Insurance Quotes Florida Homeowners

Welcome to the ultimate guide on understanding and securing the best insurance quotes for Florida homeowners. As one of the most unique and diverse states in the US, Florida presents a distinct set of challenges and opportunities when it comes to insurance coverage. From its vibrant coastal communities to its inland cities, Florida's residents require tailored insurance solutions to protect their homes and livelihoods. This comprehensive article will delve into the specifics of insurance in Florida, offering expert insights and practical tips to help you navigate the complex world of insurance quotes.

Understanding Florida’s Insurance Landscape

Florida’s insurance market is dynamic and complex, shaped by its unique geography, climate, and population. With its susceptibility to natural disasters, including hurricanes and floods, Florida has developed a specialized insurance ecosystem. Homeowners in the Sunshine State must navigate a range of coverage options and considerations to ensure their properties are adequately protected.

Natural Disaster Coverage

One of the most critical aspects of insurance in Florida is natural disaster coverage. Florida is no stranger to hurricanes, tropical storms, and severe weather events. As such, homeowners must carefully assess their insurance policies to ensure they have adequate coverage for these potential disasters. While standard homeowner’s insurance policies often cover damages caused by wind and rain, additional policies or endorsements may be necessary for specific risks, such as flood insurance.

| Coverage Type | Description |

|---|---|

| Hurricane Coverage | Covers damages caused by hurricanes, including high winds, storm surges, and flying debris. |

| Windstorm Coverage | Provides protection against strong winds, including those from hurricanes, tropical storms, and tornadoes. |

| Flood Insurance | Offers coverage for damages caused by flooding, which is typically not included in standard homeowner's policies. |

It's essential to understand the specific risks associated with your area and tailor your insurance coverage accordingly. For instance, if you live in a high-risk hurricane zone, you may want to consider additional coverage to protect against potential storm surge damages.

Homeowner’s Insurance Basics

Homeowner’s insurance is a fundamental aspect of protecting your property and assets. It provides financial protection against various risks, including damage to your home, theft, and liability claims. When obtaining insurance quotes for your Florida home, it’s essential to understand the basic components of a homeowner’s insurance policy.

- Dwelling Coverage: This covers the structure of your home, including the walls, roof, and permanent fixtures. It ensures that if your home is damaged or destroyed, you can rebuild it to its pre-loss condition.

- Personal Property Coverage: This protects your belongings, such as furniture, electronics, and clothing. It compensates you for losses due to covered perils, ensuring you can replace your possessions.

- Liability Coverage: This provides protection if someone is injured on your property or if you're found legally responsible for causing injury or property damage to others.

- Additional Living Expenses (ALE): In the event your home becomes uninhabitable due to a covered loss, ALE coverage reimburses you for the additional costs of temporary housing and living expenses.

When obtaining insurance quotes, consider your specific needs and the value of your home and possessions. Ensure that your coverage limits are sufficient to cover potential losses and that your deductible is manageable.

Securing the Best Insurance Quotes

Securing the best insurance quotes for your Florida home involves a combination of research, understanding your needs, and negotiating with insurance providers. Here are some strategies to help you navigate the process effectively.

Comparing Insurance Providers

The insurance market in Florida is highly competitive, with numerous providers offering a range of policies. To find the best insurance quotes, it’s essential to compare multiple providers. Consider factors such as coverage options, pricing, customer service, and financial stability when evaluating different insurers.

- Research online reviews and ratings to get an idea of each provider's reputation and customer satisfaction.

- Compare quotes from at least three to five reputable insurance companies to ensure you're getting a competitive rate.

- Look for providers that offer tailored coverage for Florida-specific risks, such as hurricane or flood insurance.

Remember, the cheapest quote may not always be the best option. Consider the overall value and quality of the coverage you're receiving.

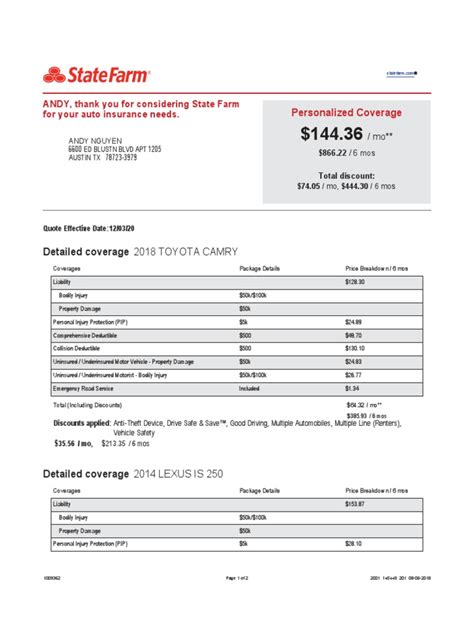

Bundling Policies

Bundling your insurance policies can often lead to significant savings. Many insurance providers offer discounts when you combine multiple policies, such as homeowner’s insurance with auto insurance or life insurance. By bundling your policies, you can simplify your insurance management and potentially reduce your overall costs.

Consider the following when bundling policies:

- Evaluate the potential savings versus the cost of individual policies.

- Ensure that the bundled policies provide adequate coverage for all your needs.

- Research the reputation and financial stability of the insurance provider to ensure long-term security.

Increasing Deductibles

Adjusting your deductible can impact the cost of your insurance premiums. A higher deductible typically results in lower premiums, as you’re assuming more financial responsibility in the event of a claim. However, it’s essential to choose a deductible that you’re comfortable paying out of pocket.

Consider the following when adjusting your deductible:

- Evaluate your financial situation and determine how much you can reasonably afford to pay in the event of a claim.

- Balance the potential savings with the risk of having to pay a higher deductible if a covered loss occurs.

- Remember that a higher deductible may also impact your ability to access certain coverage options or endorsements.

Understanding Discounts and Credits

Insurance providers often offer a variety of discounts and credits to attract and retain customers. Understanding these incentives can help you secure the best insurance quotes. Some common discounts and credits include:

- Multi-Policy Discounts: As mentioned, bundling policies can lead to significant savings.

- Loyalty Discounts: Some providers offer discounts for long-term customers or those who have maintained continuous coverage.

- Safety Features: Installing safety features like smoke detectors, fire sprinklers, or security systems may qualify you for discounts.

- Claim-Free Credits: Maintaining a claim-free history can result in credits or reduced premiums.

- Home Improvement Credits: Upgrading your home's roofing, windows, or other features may lead to credits for reduced risk.

The Importance of Working with an Agent

While researching and comparing insurance quotes online can be a valuable starting point, working with an experienced insurance agent can provide numerous benefits. Insurance agents are experts in their field and can offer personalized guidance and advice tailored to your specific needs and circumstances.

Expertise and Knowledge

Insurance agents have extensive knowledge of the insurance market and can provide valuable insights into the complexities of insurance policies. They can help you understand the nuances of different coverage options, explain the fine print, and ensure you’re making informed decisions.

For example, an agent can explain the differences between actual cash value and replacement cost coverage, helping you choose the option that best suits your needs.

Personalized Service

When you work with an agent, you receive personalized service and attention. They can assess your unique situation, including your home’s location, value, and specific risks, to recommend the most suitable insurance coverage.

An agent can also assist in customizing your policy to fit your needs, adding endorsements or additional coverage where necessary. This level of personalization ensures you're not overpaying for coverage you don't need or underinsured for potential risks.

Claims Assistance

In the event of a claim, having an agent by your side can be invaluable. They can guide you through the claims process, helping you navigate any potential challenges or complexities. Agents often have established relationships with insurance providers, which can facilitate smoother and more efficient claim resolutions.

The Future of Insurance in Florida

As Florida continues to evolve and adapt to changing climate conditions and population dynamics, the insurance landscape will likely undergo further transformations. Insurance providers will need to innovate and adapt their offerings to meet the unique needs of Florida’s residents.

Technology and Digital Innovations

The insurance industry is embracing technology to enhance customer experiences and streamline processes. From digital quoting tools to mobile apps for policy management and claims reporting, technology is making insurance more accessible and efficient.

Insurance providers are also exploring the use of advanced analytics and artificial intelligence to better assess risks and offer more accurate and tailored coverage. These innovations can help identify potential risks and provide more precise pricing, benefiting both insurers and policyholders.

Sustainable and Resilient Solutions

In response to the increasing frequency and severity of natural disasters, insurance providers are focusing on sustainable and resilient solutions. This includes offering incentives for homeowners to adopt eco-friendly practices and implement disaster-resistant features in their homes.

For example, insurance providers may offer discounts for homes with energy-efficient upgrades or for those that incorporate hurricane-resistant construction techniques.

Collaborative Risk Management

The insurance industry is recognizing the importance of collaborative efforts in managing risks. This includes working closely with local governments, community organizations, and homeowners to develop comprehensive risk management strategies.

Insurance providers may offer resources and educational materials to help homeowners better understand and mitigate risks. By fostering a culture of preparedness and collaboration, the industry can help reduce the impact of natural disasters and support the recovery process.

Conclusion

Securing the best insurance quotes for your Florida home requires a thoughtful and informed approach. By understanding the unique challenges and opportunities presented by Florida’s insurance landscape, you can make more confident decisions about your coverage. Remember to assess your specific needs, compare providers, and seek the guidance of experienced insurance agents.

As the insurance industry continues to evolve, staying informed and adapting to changing circumstances will be key to ensuring you have the right coverage to protect your home and assets. With the right insurance strategy, you can rest easier knowing you're prepared for whatever the future holds.

How often should I review my insurance coverage?

+It’s recommended to review your insurance coverage annually or whenever significant changes occur in your life or home. This includes events like home renovations, changes in family size, or moving to a new location. Regular reviews ensure your coverage remains up-to-date and adequate for your needs.

What should I do if I’m unsure about the coverage I need?

+If you’re unsure about the coverage you need, consult with an insurance agent or broker. They can assess your specific situation and recommend appropriate coverage options. It’s essential to have a clear understanding of your risks and potential liabilities to ensure you’re adequately protected.

Are there any government programs or initiatives to help Florida homeowners with insurance costs?

+Yes, Florida has established programs to assist homeowners with insurance costs, particularly for those living in high-risk areas. The Florida Hurricane Catastrophe Fund (FHCF) provides reinsurance coverage to help reduce insurance costs. Additionally, the Florida Windstorm Underwriting Association (FWUA) offers windstorm insurance to homeowners who cannot obtain coverage through the private market.