

Allstate provides multiple channels for customer support. You can reach their customer service team via phone, email, or live chat. Their contact details can be found on their website, and they are readily available to assist you with any questions or concerns you may have.