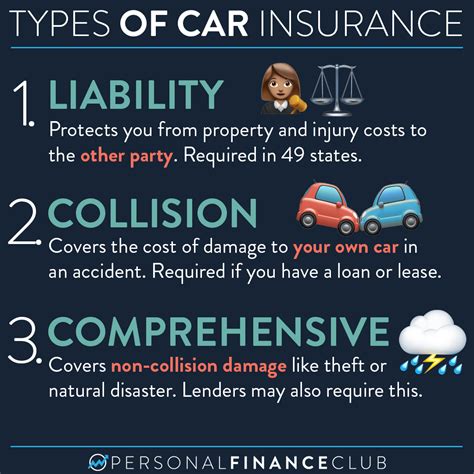

Kinds Of Car Insurance

When it comes to car insurance, there are several types of coverage options available to protect vehicle owners and drivers. Understanding the different kinds of car insurance policies is crucial for making informed decisions and ensuring adequate protection. This comprehensive guide will delve into the various types of car insurance, exploring their coverage, benefits, and real-world applications.

Liability Insurance

Liability insurance is a fundamental type of car insurance that provides coverage for damages or injuries caused to others as a result of an accident for which you are held responsible. It is a legal requirement in most countries and plays a vital role in protecting individuals from financial liabilities.

Coverage Details

Liability insurance typically covers two main aspects: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, pain and suffering, and lost wages for individuals injured in an accident caused by the insured driver. Property damage liability, on the other hand, covers the cost of repairing or replacing the other party’s vehicle or any other property damaged in the accident.

| Coverage Aspect | Description |

|---|---|

| Bodily Injury Liability | Covers medical costs, pain and suffering, and lost wages of injured individuals. |

| Property Damage Liability | Repairs or replaces the other party's vehicle or property damaged in the accident. |

Real-World Application

Imagine a scenario where you, as the insured driver, collide with another vehicle at an intersection. Liability insurance would step in to cover the medical bills and lost wages of the injured passengers in the other car, as well as the cost of repairing or replacing their vehicle. This coverage ensures that you are protected from the financial consequences of causing an accident.

Collision Insurance

Collision insurance is an optional coverage that provides protection for your own vehicle in the event of a collision with another vehicle or object. It is particularly valuable for individuals who wish to safeguard their investment in their vehicle and minimize out-of-pocket expenses.

Coverage Details

Collision insurance covers the cost of repairing or replacing your vehicle after an accident, regardless of who is at fault. It is designed to provide financial relief and peace of mind, ensuring that you can get your vehicle back on the road without incurring significant costs.

| Coverage Aspect | Description |

|---|---|

| Collision Coverage | Repairs or replaces your vehicle after a collision with another vehicle or object. |

Real-World Application

Let’s consider a situation where you accidentally collide with a tree while driving through a residential area. Collision insurance would cover the cost of repairing the damage to your vehicle, allowing you to get it fixed promptly without straining your finances.

Comprehensive Insurance

Comprehensive insurance, also known as comp insurance, is another optional coverage that provides protection for your vehicle against various non-collision-related incidents.

Coverage Details

Comprehensive insurance covers a wide range of perils, including theft, vandalism, natural disasters (such as hail or floods), and damage caused by animals. It is an essential coverage for individuals who want to protect their vehicle from unforeseen events that may result in significant financial losses.

| Coverage Aspect | Description |

|---|---|

| Theft and Vandalism | Covers the cost of replacing or repairing your vehicle if it is stolen or vandalized. |

| Natural Disasters | Provides protection against damage caused by natural disasters like floods, storms, or hail. |

| Animal-Related Incidents | Covers collisions with animals, such as deer or other wildlife. |

Real-World Application

Suppose you park your car in a busy urban area and, unfortunately, it gets vandalized during the night. Comprehensive insurance would cover the cost of repairing the damage, allowing you to restore your vehicle to its pre-incident condition.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a type of car insurance coverage that focuses on providing medical benefits to the insured driver and their passengers, regardless of who is at fault in an accident.

Coverage Details

PIP coverage offers a range of medical benefits, including coverage for medical expenses, rehabilitation costs, lost wages, and even funeral expenses in the event of a fatality. It is designed to ensure that the insured individuals receive prompt and comprehensive medical care without worrying about the financial burden.

| Coverage Aspect | Description |

|---|---|

| Medical Expenses | Covers the cost of medical treatments, including doctor visits, hospital stays, and prescription medications. |

| Rehabilitation Costs | Provides coverage for physical therapy, occupational therapy, and other rehabilitation services. |

| Lost Wages | Reimburses a portion of the insured's income if they are unable to work due to injuries sustained in the accident. |

| Funeral Expenses | Covers the cost of funeral arrangements in the event of a fatality. |

Real-World Application

Imagine a scenario where you are involved in a severe accident, resulting in multiple injuries for you and your passengers. PIP coverage would kick in to cover the cost of your medical treatments, rehabilitation, and any lost wages during your recovery period. This coverage provides valuable financial support during a challenging time.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage is designed to protect you in the event of an accident with a driver who either lacks insurance or has insufficient coverage to compensate for the damages.

Coverage Details

This type of coverage offers protection in two main scenarios: when the at-fault driver is uninsured and when the at-fault driver’s insurance coverage is inadequate to cover the full extent of the damages. It provides financial compensation for bodily injuries, medical expenses, and property damage resulting from such accidents.

| Coverage Aspect | Description |

|---|---|

| Uninsured Motorist Coverage | Provides compensation if you are involved in an accident with an uninsured driver. |

| Underinsured Motorist Coverage | Offers additional protection when the at-fault driver's insurance coverage is insufficient to cover all damages. |

Real-World Application

Consider a situation where you are hit by a driver who is uninsured. Uninsured Motorist Coverage would step in to cover your medical expenses, lost wages, and other related costs, providing you with the necessary financial support to recover from the accident.

Conclusion

Understanding the different kinds of car insurance is crucial for making informed decisions about your coverage needs. From liability insurance to comprehensive coverage, each type of insurance serves a specific purpose and provides protection against various risks. By selecting the right combination of coverages, you can ensure that you are adequately protected on the road and in unforeseen circumstances.

Frequently Asked Questions

What is the difference between liability insurance and collision insurance?

+

Liability insurance covers damages and injuries caused to others in an accident for which you are at fault. It is mandatory in most regions. Collision insurance, on the other hand, covers the cost of repairing or replacing your own vehicle after a collision, regardless of fault. It is an optional coverage but highly recommended.

Do I need comprehensive insurance if I have collision insurance?

+

While collision insurance covers collision-related incidents, comprehensive insurance provides protection against a wider range of perils, including theft, vandalism, and natural disasters. If you want comprehensive protection for your vehicle, it is recommended to have both collision and comprehensive insurance.

How does Personal Injury Protection (PIP) differ from liability insurance’s bodily injury coverage?

+

PIP coverage provides medical benefits to the insured driver and their passengers, regardless of fault. It covers a broader range of medical expenses and even includes lost wages and funeral expenses. Liability insurance’s bodily injury coverage, on the other hand, focuses on compensating the other party for their injuries and does not typically cover the insured’s medical expenses.

What happens if I am involved in an accident with an uninsured driver?

+

If you have uninsured motorist coverage as part of your car insurance policy, it will step in to provide compensation for bodily injuries, medical expenses, and property damage resulting from the accident. This coverage ensures that you are protected even when the at-fault driver lacks insurance.